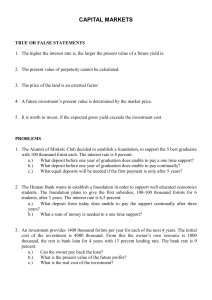

capital markets

... 4. You have to decide about a plant’s rent. The rent is 2 million forints. To pay, you have to borrow the money for 4 years with 15 percent lending rate. The plant’s gross yield can reach 2,6 million forints in the next five years, 75 percent from it is cost. a.) What is the cost of the investment? ...

... 4. You have to decide about a plant’s rent. The rent is 2 million forints. To pay, you have to borrow the money for 4 years with 15 percent lending rate. The plant’s gross yield can reach 2,6 million forints in the next five years, 75 percent from it is cost. a.) What is the cost of the investment? ...

financial reporting in the lodging industry from the segment reporting

... (d) special risks associated with operations in a particular area; (e) exchange control regulations; and (f) the underlying currency risks. Contrary to the IAS 14, SFAS 131 is based on Company’s structure and operation defined operating segment. It stresses out the Management responsibility at the ...

... (d) special risks associated with operations in a particular area; (e) exchange control regulations; and (f) the underlying currency risks. Contrary to the IAS 14, SFAS 131 is based on Company’s structure and operation defined operating segment. It stresses out the Management responsibility at the ...

Download paper (PDF)

... tilt the composition of capital flows into a country away from FDI and portfolio equity flows and towards debt including bank loans, making the country more vulnerable to a currency crisis and less able to translate a given amount of capital inflow into stimulus for economic growth. If an institutio ...

... tilt the composition of capital flows into a country away from FDI and portfolio equity flows and towards debt including bank loans, making the country more vulnerable to a currency crisis and less able to translate a given amount of capital inflow into stimulus for economic growth. If an institutio ...

November 13, 2005

... tilt the composition of capital flows into a country away from FDI and portfolio equity flows and towards debt including bank loans, making the country more vulnerable to a currency crisis and less able to translate a given amount of capital inflow into stimulus for economic growth. If an institutio ...

... tilt the composition of capital flows into a country away from FDI and portfolio equity flows and towards debt including bank loans, making the country more vulnerable to a currency crisis and less able to translate a given amount of capital inflow into stimulus for economic growth. If an institutio ...

Box B: Banks` Exposures to Inner

... building. A simple way to model potential losses on developer lending is to use loss rates in line with those seen on all Australian residential development lending during the financial crisis. In this scenario, losses still remain fairly small (Graph B4). Alternative comparisons are the Spanish and ...

... building. A simple way to model potential losses on developer lending is to use loss rates in line with those seen on all Australian residential development lending during the financial crisis. In this scenario, losses still remain fairly small (Graph B4). Alternative comparisons are the Spanish and ...

Chapter 1

... technology in exchange for fees or some other benefits. Franchising obligates a firm to provide a specialized sales or service strategy, support assistance, and possibly an initial investment, in exchange for periodic fees. ...

... technology in exchange for fees or some other benefits. Franchising obligates a firm to provide a specialized sales or service strategy, support assistance, and possibly an initial investment, in exchange for periodic fees. ...

PDF - EMM Wealth Management

... Much has been written over the last few years regarding the search for yield by global investors. Short-term, risk-free rates within the developed world remain at historic lows, while investors have clamored for securities that provide high immediate income and the potential to hedge rising rates. T ...

... Much has been written over the last few years regarding the search for yield by global investors. Short-term, risk-free rates within the developed world remain at historic lows, while investors have clamored for securities that provide high immediate income and the potential to hedge rising rates. T ...

A promising communiqué from the 3 Plenum of 18 Party Congress

... system, political system, cultural system, social system and ecocivilization system with economic reform top the priority. Although detailed reform measures have not been released (based on previous experience, detailed measures will only be announced one week after the release of communique), the c ...

... system, political system, cultural system, social system and ecocivilization system with economic reform top the priority. Although detailed reform measures have not been released (based on previous experience, detailed measures will only be announced one week after the release of communique), the c ...

Should Investors Sell After a “Correction”?

... 12.35% from its record high of 2130.82 on May 21 through August 24. Financial professionals generally describe any decline of 10% or more from a previous peak as a “correction,” although it is unclear what investors should do with this information. Should they seek to protect themselves for further ...

... 12.35% from its record high of 2130.82 on May 21 through August 24. Financial professionals generally describe any decline of 10% or more from a previous peak as a “correction,” although it is unclear what investors should do with this information. Should they seek to protect themselves for further ...

THE LEVEL OF THE EXCHANGE RATE AND THE BALANCE

... currency market through its liquidity and its profoundness is close more and more of “perfect market” concept, but when raised levels of deficit goes together with appreciation of national currency the problem raised is how much time will continue the process, and when will be over what will be happ ...

