here

... Global crisis and its aftermath has accelerated the shift by 5-10 years. China, India and America will be the world’s big three: only one is flagging. ...

... Global crisis and its aftermath has accelerated the shift by 5-10 years. China, India and America will be the world’s big three: only one is flagging. ...

Key Issues and Ideas - BYU Marriott School

... 1. FBN, Inc., has just sold 100,000 shares ok as initial public offering. The underwriter’s explicit fees were $70,000. The offering price for the shares was $50, but immediately upon issue, the share price jumped to $53. a. What is your best guess as to the total cost to FBN of the equity issue? b. ...

... 1. FBN, Inc., has just sold 100,000 shares ok as initial public offering. The underwriter’s explicit fees were $70,000. The offering price for the shares was $50, but immediately upon issue, the share price jumped to $53. a. What is your best guess as to the total cost to FBN of the equity issue? b. ...

Lynch, Troy - FSI terms of reference

... shareholders at risk in order to achieve capital growth and income; the same shareholders should bare the risk of their action (and those of their representatives who operate the entity), and not the public or the taxpayer. If argued otherwise it follows that, as per the events that followed the Glo ...

... shareholders at risk in order to achieve capital growth and income; the same shareholders should bare the risk of their action (and those of their representatives who operate the entity), and not the public or the taxpayer. If argued otherwise it follows that, as per the events that followed the Glo ...

Restructuring Distressed Financial Institutions

... depositors and senior creditors. How?: Limits to dividend pay out and/or debt redemptions, on compensation practices, and on voting rights. Ultimately, loss in share value or debt haircuts. Removal of management. ...

... depositors and senior creditors. How?: Limits to dividend pay out and/or debt redemptions, on compensation practices, and on voting rights. Ultimately, loss in share value or debt haircuts. Removal of management. ...

Newsletter January 2015CN

... to an increase in the number of new jobs in the U.S. and a decrease in the unemployment rate. As the U.S. economy grew stronger, it seemed likely that the FED would begin the process of raising interest rates. This would tend to dampen the growth of the economy and control any possible increase in i ...

... to an increase in the number of new jobs in the U.S. and a decrease in the unemployment rate. As the U.S. economy grew stronger, it seemed likely that the FED would begin the process of raising interest rates. This would tend to dampen the growth of the economy and control any possible increase in i ...

How far we`ve come, how little we`ve changed

... actions of the U.S. government carefully. They don’t want to see their investments in U.S. dollar assets become less valuable from dollar depreciation—a direct result of monetary inflation. In summary, even though we have come a long way from the crisis of 2008, there remain potential problems which ...

... actions of the U.S. government carefully. They don’t want to see their investments in U.S. dollar assets become less valuable from dollar depreciation—a direct result of monetary inflation. In summary, even though we have come a long way from the crisis of 2008, there remain potential problems which ...

Chapter 27: Money, Banking, and the Financial Sector

... Chapter 27: The Financial Sector and the Demand for Money c. Disagree. Although financial assets do not have a corresponding liability, they facilitate trades that could not otherwise have taken place and thus have enormous value to society. d. Disagree. The value of an asset depends not only on th ...

... Chapter 27: The Financial Sector and the Demand for Money c. Disagree. Although financial assets do not have a corresponding liability, they facilitate trades that could not otherwise have taken place and thus have enormous value to society. d. Disagree. The value of an asset depends not only on th ...

General Disclosures based on PFRS 7

... (k) Information about compound financial instruments with multiple embedded derivatives; 8 and (l) Breaches of terms of loans agreements. 9 Statement of Comprehensive Income 1. Items of income, expense, gains, and losses, with separate disclosure of gains and losses From: 10 (a) Financial assets mea ...

... (k) Information about compound financial instruments with multiple embedded derivatives; 8 and (l) Breaches of terms of loans agreements. 9 Statement of Comprehensive Income 1. Items of income, expense, gains, and losses, with separate disclosure of gains and losses From: 10 (a) Financial assets mea ...

FINANCIAL RISK MANAGEMENT

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

Financial integration and Economic growth

... Growth theory: one of the key ingredients in economic growth is domestic private investment It (contributes to capital stock) Production function general form : Y = A*(KaL1-a) Were Y – output (GDP); A – technology ; K- capital stock; L – quantity of labor used in production; a – parameter that tells ...

