Section 1 - Analy High School Faculty

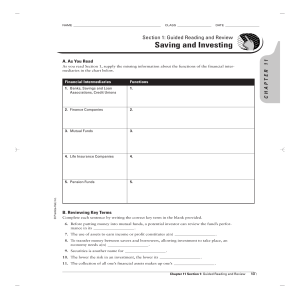

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

The Mexican peso financing of US$108 million equivalent for the

... cost through the proper combination of financial products. For practical purposes, IBRD’s local currency financing resembles a line of credit denominated in US dollars that is disbursed, serviced, and repaid in pesos. This financing structure transfers foreign currency risk from the borrower to the ...

... cost through the proper combination of financial products. For practical purposes, IBRD’s local currency financing resembles a line of credit denominated in US dollars that is disbursed, serviced, and repaid in pesos. This financing structure transfers foreign currency risk from the borrower to the ...

Financial crisis

... to pay back its sovereign debt, this is called a sovereign default. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a sudden stop in capital inflows or a sudden i ...

... to pay back its sovereign debt, this is called a sovereign default. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a sudden stop in capital inflows or a sudden i ...

Global Financial and Economic crisis and its possible implications in

... How to speed up the growth after the crisis: Measures to improve economic and social cohesion, support to accelerated growth and ...

... How to speed up the growth after the crisis: Measures to improve economic and social cohesion, support to accelerated growth and ...

MarketAlert Emergency Economic Stabilization Act

... other financial firms may sell up to $700 billion in distressed assets to the U.S. Treasury. This unprecedented step will help reestablish confidence in credit markets, prompting lenders to step up loan activity to consumers and businesses, and potentially jump-starting the U.S. economy. ■ Increases ...

... other financial firms may sell up to $700 billion in distressed assets to the U.S. Treasury. This unprecedented step will help reestablish confidence in credit markets, prompting lenders to step up loan activity to consumers and businesses, and potentially jump-starting the U.S. economy. ■ Increases ...

Financial Crises and Aggegate Economic Activity

... The contraction in lending then leads to a decline in investment spending, which slows economic activity ...

... The contraction in lending then leads to a decline in investment spending, which slows economic activity ...

FINANCE 729 FINANCIAL RISK MANAGEMENT

... • Principal is not actually exchanged -- only interest payments • Generally, only net interest payments are transacted – Avoids unnecessary transactions – Helps credit risk ...

... • Principal is not actually exchanged -- only interest payments • Generally, only net interest payments are transacted – Avoids unnecessary transactions – Helps credit risk ...

Business Ethics - FIU College of Business

... Home prices were rising to record levels. These elevated home prices warranted more borrowing (loans). Many investors were convinced that real estate value would continue to appreciate and would never depreciate. They saw this as an opportunity to invest in these popular securities (mortgage backed ...

... Home prices were rising to record levels. These elevated home prices warranted more borrowing (loans). Many investors were convinced that real estate value would continue to appreciate and would never depreciate. They saw this as an opportunity to invest in these popular securities (mortgage backed ...

Unintended Consequences of Federal Reserve Policy

... The extraordinary fall in market volatility has much to do not only with zero interest rate policy but also with sharply increased transparency of monetary policy. If central banks are trying to knock down market uncertainty by telegraphing their policy intentions as well as giving precise interest ...

... The extraordinary fall in market volatility has much to do not only with zero interest rate policy but also with sharply increased transparency of monetary policy. If central banks are trying to knock down market uncertainty by telegraphing their policy intentions as well as giving precise interest ...

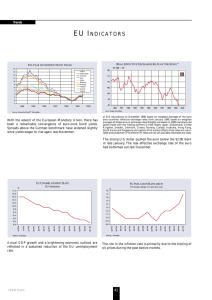

PDF Download

... area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia ...

... area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia ...

Chapter 3 - Canada`s Economic Goals

... EG. ing interest rates can promote price stability but will have an adverse effect on employment rates and national production Political Stability this can help long term planning and long term investment Reduced Public Debt is it fair to spend today and leave the debt in the hands of future generat ...

... EG. ing interest rates can promote price stability but will have an adverse effect on employment rates and national production Political Stability this can help long term planning and long term investment Reduced Public Debt is it fair to spend today and leave the debt in the hands of future generat ...