... currency market through its liquidity and its profoundness is close more and more of “perfect market” concept, but when raised levels of deficit goes together with appreciation of national currency the problem raised is how much time will continue the process, and when will be over what will be happ ...

Synacor, Inc. (Form: 8-K, Received: 03/15/2017 16

... Made excellent progress on plan to launch the new AT&T desktop and mobile web portal in the first half of 2017, and deployment will be completed through 2017. ...

... Made excellent progress on plan to launch the new AT&T desktop and mobile web portal in the first half of 2017, and deployment will be completed through 2017. ...

CH07 - U of L Class Index

... Suppose the company has a beta of 1.5. The market risk premium is expected to be 9% and the current risk-free rate is 6%. Dividends will grow at 6% per year and last dividend was $2. The stock is currently selling for $15.65. What is our cost of equity? ...

... Suppose the company has a beta of 1.5. The market risk premium is expected to be 9% and the current risk-free rate is 6%. Dividends will grow at 6% per year and last dividend was $2. The stock is currently selling for $15.65. What is our cost of equity? ...

REAL CLIENT MANAGED PORTFOLIO MEMORANDUM

... coffees. It operates 6,705 company-operated stores and 4,082 licensed stores in the United States; and 2,326 company-operated stores and 3,890 licensed stores in Canada, the U.K., China, Germany, Thailand, and internationally. The company provides regular and decaffeinated coffee beverages, Italian- ...

... coffees. It operates 6,705 company-operated stores and 4,082 licensed stores in the United States; and 2,326 company-operated stores and 3,890 licensed stores in Canada, the U.K., China, Germany, Thailand, and internationally. The company provides regular and decaffeinated coffee beverages, Italian- ...

The Trump Factor

... A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs provide investors with all types of regular income streams, diversification and long-term capital appreciation. REITs typically pay out all of their taxable income as dividends to sh ...

... A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs provide investors with all types of regular income streams, diversification and long-term capital appreciation. REITs typically pay out all of their taxable income as dividends to sh ...

Presidents Assembly Brussels PA0108

... IMF has progressively revised its world forecast for 2009 down, from +3.0% to +0.5%. On 10 March 2009, Strass-Kahn warned that the world economy could shrink in 2009, suggesting an even gloomier outlook than the current official forecast of 0.5% growth. ...

... IMF has progressively revised its world forecast for 2009 down, from +3.0% to +0.5%. On 10 March 2009, Strass-Kahn warned that the world economy could shrink in 2009, suggesting an even gloomier outlook than the current official forecast of 0.5% growth. ...

Lenders Serving Agriculture Real Estate Lenders

... changed slightly while 17% reported substantial increases. Farmers responding assessed their financial management skills as follows: only 8% of farmers participating in this survey felt they were well equipped with financial management skills. 74% said they were moderately equipped. 18% said ...

... changed slightly while 17% reported substantial increases. Farmers responding assessed their financial management skills as follows: only 8% of farmers participating in this survey felt they were well equipped with financial management skills. 74% said they were moderately equipped. 18% said ...

Cost Concepts—Key Questions

... In the short run? In the long run? How do cash and noncash costs differ? Opportunity Cost The amount a certain resource could have earned in another use. Amount given by using a resource in farming. Examples: Labor Capital Home grown feed Operating Costs (variable) Cost of goods or service ...

... In the short run? In the long run? How do cash and noncash costs differ? Opportunity Cost The amount a certain resource could have earned in another use. Amount given by using a resource in farming. Examples: Labor Capital Home grown feed Operating Costs (variable) Cost of goods or service ...

Domestic Resource Mobilization in Uganda and Economic

... The period 1990-2008 involved two phases of growth one 1990-1999 and the other 20002008. The 1990 to 1999 phase was characterized by sustained positive growth rates far above the Sub-Saharan average. At an average of 3.6 per cent, Uganda’s per capita income (measured in 1985 international prices) re ...

... The period 1990-2008 involved two phases of growth one 1990-1999 and the other 20002008. The 1990 to 1999 phase was characterized by sustained positive growth rates far above the Sub-Saharan average. At an average of 3.6 per cent, Uganda’s per capita income (measured in 1985 international prices) re ...

chapter 11 powerpoint

... • coupon rate: the interest rate that a bond issuer will pay to the bondholder • maturity: the time at which payment to a bondholder is due • par value: a bond’s stated value, to be paid to the bondholder at maturity • yield: the annual rate of return on a bond if the bond is held to maturity • savi ...

... • coupon rate: the interest rate that a bond issuer will pay to the bondholder • maturity: the time at which payment to a bondholder is due • par value: a bond’s stated value, to be paid to the bondholder at maturity • yield: the annual rate of return on a bond if the bond is held to maturity • savi ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.