Issues in the development assessment

... Assessing unmet needs of corporates & households (not easy - data deficiencies, including for crosscountry benchmarking) ...

... Assessing unmet needs of corporates & households (not easy - data deficiencies, including for crosscountry benchmarking) ...

Statistical implications of the crisis Marco Mira d’Ercole Counsellor, OECD Statistics Directorate

... Starts at the centre of developed world rather than at its periphery, as had been the case with crises of Mexico in early-80s; Sweden and Japan in early-90s; South-East Asia and Russia in late-90s; Argentina in early-2000s Focal point in the financial sector (“shadow banking”), with high leverag ...

... Starts at the centre of developed world rather than at its periphery, as had been the case with crises of Mexico in early-80s; Sweden and Japan in early-90s; South-East Asia and Russia in late-90s; Argentina in early-2000s Focal point in the financial sector (“shadow banking”), with high leverag ...

Slide

... not because of myopic mercantilism, but as part of an export-led development strategy that is rational given China’s need to import workable systems of finance & corporate governance. ...

... not because of myopic mercantilism, but as part of an export-led development strategy that is rational given China’s need to import workable systems of finance & corporate governance. ...

Capital Flows and Accelerating Mechanism: An Alternative

... (reducing the probability of a sudden stop and/or BoP crisis). ...

... (reducing the probability of a sudden stop and/or BoP crisis). ...

CONDUCT, PERFORMANCE AND DISCIPLINARY PROCEDURE

... Delivering advice to clients, their Executive Teams and Boards on the implications and specifics of funding arrangements, and presenting or discussing these face-to-face if required ...

... Delivering advice to clients, their Executive Teams and Boards on the implications and specifics of funding arrangements, and presenting or discussing these face-to-face if required ...

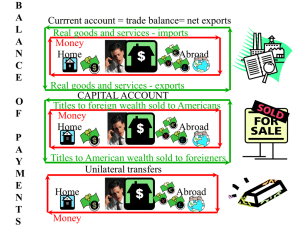

International Lecture

... Abroad Real goods and services - exports CAPITAL ACCOUNT Titles to foreign wealth sold to Americans Money Home Abroad Titles to American wealth sold to foreigners Unilateral transfers ...

... Abroad Real goods and services - exports CAPITAL ACCOUNT Titles to foreign wealth sold to Americans Money Home Abroad Titles to American wealth sold to foreigners Unilateral transfers ...

Federal Reserve - Plain Local Schools

... $ Providing certain financial services to the US Govt., to the public, to financial institutions, and to foreign official institutions, including playing a major role in operating the nation’s payment system ...

... $ Providing certain financial services to the US Govt., to the public, to financial institutions, and to foreign official institutions, including playing a major role in operating the nation’s payment system ...

The Mexican peso financing of US$108 million equivalent for the

... eliminated currency risk for the subnational government, the domestic development bank, and the federal government. ...

... eliminated currency risk for the subnational government, the domestic development bank, and the federal government. ...

Introduction to Financial Management FIN 102

... briefly about Chapter 1 and then 3 & 4 about Market Basics. Financial Institutions and Markets ...

... briefly about Chapter 1 and then 3 & 4 about Market Basics. Financial Institutions and Markets ...

Presentation (PowerPoint Only)

... Event-driven mid-sized enterprise in strong asset class Take enterprises to “next level” through refinancing or new capital injection Local expertise and diverse investment strategies ...

... Event-driven mid-sized enterprise in strong asset class Take enterprises to “next level” through refinancing or new capital injection Local expertise and diverse investment strategies ...

The impacts of currency markets in an increasingly

... Some of the dust has settled since those Monday markets but the questions remain. A cut in interest rates from the People’s Bank of China may have soothed market nerves to a certain extent and granted us a little perspective. That perspective is the gradual moving of the economic centre of gravity e ...

... Some of the dust has settled since those Monday markets but the questions remain. A cut in interest rates from the People’s Bank of China may have soothed market nerves to a certain extent and granted us a little perspective. That perspective is the gradual moving of the economic centre of gravity e ...

