Credit, commodities and currencies

... to acquire foreign currency assets. However, firms have taken advantage of favourable financing conditions in foreign currencies to fund holdings of various assets at home. To the extent that these are in the traded goods sector, currency mismatches need not necessarily arise, although there may be ...

... to acquire foreign currency assets. However, firms have taken advantage of favourable financing conditions in foreign currencies to fund holdings of various assets at home. To the extent that these are in the traded goods sector, currency mismatches need not necessarily arise, although there may be ...

Hot Money Flows, Commodity Price Cycles, and Financial

... instability by inducing massive ―hot money‖ outflows by carry traders in Asia and Latin America (McKinnon 2013). A carry trader is one who exploits interest rate differentials across countries by borrowing in low interest rate currencies to invest in currency domains with higher interest rates (Menk ...

... instability by inducing massive ―hot money‖ outflows by carry traders in Asia and Latin America (McKinnon 2013). A carry trader is one who exploits interest rate differentials across countries by borrowing in low interest rate currencies to invest in currency domains with higher interest rates (Menk ...

cash flow statement

... FLOW STATEMENT • The cash flow statement reveals: ---Whether the overall activities reveal a positive cash flow ---Whether the operating activities yield a positive cash flow ---The manner in which capital expenditure has been financed (for example, whether it has come ...

... FLOW STATEMENT • The cash flow statement reveals: ---Whether the overall activities reveal a positive cash flow ---Whether the operating activities yield a positive cash flow ---The manner in which capital expenditure has been financed (for example, whether it has come ...

Currency Volatility: Economic Drivers and Asset Allocation

... that borrowed heavily in USDs and now must repay with weaker currencies. For the moment, financial instability is present exclusively in countries such as Russia and Venezuela that have experienced plunging currency values and a negative terms-of-trade shock from lower oil prices. However, capital o ...

... that borrowed heavily in USDs and now must repay with weaker currencies. For the moment, financial instability is present exclusively in countries such as Russia and Venezuela that have experienced plunging currency values and a negative terms-of-trade shock from lower oil prices. However, capital o ...

Course 3: Capital Budgeting Analysis

... In financial management, consideration of options within capital budgeting is called contingent claims analysis or option pricing. For example, suppose you have a choice between two boiler units for your factory. Boiler A uses oil and Boiler B can use either oil or natural gas. Based on traditional ...

... In financial management, consideration of options within capital budgeting is called contingent claims analysis or option pricing. For example, suppose you have a choice between two boiler units for your factory. Boiler A uses oil and Boiler B can use either oil or natural gas. Based on traditional ...

Markets at a Glance - Sprott Asset Management

... and lenders) were the ones making all the money in an ever-escalating housing price environment. Others who were being more prudent felt forced to join in or miss the boat. So we witnessed heavy marketing by banks and other lenders. New fangled ‘hybrid’ mortgages were being offered left and right. T ...

... and lenders) were the ones making all the money in an ever-escalating housing price environment. Others who were being more prudent felt forced to join in or miss the boat. So we witnessed heavy marketing by banks and other lenders. New fangled ‘hybrid’ mortgages were being offered left and right. T ...

Long-Term Asset Class Forecasts

... Market Committee raised interest rates for the first time in nine years, stating they saw conditions warranting “only gradual” rate increases. For the fourth quarter as a whole, longer-term nominal yields rose 18 basis points1, while real yields at similar maturities were unchanged. The net result w ...

... Market Committee raised interest rates for the first time in nine years, stating they saw conditions warranting “only gradual” rate increases. For the fourth quarter as a whole, longer-term nominal yields rose 18 basis points1, while real yields at similar maturities were unchanged. The net result w ...

pubP-FDI

... • While better fundamentals (including higher FDI) lead to an increase in domestic stock market activity, more of this activity is expected to occur abroad as better fundamentals also spur the migration in capital raising, listing, and trading • Firm perspective – As firms from emerging markets cont ...

