Overview of International Financial Markets

... back up international trade -> growing in line with International Trade; and - International Investment independent of international trade -> growing much faster than International Trade ...

... back up international trade -> growing in line with International Trade; and - International Investment independent of international trade -> growing much faster than International Trade ...

An Asian Investment Fund - Global Clearinghouse for Development

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

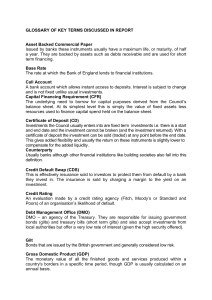

GLOSSARY OF KEY TERMS DISCUSSED IN

... Asset Backed Commercial Paper Issued by banks these instruments usually have a maximum life, or maturity, of half a year. They are backed by assets such as debts receivable and are used for short term financing. Base Rate The rate at which the Bank of England lends to financial institutions. Call Ac ...

... Asset Backed Commercial Paper Issued by banks these instruments usually have a maximum life, or maturity, of half a year. They are backed by assets such as debts receivable and are used for short term financing. Base Rate The rate at which the Bank of England lends to financial institutions. Call Ac ...

The financial crisis - World Economy & Finance Research

... “The TARP was originally conceived to purchase troubled assets directly from banks. However, as quickly became apparent, properly valuing these assets was extremely difficult as a result of ongoing home mortgage foreclosures, defaults, and falling house prices. The financial turmoil intensified in ...

... “The TARP was originally conceived to purchase troubled assets directly from banks. However, as quickly became apparent, properly valuing these assets was extremely difficult as a result of ongoing home mortgage foreclosures, defaults, and falling house prices. The financial turmoil intensified in ...

Short Readings 1

... management in financial institutions: a speech at the Federal Reserve Bank of Chicago's Annual Conference on Bank Structure and Competition” by Ben Bernanke, (there is a link on your syllabus to each article) and answer the following questions a. One article argues that increased integration of fina ...

... management in financial institutions: a speech at the Federal Reserve Bank of Chicago's Annual Conference on Bank Structure and Competition” by Ben Bernanke, (there is a link on your syllabus to each article) and answer the following questions a. One article argues that increased integration of fina ...

Money and Investing - St. John the Baptist Diocesan High School

... commodities or financial assets in the future at a price set today. Options give a holder of a stock the right to buy or sell stock at a set price or a set period of time. Call option - right to buy Put option - right to sell ...

... commodities or financial assets in the future at a price set today. Options give a holder of a stock the right to buy or sell stock at a set price or a set period of time. Call option - right to buy Put option - right to sell ...

Speech to Town Hall – Los Angeles Los Angeles, California

... Many of the liquidity problems afflicting banks and other financial market participants are gradually being resolved, but it’s not clear that all markets will return to “business as usual,” as defined by conditions in the first half of this year, even after that occurs. For one thing, many of the st ...

... Many of the liquidity problems afflicting banks and other financial market participants are gradually being resolved, but it’s not clear that all markets will return to “business as usual,” as defined by conditions in the first half of this year, even after that occurs. For one thing, many of the st ...

Letter of Representation

... o (Option 1) Personnel costs reported in the Financial Statement are not based on budgeted or estimated amounts. They are calculated using rates based on actual costs, and reflect the time actually worked on the [ ] project during the period covered by the Financial Statement. OR o (Option 2) Person ...

... o (Option 1) Personnel costs reported in the Financial Statement are not based on budgeted or estimated amounts. They are calculated using rates based on actual costs, and reflect the time actually worked on the [ ] project during the period covered by the Financial Statement. OR o (Option 2) Person ...

Fakhri Mammadov

... Analyzing financial indicators of the Company’s future projects Preparing income statement, balance sheet and other financial statements of the projects Creating Present Value, FV, IRR, NPV, payout period of the projects and other financial calculation and presenting them to the head of depart ...

... Analyzing financial indicators of the Company’s future projects Preparing income statement, balance sheet and other financial statements of the projects Creating Present Value, FV, IRR, NPV, payout period of the projects and other financial calculation and presenting them to the head of depart ...

Why do Financial Intermediaries Exist?

... Market value of mortgages held by S&Ls fell as interest rates rose making the value of assets less than value of liabilities ...

... Market value of mortgages held by S&Ls fell as interest rates rose making the value of assets less than value of liabilities ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.