Preparing for Rising Rates

... mind that as interest rates rise, bond prices will fall. As mentioned previously, we believe the Fed will continue normalizing short-term interest rates in 2017. If you buy (or bought) fixed rate, investment-grade bonds and intend to hold them until they mature, rising U.S. rates won’t have any effe ...

... mind that as interest rates rise, bond prices will fall. As mentioned previously, we believe the Fed will continue normalizing short-term interest rates in 2017. If you buy (or bought) fixed rate, investment-grade bonds and intend to hold them until they mature, rising U.S. rates won’t have any effe ...

Equity Trading Strategy

... any other person without the prior written permission of DBS Bank. This publication is and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offe ...

... any other person without the prior written permission of DBS Bank. This publication is and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offe ...

Australian Dollar Outlook

... Higher commodity prices are likely providing the AUD with support, but the AUD appears to be trading much lower than what commodity prices are currently suggesting (see charts above page 3). It appears that the Australian dollar has “decoupled” from commodity prices. This divergence between commodit ...

... Higher commodity prices are likely providing the AUD with support, but the AUD appears to be trading much lower than what commodity prices are currently suggesting (see charts above page 3). It appears that the Australian dollar has “decoupled” from commodity prices. This divergence between commodit ...

Fixed rate bonds

... It follows the concept that interest rates and bond prices move in opposite directions. It’s used to determine the effect « a 100 bp (1%) change in interest rates » will have on the price of a bond. Ex : a 15 year bond with a Modified Duration of 7 years would fall approximately 7% in value if ...

... It follows the concept that interest rates and bond prices move in opposite directions. It’s used to determine the effect « a 100 bp (1%) change in interest rates » will have on the price of a bond. Ex : a 15 year bond with a Modified Duration of 7 years would fall approximately 7% in value if ...

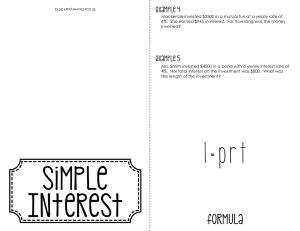

I = prt - SWMStbradford

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

Influence of profit and investors` value taxation on financing

... above problem by including into their regressions proxies for both profitability and financial leverage. However the regressions indicated negative relationship between financial leverage and Tobin Q2 ratio. The authors concluded that their regressions failed to separate net effect of debt tax shiel ...

... above problem by including into their regressions proxies for both profitability and financial leverage. However the regressions indicated negative relationship between financial leverage and Tobin Q2 ratio. The authors concluded that their regressions failed to separate net effect of debt tax shiel ...

Focus on emerging market corporate debt_Insights_r4

... challenged by the current macro backdrop. There has already been some evidence of this in the most recent quarterly corporate earnings releases, particularly from China, where industrials are suffering margin compression as a result of higher costs and revenues are coming under some pressure. Howeve ...

... challenged by the current macro backdrop. There has already been some evidence of this in the most recent quarterly corporate earnings releases, particularly from China, where industrials are suffering margin compression as a result of higher costs and revenues are coming under some pressure. Howeve ...

Currency Shake-up ´97 : A Case Study of the Czech Economy

... the Czech economic policy but also as a failure of a more general transformation philosophy supported by the International Monetary Fund and other prominent financial institutions. Second, measured in absolute terms of key economic variables (e.g. the volume of capital movements, volume of foreign e ...

... the Czech economic policy but also as a failure of a more general transformation philosophy supported by the International Monetary Fund and other prominent financial institutions. Second, measured in absolute terms of key economic variables (e.g. the volume of capital movements, volume of foreign e ...

- Südzucker International Finance BV

... bond. Neither does Südzucker currently intend to take any action, such as increase capital for cash or issue a new hybrid bond to fulfil the conditions for termination nor make a public offer to buy back any bonds by way of meeting a capital market compliant procedure, since this could negatively im ...

... bond. Neither does Südzucker currently intend to take any action, such as increase capital for cash or issue a new hybrid bond to fulfil the conditions for termination nor make a public offer to buy back any bonds by way of meeting a capital market compliant procedure, since this could negatively im ...

S`pore`s real estate story - Institute of Real Estate Studies

... Innovations in the real estate industry and the capital markets over the past 20 years have enabled all parts of the underlying capital structure of real estate to become tradable both in the private and public markets. This transformational change has resulted in a vastly expanded range of real est ...

... Innovations in the real estate industry and the capital markets over the past 20 years have enabled all parts of the underlying capital structure of real estate to become tradable both in the private and public markets. This transformational change has resulted in a vastly expanded range of real est ...

Economics for Today 2nd edition Irvin B. Tucker

... accounts records the purchase and sale of financial assets and real estate between the United States and other nations? a. The balance of trade account. b. The current account. c. The capital account. d. The balance of payments account. C. The balance of trade is the value of a nation’s merchandise ...

