Financial Intermediation and Growth: Causality

... even wealth” of nations.1 Economic theories mirror these divisions. Some models show that economic agents create debt contracts and financial intermediaries to ameliorate the economic consequences of informational asymmetries, with beneficial implications for resource allocation and economic activit ...

... even wealth” of nations.1 Economic theories mirror these divisions. Some models show that economic agents create debt contracts and financial intermediaries to ameliorate the economic consequences of informational asymmetries, with beneficial implications for resource allocation and economic activit ...

waste connections, inc.

... derivatives on the balance sheet at fair value. Derivatives that are not hedges must be adjusted to fair value through income. If the derivative is a hedge, depending on the nature of the hedge, changes in the fair value of derivatives will either be offset against the change in fair value of the he ...

... derivatives on the balance sheet at fair value. Derivatives that are not hedges must be adjusted to fair value through income. If the derivative is a hedge, depending on the nature of the hedge, changes in the fair value of derivatives will either be offset against the change in fair value of the he ...

Fiscal and monetary policy determinants of the

... adopted fiscal austerity packages (the UK, Ireland, Portugal, Greece, Italy and others). There is little hope for the so-called non-Keynesian effects of fiscal tightening, even if such effects could be sometimes observed in the past (see Siwinska & Bujak, 2006). However, even if one does not want to ...

... adopted fiscal austerity packages (the UK, Ireland, Portugal, Greece, Italy and others). There is little hope for the so-called non-Keynesian effects of fiscal tightening, even if such effects could be sometimes observed in the past (see Siwinska & Bujak, 2006). However, even if one does not want to ...

MEASURING GLOBALIZATION

... among civil liberties, more political rights, lower levels of corruption and ... the level of globalization. ...

... among civil liberties, more political rights, lower levels of corruption and ... the level of globalization. ...

MEASURING GLOBALIZATION

... among civil liberties, more political rights, lower levels of corruption and ... the level of globalization. ...

... among civil liberties, more political rights, lower levels of corruption and ... the level of globalization. ...

Equity Risk, Credit Risk, Default Correlation, and Corporate Sustainability

... A Measure of Systemic Risk? • Obviously, if the market things public companies are not going to be around very long, the economy is in a bad way • Low equity valuations and high leverage equate to short life expectancy – Higher leverage can be sustained with higher growth rates that cause higher eq ...

... A Measure of Systemic Risk? • Obviously, if the market things public companies are not going to be around very long, the economy is in a bad way • Low equity valuations and high leverage equate to short life expectancy – Higher leverage can be sustained with higher growth rates that cause higher eq ...

FRBSF L CONOMIC

... Economic booms are often characterized by waves of optimism and the view that the economy is entering a new era in which the business cycle has been tamed. The idea that “this time, things are different” became pervasive during the expansion of the mid-2000s, just before the worst financial crisis s ...

... Economic booms are often characterized by waves of optimism and the view that the economy is entering a new era in which the business cycle has been tamed. The idea that “this time, things are different” became pervasive during the expansion of the mid-2000s, just before the worst financial crisis s ...

The Long-Term Case for Consumer Staples

... use most of them on a regular basis. The companies have long histories of profitable operations. There has been little change to their overarching strategies, and we understand what these strategies are. Their net earnings are real and convert to free cash flow. And they tend to use this cash flow t ...

... use most of them on a regular basis. The companies have long histories of profitable operations. There has been little change to their overarching strategies, and we understand what these strategies are. Their net earnings are real and convert to free cash flow. And they tend to use this cash flow t ...

U.S. Government and Federal Agency Securities

... operating Fannie Mae and Freddie Mac. The authority to do so was granted by Congress in July by the Housing and Economic Recovery Act of 2008. The decision was made because of concerns that increasing mortgage defaults had impaired the government sponsored enterprises’ (GSE) ability to both maintain ...

... operating Fannie Mae and Freddie Mac. The authority to do so was granted by Congress in July by the Housing and Economic Recovery Act of 2008. The decision was made because of concerns that increasing mortgage defaults had impaired the government sponsored enterprises’ (GSE) ability to both maintain ...

