Document

... ATM for upgrading the Bank of Albania operations was implemented. Albanian Interbank Payment System. Transactions in real time, 2 seconds at maximum. 94 payments effected during the first day, at the value of 48 million dollars. 12 banks in the system. The entry of two new banks is expected. Benefit ...

... ATM for upgrading the Bank of Albania operations was implemented. Albanian Interbank Payment System. Transactions in real time, 2 seconds at maximum. 94 payments effected during the first day, at the value of 48 million dollars. 12 banks in the system. The entry of two new banks is expected. Benefit ...

PDF Download

... Japanese export enterprises cut export prices in yen because they priced their products in dollars to the U.S. market (Athukorola and Menon 1994). Secondly, to the extend that the yen appreciation was shifted to dollar prices, Japanese exports declined, causing a deep recession in Japan. The negativ ...

... Japanese export enterprises cut export prices in yen because they priced their products in dollars to the U.S. market (Athukorola and Menon 1994). Secondly, to the extend that the yen appreciation was shifted to dollar prices, Japanese exports declined, causing a deep recession in Japan. The negativ ...

3 8 The economic impact of Private Equity and

... the change in inventories + (exports - imports). It is usually valued at market price and by subtracting indirect tax and adding any government subsidy, however, GDP can be calculated at factor costs. This measure more accurately reveals the income paid to factors of production. In our analysis we h ...

... the change in inventories + (exports - imports). It is usually valued at market price and by subtracting indirect tax and adding any government subsidy, however, GDP can be calculated at factor costs. This measure more accurately reveals the income paid to factors of production. In our analysis we h ...

Macro prudential measures and housing markets A note on

... policy changes. The authors are aware of this and are cautious in their interpretation of the results.7 Krznar and Morsink (2014) study various macroprudential policies regarding housing finance in Canada. The authors begin by providing an overview of the housing finance in Canada focusing on the go ...

... policy changes. The authors are aware of this and are cautious in their interpretation of the results.7 Krznar and Morsink (2014) study various macroprudential policies regarding housing finance in Canada. The authors begin by providing an overview of the housing finance in Canada focusing on the go ...

13 - Finance

... ROE = EAT equity = $13,500 $90,000 = 15% EPS = EAT number of shares = $13,500 9,000,000 = $1.50 The treasurer feels debt can be traded for equity without immediately affecting the price of the stock or the rate at which the firm can borrow. Management believes it is in the best interest of t ...

... ROE = EAT equity = $13,500 $90,000 = 15% EPS = EAT number of shares = $13,500 9,000,000 = $1.50 The treasurer feels debt can be traded for equity without immediately affecting the price of the stock or the rate at which the firm can borrow. Management believes it is in the best interest of t ...

06.09.11 Presentation fr 2010 Innovation Award Winner. White

... • Augusta County Service Authority has 25 outstanding bonds and loans • $25 Million recently borrowed for 3 largest WWTPs ENR upgrades and Authority is now at “debt capacity” because bond revenue covenants are now driving rate increases • Therefore, being able to easily report on debt for Board disc ...

... • Augusta County Service Authority has 25 outstanding bonds and loans • $25 Million recently borrowed for 3 largest WWTPs ENR upgrades and Authority is now at “debt capacity” because bond revenue covenants are now driving rate increases • Therefore, being able to easily report on debt for Board disc ...

Institute of Actuaries of India Subject CT8 – Financial Economics INDICATIVE SOLUTIONS

... ΣΣpA(7%) > ΣΣp B(7%), ΣΣpA(6%) > ΣΣp B(6%) and ΣΣpA(5%) > ΣΣp B(5%) So asset B second-order dominates asset A. ii) ...

... ΣΣpA(7%) > ΣΣp B(7%), ΣΣpA(6%) > ΣΣp B(6%) and ΣΣpA(5%) > ΣΣp B(5%) So asset B second-order dominates asset A. ii) ...

A Study of Financial Distress based on MDA

... profitability position. In today’s economic climate overtrading can also create the risk of illiquidity and lead to corporate collapse. A prediction is a report regarding the means effects will take place in the future, frequently but not constantly based on experience. Prediction is very much assoc ...

... profitability position. In today’s economic climate overtrading can also create the risk of illiquidity and lead to corporate collapse. A prediction is a report regarding the means effects will take place in the future, frequently but not constantly based on experience. Prediction is very much assoc ...

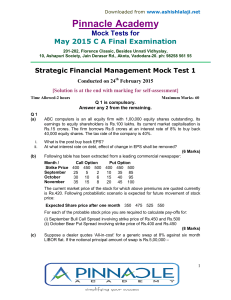

Pinnacle Academ y

... shall pay to A Inc. 1 % over the ¥ Loan interest rate, which the later will have to pay as a result of currency swap whereas A Inc. will reimburse interest to B Inc. only to the extent of 9%. Assuming stability of exchange rate, determine the net gain or loss to each of the party due to currency swa ...

