robin hood tax now! - National Union of Public and General

... They made us pay. They expect us to pay again. The world’s banks and financial institutions brought the global economy to the brink in 2008 with their crazy speculation, risky lending practices and payment of outrageous bonuses to themselves. And when it all came down to who bailed them out—we did! ...

... They made us pay. They expect us to pay again. The world’s banks and financial institutions brought the global economy to the brink in 2008 with their crazy speculation, risky lending practices and payment of outrageous bonuses to themselves. And when it all came down to who bailed them out—we did! ...

European Business School London Regents College

... which spread to the financial sector • Thailand has experienced a massive net capital inflow during the previous three years (13% of Thai GDP) • The year 1997 saw this inflow at first stop, and by the second and third quarters, sharply reverse • An unexpected fall in exports in early 1997 heightened ...

... which spread to the financial sector • Thailand has experienced a massive net capital inflow during the previous three years (13% of Thai GDP) • The year 1997 saw this inflow at first stop, and by the second and third quarters, sharply reverse • An unexpected fall in exports in early 1997 heightened ...

FedViews

... Inflation remains below the Federal Open Market Committee’s 2% long-run target. We may see some further weakness in overall inflation in the second half of the year due to lower oil prices and a stronger dollar. However, we expect inflation to gradually move back to the target over the medium term a ...

... Inflation remains below the Federal Open Market Committee’s 2% long-run target. We may see some further weakness in overall inflation in the second half of the year due to lower oil prices and a stronger dollar. However, we expect inflation to gradually move back to the target over the medium term a ...

Only One Clear Winner (October 2010)

... The aggressive monetary policy followed by the U.S. policymakers is central in both processes. The necessary adjustments are difficult to accomplish, especially if accompanied by immediate losses for the countries concerned. Export-orientated economies whose currencies have appreciated against the d ...

... The aggressive monetary policy followed by the U.S. policymakers is central in both processes. The necessary adjustments are difficult to accomplish, especially if accompanied by immediate losses for the countries concerned. Export-orientated economies whose currencies have appreciated against the d ...

International Trade – A Global Transformation Mark S

... Keynsians and their critics • Does increased government spending really stop a downturn? • Weak recovery suggests that it may not work that well ...

... Keynsians and their critics • Does increased government spending really stop a downturn? • Weak recovery suggests that it may not work that well ...

History of the Gold Standard - Capital Consulting Group NC, Inc.

... may not be a desirable byproduct at the time. Also, if one country began to hoard gold, it would require other countries to raise interest rates to keep their money. If that country happened to also be in recession, the end result would not be good. ...

... may not be a desirable byproduct at the time. Also, if one country began to hoard gold, it would require other countries to raise interest rates to keep their money. If that country happened to also be in recession, the end result would not be good. ...

SYLLABUS COURSE TITLE Managerial Finance Faculty/Institute

... The Roles of Finance Financial Assets Investing in Long-Term Assets: Capital Budgeting Capital Structure and Dividend Policy Linkage between stock price and intrinsic value (Dis-) advantages of forms of business organization ...

... The Roles of Finance Financial Assets Investing in Long-Term Assets: Capital Budgeting Capital Structure and Dividend Policy Linkage between stock price and intrinsic value (Dis-) advantages of forms of business organization ...

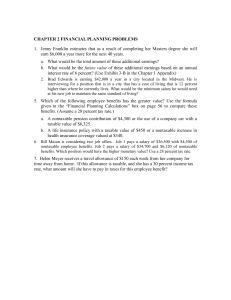

CHAPTER 2 FINANCIAL PLANNING PROBLEMS

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

dr. buser`s lecture power point here

... What the Implication of International Demand for the Tipping Point? International Demand Clearly Adds to the Capacity for US Debt Relative to the Level of Debt Capacity for Other Nations. However, the Full Extent of the Increase In Debt Capacity Had Yet to Be Tested In Addition, it is too Early to ...