Introduction

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

Stabilitetsplan för Sverige

... set the stage for speculation and soaring real estate prices. A real estate bubble burst, a currency crisis including soaring interests rates turned the economy into a deep recession. Increasing budget deficits and sharply rising bank losses and financing problems – an extraordinary vulnerable situa ...

... set the stage for speculation and soaring real estate prices. A real estate bubble burst, a currency crisis including soaring interests rates turned the economy into a deep recession. Increasing budget deficits and sharply rising bank losses and financing problems – an extraordinary vulnerable situa ...

The Post GFC World - Melbourne Institute of Applied Economic and

... • Key is whether the boom in the terms of trade is permanent or temporary • Optimal response should not be based on our ability to forecast but should manage the risks of alternative futures ...

... • Key is whether the boom in the terms of trade is permanent or temporary • Optimal response should not be based on our ability to forecast but should manage the risks of alternative futures ...

Our World at a Glance

... – Whether the investor expects to collect all amounts due according to the contractual terms of a security – If an adverse change in cash flows has occurred, the investment is other than temporarily impaired – The degree of decline in value, the time until anticipated recovery of value, and period o ...

... – Whether the investor expects to collect all amounts due according to the contractual terms of a security – If an adverse change in cash flows has occurred, the investment is other than temporarily impaired – The degree of decline in value, the time until anticipated recovery of value, and period o ...

Answers to pause for thought questions

... Do you agree that ‘ever more rapid financial flows across the world that are unpredictable and uncertain’ make Keynesian discretionary fiscal (and monetary) policy less suitable? Explain. Discretionary fiscal policy can be undermined by international financial flows. For example, if government expen ...

... Do you agree that ‘ever more rapid financial flows across the world that are unpredictable and uncertain’ make Keynesian discretionary fiscal (and monetary) policy less suitable? Explain. Discretionary fiscal policy can be undermined by international financial flows. For example, if government expen ...

Global Trade Terms

... Global economy- the merging of regional economies in which nations become dependent on each other for goods and services. Globalization- the development of an increasingly integrated global economy marked especially by free trade, free flow of capital, and the tapping of cheaper foreign labor market ...

... Global economy- the merging of regional economies in which nations become dependent on each other for goods and services. Globalization- the development of an increasingly integrated global economy marked especially by free trade, free flow of capital, and the tapping of cheaper foreign labor market ...

the rise and decline of fiat money?

... further eroded the legitimacy of the international monetary system. Macro-economic policy and the international monetary system now seem to be at a historic tipping point, just as they were during the Great Depression. Reshaping them are the great challenges for the future. How might this be done? D ...

... further eroded the legitimacy of the international monetary system. Macro-economic policy and the international monetary system now seem to be at a historic tipping point, just as they were during the Great Depression. Reshaping them are the great challenges for the future. How might this be done? D ...

Int'l Monetary Crisis - University of Texas at Austin

... handling of government debt Via reserve requirements, discount rate, open market operations ¢ Regulation of finance part of monetary policy ...

... handling of government debt Via reserve requirements, discount rate, open market operations ¢ Regulation of finance part of monetary policy ...

SS7E2 The student will explain how voluntary trade benefits buyers

... a. Explain the relationship between investment in human capital (education and training) and gross domestic product (GDP). b. Explain the relationship between investment in capital (factories, machinery, and technology) and gross domestic product (GDP). c. Explain how the distribution of diamonds, g ...

... a. Explain the relationship between investment in human capital (education and training) and gross domestic product (GDP). b. Explain the relationship between investment in capital (factories, machinery, and technology) and gross domestic product (GDP). c. Explain how the distribution of diamonds, g ...

Statement by Mr. Svetoslav Gavriiski, Governor of the Bulgarian

... will be able to come to an agreement. This will add up to the financial stability of the country. I believe that there is room for improvement of banks’ activities. Typical of any economy in transition is the weak participation of the banking system as a mediator between financial resources and comp ...

... will be able to come to an agreement. This will add up to the financial stability of the country. I believe that there is room for improvement of banks’ activities. Typical of any economy in transition is the weak participation of the banking system as a mediator between financial resources and comp ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.