... accounts records the purchase and sale of financial assets and real estate between the United States and other nations? a. The balance of trade account. b. The current account. c. The capital account. d. The balance of payments account. C. The balance of trade is the value of a nation’s merchandise ...

Investment Efficiency and the Welfare Gain from

... calibrates the model and does a sensitivity analysis for Tobin’s q, growth rate acceleration, and welfare gain in relation to the size of the adjustment cost parameter. Section 5 derives a method for calculating the welfare gain from international financial integration based on the ...

... calibrates the model and does a sensitivity analysis for Tobin’s q, growth rate acceleration, and welfare gain in relation to the size of the adjustment cost parameter. Section 5 derives a method for calculating the welfare gain from international financial integration based on the ...

Asset Prices, Financial Stability and Monetary Policy

... global real interest rates have remained at very low levels.g Population growth continues to drive housing prices in many countries, particularly where, due to geography and regulation, supply remains scarce. The contrast between the United Kingdom and the United States is a good case in point. Wher ...

... global real interest rates have remained at very low levels.g Population growth continues to drive housing prices in many countries, particularly where, due to geography and regulation, supply remains scarce. The contrast between the United Kingdom and the United States is a good case in point. Wher ...

Corporate Finance

... BV is more stable than EPS, therefore P/BV may be more meaningful when EPS is abnormally low or high P/BV is particularly appropriate for companies with ...

... BV is more stable than EPS, therefore P/BV may be more meaningful when EPS is abnormally low or high P/BV is particularly appropriate for companies with ...

Mankiw8e_Student_PPTs_Chapter 12 - E-SGH

... Income and credit history– to get mortgages to buy home. One of these developments was securitization, the process by which one makes loans and then sells them to an investment bank which in turn bundles them together into a variety of “mortgage-backed securities” and then sells them to a third fina ...

... Income and credit history– to get mortgages to buy home. One of these developments was securitization, the process by which one makes loans and then sells them to an investment bank which in turn bundles them together into a variety of “mortgage-backed securities” and then sells them to a third fina ...

What Matters for Financial Development? Capital Controls

... which include private credit creation (PCGDP), stock market capitalization (SMKC), stock market total value (SMTV), all measured as a ratio of GDP, and stock market turnover (SMTO). Also for the series of regressions with different financial development measures, we also include each of the nine leg ...

... which include private credit creation (PCGDP), stock market capitalization (SMKC), stock market total value (SMTV), all measured as a ratio of GDP, and stock market turnover (SMTO). Also for the series of regressions with different financial development measures, we also include each of the nine leg ...

It is not appropriate to discount the cash flows of a bond by the yield

... If E(z)s are not equal forward rates then total returns are not equal for all investment strategies spanning an investment horizon. Conditioned on E(z)s and decision maker’s risk tolerance, a decision maker may select a strategy that produces an interest rate risk exposure if the expected return fr ...

... If E(z)s are not equal forward rates then total returns are not equal for all investment strategies spanning an investment horizon. Conditioned on E(z)s and decision maker’s risk tolerance, a decision maker may select a strategy that produces an interest rate risk exposure if the expected return fr ...

The interaction of monetary and macroprudential policies in the

... recession and emerge from a banking crisis, easing both policies works in a single, common direction, since inflation pressures and risk-taking are both at a low level. The easy monetary policy does not compress risk premia and does not encourage excessive risk-taking. If the economy is in a phase w ...

... recession and emerge from a banking crisis, easing both policies works in a single, common direction, since inflation pressures and risk-taking are both at a low level. The easy monetary policy does not compress risk premia and does not encourage excessive risk-taking. If the economy is in a phase w ...

Presentation

... Regular compilation and dissemination of Financial Soundness Indicators, a complement to the BSA in enhancing vulnerability and financial stability analysis Development of a conceptual framework for the compilation and presentation of debt securities (issuance and holdings) with the BIS, ECB, an ...

... Regular compilation and dissemination of Financial Soundness Indicators, a complement to the BSA in enhancing vulnerability and financial stability analysis Development of a conceptual framework for the compilation and presentation of debt securities (issuance and holdings) with the BIS, ECB, an ...

Price Level Accounting by Rekha

... PRICE LEVEL ACCOUNTING 1.CURRENT PURCHASING POWER TECHNIQUE:Current Purchasing Power Technique of accounting requires the companies to keep their records and present the financial statements on conventional historical cost basis but if further requires presentation of supplementary statements in ite ...

... PRICE LEVEL ACCOUNTING 1.CURRENT PURCHASING POWER TECHNIQUE:Current Purchasing Power Technique of accounting requires the companies to keep their records and present the financial statements on conventional historical cost basis but if further requires presentation of supplementary statements in ite ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.