... shall pay to A Inc. 1 % over the ¥ Loan interest rate, which the later will have to pay as a result of currency swap whereas A Inc. will reimburse interest to B Inc. only to the extent of 9%. Assuming stability of exchange rate, determine the net gain or loss to each of the party due to currency swa ...

Chapter 12.1: Bankruptcy

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

MEASURING VALUE AT RISK ON EMERGING

... index BELEX 15 we tested the relative performance of a variety of symmetric and asymmetric GARCH type models based on normal and Student t distribution for period of October 2005 to October 2012, a sufficiently long period which includes tranquil as well as crisis years. For investors, in the curren ...

... index BELEX 15 we tested the relative performance of a variety of symmetric and asymmetric GARCH type models based on normal and Student t distribution for period of October 2005 to October 2012, a sufficiently long period which includes tranquil as well as crisis years. For investors, in the curren ...

Recent Enhancements to the Management of

... Implementing two-way Credit Support Annexes as part of the International Swaps and Derivatives Association agreements between the government and private sector counterparties for derivatives transactions has improved credit-risk management for funding the EFA. Like many sovereigns, Canada has establ ...

... Implementing two-way Credit Support Annexes as part of the International Swaps and Derivatives Association agreements between the government and private sector counterparties for derivatives transactions has improved credit-risk management for funding the EFA. Like many sovereigns, Canada has establ ...

Asset price bubbles: What are the causes

... cycle in the U.S. was worse than preceding cycles. First, mortgage leverage reached levels never seen before. Second, there was an additional leverage effect because of the securitization of mortgages. These two factors reinforced one another. Third, credit default swaps (CDSs), which did not exist ...

... cycle in the U.S. was worse than preceding cycles. First, mortgage leverage reached levels never seen before. Second, there was an additional leverage effect because of the securitization of mortgages. These two factors reinforced one another. Third, credit default swaps (CDSs), which did not exist ...

Indebted Society Study Guide – Lecture 2: Household Debt

... o 3) probably over 100 firms that are putting billions of dollars chasing them same opportunity sets Some are Club Deals: being public is getting harder; companies are much more efficiently managed; large firms getting together to buy other companies; eliminate other bidders for companies; driving ...

... o 3) probably over 100 firms that are putting billions of dollars chasing them same opportunity sets Some are Club Deals: being public is getting harder; companies are much more efficiently managed; large firms getting together to buy other companies; eliminate other bidders for companies; driving ...

Document

... KASE is a commercial joint-stock company with 69 shareholders (as at January 3, 2008). The National Bank of the Republic of Kazakhstan is the largest shareholder. Other shareholders include: banks, brokerage firms, asset management companies, pension funds and other professional financial institutio ...

... KASE is a commercial joint-stock company with 69 shareholders (as at January 3, 2008). The National Bank of the Republic of Kazakhstan is the largest shareholder. Other shareholders include: banks, brokerage firms, asset management companies, pension funds and other professional financial institutio ...

The Status Quo and Prospect of Shanghai and Hong Kong

... ocean shipping and air transportation. Especially, Hong Kong takes advantage of time difference to fill the time gap of trade between Europe and America, the two most important international financial markets, and becomes a major joint that contributes to the 24-hour continuous operation of the inte ...

... ocean shipping and air transportation. Especially, Hong Kong takes advantage of time difference to fill the time gap of trade between Europe and America, the two most important international financial markets, and becomes a major joint that contributes to the 24-hour continuous operation of the inte ...

Lecture

... The costs are incurred and paid at different times and places, by different agencies and groups(e.g., users, neighbors, taxpayers), and in monetary and nonmonetary terms . When the cost is acceptable and low, this gives indication that the performance is well. ...

... The costs are incurred and paid at different times and places, by different agencies and groups(e.g., users, neighbors, taxpayers), and in monetary and nonmonetary terms . When the cost is acceptable and low, this gives indication that the performance is well. ...

DOC - Douglas Dynamics Investor Relations

... Guaranteed investment contract is valued at fair value which represents the value the Plan would receive if the contract was terminated, which is book value less an early surrender charge (see Note 5). Common collective trust is valued at the net asset value (“NAV”) which is based on the market valu ...

... Guaranteed investment contract is valued at fair value which represents the value the Plan would receive if the contract was terminated, which is book value less an early surrender charge (see Note 5). Common collective trust is valued at the net asset value (“NAV”) which is based on the market valu ...

Deutsche Bank`s View of the US Economy and the Fed

... purposes only. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction or as an advertisement of any financial instruments. The financial instruments discussed ...

... purposes only. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction or as an advertisement of any financial instruments. The financial instruments discussed ...

Lessons from a collapse of a financial system

... 16.6% per year during this period. Simultaneously, aggregate demand increased also, private saving fell and the current account deficit was 14.3% on average over this period, reflecting rapid consumption and investment growth. The emergence of Iceland’s internationally active banking system offers ...

... 16.6% per year during this period. Simultaneously, aggregate demand increased also, private saving fell and the current account deficit was 14.3% on average over this period, reflecting rapid consumption and investment growth. The emergence of Iceland’s internationally active banking system offers ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.