... What the Implication of International Demand for the Tipping Point? International Demand Clearly Adds to the Capacity for US Debt Relative to the Level of Debt Capacity for Other Nations. However, the Full Extent of the Increase In Debt Capacity Had Yet to Be Tested In Addition, it is too Early to ...

Freedom 55 Financial`s new Freedom for life

... Introducing Freedom for lifeTM, a brand positioning that’s fresh and relevant to today’s financial realities. The new online digital campaign aims to help this younger demographic see the importance of having a financial plan to help them meet their day-to-day financial goals – paying down debt, sav ...

... Introducing Freedom for lifeTM, a brand positioning that’s fresh and relevant to today’s financial realities. The new online digital campaign aims to help this younger demographic see the importance of having a financial plan to help them meet their day-to-day financial goals – paying down debt, sav ...

Speech to the National Association for Business Economics’ Annual Meeting

... instead actually fell slightly in August, in part due to a drop in construction jobs. However, recent data on manufacturing output and on orders and shipments for core capital goods have been upbeat, and business investment in equipment and software promises to be a bright spot. Despite the hike in ...

... instead actually fell slightly in August, in part due to a drop in construction jobs. However, recent data on manufacturing output and on orders and shipments for core capital goods have been upbeat, and business investment in equipment and software promises to be a bright spot. Despite the hike in ...

THE EU INSTITUTIONAL SYSTEM

... The impact of full economic integration: The balance of payments crisis of 1985 ...

... The impact of full economic integration: The balance of payments crisis of 1985 ...

Burton and Lambra: Chapter One

... Pension Funds Mutual Funds Market Mutual Funds Finance Companies ...

... Pension Funds Mutual Funds Market Mutual Funds Finance Companies ...

1) Corporate financial plans are often used as a basis

... 1) Corporate financial plans are often used as a basis for judging subsequent performance. What can be learned from such comparisons? What problems might arise and how might you cope with such problems? The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring ...

... 1) Corporate financial plans are often used as a basis for judging subsequent performance. What can be learned from such comparisons? What problems might arise and how might you cope with such problems? The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring ...

the charles schwab guide to finances after fifty

... Under her leadership, the Foundation has established two notable financial education programs designed to speak to people at opposite ends of the age spectrum. Money Matters: Make It CountSM, a national personal finance program for teens created in collaboration with Boys & Girls Clubs of America, w ...

... Under her leadership, the Foundation has established two notable financial education programs designed to speak to people at opposite ends of the age spectrum. Money Matters: Make It CountSM, a national personal finance program for teens created in collaboration with Boys & Girls Clubs of America, w ...

FRBSF L CONOMIC

... channels by which risk is shared. Yet, average output growth from 1945 to 1975 in the 14 countries was double the rate of the period since then. And economic activity has become more volatile. Hume and Sentance (2009) have pointed out that aggregate investment has stagnated or fallen despite the sha ...

... channels by which risk is shared. Yet, average output growth from 1945 to 1975 in the 14 countries was double the rate of the period since then. And economic activity has become more volatile. Hume and Sentance (2009) have pointed out that aggregate investment has stagnated or fallen despite the sha ...

download

... ones in some unit case studies, and the bank will make its money on the difference between what it pays out in interest on deposits and what it gets in interest from its loans. If you want to live more dangerously you could buy some bonds, and as long as the organisation or country you've invested i ...

... ones in some unit case studies, and the bank will make its money on the difference between what it pays out in interest on deposits and what it gets in interest from its loans. If you want to live more dangerously you could buy some bonds, and as long as the organisation or country you've invested i ...

3.17 – Globalism`s Discontents

... post-WWII establishment of Bretton Woods system (the system that created IMF/World Bank) US dollar as reserve currency US $ is the most widely held reserve currency in the world today. Throughout the last decade, an average of 2/3s of the total allocated foreign exchange reserves of countries ...

... post-WWII establishment of Bretton Woods system (the system that created IMF/World Bank) US dollar as reserve currency US $ is the most widely held reserve currency in the world today. Throughout the last decade, an average of 2/3s of the total allocated foreign exchange reserves of countries ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.