Financial Stability: The Role of Prudent Banking Policies and Information Flows

... The peer review process provides for follow-up actions, which include monitoring of agreed implementation actions and sharing insights with other parties. ...

... The peer review process provides for follow-up actions, which include monitoring of agreed implementation actions and sharing insights with other parties. ...

The World Bank Group

... fund has a AAA rating allowing it to gain capital from international financial markets. At this point, retained earnings also make up a large portion of the IFC. ...

... fund has a AAA rating allowing it to gain capital from international financial markets. At this point, retained earnings also make up a large portion of the IFC. ...

Global Imbalances Ford Ramsey, Claire Huang, and

... rates, American households and investors were more willing to continue expanding consumption and the housing boom, as well as making riskier decisions in the instruments they used. All in all, imblances led to a unique combination of low interest rates, low inflation, housing appreciation, lax lendi ...

... rates, American households and investors were more willing to continue expanding consumption and the housing boom, as well as making riskier decisions in the instruments they used. All in all, imblances led to a unique combination of low interest rates, low inflation, housing appreciation, lax lendi ...

Presentation_Barrell_ppt

... The weighting meant own currency sovereign bonds had a zero risk weights. Domestic holders of Greek debt had a more realistic perception of risks, so returns looked high to banks elsewhere ...

... The weighting meant own currency sovereign bonds had a zero risk weights. Domestic holders of Greek debt had a more realistic perception of risks, so returns looked high to banks elsewhere ...

ageing and financial stability

... appreciation/loss of competitiveness, excess liquidity, asset price volatility, possible policy errors (as Japan) • Later balance of payments deficit, with risks of currency crises and exchange rate volatility accompanying banking crises • Underlines need to promote growth in EU – and slow growing E ...

... appreciation/loss of competitiveness, excess liquidity, asset price volatility, possible policy errors (as Japan) • Later balance of payments deficit, with risks of currency crises and exchange rate volatility accompanying banking crises • Underlines need to promote growth in EU – and slow growing E ...

1. Intertwined World Economy

... • The net result of these factors has been the increased interdependence of countries/economies and increased competitiveness and the concomitant need for firms to keep a constant watch on the international economic environment. • Consumers and companies in the U.S. and Japan tend to be able to find ...

... • The net result of these factors has been the increased interdependence of countries/economies and increased competitiveness and the concomitant need for firms to keep a constant watch on the international economic environment. • Consumers and companies in the U.S. and Japan tend to be able to find ...

Macroeconomic and International Policy Terms

... Recession. A cyclical downward movement in the economy involving at least two consecutive quarters of a decline in the real (inflation-adjusted) Gross National Product (GNP). A recession can also be used to describe a sustained period of depressed economic conditions for an individual industry, suc ...

... Recession. A cyclical downward movement in the economy involving at least two consecutive quarters of a decline in the real (inflation-adjusted) Gross National Product (GNP). A recession can also be used to describe a sustained period of depressed economic conditions for an individual industry, suc ...

Key messages

... The impact of the crisis is spreading beyond advanced and emerging markets to LICs (“third wave”). ...

... The impact of the crisis is spreading beyond advanced and emerging markets to LICs (“third wave”). ...

Griffin_01

... Exporting and Importing • Exporting: selling of products made in one’s own country for use or resale in other countries • Importing: buying of products made in other countries for use or resale in one’s own country ...

... Exporting and Importing • Exporting: selling of products made in one’s own country for use or resale in other countries • Importing: buying of products made in other countries for use or resale in one’s own country ...

Review of Jens Forssbæck and Lars Oxelheim`s Money

... refuge from this sort of international economic pressure in regional monetary arrangements such as the Economic and Monetary Union (EMU) in Europe. However, membership in these sorts of institutional arrangements also brings a significant loss of sovereignty. After all, these sorts of arrangements e ...

... refuge from this sort of international economic pressure in regional monetary arrangements such as the Economic and Monetary Union (EMU) in Europe. However, membership in these sorts of institutional arrangements also brings a significant loss of sovereignty. After all, these sorts of arrangements e ...

seminsar_Mar10_Bhanupong

... of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for machinery and equipment related to productions and services at 40% of costs ...

... of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for machinery and equipment related to productions and services at 40% of costs ...

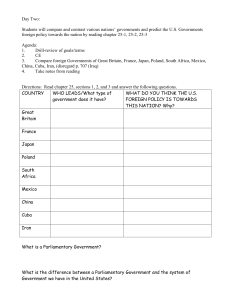

National Teacher Conference

... asset stripping, financing conflict, tax evasion or other morally reprehensible practices. ...