The Returns to Acquiring Privately Held Firms: Costly Value Addition

... CAC based on the theory that capital will flow from high capital-endowment countries to low capital-endowment countries, from low-return-to-capital countries to highreturn-to-capital countries. But CAC often led to movement of capital from developing countries to developed countries. One reason is i ...

... CAC based on the theory that capital will flow from high capital-endowment countries to low capital-endowment countries, from low-return-to-capital countries to highreturn-to-capital countries. But CAC often led to movement of capital from developing countries to developed countries. One reason is i ...

Ninth Annual Inland Empire Real Estate Conference Riverside Convention Center Riverside, California

... While it’s too soon to say for sure whether the productivity surge is temporary or permanent, two pieces of evidence do seem to point to a fundamental shift in productivity— a. ...

... While it’s too soon to say for sure whether the productivity surge is temporary or permanent, two pieces of evidence do seem to point to a fundamental shift in productivity— a. ...

Financial Engineering in the U.S.

... globe. Financial engineering creates value for businesses, as hedging future financial uncertainties leads to more accurate and efficient corporate planning. However, financial engineered products are complicated and require a requisite level of knowledge and experience. The market for financial eng ...

... globe. Financial engineering creates value for businesses, as hedging future financial uncertainties leads to more accurate and efficient corporate planning. However, financial engineered products are complicated and require a requisite level of knowledge and experience. The market for financial eng ...

Intelligent Considerations During Short

... in rising markets and becomes more conservative during market downturns. Psychologically this appears to make good sense, but pragmatically it is the opposite of how investors should act and feel. As many investors have learned the hard way, becoming overly optimistic about investing during good tim ...

... in rising markets and becomes more conservative during market downturns. Psychologically this appears to make good sense, but pragmatically it is the opposite of how investors should act and feel. As many investors have learned the hard way, becoming overly optimistic about investing during good tim ...

Corporate Finance What - Hong Kong Securities and Investment

... the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

... the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

Download Syllabus

... in charge of markets (currency and bond trading activity) during a period of significant interventions by the SNB, particularly in the FX (foreign exchange) market. During the second phase of his mandate (2012-2015) he was in charge of financial stability, including bank regulation. During this latt ...

... in charge of markets (currency and bond trading activity) during a period of significant interventions by the SNB, particularly in the FX (foreign exchange) market. During the second phase of his mandate (2012-2015) he was in charge of financial stability, including bank regulation. During this latt ...

Capital Flows and Accelerating Mechanism: An Alternative

... «In particular, while the “natural” interest rate of this economy declines with the world rate, the policy rate may indeed need to be increased to accommodate reserve requirements—in contrast to the Turkey experience.» ...

... «In particular, while the “natural” interest rate of this economy declines with the world rate, the policy rate may indeed need to be increased to accommodate reserve requirements—in contrast to the Turkey experience.» ...

Venezuela_en.pdf

... In the first nine months of 2013, the average urban unemployment rate dropped 0.4 percentage points compared with the year-earlier period, to 7.9%. Meanwhile, the participation rate edged up 0.3 percentage points to 64.3%. Real wages, pushed down by high inflation, fell by 4.8% year on year in the f ...

... In the first nine months of 2013, the average urban unemployment rate dropped 0.4 percentage points compared with the year-earlier period, to 7.9%. Meanwhile, the participation rate edged up 0.3 percentage points to 64.3%. Real wages, pushed down by high inflation, fell by 4.8% year on year in the f ...

Slide 1

... Scenario: accession countries join EMU in 2010. (UK stays out), but 20% of London turnover counts toward Euro financial depth, and currencies depreciate at the average 20-year rates up to 2007. ...

... Scenario: accession countries join EMU in 2010. (UK stays out), but 20% of London turnover counts toward Euro financial depth, and currencies depreciate at the average 20-year rates up to 2007. ...

Economic Policy Objectives and Challenges in Tanzania

... Economic Policy Objectives and Challenges in Tanzania Roger Nord Disclaimer The views expressed in this presentation are those of the authors only, and the presence of them, or of links to them, on the IMF website does not imply that the IMF, its Executive Board, or its management endorses or shares ...

... Economic Policy Objectives and Challenges in Tanzania Roger Nord Disclaimer The views expressed in this presentation are those of the authors only, and the presence of them, or of links to them, on the IMF website does not imply that the IMF, its Executive Board, or its management endorses or shares ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.