Achieving Your Financial Goals

... Record location of all original documents Make visual record of your possessions Record model and serial numbers ...

... Record location of all original documents Make visual record of your possessions Record model and serial numbers ...

REIT Performance Evaluation: A Case Study of Washington Real

... The ratio of long-term debt outstanding to total capitalization is about 35% to 42% -- conservative debt policy by US standards REITs typically use long term debt proceeds to repay advances on lines of credit, finance acquisitions and capital improvement ...

... The ratio of long-term debt outstanding to total capitalization is about 35% to 42% -- conservative debt policy by US standards REITs typically use long term debt proceeds to repay advances on lines of credit, finance acquisitions and capital improvement ...

Click here to free sample

... is enormous, making the interpretation quite imprecise. Second, the International Monetary Fund (IMF) changed its definition of reserves in 1997: An item labeled “Liabilities constituting foreign authorities reserves” was deleted from official reserves and moved to the capital flows account. This fi ...

... is enormous, making the interpretation quite imprecise. Second, the International Monetary Fund (IMF) changed its definition of reserves in 1997: An item labeled “Liabilities constituting foreign authorities reserves” was deleted from official reserves and moved to the capital flows account. This fi ...

Is the U.S. Economy Headed for a Hard Landing?

... benefits than they did several decades ago. It appears to be the end of an era in which blue-collar workers in the US could be part of the middle class. Another increasingly important strategy by capitalists to reduce wage costs has been to move their production operations to low-wage areas around t ...

... benefits than they did several decades ago. It appears to be the end of an era in which blue-collar workers in the US could be part of the middle class. Another increasingly important strategy by capitalists to reduce wage costs has been to move their production operations to low-wage areas around t ...

Lecture 7 Balance of payments and exchange rates

... “Some argue our large trade deficit (or current account deficit) is responsible for the fall in the dollar's value. They have it backward. It is the flow of foreign investment dollars (the capital account) into the U.S. economy that drives the trade deficit. The U.S. economy's higher return on capit ...

... “Some argue our large trade deficit (or current account deficit) is responsible for the fall in the dollar's value. They have it backward. It is the flow of foreign investment dollars (the capital account) into the U.S. economy that drives the trade deficit. The U.S. economy's higher return on capit ...

Financial planning

... We want to become immediately after the Rex the reference hotel for people who want a unique experience and not the standard (high level) service provided by international chains ...

... We want to become immediately after the Rex the reference hotel for people who want a unique experience and not the standard (high level) service provided by international chains ...

CIO Weekly Letter - Merrill Lynch Wealth Management

... information is neither reviewed nor approved by BofA ML Research. This information and any discussion should not be construed as a personalized and individual recommendation, which should be based on your investment objectives, risk tolerance, and financial situation and needs. This information and ...

... information is neither reviewed nor approved by BofA ML Research. This information and any discussion should not be construed as a personalized and individual recommendation, which should be based on your investment objectives, risk tolerance, and financial situation and needs. This information and ...

glossary and abbreviations - ACT Department of Treasury

... depreciation is generally used in relation to non-current assets that have physical substance (for example, property, plant and equipment), while amortisation is generally used in relation to intangible non-current assets (for example, intangible and leased assets). Appropriation The maximum amount ...

... depreciation is generally used in relation to non-current assets that have physical substance (for example, property, plant and equipment), while amortisation is generally used in relation to intangible non-current assets (for example, intangible and leased assets). Appropriation The maximum amount ...

The Solow Growth Model

... prices because we are strictly interested in output = real income. Everyone works all the time, so there is no labor/leisure choice. In fact, there is no choice at all: the consumer always saves a fixed portion of income, always works, and owns the firm so collects all “wage” income and profit in th ...

... prices because we are strictly interested in output = real income. Everyone works all the time, so there is no labor/leisure choice. In fact, there is no choice at all: the consumer always saves a fixed portion of income, always works, and owns the firm so collects all “wage” income and profit in th ...

BBY Conference Presentation 14 Sept 2010

... Performance not linked to grain prices (apart from impacts on working capital) Sales dollars are linked to grain prices but profitability is driven by volume and margin Ridley’s business is supported by customer contracts (c.60%) Ridley converts a high proportion of its EBITDA to cash - part ...

... Performance not linked to grain prices (apart from impacts on working capital) Sales dollars are linked to grain prices but profitability is driven by volume and margin Ridley’s business is supported by customer contracts (c.60%) Ridley converts a high proportion of its EBITDA to cash - part ...

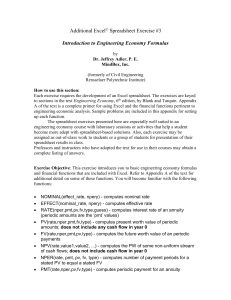

Additional Computer Exercise 3

... Future value (fv) – the value of the investment or loan after all payments have been made. (F) Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an inve ...

