R e c e n t d e... f i n a n c i a l ...

... This article assesses the current state of, and threats to, financial stability in New Zealand. It does this against a backdrop of continued softness in global growth and in corporate credit quality abroad. It concludes that New Zealand’s financial sector has remained resilient despite continued glo ...

... This article assesses the current state of, and threats to, financial stability in New Zealand. It does this against a backdrop of continued softness in global growth and in corporate credit quality abroad. It concludes that New Zealand’s financial sector has remained resilient despite continued glo ...

Discussion of “Coordinating Business Cycles” Christophe Chamley May 14, 2015

... and all firms investing) ...

... and all firms investing) ...

Impact of Financial Crisis in Mozambique

... make commercial banks even more reluctant to undertake long-term lending, increasing their preference for cash hoarding. Second, uncertainty will also lead businesses to delay long-term investment projects and increase their holdings in short-term assets and liquidity. Ultimately the financial crisi ...

... make commercial banks even more reluctant to undertake long-term lending, increasing their preference for cash hoarding. Second, uncertainty will also lead businesses to delay long-term investment projects and increase their holdings in short-term assets and liquidity. Ultimately the financial crisi ...

Impact of Financial Crisis in Mozambique

... make commercial banks even more reluctant to undertake long-term lending, increasing their preference for cash hoarding. Second, uncertainty will also lead businesses to delay long-term investment projects and increase their holdings in short-term assets and liquidity. Ultimately the financial crisi ...

... make commercial banks even more reluctant to undertake long-term lending, increasing their preference for cash hoarding. Second, uncertainty will also lead businesses to delay long-term investment projects and increase their holdings in short-term assets and liquidity. Ultimately the financial crisi ...

Chapter 11 – Cost Of Capital (Block)

... preferred equity is 7%, and its pretax cost of debt is also 7%. If the corporate tax rate is 35%, what is the weighted average cost of capital? a. Between 7% and 8% b. Between 8% and 9% c. Between 9% and 10% d. Between 10% and 12% 7. For a firm paying 7% for new debt, the higher the firm's tax rate ...

... preferred equity is 7%, and its pretax cost of debt is also 7%. If the corporate tax rate is 35%, what is the weighted average cost of capital? a. Between 7% and 8% b. Between 8% and 9% c. Between 9% and 10% d. Between 10% and 12% 7. For a firm paying 7% for new debt, the higher the firm's tax rate ...

Financial Management in the International Business

... 55. The relationship between a country's relative inflation rates and changes in exchange rates is, A. Much closer than what theory would predict B. Not reliable in the short run C. Totally reliable in the long run D. According to empirical studies, non existent in the long run ...

... 55. The relationship between a country's relative inflation rates and changes in exchange rates is, A. Much closer than what theory would predict B. Not reliable in the short run C. Totally reliable in the long run D. According to empirical studies, non existent in the long run ...

Differences between SNA 2008 and ESA 2010

... SNA 2008 (4.56): SPEs are often resident in a territory other than territory of the related corporations. ESA 2010 defines SPEs as units only having links to non-residents (the „often” is missing). Sector classification of holdings and captive institutions - Béla Simon ...

... SNA 2008 (4.56): SPEs are often resident in a territory other than territory of the related corporations. ESA 2010 defines SPEs as units only having links to non-residents (the „often” is missing). Sector classification of holdings and captive institutions - Béla Simon ...

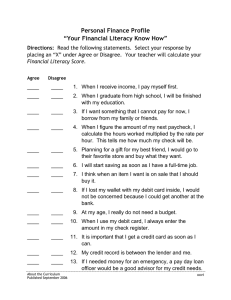

Introduction - Missouri Center for Career Education

... 15. An opportunity cost of saving to buy a car now could be not going on a trip with my friends. Students need to recognize that the benefits of saving are received in the future. Sacrificing the trip allows one to continue to save for the specific goal on a consistent basis ...

... 15. An opportunity cost of saving to buy a car now could be not going on a trip with my friends. Students need to recognize that the benefits of saving are received in the future. Sacrificing the trip allows one to continue to save for the specific goal on a consistent basis ...

Document

... In 1994, doubts about Mexico's political stability and questions about the government's willingness to stick to its reform policies made foreign investors uneasy Investors began selling off Mexican assets and not renewing loans The loss of capital inflows forced Mexico to reduce its current acc ...

... In 1994, doubts about Mexico's political stability and questions about the government's willingness to stick to its reform policies made foreign investors uneasy Investors began selling off Mexican assets and not renewing loans The loss of capital inflows forced Mexico to reduce its current acc ...

Financial Sector: Saving, Investment and the Financial System

... etc. for a loan. Or Kestory could just simply go to a bank, which specializes in providing these funds. Banks, and other financial services companies, are able to make it easier, and less costly, for firms to engage in financial transactions like borrowing to make investments. ...