... • While better fundamentals (including higher FDI) lead to an increase in domestic stock market activity, more of this activity is expected to occur abroad as better fundamentals also spur the migration in capital raising, listing, and trading • Firm perspective – As firms from emerging markets cont ...

PDF

... machinery must be in a form which is adapted not only to an agriculture becoming commercial, but also to a situation where surplus earnings need to be marshalled for investment. In many countries emerging from subsistence and during early stages of development the organization of co-operatives is an ...

... machinery must be in a form which is adapted not only to an agriculture becoming commercial, but also to a situation where surplus earnings need to be marshalled for investment. In many countries emerging from subsistence and during early stages of development the organization of co-operatives is an ...

Das vollständige Interview im pdf

... government the financial firepower to counter most growth or financial stability problems such as the slowdown in real estate and the correlated increase in non-performing loans. 3. Besides the growth scares, investors worry that the tightening in Fed monetary policy likely in 2015 will lead to an u ...

... government the financial firepower to counter most growth or financial stability problems such as the slowdown in real estate and the correlated increase in non-performing loans. 3. Besides the growth scares, investors worry that the tightening in Fed monetary policy likely in 2015 will lead to an u ...

II. DOMESTIC ECONOMIC OUTLOOK

... inflows to countries like Turkey, with relatively stronger economic fundamentals. While domestic demanddriven growth continues, unemployment rates decline. These developments give way to concerns of overheating in Turkey, as in other emerging economies. However, the persisting low level of capacity ...

... inflows to countries like Turkey, with relatively stronger economic fundamentals. While domestic demanddriven growth continues, unemployment rates decline. These developments give way to concerns of overheating in Turkey, as in other emerging economies. However, the persisting low level of capacity ...

BRIEFING PAPER FOR THE MONETARY DIALOGUE FIRST

... increase in the cost of external financing to firms and other types of borrowers (the so called “financing premium”), which is the wedge between the cost of funds raised externally (by issuing equity or debt) and the opportunity cost of funds raised internally (by retaining earnings) (Bernanke and G ...

... increase in the cost of external financing to firms and other types of borrowers (the so called “financing premium”), which is the wedge between the cost of funds raised externally (by issuing equity or debt) and the opportunity cost of funds raised internally (by retaining earnings) (Bernanke and G ...

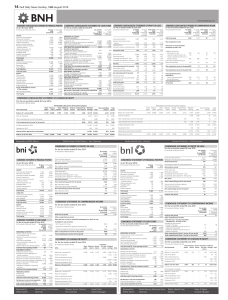

14 Gulf Daily News Sunday, 14th August 2016

... Cash flows (used in) / from operating activities ...

... Cash flows (used in) / from operating activities ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... In a study that investigates more broadly the relation between financial instability and macroeconomic dynamics, Hubrich and Tetlow (2012) analyze the interaction of financial stress with output growth, inflation, and monetary policy. They estimate a Markov-switching model with recently developed Ba ...

... In a study that investigates more broadly the relation between financial instability and macroeconomic dynamics, Hubrich and Tetlow (2012) analyze the interaction of financial stress with output growth, inflation, and monetary policy. They estimate a Markov-switching model with recently developed Ba ...

Financial Sector Sector Financial Finance 724/824, Fall 2010

... * Personal savings rates are expressed in nominal terms. During several quarters between 2005 and 2008, real savings were negative. ...

... * Personal savings rates are expressed in nominal terms. During several quarters between 2005 and 2008, real savings were negative. ...

Economic Globalisation and the Nation State The transformation of

... tied in principle to the value of gold. If a country ran a trade deficit, gold would flow out, the money supply would fall, and this reduced demand for imports while also reducing the price of domestically produced goods so that the country could become competitive again. The reverse process occurre ...

... tied in principle to the value of gold. If a country ran a trade deficit, gold would flow out, the money supply would fall, and this reduced demand for imports while also reducing the price of domestically produced goods so that the country could become competitive again. The reverse process occurre ...