European Business School London Regents College

... Banking industry in US: Credit Unions • Credit Unions are another type of mutual depository institutions which have grown in importance over the last decade or so • These are non-profit institutions and are owned by their members • Members deposits are used to offer loans to the members. • They are ...

... Banking industry in US: Credit Unions • Credit Unions are another type of mutual depository institutions which have grown in importance over the last decade or so • These are non-profit institutions and are owned by their members • Members deposits are used to offer loans to the members. • They are ...

Extending Factor Models of Equity Risk to Credit Risk, Default Correlation, and Corporate Sustainability

... of credit risk can be linked to provide consistent measures of equity risk, default risk and default correlation Introduce a quantitative measure of the “sustainability” sustainability of firms Describe results in an empirical analysis of all US listed equities q from 1992 to present p Show that com ...

... of credit risk can be linked to provide consistent measures of equity risk, default risk and default correlation Introduce a quantitative measure of the “sustainability” sustainability of firms Describe results in an empirical analysis of all US listed equities q from 1992 to present p Show that com ...

China`s long-term economic outlook

... Why are there such sharply diverging views of future economic development in China? The primary reason is the lack of transparency. Because of the commissions, which can hardly be ignored and which operate outside their own government, it is much less clear in China than in other emerging market cou ...

... Why are there such sharply diverging views of future economic development in China? The primary reason is the lack of transparency. Because of the commissions, which can hardly be ignored and which operate outside their own government, it is much less clear in China than in other emerging market cou ...

Financial Stability Report May 2008 Contents

... in the household and business sectors as well as the broader ...

... in the household and business sectors as well as the broader ...

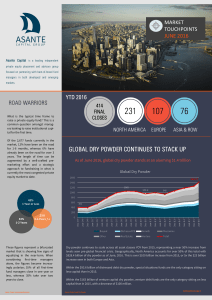

global dry powder continues to stack up

... These figures represent a bifurcated market that is showing few signs of equalizing in the near-term. When considering first-time managers alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

... These figures represent a bifurcated market that is showing few signs of equalizing in the near-term. When considering first-time managers alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

CHAPTER 16, CREDIT IN AMERICA CREDIT

... Interest rates were very high (25-50%). Credit wasn’t easily accepted by most people, it signified debt and dependence on others. Early 1900’s Lending institutions began to ask for security on loans. Individual purchasing power increased. More people were willing and able to buy more goods and servi ...

... Interest rates were very high (25-50%). Credit wasn’t easily accepted by most people, it signified debt and dependence on others. Early 1900’s Lending institutions began to ask for security on loans. Individual purchasing power increased. More people were willing and able to buy more goods and servi ...

Financial Stability in European Banking: The Role of Common Factors

... common factor explains about 90 percent of total CDS spread variation across time and across banks. Moreover, it impacts on all banks in a similar direction though with different magnitude. It suggests, that it is not changes in individual banks’ characteristics that change its perceived riskiness, ...

... common factor explains about 90 percent of total CDS spread variation across time and across banks. Moreover, it impacts on all banks in a similar direction though with different magnitude. It suggests, that it is not changes in individual banks’ characteristics that change its perceived riskiness, ...

Lesson 6-2

... • Time is the key to savings growth and 5 years is just too short a time period! • What if we put away $5000 the day our child was born with just 4% interest, how much would they have at age 65?: A(65) = 5000 (1 + 0.04/365)(365)65 A(65) = 5000(1.000109589)23725 ...

... • Time is the key to savings growth and 5 years is just too short a time period! • What if we put away $5000 the day our child was born with just 4% interest, how much would they have at age 65?: A(65) = 5000 (1 + 0.04/365)(365)65 A(65) = 5000(1.000109589)23725 ...

2016:6 Skanska Financial Services AB Decision

... that a party which has Sweden as it home member state and which has distributed or issued negotiable securities which, following application by the issuer, are admitted for trading on a regulated market operated by the exchange, prepares the prescribed periodic financial information. Chapter 16, sec ...

... that a party which has Sweden as it home member state and which has distributed or issued negotiable securities which, following application by the issuer, are admitted for trading on a regulated market operated by the exchange, prepares the prescribed periodic financial information. Chapter 16, sec ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.