The African State and Natural Resource Governance in the 21 Century

... contracts. For example, the recent practice of exchanging natural resource licenses for infrastructure projects is inherently difficult to evaluate, and will thus be perceived as non-transparent. We will only generate hostility from local communities if contract negotiations and tax payments by fore ...

... contracts. For example, the recent practice of exchanging natural resource licenses for infrastructure projects is inherently difficult to evaluate, and will thus be perceived as non-transparent. We will only generate hostility from local communities if contract negotiations and tax payments by fore ...

T5_FM_MT_1 - RuralNaukri.com

... year. Hence, what could be bough by Rs Rs 1,000 today will need Rs (1,000 / 0.935) after one year. On the other hand, if money is invested today, it can earn returns. e.g. if Rs. 10,000 invested with expected rate of return of 5 % per annum, at the end of one year, it will be Rs 10,000 + (10,000 X 0 ...

... year. Hence, what could be bough by Rs Rs 1,000 today will need Rs (1,000 / 0.935) after one year. On the other hand, if money is invested today, it can earn returns. e.g. if Rs. 10,000 invested with expected rate of return of 5 % per annum, at the end of one year, it will be Rs 10,000 + (10,000 X 0 ...

Eduardo Cavallo

... Outlook for LAC in the context of the crisis It makes all the difference if the world economy reaches its pre-crisis levels of industrial production in 2010 or in 2013. ...

... Outlook for LAC in the context of the crisis It makes all the difference if the world economy reaches its pre-crisis levels of industrial production in 2010 or in 2013. ...

Chapter 15

... 1. Compute the present value of an asset that delivers a stream of future benefits. 2. Explain why the demand for investment is negatively related to the interest rate. ...

... 1. Compute the present value of an asset that delivers a stream of future benefits. 2. Explain why the demand for investment is negatively related to the interest rate. ...

The Research on Evaluation System of Financial Strength

... Company's financial strength evaluation is to estimate the company's financial position and operating results in ordering to reveal the financial situation and further trend, which based on the main index in the financial reports. Financial strength evaluation is important for investors to assess th ...

... Company's financial strength evaluation is to estimate the company's financial position and operating results in ordering to reveal the financial situation and further trend, which based on the main index in the financial reports. Financial strength evaluation is important for investors to assess th ...

The City of Neenah Municipal Museum Fund

... of any quarter, the equity exposure will be reviewed and reduced where appropriate to comply with this limitation. The vast majority of the investments will be highly marketable with the likely exception being small capitalization stocks, an area that may involve less-liquid investments. Fixed incom ...

... of any quarter, the equity exposure will be reviewed and reduced where appropriate to comply with this limitation. The vast majority of the investments will be highly marketable with the likely exception being small capitalization stocks, an area that may involve less-liquid investments. Fixed incom ...

EPIC RECESSION - Kyklos Productions

... -The Two Faces of Speculative Investing -The Fed, Liquidity and Credit -Securitization and Credit -‘Global Savings Glut’ and Global Liquidity -Inequality and Liquidity -The Shadow Banking System Post 2000 -A Partial Summary -From Excess Credit to Excessive Debt -The ‘Dot.com’ Bust -The Jobless Reces ...

... -The Two Faces of Speculative Investing -The Fed, Liquidity and Credit -Securitization and Credit -‘Global Savings Glut’ and Global Liquidity -Inequality and Liquidity -The Shadow Banking System Post 2000 -A Partial Summary -From Excess Credit to Excessive Debt -The ‘Dot.com’ Bust -The Jobless Reces ...

Cash Flow Summary

... Cash Flow According to Williams (2002, Chapter Summary), the purpose of a statement of cash flows is to provide information about the cash receipts and cash payments of the entity, and how they relate to the entity's operating, investing, and financing activities. Readers of financial statements use ...

... Cash Flow According to Williams (2002, Chapter Summary), the purpose of a statement of cash flows is to provide information about the cash receipts and cash payments of the entity, and how they relate to the entity's operating, investing, and financing activities. Readers of financial statements use ...

FIN-121 Personal Finance

... Be able to manage your cash and credit through budgeting and discipline Understand how to best use credit and maximize your purchasing power for all purchases, including major purchase such as a home or automobile Minimize risk exposure through proper insurance of life, health and property, an ...

... Be able to manage your cash and credit through budgeting and discipline Understand how to best use credit and maximize your purchasing power for all purchases, including major purchase such as a home or automobile Minimize risk exposure through proper insurance of life, health and property, an ...

trends in australia`s trade and the balance of

... Table 9 shows that over time the stock of foreign liabilities had risen to $2,034,170m in 2010-11, consisting of $734,650m in equity borrowings and $1,299,520m in debt borrowings. Total foreign assets were valued at -$1,253,049m in 2010-11, consisting of -$628,520m in equity lending and -$624,529m i ...

