Safety In Numbers

... New Constructs has provided Nashville Post with its unique research on 23 Nashville public companies. (This analysis took place in late August.) Company snapshots combine five equally weighted criteria: economic versus reported earnings per share (EPS), return on invested capital ranked by quintile, ...

... New Constructs has provided Nashville Post with its unique research on 23 Nashville public companies. (This analysis took place in late August.) Company snapshots combine five equally weighted criteria: economic versus reported earnings per share (EPS), return on invested capital ranked by quintile, ...

5 Financial Concepts To Teach Your Teen Before High School

... With graduation around the corner, high school seniors and their parents are focused on their school’s graduation requirements. But what about their personal finance education requirements? Are financial skills included in a student’s formal education? Not usually. In fact, I am astonished by how li ...

... With graduation around the corner, high school seniors and their parents are focused on their school’s graduation requirements. But what about their personal finance education requirements? Are financial skills included in a student’s formal education? Not usually. In fact, I am astonished by how li ...

Systemic indicators

... reports Real economy: GDP, government fiscal position, inflation Corporate sector: debt to equity, earnings (to interest and ...

... reports Real economy: GDP, government fiscal position, inflation Corporate sector: debt to equity, earnings (to interest and ...

4.03 saving and investing

... expand their business: buildings, replacing old equipment, or offering new products. ...

... expand their business: buildings, replacing old equipment, or offering new products. ...

Sole Proprietorships A sole proprietorship is a business owned by

... to make a major contribution to the firm’s overall profits. Corporations commonly measure profits in terms of earnings per share (EPS), which represent the amount earned during the period on behalf of each outstanding share of common stock. But is profit maximization a reasonable goal? No. It fails ...

... to make a major contribution to the firm’s overall profits. Corporations commonly measure profits in terms of earnings per share (EPS), which represent the amount earned during the period on behalf of each outstanding share of common stock. But is profit maximization a reasonable goal? No. It fails ...

Investment

... (5 points) Smith-Corona typewriter, Inc. has common stock, bonds, and bank loans in its capital structure. The bank loans are secured by the company’s industrial plant. Its bonds are currently selling at a discount and offer a rate of return appropriate to a BBB rated bond. They have been incurring ...

... (5 points) Smith-Corona typewriter, Inc. has common stock, bonds, and bank loans in its capital structure. The bank loans are secured by the company’s industrial plant. Its bonds are currently selling at a discount and offer a rate of return appropriate to a BBB rated bond. They have been incurring ...

The Relationship Between Rising Rates And Rising Ringgit

... If a country raises its interest rates, the currency of that country will strengthen in relation to other countries, as investors shift assets to that country to gain a higher return. Raising interest rates isn’t a bad thing. It is an indicator of a stronger economy which can now (2006) take on high ...

... If a country raises its interest rates, the currency of that country will strengthen in relation to other countries, as investors shift assets to that country to gain a higher return. Raising interest rates isn’t a bad thing. It is an indicator of a stronger economy which can now (2006) take on high ...

increases the asymmetric information

... problems. A fall in the firm’s net worth (NW) increases the asymmetric information problems and reduces the efficiency of the financial system. Definition (Frederick Mishkin and others): ‘A financial crisis occurs when, due to disruption on financial markets, the increase of the adverse selectio ...

... problems. A fall in the firm’s net worth (NW) increases the asymmetric information problems and reduces the efficiency of the financial system. Definition (Frederick Mishkin and others): ‘A financial crisis occurs when, due to disruption on financial markets, the increase of the adverse selectio ...

Input Demand: The Capital Market and the Investment Decision

... • The financial capital market is the part of the capital market in which savers and investors interact through intermediaries. Demand for new capital (investment) comes from firms. Supply of new capital comes from households through the act of saving. • The capital market exists to direct savings i ...

... • The financial capital market is the part of the capital market in which savers and investors interact through intermediaries. Demand for new capital (investment) comes from firms. Supply of new capital comes from households through the act of saving. • The capital market exists to direct savings i ...

capital investment

... Because of the higher rate of return (47.16%), it takes longer to receive your rate of return and principal back (not until almost the end of the 2nd year since more of the cash flow is rate of return rather than return of principal) and you must now earn a 47.16% rate of return on the surplus funds ...

... Because of the higher rate of return (47.16%), it takes longer to receive your rate of return and principal back (not until almost the end of the 2nd year since more of the cash flow is rate of return rather than return of principal) and you must now earn a 47.16% rate of return on the surplus funds ...

Commission rings changes for 4th Anti- money

... Tracking and freezing terrorist assets There are several UN regimes in place to freeze the assets of persons with links to terrorism. Within the EU such freezing measures are currently implemented under the Common Foreign and Security Policy and Article 215 Treaty on the Functioning of the European ...

