THE CFO`S 10-STEP GUIDE TO SLEEPING

... represents the weaving together of multiple complex threads to create the foundation required for long term success. For high growth companies heavily focused on creating product and customer traction, the IPO preparation process is often analogous to the big bang, with too much to do in too little ...

... represents the weaving together of multiple complex threads to create the foundation required for long term success. For high growth companies heavily focused on creating product and customer traction, the IPO preparation process is often analogous to the big bang, with too much to do in too little ...

financial markets group

... use of equity market finance. As for the bond markets, the annual growth rate of issuance by euro area non- financial firms has been well above 20 per cent over the past three to four years. The overall size of the debt market – including also previously predominant government and bank bonds – is no ...

... use of equity market finance. As for the bond markets, the annual growth rate of issuance by euro area non- financial firms has been well above 20 per cent over the past three to four years. The overall size of the debt market – including also previously predominant government and bank bonds – is no ...

Key Success Factors - NYU Stern School of Business

... global (global industry and detailed sector knowledge required) • The markets have lost liquidity (blue chip companies are buying back their stocks) ...

... global (global industry and detailed sector knowledge required) • The markets have lost liquidity (blue chip companies are buying back their stocks) ...

Best Credit Data Bond Analytics Calculation Methodology Created by

... 1. Evaluation of an interest-sensitive fixed-income security (in other words, a security whose future redemption date and payment stream are influenced by interest rates through the presence of an implicit embedded option). For example, is a 50 bp OAS appropriate for an A-rated asset? 2. Facilitates ...

... 1. Evaluation of an interest-sensitive fixed-income security (in other words, a security whose future redemption date and payment stream are influenced by interest rates through the presence of an implicit embedded option). For example, is a 50 bp OAS appropriate for an A-rated asset? 2. Facilitates ...

guyana goldfields inc. management`s discussion and analysis for

... The following management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Guyana Goldfields Inc. (“Guyana Goldfields” or “Company”) constitutes management’s review of the factors that affected the Company’s financial and operating performance for the three m ...

... The following management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Guyana Goldfields Inc. (“Guyana Goldfields” or “Company”) constitutes management’s review of the factors that affected the Company’s financial and operating performance for the three m ...

Maxis Bhd

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

The euro-dollar exchange rate IN-DEPTH

... the respective current account balance positions (CAP). The country with a weaker current account position tends to have a weaker currency (Edwards, 1989). The country with a current account deficit and with limited foreign currency reserves at its disposal may be forced by financial markets to depr ...

... the respective current account balance positions (CAP). The country with a weaker current account position tends to have a weaker currency (Edwards, 1989). The country with a current account deficit and with limited foreign currency reserves at its disposal may be forced by financial markets to depr ...

The Determinants of the Market Interest Rate Given the quoted

... • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds ...

... • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds ...

Set 1 - NYU Stern

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 212. The KMV model uses the OPM to extract the impli ...

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 212. The KMV model uses the OPM to extract the impli ...

Portfolio Diversification with Municipal Bonds

... bond index. Standard and Poor’s® (S&P®) 500 Index is calculated with dividends reinvested and consists of 500 widely held common stocks covering in the leading industries of the U.S. economy. Russell 2000 Index measures the performance of U.S. small cap stocks: the 2000 smallest companies in the Rus ...

... bond index. Standard and Poor’s® (S&P®) 500 Index is calculated with dividends reinvested and consists of 500 widely held common stocks covering in the leading industries of the U.S. economy. Russell 2000 Index measures the performance of U.S. small cap stocks: the 2000 smallest companies in the Rus ...

Stock Market Development and Economic Growth: An

... growth vary according to a country’s level of economic development with a larger impact in less developed economies, as argued by Filler et al. (1999). The view that stock market developments drive the economy is based on the assumption that it first affects specific macroeconomic variables such as ...

... growth vary according to a country’s level of economic development with a larger impact in less developed economies, as argued by Filler et al. (1999). The view that stock market developments drive the economy is based on the assumption that it first affects specific macroeconomic variables such as ...

IFRS: Valuations in financial reporting by Shân Kennedy

... IAS 39: financial instruments • Most controversial standard with much in press • Value reporting relevant to: – derivatives and embedded derivatives – option to carry any financial instrument at FV through profit – most applicable to banks – measurement of impairment of financial instruments – i.e. ...

... IAS 39: financial instruments • Most controversial standard with much in press • Value reporting relevant to: – derivatives and embedded derivatives – option to carry any financial instrument at FV through profit – most applicable to banks – measurement of impairment of financial instruments – i.e. ...

Chapter 15: Intercorporate Investments

... financial statements because they did not have “control” (i.e., own a majority of the voting interest) of the SPE. • By avoiding consolidation, sponsors did not have to report the assets and the liabilities of the SPE; financial performance as measured by unconsolidated financial statements was pote ...

... financial statements because they did not have “control” (i.e., own a majority of the voting interest) of the SPE. • By avoiding consolidation, sponsors did not have to report the assets and the liabilities of the SPE; financial performance as measured by unconsolidated financial statements was pote ...

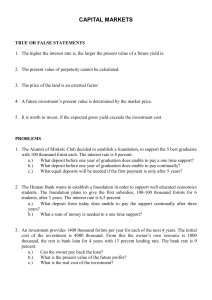

capital markets

... 4. You have to decide about a plant’s rent. The rent is 2 million forints. To pay, you have to borrow the money for 4 years with 15 percent lending rate. The plant’s gross yield can reach 2,6 million forints in the next five years, 75 percent from it is cost. a.) What is the cost of the investment? ...

... 4. You have to decide about a plant’s rent. The rent is 2 million forints. To pay, you have to borrow the money for 4 years with 15 percent lending rate. The plant’s gross yield can reach 2,6 million forints in the next five years, 75 percent from it is cost. a.) What is the cost of the investment? ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.