... etc. for a loan. Or Kestory could just simply go to a bank, which specializes in providing these funds. Banks, and other financial services companies, are able to make it easier, and less costly, for firms to engage in financial transactions like borrowing to make investments. ...

(FATF) The Financial Action Task Force - APEC-Asia

... MSC (Multimedia Super Corridor) Status since 2001. Slogan: “By Bankers, For Bankers” (R&D Capabilities with Right Domain Knowledge) ...

... MSC (Multimedia Super Corridor) Status since 2001. Slogan: “By Bankers, For Bankers” (R&D Capabilities with Right Domain Knowledge) ...

security analysis and portfolio management

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

Effective Manager Programme

... Amounts set aside in one year to cover expenditure in the future. Provisions are for liabilities or losses which are likely to be incurred but the amounts or the dates on which they arise are uncertain. Reserves are amounts set aside which do not fall within the definition of provisions and include ...

... Amounts set aside in one year to cover expenditure in the future. Provisions are for liabilities or losses which are likely to be incurred but the amounts or the dates on which they arise are uncertain. Reserves are amounts set aside which do not fall within the definition of provisions and include ...

14 App 1 Appendix 14(1): Interpretation

... (b) is subsidiary undertakings are either exclusively or mainly: (i) credit institutions;, (ii) investment firms; (iii) broad scope firms or undertakings carrying on activities which (if they were firms doing those activities in the United Kingdom) would make them broad scope firms; and (iv) financi ...

... (b) is subsidiary undertakings are either exclusively or mainly: (i) credit institutions;, (ii) investment firms; (iii) broad scope firms or undertakings carrying on activities which (if they were firms doing those activities in the United Kingdom) would make them broad scope firms; and (iv) financi ...

L21-23. - Harvard Kennedy School

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

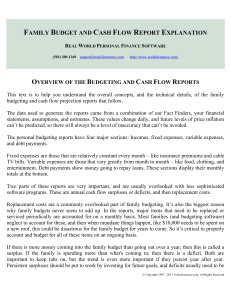

Family Budgeting and Cash Flow Report

... interest rates for extended periods of time). The chart, Snapshot of Major Expense Categories, helps in understanding what major categories your money is going into. The details are on the following pages. They are shown both for normal times, and if the breadwinner were to become disabled. Disabili ...

... interest rates for extended periods of time). The chart, Snapshot of Major Expense Categories, helps in understanding what major categories your money is going into. The details are on the following pages. They are shown both for normal times, and if the breadwinner were to become disabled. Disabili ...

here

... • IDA is one of the largest sources of assistance for 77 countries, 39 of which are in Africa. • IDA lends money on concessional terms. • This means that IDA credits have a zero or very low interest charge and repayments are stretched over 25 to 40 years, including a 5- to 10-year grace period. • ID ...

... • IDA is one of the largest sources of assistance for 77 countries, 39 of which are in Africa. • IDA lends money on concessional terms. • This means that IDA credits have a zero or very low interest charge and repayments are stretched over 25 to 40 years, including a 5- to 10-year grace period. • ID ...

Personal Finance - Adventist Education

... Read, research, analyze, write, and present using various sources (technology, financial reports, budgets, etc.). Identify key concepts and themes. Acknowledge the positive and negative implications of technological advances. Demonstrate ability to apply financial concepts with integrity. Assess per ...

... Read, research, analyze, write, and present using various sources (technology, financial reports, budgets, etc.). Identify key concepts and themes. Acknowledge the positive and negative implications of technological advances. Demonstrate ability to apply financial concepts with integrity. Assess per ...

Welcome to Introduction to Accounting Preparing for a User`s

... recorded in 20X3 because it matched the revenues back in 20X2. All we are doing is eliminating the liability account. In compliance with the matching principle, you can see that selling expenses are properly matched to sales revenues in 20X2. This one is not so easy. Accounts payable account is used ...

... recorded in 20X3 because it matched the revenues back in 20X2. All we are doing is eliminating the liability account. In compliance with the matching principle, you can see that selling expenses are properly matched to sales revenues in 20X2. This one is not so easy. Accounts payable account is used ...

Slides 1-4 (1m:49s) Welcome to Introduction to Accounting

... recorded in 20X3 because it matched the revenues back in 20X2. All we are doing is eliminating the liability account. In compliance with the matching principle, you can see that selling expenses are properly matched to sales revenues in 20X2. This one is not so easy. Accounts payable account is used ...

... recorded in 20X3 because it matched the revenues back in 20X2. All we are doing is eliminating the liability account. In compliance with the matching principle, you can see that selling expenses are properly matched to sales revenues in 20X2. This one is not so easy. Accounts payable account is used ...