Empirical Determinants and Patterns of Research and Development

... economic growth in the region. Research and development (R&D) investment, the vital force behind innovation, was naturally cast as the main driver of future (high) Asian growth. A number of Asian economies appear to have done quite well in approaching this goal. Japan and the Republic of Korea, for ...

... economic growth in the region. Research and development (R&D) investment, the vital force behind innovation, was naturally cast as the main driver of future (high) Asian growth. A number of Asian economies appear to have done quite well in approaching this goal. Japan and the Republic of Korea, for ...

savings

... How do they know you will pay them back? They don’t. So, they’ll check your financial history and make a decision based on your past actions. Whenever you apply for credit or a loan, you give the lender permission to check your financial history. ...

... How do they know you will pay them back? They don’t. So, they’ll check your financial history and make a decision based on your past actions. Whenever you apply for credit or a loan, you give the lender permission to check your financial history. ...

Name Last 4 (PSU ID) ______ First 2 letters of

... conference to clarify what the implications of this (possible/probable) tapering would have on the future path of short term interest rates. In fact, he was trying really hard to separate the idea of tapering and the influence of short term interest rates moving forward. How did he do this, what did ...

... conference to clarify what the implications of this (possible/probable) tapering would have on the future path of short term interest rates. In fact, he was trying really hard to separate the idea of tapering and the influence of short term interest rates moving forward. How did he do this, what did ...

Assignment 6 - cloudfront.net

... jealous, etc. Have them silently identify aspects of their lives that could develop into money making opportunities. ...

... jealous, etc. Have them silently identify aspects of their lives that could develop into money making opportunities. ...

Circular Flows - A Teaching Plan

... existing resources more intensively, by acquiring new ones using their own accumulated financial resources, or by borrowing from the financial sector. Production costs may rise. ...

... existing resources more intensively, by acquiring new ones using their own accumulated financial resources, or by borrowing from the financial sector. Production costs may rise. ...

FREE Sample Here

... There is a wide dispersion in the dollar remuneration of CEOs across the world. American CEOs are the best paid, followed by their Brazilian and Hong Kong counterparts. Korean and German CEOs have very low compensations relative to Americans. The implied PPP exchange rates suggest that all currencie ...

... There is a wide dispersion in the dollar remuneration of CEOs across the world. American CEOs are the best paid, followed by their Brazilian and Hong Kong counterparts. Korean and German CEOs have very low compensations relative to Americans. The implied PPP exchange rates suggest that all currencie ...

presentation source

... EQUILIBRIUM INTEREST RATE 4. Change in time preferences. If people become more patient ( more willing to delay consumption ), the supply of savings will increase and the equilibrium interest rate will decrease. ...

... EQUILIBRIUM INTEREST RATE 4. Change in time preferences. If people become more patient ( more willing to delay consumption ), the supply of savings will increase and the equilibrium interest rate will decrease. ...

The East Asian Financial Crisis 1997-1998

... weakness, the excess of the booming years (too much domestic lending and too much foreign short-term borrowing) coupled with severe currency and maturity mismatch in the banking sector account for the sudden stop of economic activity in these countries. ∗ Credit crunch + sudden change in the consume ...

... weakness, the excess of the booming years (too much domestic lending and too much foreign short-term borrowing) coupled with severe currency and maturity mismatch in the banking sector account for the sudden stop of economic activity in these countries. ∗ Credit crunch + sudden change in the consume ...

Navigating a World in Transition

... on infrastructure spending and tax cuts could lead to a higher budget deficit and higher inflation. Despite the rise, rates remain relatively low by historical standards and appear poised to remain so for some time. •• Even if the Fed does continue to slowly ...

... on infrastructure spending and tax cuts could lead to a higher budget deficit and higher inflation. Despite the rise, rates remain relatively low by historical standards and appear poised to remain so for some time. •• Even if the Fed does continue to slowly ...

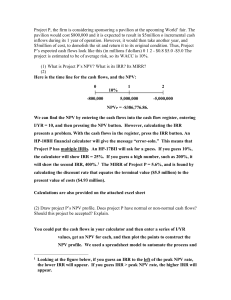

Project P, the firm is considering sponsoring a pavilion

... (5) What is the underlying cause of ranking conflicts between NPV and IRR? For normal projects’ NPV profiles to cross, one project must have both a higher vertical axis intercept and a steeper slope than the other. A project’s vertical axis intercept typically depends on (1) the size of the project ...

... (5) What is the underlying cause of ranking conflicts between NPV and IRR? For normal projects’ NPV profiles to cross, one project must have both a higher vertical axis intercept and a steeper slope than the other. A project’s vertical axis intercept typically depends on (1) the size of the project ...

