Historical Patterns of Corporate Control in the United

... corporate control in the U.S. since 1945? Since 1890? • To what extent is at a sharpening of real but relatively minor differences? ...

... corporate control in the U.S. since 1945? Since 1890? • To what extent is at a sharpening of real but relatively minor differences? ...

The Rule of 72 - Riverside School District

... Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona ...

... Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona ...

UNIVERSITY OF NAIROBI SCHOOL OF BUSINESS MASTER OF

... 8. Plant and equipment is sh.6,000,000. It is one-third depreciated 9. Dividend paid on 8% non participating prefered are sh40,000. Thereis no change in common shares. The prefered shares were isssued two years ago at par. 10. Earnings per share are sh.3.75 11. Common stock has a sh.5 par value and ...

... 8. Plant and equipment is sh.6,000,000. It is one-third depreciated 9. Dividend paid on 8% non participating prefered are sh40,000. Thereis no change in common shares. The prefered shares were isssued two years ago at par. 10. Earnings per share are sh.3.75 11. Common stock has a sh.5 par value and ...

What if Interest Rates Rise and Nobody Does Anything?

... The communication is offered solely for discussion purposes. Lockton does not provide legal or tax advice. The services referenced are not a comprehensive list of all necessary components for consideration. You are encouraged to seek qualified legal and tax counsel to assist in considering all the u ...

... The communication is offered solely for discussion purposes. Lockton does not provide legal or tax advice. The services referenced are not a comprehensive list of all necessary components for consideration. You are encouraged to seek qualified legal and tax counsel to assist in considering all the u ...

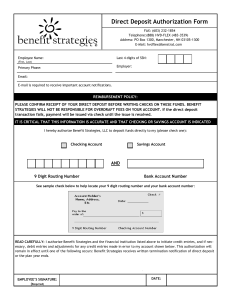

Direct Deposit Authorization Form

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

Appendices - NT Treasury

... Provides a relatively comprehensive picture of a government’s overall financial position. It is calculated as total assets less total liabilities less shares and other contributed capital. It includes a government’s non financial assets such as land and other fixed assets, which may be sold and used ...

... Provides a relatively comprehensive picture of a government’s overall financial position. It is calculated as total assets less total liabilities less shares and other contributed capital. It includes a government’s non financial assets such as land and other fixed assets, which may be sold and used ...

CIS September 2011 Exam Diet Examination Paper 2.1:

... B. Machine hours are a constraint in this problem. C. Labour hours are not a constraint in this problem. D. This problem can be solved using graphical method. 38. Which of the following hypothesis statements would not entail a one-tailed test? A. The average dividend payout ratio in the automotive i ...

... B. Machine hours are a constraint in this problem. C. Labour hours are not a constraint in this problem. D. This problem can be solved using graphical method. 38. Which of the following hypothesis statements would not entail a one-tailed test? A. The average dividend payout ratio in the automotive i ...

Are Businesses Ready To Deal With A Rise In Interest

... shows that personal and consumer debt levels have recently reached a record high of £1.43 trillion. Therefore an earlier than expected interest rate rise will push a lot of households into an unsustainable debt cycle and will dent consumer confidence, one of the key drivers of the UK economy over th ...

... shows that personal and consumer debt levels have recently reached a record high of £1.43 trillion. Therefore an earlier than expected interest rate rise will push a lot of households into an unsustainable debt cycle and will dent consumer confidence, one of the key drivers of the UK economy over th ...

The strategy`s return for the quarter was

... Sharp falls in the Chinese share market and concerns about their economy led to a sell-off in global shares during the quarter. In Europe, signs that a recovery might be on its way remain patchy despite stimulus from the European Central Bank. The bright spot in the global economy is the US, with re ...

... Sharp falls in the Chinese share market and concerns about their economy led to a sell-off in global shares during the quarter. In Europe, signs that a recovery might be on its way remain patchy despite stimulus from the European Central Bank. The bright spot in the global economy is the US, with re ...

Comments on the evolution of commodity prices and

... But even within the same group (e.g., fuel exporters) some doing better than others. This is largely due to fundamentals – the way the twin booms were managed (exchange rates, BOP, savings and investment, fiscal surpluses, stabilization funds, reserves etc). ...

... But even within the same group (e.g., fuel exporters) some doing better than others. This is largely due to fundamentals – the way the twin booms were managed (exchange rates, BOP, savings and investment, fiscal surpluses, stabilization funds, reserves etc). ...

