latin american equity research

... Exhaustion of SBPE-subsidized funding pressures banks to fund new projects and mortgages with alternative sources, most likely through CDI-linked securities such as LCI/LH. This need comes at a time when the interest rate continues to rise, widening the minimum spread necessary to continue having a ...

... Exhaustion of SBPE-subsidized funding pressures banks to fund new projects and mortgages with alternative sources, most likely through CDI-linked securities such as LCI/LH. This need comes at a time when the interest rate continues to rise, widening the minimum spread necessary to continue having a ...

Why the current account may matter in a monetary union 1

... pack of lies for years (something of which the Commission had been unaware)2 . But this was not the case for the other three countries, two of which moreover exhibited an enviable and widely praised record of high primary surpluses, low overall de…cits (surpluses in some years) and low debt levels u ...

... pack of lies for years (something of which the Commission had been unaware)2 . But this was not the case for the other three countries, two of which moreover exhibited an enviable and widely praised record of high primary surpluses, low overall de…cits (surpluses in some years) and low debt levels u ...

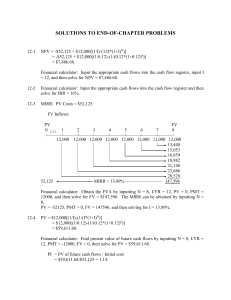

solutions to end-of

... Projects A and B are mutually exclusive, thus, only one of the projects can be chosen. As long as the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. However, if the cost of capital is less than the crossover rate the two meth ...

... Projects A and B are mutually exclusive, thus, only one of the projects can be chosen. As long as the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. However, if the cost of capital is less than the crossover rate the two meth ...

NBER WORKING PAPER SERIES TAXATION OF ASSET INCOME WORLD SECURITIES MARKET

... prices. When a government considers what will happen to market prices, we assume that it takes as given the tax rates chosen by other governments, that it assumes all individuals and firms will continue to behave competitively, and that market prices will adjust so that all markets continue to clear ...

... prices. When a government considers what will happen to market prices, we assume that it takes as given the tax rates chosen by other governments, that it assumes all individuals and firms will continue to behave competitively, and that market prices will adjust so that all markets continue to clear ...

NBER WORKING PAPERS SERIES THE OF CAPITAL MARKETS Guillermo A. Calvo

... transformation and restructuring in Eastern Europe and the U.S.S.R. The economic system in CPEs is highly distorted. Prices do not represent real social costs, incentives systems are absent, losses of unprofitable stateowned enterprises sre automatically financed, legislations vital for the function ...

... transformation and restructuring in Eastern Europe and the U.S.S.R. The economic system in CPEs is highly distorted. Prices do not represent real social costs, incentives systems are absent, losses of unprofitable stateowned enterprises sre automatically financed, legislations vital for the function ...

Memo - WICPA

... Does Tootsie Roll’s pay dividends? If so, how much in 09 & 10? What percent of net income did they pay out in cash dividends in 09 & 10? Classify Tootsie Roll’s as a growth or income company Balance Sheet What was Tootsie Roll’s working capital, current ratio, acid-test ratio, and debt to eq ...

... Does Tootsie Roll’s pay dividends? If so, how much in 09 & 10? What percent of net income did they pay out in cash dividends in 09 & 10? Classify Tootsie Roll’s as a growth or income company Balance Sheet What was Tootsie Roll’s working capital, current ratio, acid-test ratio, and debt to eq ...

Existe-t-il une relation entre l*information sectorielle et le tableau

... Two main hypothesis Hypothesis 1: As investment property is the core business of REITs, they should adopt a financial approach and choose the Fair Value Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their ...

... Two main hypothesis Hypothesis 1: As investment property is the core business of REITs, they should adopt a financial approach and choose the Fair Value Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their ...

Intro to Banking 4

... Discount instrument prices fall when yields rise Does this make sense? If investors demand higher yields this implies they need to be compensated for higher expected and unexpected risks Issuers of discount instruments can not change repayment Investors need to buy those instruments at lower ...

... Discount instrument prices fall when yields rise Does this make sense? If investors demand higher yields this implies they need to be compensated for higher expected and unexpected risks Issuers of discount instruments can not change repayment Investors need to buy those instruments at lower ...

Emerging Market Corporate Debt: An Attractive Investment Opportunity

... Opportunity This investment grade-rated, geographically-diversified asset class offers investors attractive opportunities for yield without excessive levels of risk. We believe this opportunity will become increasingly compelling as global commodity prices stabilize, EM economies grow and corporate ...

... Opportunity This investment grade-rated, geographically-diversified asset class offers investors attractive opportunities for yield without excessive levels of risk. We believe this opportunity will become increasingly compelling as global commodity prices stabilize, EM economies grow and corporate ...

March 2010 by Alexander J. Field

... The bust part of the financial cycle in both cases saw significant and sometimes frightening disruptions in credit markets, with many bankruptcies or near bankruptcies of financial institutions, and big declines in the price of equities, with extraordinarily high stock market volatility -- large up ...