Economic Analysis - Fisher College of Business

... are in the Info Tech Sector. On March 24, S&P Equity Strategy upgraded the technology sector to overweight from market weight. • Above average balance sheet strength and potential to continue outgrowing the overall economy. • Industry leaders in this Sector trade predominantly in the U.S Stock marke ...

... are in the Info Tech Sector. On March 24, S&P Equity Strategy upgraded the technology sector to overweight from market weight. • Above average balance sheet strength and potential to continue outgrowing the overall economy. • Industry leaders in this Sector trade predominantly in the U.S Stock marke ...

sygnia skeleton worldwide flexible fund

... expectations of Iran’s oil coming online, no signs of a slow-down in production and weak demand expectations from China led to oil prices plunging to below US$30 a barrel, a 12 year low. Prices recovered to US$40 a barrel in March after the world’s biggest oil producers, accounting for 73% of global ...

... expectations of Iran’s oil coming online, no signs of a slow-down in production and weak demand expectations from China led to oil prices plunging to below US$30 a barrel, a 12 year low. Prices recovered to US$40 a barrel in March after the world’s biggest oil producers, accounting for 73% of global ...

Financial Sector Regulation in Developing Countries: Reckoning after the crisis

... US or some European countries, developing countries do not have shadow banking systems of any size. Nor did their banks hold complex, toxic assets. This could be partly due to self-restraint; but it was mostly due to regulatory constraints. A number of developing countries, especially in Asia, becam ...

... US or some European countries, developing countries do not have shadow banking systems of any size. Nor did their banks hold complex, toxic assets. This could be partly due to self-restraint; but it was mostly due to regulatory constraints. A number of developing countries, especially in Asia, becam ...

Double-entry bookkeeping

... thereof), and one for each type of expense and income. In addition a sole trader will also have an account for capital. Capital represents the proprietary interest in the net assets of the business. It is created when the owner introduces resources into the business entity and increases when the bus ...

... thereof), and one for each type of expense and income. In addition a sole trader will also have an account for capital. Capital represents the proprietary interest in the net assets of the business. It is created when the owner introduces resources into the business entity and increases when the bus ...

Quantitative and Qualitative Monetary Easing (QQE)

... asset purchases except for reinvestment. If one stands on the "stock view" of QE, suggesting that what matters for monetary easing effects is the central bank's holdings of assets rather than the amount of asset purchases during a period of time, the Federal Reserve's massive bond holdings is still ...

... asset purchases except for reinvestment. If one stands on the "stock view" of QE, suggesting that what matters for monetary easing effects is the central bank's holdings of assets rather than the amount of asset purchases during a period of time, the Federal Reserve's massive bond holdings is still ...

Monetary Policy: A Primer

... activity. It is the endeavour of the Reserve Bank to ensure all these aspects of financial stability. As far as the conduct of monetary policy is concerned, it may be noted that monetary policy in India used to be conducted till 1997-98 with broad money (M3) as an intermediate target. The aim was to ...

... activity. It is the endeavour of the Reserve Bank to ensure all these aspects of financial stability. As far as the conduct of monetary policy is concerned, it may be noted that monetary policy in India used to be conducted till 1997-98 with broad money (M3) as an intermediate target. The aim was to ...

How a Banker Looks at Financial Leverage

... satisfactory. Assets are often approached from the vantage point of "What is their replacement value?" But replacement has no value if revenue and profits cannot be generated. Generally, whenever the return on assets exceeds the cost of debt, leverage is favorable, and the higher the leverage factor ...

... satisfactory. Assets are often approached from the vantage point of "What is their replacement value?" But replacement has no value if revenue and profits cannot be generated. Generally, whenever the return on assets exceeds the cost of debt, leverage is favorable, and the higher the leverage factor ...

Global Asset Allocation Views - JP Morgan Asset Management

... regulatory, tax, credit, and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any inve ...

... regulatory, tax, credit, and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any inve ...

economic outlook briefing

... reported that it expects its opt-in policy for communications to see it lose around £7m a year or 4% of its income – costing £36m by 2020. Even before the Etherington Review was concluded, a number of charities had said that restrictions on frequency of communications With public funding for chariti ...

... reported that it expects its opt-in policy for communications to see it lose around £7m a year or 4% of its income – costing £36m by 2020. Even before the Etherington Review was concluded, a number of charities had said that restrictions on frequency of communications With public funding for chariti ...

INTRODUCTION - State Bank of Pakistan

... Communication services cover receipts and payments for telephone, telegraph, facsimile and telex including broadcasting and electronic mail services, postal and courier services. 4. Construction services covers receipts for work abroad on construction projects and installation by personnel of reside ...

... Communication services cover receipts and payments for telephone, telegraph, facsimile and telex including broadcasting and electronic mail services, postal and courier services. 4. Construction services covers receipts for work abroad on construction projects and installation by personnel of reside ...