conclusions for small open economies

... Yet there are some sporadic “cases” of, and “markets” with, unequal legal or regulatory treatment of participants during the crisis. ...

... Yet there are some sporadic “cases” of, and “markets” with, unequal legal or regulatory treatment of participants during the crisis. ...

For immediate distribution 28 April 2009 COMMODITIES

... HFM Columbus is a joint wealth management operation utilising the expertise of IFA firms Hoyland Financial Management and Columbus. The company targets the higher net worth end of the market and offers in-depth solutions ranging from mortgages and investments to employee benefits, retirement and IHT ...

... HFM Columbus is a joint wealth management operation utilising the expertise of IFA firms Hoyland Financial Management and Columbus. The company targets the higher net worth end of the market and offers in-depth solutions ranging from mortgages and investments to employee benefits, retirement and IHT ...

Chapter 1 - Pearson Canada

... 3. Basic supply and demand approach to understand behavior in financial markets 4. Search for profits 5. Transactions cost and asymmetric information approach to financial structure 6. Aggregate supply and demand analysis Features 1. Case studies 2. Applications 3. Special-interest boxes 4. Followin ...

... 3. Basic supply and demand approach to understand behavior in financial markets 4. Search for profits 5. Transactions cost and asymmetric information approach to financial structure 6. Aggregate supply and demand analysis Features 1. Case studies 2. Applications 3. Special-interest boxes 4. Followin ...

Corporate Finance Chap 1

... sources of financing (from internal financing to equity) according to the law of least effort, or of least resistance, preferring to raise equity as a financing means “of last resort”. Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any ...

... sources of financing (from internal financing to equity) according to the law of least effort, or of least resistance, preferring to raise equity as a financing means “of last resort”. Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any ...

C20 Working Group Financial Architecture - G-20Y

... New Financial Architecture for XXI Century Financing for investment, including long-term investments into infrastructure, is a key contributor to economic growth and job creation in all countries. Availability of financing must be an overarching goal of the New Financial Architecture. Current preocc ...

... New Financial Architecture for XXI Century Financing for investment, including long-term investments into infrastructure, is a key contributor to economic growth and job creation in all countries. Availability of financing must be an overarching goal of the New Financial Architecture. Current preocc ...

Economic Turbulence Ahead: How Much, How Long, and What

... Third is the use of mortgage-backed securities by major financial institutions such as Fannie Mae and Freddie Mac. These institutions are backed by the full faith and credit of the U.S. government, which led them to expand credit to higher risk markets. New debt instruments such as collateralized de ...

... Third is the use of mortgage-backed securities by major financial institutions such as Fannie Mae and Freddie Mac. These institutions are backed by the full faith and credit of the U.S. government, which led them to expand credit to higher risk markets. New debt instruments such as collateralized de ...

"Uncertainty and the Welfare Economics of Medical Care" Arrow

... Exempt from certain antitrust rules Predominance of nonprofit over for profit hospitals ...

... Exempt from certain antitrust rules Predominance of nonprofit over for profit hospitals ...

Fair Value Hierarchy In determining fair value, we utilize various

... observable market inputs. We consider recently executed transactions, market price quotations and various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted mark ...

... observable market inputs. We consider recently executed transactions, market price quotations and various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted mark ...

Speech to the Silicon Valley Chapter of Financial Executives International

... primary target. Nonresidential construction is another sector that has been affected by the financial crisis, in part because the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up. Banks and other traditional lenders have also become less ...

... primary target. Nonresidential construction is another sector that has been affected by the financial crisis, in part because the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up. Banks and other traditional lenders have also become less ...

Fair value of financial instruments Amortized cost of financial

... particular security is considered relating to factors including, but not limited to, evidence of significant financial difficulty of the issuer and breach of contractual obligations of the security, such as a default or delinquency on interest or principal payments. The A llianz Group also conside ...

... particular security is considered relating to factors including, but not limited to, evidence of significant financial difficulty of the issuer and breach of contractual obligations of the security, such as a default or delinquency on interest or principal payments. The A llianz Group also conside ...

(I) What happens to loan performance?

... Responsible use of consumer information yields efficiencies and growth across a large number of sectors Overly-restrictive data regimes often worst of both worlds: ...

... Responsible use of consumer information yields efficiencies and growth across a large number of sectors Overly-restrictive data regimes often worst of both worlds: ...