Money, Prices, and Bubbles Gerald P. O’Driscoll Jr.

... real interest rates have their greatest impact on the value of longlived assets and on productive activities requiring long periods to fruition. The lower discounting of future output raises the value of such assets and activities. In the recent housing boom, real rates were negative for at least pa ...

... real interest rates have their greatest impact on the value of longlived assets and on productive activities requiring long periods to fruition. The lower discounting of future output raises the value of such assets and activities. In the recent housing boom, real rates were negative for at least pa ...

What should we make of the negative interest rates that

... from one saver to another. Smaller savers would face fewer constraints for holding cash, and would therefore react more quickly to a drop by interest rates into negative territory. On the other hand, institutional investors, who invest hundreds of millions, or even billions of dollars, in the money ...

... from one saver to another. Smaller savers would face fewer constraints for holding cash, and would therefore react more quickly to a drop by interest rates into negative territory. On the other hand, institutional investors, who invest hundreds of millions, or even billions of dollars, in the money ...

Potentials and limits of monetary policy to boost growth and

... to the banks at large scale was successful in alleviating deleveraging pressure for some troubled banks. But some other banks have used this cheap liquidity for purchasing bonds and other assets (‘carry trade’3), while the direct impact on lending to firms and households has been weak or even non-si ...

... to the banks at large scale was successful in alleviating deleveraging pressure for some troubled banks. But some other banks have used this cheap liquidity for purchasing bonds and other assets (‘carry trade’3), while the direct impact on lending to firms and households has been weak or even non-si ...

speech speech by governor lars rohde at danske bank markets

... Major reforms of the labour market have been implemented over the past two decades. This has raised the structural level of employment. The pension reforms have increased markedly the participation rates among senior groups on the labour market and will continue to do so in the coming years as the r ...

... Major reforms of the labour market have been implemented over the past two decades. This has raised the structural level of employment. The pension reforms have increased markedly the participation rates among senior groups on the labour market and will continue to do so in the coming years as the r ...

Sundiro Holding Co., Ltd. The Third Quarter of 2012

... Sub-total of cash inflows from operating activities Cash of purchasing commodities and paying labor service Net increase in loans and advances Net increase in central banks and interbank payments Cash paid for the indemnity of original insurance contract Cash paid for interest, fees and commissions ...

... Sub-total of cash inflows from operating activities Cash of purchasing commodities and paying labor service Net increase in loans and advances Net increase in central banks and interbank payments Cash paid for the indemnity of original insurance contract Cash paid for interest, fees and commissions ...

PowerPoint-Präsentation

... The global financial crisis and the European sovereign debt crisis originated in the United States US housing finance system is at the core of the crisis - Low-interest rate policy of the US Federal Reserve caused real interest rates to be negative - US Mortgage loans became more affordable - Demand ...

... The global financial crisis and the European sovereign debt crisis originated in the United States US housing finance system is at the core of the crisis - Low-interest rate policy of the US Federal Reserve caused real interest rates to be negative - US Mortgage loans became more affordable - Demand ...

Reconciling the Cambridge and Wall Street

... post-Keynesian consensus in macroeconomics, as it allows to entertain both monetary and real issues within a single model. ...

... post-Keynesian consensus in macroeconomics, as it allows to entertain both monetary and real issues within a single model. ...

Engineering Economics - Inside Mines

... The acceptance or rejection of a project based on the IRR criterion is made by comparing the calculated rate with the required rate of return, or cutoff rate established by the firm. If the IRR exceeds the required rate the project should be accepted; if not, it should be rejected. If the required r ...

... The acceptance or rejection of a project based on the IRR criterion is made by comparing the calculated rate with the required rate of return, or cutoff rate established by the firm. If the IRR exceeds the required rate the project should be accepted; if not, it should be rejected. If the required r ...

Stefan Gerlach Alberto Giovannini Cédric Tille 17 July 2009, VOX

... amounts across the world and became less volatile. At the same time, the world economy became much better integrated or globalised. Finally, actual and expected rates of return on financial assets, both in nominal and real terms, declined and became less volatile. We assess the driving forces behind ...

... amounts across the world and became less volatile. At the same time, the world economy became much better integrated or globalised. Finally, actual and expected rates of return on financial assets, both in nominal and real terms, declined and became less volatile. We assess the driving forces behind ...

Farm Credit System

... 2009 Farmers Cooperative Conference Credit Markets Update November 9, 2009 ...

... 2009 Farmers Cooperative Conference Credit Markets Update November 9, 2009 ...