... Growth theory: one of the key ingredients in economic growth is domestic private investment It (contributes to capital stock) Production function general form : Y = A*(KaL1-a) Were Y – output (GDP); A – technology ; K- capital stock; L – quantity of labor used in production; a – parameter that tells ...

Assessment of alternative international monetary regimes

... Geography of wealth transfers during the crisis Different fortunes depending on portfolio structure Countries long equity or FDI tend to have valuation losses Structure of debt portfolio key: government debt versus corporate debt Correlation of losses with ABCP conduits, ABS investments, dollar shor ...

... Geography of wealth transfers during the crisis Different fortunes depending on portfolio structure Countries long equity or FDI tend to have valuation losses Structure of debt portfolio key: government debt versus corporate debt Correlation of losses with ABCP conduits, ABS investments, dollar shor ...

www.regionalcommissions.org

... • GCC governments have announces large programmes of investment in infrastructure and real estate; • More diversified countries also announced fiscal stimulus packages – including through construction projects. ...

... • GCC governments have announces large programmes of investment in infrastructure and real estate; • More diversified countries also announced fiscal stimulus packages – including through construction projects. ...

Introduction

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

Speech to the San Francisco Planning and Urban Research Group

... the increased riskiness of the securities they are covering. Those losses can affect the guarantors’ capital positions and even their own credit ratings. A rating downgrade of a guarantor reduces the value of its credit enhancements and lowers the price of the covered securities. Holders of those se ...

... the increased riskiness of the securities they are covering. Those losses can affect the guarantors’ capital positions and even their own credit ratings. A rating downgrade of a guarantor reduces the value of its credit enhancements and lowers the price of the covered securities. Holders of those se ...

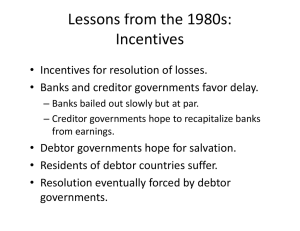

- Why Was the Financial Crisis Less Enduring in Japan and Other Countries...This Time Around?

... Mr. Porte also underscores the increased transparency measures undertaken in the wake of its previous crisis as a differentiating factor. Japan undertook major reforms, including the establishment of the Financial Services Agency in 1998. In the early 1990s, standards regarding nonperforming loan di ...

... Mr. Porte also underscores the increased transparency measures undertaken in the wake of its previous crisis as a differentiating factor. Japan undertook major reforms, including the establishment of the Financial Services Agency in 1998. In the early 1990s, standards regarding nonperforming loan di ...

The Risk and Term Structure of Interest Rates

... are important in understanding why the risk premium behaves as it does. One of the largest risk premiums in U.S. history occurred in the early 1930s when the Great Depression was at its worst. In times of economic prosperity, the risk premium tends to be much smaller. For example, in the boom year o ...

... are important in understanding why the risk premium behaves as it does. One of the largest risk premiums in U.S. history occurred in the early 1930s when the Great Depression was at its worst. In times of economic prosperity, the risk premium tends to be much smaller. For example, in the boom year o ...

Graeme Oram Presentation[1]

... Tooled up by every available course but no progress into work Biggest barrier - £000s of doorstep and other high-cost credit Debt had created an insurmountable array of issues Local advice services weren’t helping Five Lamps recognised a massive gap in the financial services marketplace …… and our c ...

... Tooled up by every available course but no progress into work Biggest barrier - £000s of doorstep and other high-cost credit Debt had created an insurmountable array of issues Local advice services weren’t helping Five Lamps recognised a massive gap in the financial services marketplace …… and our c ...

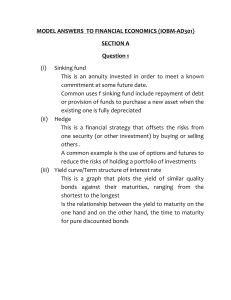

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... Sinking fund This is an annuity invested in order to meet a known commitment at some future date. Common uses f sinking fund include repayment of debt or provision of funds to purchase a new asset when the existing one is fully depreciated (ii) Hedge This is a financial strategy that offsets the ris ...

... Sinking fund This is an annuity invested in order to meet a known commitment at some future date. Common uses f sinking fund include repayment of debt or provision of funds to purchase a new asset when the existing one is fully depreciated (ii) Hedge This is a financial strategy that offsets the ris ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.

![Graeme Oram Presentation[1]](http://s1.studyres.com/store/data/021314501_1-3cb04f79840be6ebc60c4382080f818a-300x300.png)