... Tracking and freezing terrorist assets There are several UN regimes in place to freeze the assets of persons with links to terrorism. Within the EU such freezing measures are currently implemented under the Common Foreign and Security Policy and Article 215 Treaty on the Functioning of the European ...

Comparison of efficiency and costs of payments: Some new

... • Even on the cost side, there are large differences between different countries/studies • In terms of unit costs for different payment media, they follow the same pattern • On the top, we have David Humphrey’s claim of something like 1 % gain form more efficient payment system ...

... • Even on the cost side, there are large differences between different countries/studies • In terms of unit costs for different payment media, they follow the same pattern • On the top, we have David Humphrey’s claim of something like 1 % gain form more efficient payment system ...

Lesson 10-2 Principles of Saving and Investing

... Long-Term Focus – A systematic saving and investing plan is designed for growth in the long run, not for short-term results. ...

... Long-Term Focus – A systematic saving and investing plan is designed for growth in the long run, not for short-term results. ...

1. Bankruptcy Cost

... this expectation into bond prices by demanding much higher rates on debt. If bondholders can protect themselves against such actions by ...

... this expectation into bond prices by demanding much higher rates on debt. If bondholders can protect themselves against such actions by ...

Assignment-77 - The complete management portal

... 19) The term receivables is defined as => Debts owned to the firm by customers arising from sale of goods or services in the ordinary course of business * 20) The 'going concern concept' is the underlying basis for => depreciating fixed asset over their useful lives * 21) Variable Working Capital is ...

... 19) The term receivables is defined as => Debts owned to the firm by customers arising from sale of goods or services in the ordinary course of business * 20) The 'going concern concept' is the underlying basis for => depreciating fixed asset over their useful lives * 21) Variable Working Capital is ...

GROW... - Amerisource Funding

... short time, discover that they need more cash and are forced to go back to the lender to obtain an additional high interest rate loan (this is referred to as “Stacking”). Factoring, on the other hand, is a true operating line of credit that matches the client’s cash needs with their business operati ...

... short time, discover that they need more cash and are forced to go back to the lender to obtain an additional high interest rate loan (this is referred to as “Stacking”). Factoring, on the other hand, is a true operating line of credit that matches the client’s cash needs with their business operati ...

Financial Services and Capital Transfer Provisions in Recent Free

... Investment and Capital Transfer Provisions in the Chile and Singapore FTAs In the negotiations of the Chile and Singapore FTAs, all sides agreed on the importance of free transfers and avoiding capital controls. The investment chapters of the Chile and Singapore FTAs provide for the free transfer of ...

... Investment and Capital Transfer Provisions in the Chile and Singapore FTAs In the negotiations of the Chile and Singapore FTAs, all sides agreed on the importance of free transfers and avoiding capital controls. The investment chapters of the Chile and Singapore FTAs provide for the free transfer of ...

G20 정상회의와 금융산업정책 방향

... In September 2010, Guido Mantega, the Brazilian finance minster, claimed that a currency war had begun between the developed economies and the developing economies In particular, the use of QE is very controversial Other things being equal, the increase in money supply that QE brings should ma ...

... In September 2010, Guido Mantega, the Brazilian finance minster, claimed that a currency war had begun between the developed economies and the developing economies In particular, the use of QE is very controversial Other things being equal, the increase in money supply that QE brings should ma ...

Savings and Investing

... Interest rates are usually based on one year time periods They can be given on other periods such as daily, weekly, monthly Usually, the more times interest is paid, the greater yield it will return Simple interest is calculated only on the principal amount I = Prt ...

... Interest rates are usually based on one year time periods They can be given on other periods such as daily, weekly, monthly Usually, the more times interest is paid, the greater yield it will return Simple interest is calculated only on the principal amount I = Prt ...

CI Signature Canadian Balanced Fund

... Benchmark 40% FTSE TMX Canada Universe Bond, 30% S&P/TSX, 30% MSCI All Country World Net ...

... Benchmark 40% FTSE TMX Canada Universe Bond, 30% S&P/TSX, 30% MSCI All Country World Net ...

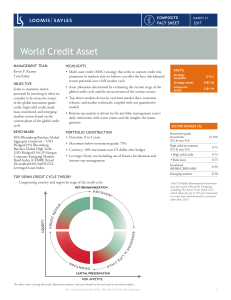

World Credit Asset

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

Two Take Whole Foods` Tack on Proxy Access

... It’s time to span the corporate governance globe to review important developments in December, among them new voting guidelines in Switzerland, a report from UK insurer Aviva on potential risks to European and global economic growth, and two more companies follow the lead of Whole Foods Market on th ...

... It’s time to span the corporate governance globe to review important developments in December, among them new voting guidelines in Switzerland, a report from UK insurer Aviva on potential risks to European and global economic growth, and two more companies follow the lead of Whole Foods Market on th ...