... Table 9 shows that over time the stock of foreign liabilities had risen to $2,034,170m in 2010-11, consisting of $734,650m in equity borrowings and $1,299,520m in debt borrowings. Total foreign assets were valued at -$1,253,049m in 2010-11, consisting of -$628,520m in equity lending and -$624,529m i ...

Summer Fusion 2015

... and you have to provide financial justification and you have to make decisions on numbers that come from other people. If you do not know what you are looking at, and you do not know the right questions to ask..................your effectiveness is diminished. ...

... and you have to provide financial justification and you have to make decisions on numbers that come from other people. If you do not know what you are looking at, and you do not know the right questions to ask..................your effectiveness is diminished. ...

STRENGTHENING THE FINANCIAL SYSTEM

... firms to disclose clear, comprehensive, and timely information about compensation. Supervisors will assess firms’ policies as part of their overall assessment of their soundness. Where necessary they will intervene with responses that can include increased capital requirements. Tax havens and non- ...

... firms to disclose clear, comprehensive, and timely information about compensation. Supervisors will assess firms’ policies as part of their overall assessment of their soundness. Where necessary they will intervene with responses that can include increased capital requirements. Tax havens and non- ...

Chapter 8 Working Capital Management

... RECEIVABLE MANAGEMENT • Aging schedule, which is a breakdown of accounts by length of time outstanding: - Use a weighted average collection period measure to get a better picture of how long accounts are outstanding. - Examine changes from the typical pattern. • Number of days receivable: ...

... RECEIVABLE MANAGEMENT • Aging schedule, which is a breakdown of accounts by length of time outstanding: - Use a weighted average collection period measure to get a better picture of how long accounts are outstanding. - Examine changes from the typical pattern. • Number of days receivable: ...

word_link - Alexander`s Inc.

... $15,000,000 will be used to pay its liability to Federated. The Company estimates that capital expenditure requirements for the redevelopment of its Paramus property, will approximate $100,000,000. The Company is evaluating development plans for the Lexington Avenue site, which may include a large m ...

... $15,000,000 will be used to pay its liability to Federated. The Company estimates that capital expenditure requirements for the redevelopment of its Paramus property, will approximate $100,000,000. The Company is evaluating development plans for the Lexington Avenue site, which may include a large m ...

WORKING CAPITAL MANAGEMENT What is Working Capital

... Working capital management is more critical for those industries which seek higher liquidity for their daily operational activities or by nature whose operating cycle is higher - such as technology firms because goods take time to produce and it is reasonable to expect these firms to have a large va ...

... Working capital management is more critical for those industries which seek higher liquidity for their daily operational activities or by nature whose operating cycle is higher - such as technology firms because goods take time to produce and it is reasonable to expect these firms to have a large va ...

Discussion on the Financial Sector Reform and the Economy

... Under financial restraints, banks were induced to provide services that are not supplied under perfectly competitive markets (e.g. term loans are usually under-supplied, because banks are reluctant to engage in longterm lending due to agency problems, inflation risk and the lack of liquidity that ac ...

... Under financial restraints, banks were induced to provide services that are not supplied under perfectly competitive markets (e.g. term loans are usually under-supplied, because banks are reluctant to engage in longterm lending due to agency problems, inflation risk and the lack of liquidity that ac ...

statement of investment policy

... Investments of the Corning Healthcare District shall be undertaken in a manner that seeks to ensure the preservation of capital in the overall portfolio. B. Liquidity: An adequate percentage of the portfolio will be maintained in liquid, shortterm securities which can be converted to cash if necessa ...

... Investments of the Corning Healthcare District shall be undertaken in a manner that seeks to ensure the preservation of capital in the overall portfolio. B. Liquidity: An adequate percentage of the portfolio will be maintained in liquid, shortterm securities which can be converted to cash if necessa ...

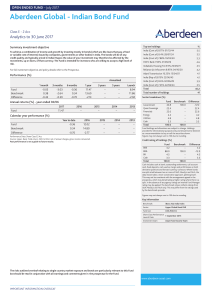

Aberdeen Global - Indian Bond Fund

... Risk factors you should consider before investing: l The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have ...

... Risk factors you should consider before investing: l The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have ...

issue of PNAS the results of her research

... ment. You have a Catch 22 situation. There’s an old saying that “When anyone can borrow, no one will default,” and I think that’s a pretty good description of what we’ve been through in the last few years. I guess that’s the flip side of a bank always being willing to give you a loan—unless you rea ...

... ment. You have a Catch 22 situation. There’s an old saying that “When anyone can borrow, no one will default,” and I think that’s a pretty good description of what we’ve been through in the last few years. I guess that’s the flip side of a bank always being willing to give you a loan—unless you rea ...