... The bust part of the financial cycle in both cases saw significant and sometimes frightening disruptions in credit markets, with many bankruptcies or near bankruptcies of financial institutions, and big declines in the price of equities, with extraordinarily high stock market volatility -- large up ...

Governments are putting up impediments to globalisation. It is time

... economic malfunctions within many other countries that were still on the US dollar standard. As nations floundered economically, they contaminated other trading partner economies. Stagflation, stagnant economies with rampant inflation, became like an epidemic sweeping around the world. Let us look ...

... economic malfunctions within many other countries that were still on the US dollar standard. As nations floundered economically, they contaminated other trading partner economies. Stagflation, stagnant economies with rampant inflation, became like an epidemic sweeping around the world. Let us look ...

Swedish post-war economic development — The role of age structure

... rates and national saving rates first rise and then fall with the difference between savings and investment constituting the current account. Finally in the fourth panel the sound public finances up to the mid 1970s is reflected in the financial saving of the consolidated government sector. The Swed ...

... rates and national saving rates first rise and then fall with the difference between savings and investment constituting the current account. Finally in the fourth panel the sound public finances up to the mid 1970s is reflected in the financial saving of the consolidated government sector. The Swed ...

15 - Finance

... marketing/sales department. The increased expenses generated will be accommodated by planning Marketing Department expenses at 19% of the expanded revenue rather than the current 18%. 3. A major cost reduction effort is underway in the Manufacturing Department which is expected to reduce the Cost Ra ...

... marketing/sales department. The increased expenses generated will be accommodated by planning Marketing Department expenses at 19% of the expanded revenue rather than the current 18%. 3. A major cost reduction effort is underway in the Manufacturing Department which is expected to reduce the Cost Ra ...

NBER WORKING PAPER SERIES DEFICIT AND INTERGENERATIONAL WELFARE IN OPEN ECONOMIES Torsten Persson

... From the earlier discussion about stability we know that the increase in interest rates and associated decrease in capital—labor ratios will continue in subsequent periods as the econorrv approaches its stationary state. The long—run effects on factor prices are easily found from equations (10) to ( ...

... From the earlier discussion about stability we know that the increase in interest rates and associated decrease in capital—labor ratios will continue in subsequent periods as the econorrv approaches its stationary state. The long—run effects on factor prices are easily found from equations (10) to ( ...

CapStrStu

... __________, the D.Ct. and CA-5 held for the taxpayer (i.e., business bad debt). In _________, the S.Ct. formulated the touchstone as the taxpayer’s _________ motive for the loan guarantees. Did the guarantees protect his ________ (annual pre-tax salary of $12,000) or _______ ($39,000 investment)? Th ...

... __________, the D.Ct. and CA-5 held for the taxpayer (i.e., business bad debt). In _________, the S.Ct. formulated the touchstone as the taxpayer’s _________ motive for the loan guarantees. Did the guarantees protect his ________ (annual pre-tax salary of $12,000) or _______ ($39,000 investment)? Th ...

Ensure comprehensive financial regulation

... 1. Identify macroeconomic imbalances in order to reduce them and lay the foundations for strong and sustainable growth 2. Reform the international monetary system to achieve financial stability in a ...

... 1. Identify macroeconomic imbalances in order to reduce them and lay the foundations for strong and sustainable growth 2. Reform the international monetary system to achieve financial stability in a ...

Circular Flow of Economy

... injection that the financial sector provides into the economy is | |investment (I) into the business/firms sector. | |An example of a group in the finance sector includes banks such as Westpac or financial institutions such as Suncorp. | |The next sector introduced into the circular flow of income ...

... injection that the financial sector provides into the economy is | |investment (I) into the business/firms sector. | |An example of a group in the finance sector includes banks such as Westpac or financial institutions such as Suncorp. | |The next sector introduced into the circular flow of income ...

Factor: corporate indebtedness and lack of equity

... – The growth in the corporate loans from ROW in the last years was in greater extent influenced by firms in ROW and less so by banks. – Loans at banks have decreased in H2-2015, as well as loans at international institutions. Corporate loans from ROW have increased in 2015. Figure: Stock of corporat ...

... – The growth in the corporate loans from ROW in the last years was in greater extent influenced by firms in ROW and less so by banks. – Loans at banks have decreased in H2-2015, as well as loans at international institutions. Corporate loans from ROW have increased in 2015. Figure: Stock of corporat ...

February 9, 2017 150/2017-SAE/GAE 2 Itaú Unibanco Holding

... Based on slide 9 made available to the conference call (attached), named “Business Model”, which includes the 9,4% Credit’s Recurring ROE for fiscal year 2016, and on the Projections, an analyst questioned the speaker about the relationship between ROE (return on equity) and cost of capital, and sta ...

... Based on slide 9 made available to the conference call (attached), named “Business Model”, which includes the 9,4% Credit’s Recurring ROE for fiscal year 2016, and on the Projections, an analyst questioned the speaker about the relationship between ROE (return on equity) and cost of capital, and sta ...