Slide 1 - West Ada

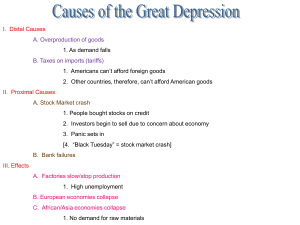

... II. Proximal Causes A. Stock Market crash 1. People bought stocks on credit 2. Investors begin to sell due to concern about economy 3. Panic sets in [4. “Black Tuesday” = stock market crash] B. Bank failures III. Effects A. Factories slow/stop production 1. High unemployment B. European economies co ...

... II. Proximal Causes A. Stock Market crash 1. People bought stocks on credit 2. Investors begin to sell due to concern about economy 3. Panic sets in [4. “Black Tuesday” = stock market crash] B. Bank failures III. Effects A. Factories slow/stop production 1. High unemployment B. European economies co ...

ESI Fund Guidance on Financial Instruments

... instruments may take the form of equity or quasi-equity investments, loans or guarantees, or other risk-sharing instruments, and may, where appropriate, be combined with grants in accordance with Article 37(7)(8)(9). A fund set up with the objective of contributing support from a programme or CPR Ar ...

... instruments may take the form of equity or quasi-equity investments, loans or guarantees, or other risk-sharing instruments, and may, where appropriate, be combined with grants in accordance with Article 37(7)(8)(9). A fund set up with the objective of contributing support from a programme or CPR Ar ...

Recent Pension Developments in the Netherlands

... Key pension elements in the Netherlands (in 2000) • 2nd pillar (occupational pensions) very large: ± 125% gdp • Mostly defined benefit • Corporate and industry wide pension funds, separate legal entities • Liabilities discounted at fixed rate of 4% ...

... Key pension elements in the Netherlands (in 2000) • 2nd pillar (occupational pensions) very large: ± 125% gdp • Mostly defined benefit • Corporate and industry wide pension funds, separate legal entities • Liabilities discounted at fixed rate of 4% ...

Issues Influencing the Market

... While the new push for regulating the markets is trying to evaluate many curial factors that are not yet well defined, this uncertainty often takes a toll on the markets until all the “rules” are clarified. The proposed oversight for investment banks is quite fluid and under pressure from the politi ...

... While the new push for regulating the markets is trying to evaluate many curial factors that are not yet well defined, this uncertainty often takes a toll on the markets until all the “rules” are clarified. The proposed oversight for investment banks is quite fluid and under pressure from the politi ...

The Economic Significance of the Swiss Financial Sector

... investment that without financial intermediaries could be performed only with substantially higher transaction costs, or not at all. In addition, financial intermediaries fulfil functions that are indispensable for a modern economy. These include, for example, the settlement of payment transactions ...

... investment that without financial intermediaries could be performed only with substantially higher transaction costs, or not at all. In addition, financial intermediaries fulfil functions that are indispensable for a modern economy. These include, for example, the settlement of payment transactions ...

Investment Report

... merely an anomaly. Seasonal factors also played a major role. We are expecting overall economic ...

... merely an anomaly. Seasonal factors also played a major role. We are expecting overall economic ...

Slide 1

... A good guess is that the monetary and fiscal response we have seen so far have been sufficient to halt the economic free-fall, so that the steep rate of decline will level off in the 2nd half of this year. It won’t be enough to return us rapidly to full employment and potential output. Given the pat ...

... A good guess is that the monetary and fiscal response we have seen so far have been sufficient to halt the economic free-fall, so that the steep rate of decline will level off in the 2nd half of this year. It won’t be enough to return us rapidly to full employment and potential output. Given the pat ...

President’s Message

... will have to withdraw the excess reserves, which will result in rapidly rising interest rates and major losses for bond holders. If the Fed does not shrink its balance sheet, the economy could be stuck in very slow growth as the government consumes an increasing share of the economy, as has happened ...

... will have to withdraw the excess reserves, which will result in rapidly rising interest rates and major losses for bond holders. If the Fed does not shrink its balance sheet, the economy could be stuck in very slow growth as the government consumes an increasing share of the economy, as has happened ...

A Republican Road to Economic Recovery

... - Fix the financial sector. A durable economic recovery requires a solution to the banking crisis. There are no easy or painless solutions, but the most damaging solution over the long term would be to nationalize our financial system. Once we put politicians in charge of allocating credit and resou ...

... - Fix the financial sector. A durable economic recovery requires a solution to the banking crisis. There are no easy or painless solutions, but the most damaging solution over the long term would be to nationalize our financial system. Once we put politicians in charge of allocating credit and resou ...

prezentacija ljubljanske borze

... Providing services to all exchanges and markets Driver of success or failure for national markets? ...

... Providing services to all exchanges and markets Driver of success or failure for national markets? ...

METODE DE CALCULATIE A COSTURILOR ÎN INDUSTRIA MINIERA /

... Abstract: Financial accounting has the role of providing the necessary information for the drawing up of financial situations, offering to the internal and external users of the enterprise data regarding its financial standing. Unlike financial accounting, administration accounting seeks to offer an ...

... Abstract: Financial accounting has the role of providing the necessary information for the drawing up of financial situations, offering to the internal and external users of the enterprise data regarding its financial standing. Unlike financial accounting, administration accounting seeks to offer an ...

Euro and Macroeconomic Stability

... markets have been suffering from crisis no matter whether they are a member of the Euro zone or not. Macroeconomic stability cannot be introduced or imported via the adoption of Euro, but it must be based on stable and reasonable economic policy. ...

... markets have been suffering from crisis no matter whether they are a member of the Euro zone or not. Macroeconomic stability cannot be introduced or imported via the adoption of Euro, but it must be based on stable and reasonable economic policy. ...

Explanation regarding Agenda item 1 according to § 124a sentence

... on Wednesday, May 4, 2016, at 10 am at the Olympiahalle at the Olympiapark, Coubertinplatz, 80809 Munich, Germany ...

... on Wednesday, May 4, 2016, at 10 am at the Olympiahalle at the Olympiapark, Coubertinplatz, 80809 Munich, Germany ...

Recommendations from Squam Lake

... economists from academic institutions across the country met at New Hampshire’s Squam Lake to discuss non-partisan steps to address shortand long-term financial reforms. The economists’ recommendations revolved around the simple notion that any negative result of risks taken should be borne by the r ...

... economists from academic institutions across the country met at New Hampshire’s Squam Lake to discuss non-partisan steps to address shortand long-term financial reforms. The economists’ recommendations revolved around the simple notion that any negative result of risks taken should be borne by the r ...

global meltdown and india_VINEET

... values going down. Asian products and services are also global, and a slowdown in wealthy countries means increased chances of a slowdown in Asia and the risk of job losses and associated problems such as social ...

... values going down. Asian products and services are also global, and a slowdown in wealthy countries means increased chances of a slowdown in Asia and the risk of job losses and associated problems such as social ...

International Monetary Fund

... array of financial instruments and also generate resources for public goods. This alone would not resolve the crisis, of course, but it could play an important role in raising funds to compensate those who ended up paying for the resulting “bail-outs”. ...

... array of financial instruments and also generate resources for public goods. This alone would not resolve the crisis, of course, but it could play an important role in raising funds to compensate those who ended up paying for the resulting “bail-outs”. ...

CH 14-16 macro gnp money

... Stock markets, real estate Speculative exchange in the global economy ...

... Stock markets, real estate Speculative exchange in the global economy ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.