... asset stripping, financing conflict, tax evasion or other morally reprehensible practices. ...

1-10-12 govt - TuscaroraGovernment

... All males when they reach age 18 are required to: a. obtain a passport b. obtain a visa c. serve in the military d. register for the draft ...

... All males when they reach age 18 are required to: a. obtain a passport b. obtain a visa c. serve in the military d. register for the draft ...

Research Statement

... one. The general point is that domestic economic exposure to the adverse consequences of default helps the government “purchase commitment” to make repayments in future periods. Beyond the specific model framework I have employed, it would be interesting to explore other measures of domestic economi ...

... one. The general point is that domestic economic exposure to the adverse consequences of default helps the government “purchase commitment” to make repayments in future periods. Beyond the specific model framework I have employed, it would be interesting to explore other measures of domestic economi ...

Greek crisis

... assessment by the EC and the ECB of the risks to financial stability in the euro area. The adjustment programme agreed was negotiated, in liaison with the ECB and the IMF. The overall financing package amounts to €110 billion over three years. The first review of the programme in Summer 2010 conclud ...

... assessment by the EC and the ECB of the risks to financial stability in the euro area. The adjustment programme agreed was negotiated, in liaison with the ECB and the IMF. The overall financing package amounts to €110 billion over three years. The first review of the programme in Summer 2010 conclud ...

ch30

... The United States and the rest of the world are linked through many channels – Key channels that allowed the crisis to spread were financial links due to both holdings of assets across borders and the spread of pessimism across markets – In addition, links across countries due to trade flows meant t ...

... The United States and the rest of the world are linked through many channels – Key channels that allowed the crisis to spread were financial links due to both holdings of assets across borders and the spread of pessimism across markets – In addition, links across countries due to trade flows meant t ...

TMA Europe Conference will be held at the Landmark Hotel

... Down cycle prolonged by not taking pain early Overall drag on economic growth ...

... Down cycle prolonged by not taking pain early Overall drag on economic growth ...

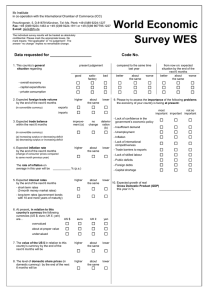

WES Questionnaire (PDF, 25 KB)

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

Miscellaneous DEPARTMENT OF FINANCIAL SERVICES FSC

... following application. Comments may be submitted to the Division Director, 200 East Gaines Street, Tallahassee, Florida 32399-0371, for inclusion in the official record without requesting a hearing. However, pursuant to provisions specified in Chapter 69U-105, Florida Administrative Code, any person ...

... following application. Comments may be submitted to the Division Director, 200 East Gaines Street, Tallahassee, Florida 32399-0371, for inclusion in the official record without requesting a hearing. However, pursuant to provisions specified in Chapter 69U-105, Florida Administrative Code, any person ...

Y BRIEFS MPDD POLIC

... The notable sensitivity of capital flows in emerging Asia-Pacific to global risk appetite reminds us that while the region may look more appealing to investors than other world’s emerging regions, it remains far from being a safe haven market. Investors fled much of Asia-Pacific to cut their exposur ...

... The notable sensitivity of capital flows in emerging Asia-Pacific to global risk appetite reminds us that while the region may look more appealing to investors than other world’s emerging regions, it remains far from being a safe haven market. Investors fled much of Asia-Pacific to cut their exposur ...

FRBSF L CONOMIC

... The effectiveness of the regulatory regime gradually declined, primarily because of the growth of the more loosely supervised shadow banking system consisting of nondepository financial institutions such as investment banks, hedge funds, money market funds, special purpose vehicles, and insurers. Th ...

... The effectiveness of the regulatory regime gradually declined, primarily because of the growth of the more loosely supervised shadow banking system consisting of nondepository financial institutions such as investment banks, hedge funds, money market funds, special purpose vehicles, and insurers. Th ...

From a financial crisis

... Growing again: The pre-crisis need for structural reform is reinforced. Releasing Europe’s growth potential is a pressing priority. A well-functioning EMU will help. ...

... Growing again: The pre-crisis need for structural reform is reinforced. Releasing Europe’s growth potential is a pressing priority. A well-functioning EMU will help. ...

Gearing Capital Funding

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.