May in perspective – global markets May proved to be another

... bonds) move lower, their prices move higher. With that by way of introduction, let’s consider what has been happening in global bond markets of late. In short, bond prices have been rising to record (high) levels and yields (interest rates) have been declining to record (low) levels. Typically, yiel ...

... bonds) move lower, their prices move higher. With that by way of introduction, let’s consider what has been happening in global bond markets of late. In short, bond prices have been rising to record (high) levels and yields (interest rates) have been declining to record (low) levels. Typically, yiel ...

With widespread deregulation and rapid growth of financial wealth, business

... inflation, raise aggregate demand and growth, thereby making such inflows even more attractive. However, this process can also increase vulnerability to exchange rate swings by generating unsustainable trade deficits and currency and maturity mismatches in balance sheets. ...

... inflation, raise aggregate demand and growth, thereby making such inflows even more attractive. However, this process can also increase vulnerability to exchange rate swings by generating unsustainable trade deficits and currency and maturity mismatches in balance sheets. ...

Economic Meltdown And The Challenges In Business Enterprises: The Nigerian Experience:

... their mortgages, which exacerbated the bank lending crisis. All of these factors created a giant snowball effect of economic catastrophe. She stressed further that economic meltdowns are not new. The most significant of these meltdowns was Great Depression beginning in 1929. This meltdown was caused ...

... their mortgages, which exacerbated the bank lending crisis. All of these factors created a giant snowball effect of economic catastrophe. She stressed further that economic meltdowns are not new. The most significant of these meltdowns was Great Depression beginning in 1929. This meltdown was caused ...

Inflation-Phobia Might Cause Stagflation “Central banks could revive

... justified in the region. Even though all inflation processes have been affected by international prices, there are few countries where inflation contains an important component of demand pressures. For example Chile, Colombia and Peru –whose economies have been running at a speed faster than its pot ...

... justified in the region. Even though all inflation processes have been affected by international prices, there are few countries where inflation contains an important component of demand pressures. For example Chile, Colombia and Peru –whose economies have been running at a speed faster than its pot ...

Feldstein-Horioka Puzzle and Capital Flows

... x-section with IVs. FH criticized this approach arguing that simultaneous equation bias makes the results too unreliable. One approach with time studies has been to test the intertemporal CA theory. As you remember, Ghosh 95, EJ tests the joint hypothesis of C smoothing and capital mobility. He comp ...

... x-section with IVs. FH criticized this approach arguing that simultaneous equation bias makes the results too unreliable. One approach with time studies has been to test the intertemporal CA theory. As you remember, Ghosh 95, EJ tests the joint hypothesis of C smoothing and capital mobility. He comp ...

417_Globalautos_063

... additional 10% by 2012. Japan: requires 23% reduction in vehicle CO2 emissions by 2010 (from 1995 levels). Australia: voluntary commitment to improve fuel economy by 18% by 2010. Canada: has proposed a 25% improvement in fuel economy by 2010. China: Introduced new fuel economy standards in 2004; wei ...

... additional 10% by 2012. Japan: requires 23% reduction in vehicle CO2 emissions by 2010 (from 1995 levels). Australia: voluntary commitment to improve fuel economy by 18% by 2010. Canada: has proposed a 25% improvement in fuel economy by 2010. China: Introduced new fuel economy standards in 2004; wei ...

CAPITAL BUDGET CARRY FORWARD

... 3. The Procedures a. The amount of carry forward budget on projects and programmes is finalised in January of the following year, after completion of year end accounting. This confirms the capital funding sources including net surplus, depreciation, asset sales and external revenue sources against t ...

... 3. The Procedures a. The amount of carry forward budget on projects and programmes is finalised in January of the following year, after completion of year end accounting. This confirms the capital funding sources including net surplus, depreciation, asset sales and external revenue sources against t ...