833-2869-1-SP

... central banks to a degree when the policy rate is at the lower bound but there are risks and policy overlaps Effective for highly credible central banks in stemming appreciation in the short-run but also poses important policy, balance sheet, and multilateral risks Weak case to be done by the centra ...

... central banks to a degree when the policy rate is at the lower bound but there are risks and policy overlaps Effective for highly credible central banks in stemming appreciation in the short-run but also poses important policy, balance sheet, and multilateral risks Weak case to be done by the centra ...

The crisis

... A banking crisis: the worst-case scenario Put the following statements in the chronological order: a. The regulators do not spot the trouble in time. b. The bank goes bankrupt. c. The government (the Treasury) steps in and guarantees 100 per cent of the deposits, but repays only investors who made ...

... A banking crisis: the worst-case scenario Put the following statements in the chronological order: a. The regulators do not spot the trouble in time. b. The bank goes bankrupt. c. The government (the Treasury) steps in and guarantees 100 per cent of the deposits, but repays only investors who made ...

Weekly roundup - Jesmond Mizzi Financial Advisors

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

BloombugCapitalWeeklyForecast8

... In order to avoid the fate of bankruptcy, GM must reach debt-for-stock agreement with creditors before June 1, but creditors are not happy with the GM bids. Some analysts said, GM bankruptcy will lead to increase in U.S. unemployment, and cause severe impact on economic. This week the U.S. Treasury ...

... In order to avoid the fate of bankruptcy, GM must reach debt-for-stock agreement with creditors before June 1, but creditors are not happy with the GM bids. Some analysts said, GM bankruptcy will lead to increase in U.S. unemployment, and cause severe impact on economic. This week the U.S. Treasury ...

The End of Prosperity?

... next wave of bank failures, between February and August 1931, saw commercial-bank deposits fall by $2.7 billion--9% of the total. By January 1932, 1,860 banks had failed. Only in April 1932, amid heavy political pressure, did the Fed attempt large-scale open-market purchases--its first serious effor ...

... next wave of bank failures, between February and August 1931, saw commercial-bank deposits fall by $2.7 billion--9% of the total. By January 1932, 1,860 banks had failed. Only in April 1932, amid heavy political pressure, did the Fed attempt large-scale open-market purchases--its first serious effor ...

факультета дистанционного обучения

... the total increase in value plus ant dividends or other payments. In this way, all investment instruments can be compared and evaluated by yield: their percentage increase in_______ over a given period of time. Inflation also has to be considered. Money is worth only what it will buy in goods and se ...

... the total increase in value plus ant dividends or other payments. In this way, all investment instruments can be compared and evaluated by yield: their percentage increase in_______ over a given period of time. Inflation also has to be considered. Money is worth only what it will buy in goods and se ...

Written exam 2008 spring

... – There exists some common variable that can be used to standardize the price. c) When is the DCF approach easiest to use? • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the com ...

... – There exists some common variable that can be used to standardize the price. c) When is the DCF approach easiest to use? • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the com ...

Fed Delays Interest

... take a little bit more time to evaluate the likely impacts on the United States,” Fed Chairwoman Janet Yellen said Thursday at a press conference following a two-day policy meeting. The decision left uncertain for a while longer just when the Fed would raise its benchmark rate, which has been near z ...

... take a little bit more time to evaluate the likely impacts on the United States,” Fed Chairwoman Janet Yellen said Thursday at a press conference following a two-day policy meeting. The decision left uncertain for a while longer just when the Fed would raise its benchmark rate, which has been near z ...

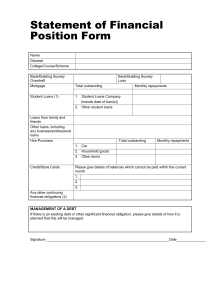

Statement of Financial Position Form

... It should be noted that grants from Central Church Funds are allocated on the basis that ordinands will not receive loans within the Government Student Loan Scheme. The stage has not yet been reached where any candidate beginning ordained ministry has been required to repay a government student loan ...

... It should be noted that grants from Central Church Funds are allocated on the basis that ordinands will not receive loans within the Government Student Loan Scheme. The stage has not yet been reached where any candidate beginning ordained ministry has been required to repay a government student loan ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.