... Future value (fv) – the value of the investment or loan after all payments have been made. (F) Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an inve ...

A Macroprudential Perspective in the Conduct of Monetary Policy Ryuzo Miyao

... growth and stable inflation—the so-called Great Moderation. Such an environment led to the prevalence of optimism about the future. There was also growing overconfidence in the sophistication of financial technologies. In those circumstances, imbalances accumulated in the form of expanding credit an ...

... growth and stable inflation—the so-called Great Moderation. Such an environment led to the prevalence of optimism about the future. There was also growing overconfidence in the sophistication of financial technologies. In those circumstances, imbalances accumulated in the form of expanding credit an ...

O PAPEL DA MOEDA EM MARX E KEYNES

... reversal potential for Brazil and, then, the external vulnerability of this economy. - To measure the volatility of each sub-account of the Financial Account, detecting which flows have more influence on the vulnerability of this account. - To find out which capital flight measure is the best one fo ...

... reversal potential for Brazil and, then, the external vulnerability of this economy. - To measure the volatility of each sub-account of the Financial Account, detecting which flows have more influence on the vulnerability of this account. - To find out which capital flight measure is the best one fo ...

INTRODUCTION - State Bank of Pakistan

... 2. The main categories of BOP are (a) Current Account (CA) (b) Capital Account, (c) Financial Account, and (d) Errors and Omissions. The CA comprises of balance of trade in goods & services, income account and current transfers. Capital account relates to acquisition / disposal of non-produced non-f ...

... 2. The main categories of BOP are (a) Current Account (CA) (b) Capital Account, (c) Financial Account, and (d) Errors and Omissions. The CA comprises of balance of trade in goods & services, income account and current transfers. Capital account relates to acquisition / disposal of non-produced non-f ...

Full Page with Layout Heading

... The information and any analyses contained in this presentation are taken from, or based upon, information obtained from the recipient or from publicly available sources, the completeness and accuracy of which has not been independently verified, and cannot be assured by RBC Capital Markets. The inf ...

... The information and any analyses contained in this presentation are taken from, or based upon, information obtained from the recipient or from publicly available sources, the completeness and accuracy of which has not been independently verified, and cannot be assured by RBC Capital Markets. The inf ...

Developments in Banking Capital and Liquidity

... — Eligible collateral - all assets available for repurchase with the RBA under normal operations (including ‘self-securitised’ RMBS). However, the collateral pool must also be ‘diversified’. — Coverage and Usage - supports AUD liquidity shortfalls only and is only intended to be utilised in a ‘crisi ...

... — Eligible collateral - all assets available for repurchase with the RBA under normal operations (including ‘self-securitised’ RMBS). However, the collateral pool must also be ‘diversified’. — Coverage and Usage - supports AUD liquidity shortfalls only and is only intended to be utilised in a ‘crisi ...

External Impact of US Monetary Policy on Emerging Markets

... particularly to the devaluation of the Renminbi. ...

... particularly to the devaluation of the Renminbi. ...

Finance capital and the nature of capitalism in India today

... productivity and output growth by providing the actual cultivators – whether tenants or peasants – with the means and incentive to invest and by distributing more equally the benefits of that growth so that those benefits could translate into demand for manufactured goods that have a mass market tha ...

... productivity and output growth by providing the actual cultivators – whether tenants or peasants – with the means and incentive to invest and by distributing more equally the benefits of that growth so that those benefits could translate into demand for manufactured goods that have a mass market tha ...

Name: Date: Understanding Personal Finances 1. Budgeting is

... c. Allow your financial planner to make all of your major money decisions d. Regularly monitor and reassess your financial plan 15. Why is having a fully funded emergency fund so important when it comes to your financial well-being? a. As long as you have a good-paying job, you really donʹt need an ...

... c. Allow your financial planner to make all of your major money decisions d. Regularly monitor and reassess your financial plan 15. Why is having a fully funded emergency fund so important when it comes to your financial well-being? a. As long as you have a good-paying job, you really donʹt need an ...

Financial Sector 3

... money ultimately created per dollar deposited in the banking system. The financial sector is the market where financial assets are created and exchanged ...

... money ultimately created per dollar deposited in the banking system. The financial sector is the market where financial assets are created and exchanged ...

k8055e

... fuel crisis of 2006–08. While food commodity prices in world markets declined substantially in the wake of the financial crisis, they remained high by recent historical standards. This has been arguably due to increased linkage of food commodity prices to energy prices on the supply and demand sides ...

... fuel crisis of 2006–08. While food commodity prices in world markets declined substantially in the wake of the financial crisis, they remained high by recent historical standards. This has been arguably due to increased linkage of food commodity prices to energy prices on the supply and demand sides ...