5 3 6 7

... In recent years, the federal government and the Bank of Canada have taken several actions to tighten mortgage lending rules. These changes were made to tackle Canadians’ high debt levels and prevent a US-style housing market free fall. In particular, we’ve seen significant restrictions placed on the ...

... In recent years, the federal government and the Bank of Canada have taken several actions to tighten mortgage lending rules. These changes were made to tackle Canadians’ high debt levels and prevent a US-style housing market free fall. In particular, we’ve seen significant restrictions placed on the ...

Chapter 8 - The Market for Loanable Funds

... You should now be able to… • Explain what the market for loanable funds is and list a few markets that compose it. • Explain who the suppliers and the demanders of loanable funds are. • Explain what the interest rate is from the perspectives of both suppliers and demanders of loanable funds. • Diff ...

... You should now be able to… • Explain what the market for loanable funds is and list a few markets that compose it. • Explain who the suppliers and the demanders of loanable funds are. • Explain what the interest rate is from the perspectives of both suppliers and demanders of loanable funds. • Diff ...

Exchange Rates and the International Financial

... International trade is sometimes seen as a zerosum, Darwinian conflict. This view is misleading at best and wrong at worst. International trade and finance, like all voluntary exchange, can improve the well-being of both participants in the transaction. When the United States sells wheat to Japan an ...

... International trade is sometimes seen as a zerosum, Darwinian conflict. This view is misleading at best and wrong at worst. International trade and finance, like all voluntary exchange, can improve the well-being of both participants in the transaction. When the United States sells wheat to Japan an ...

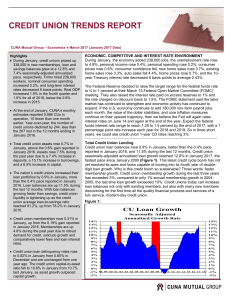

credit union trends report

... During January, the economy added 238,000 jobs, the unemployment rate rose to 4.8%, personal income rose 0.4%, personal spending rose 0.2%, consumer prices rose 0.6%, consumer confidence fell, new home sales rose 3.7%, existing home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and t ...

... During January, the economy added 238,000 jobs, the unemployment rate rose to 4.8%, personal income rose 0.4%, personal spending rose 0.2%, consumer prices rose 0.6%, consumer confidence fell, new home sales rose 3.7%, existing home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and t ...

the az guide to e-mini futures trading

... default on futures and options products by the exchange’s sophisticated risk management and surveillance techniques. The exchange itself provides the integrity for each and every transaction. Diversity – E-Mini’s cover a broad spectrum of the stock index world. From the S&P 500 to the Dow and NASDAQ ...

... default on futures and options products by the exchange’s sophisticated risk management and surveillance techniques. The exchange itself provides the integrity for each and every transaction. Diversity – E-Mini’s cover a broad spectrum of the stock index world. From the S&P 500 to the Dow and NASDAQ ...

STAKEHOLDER THEORY AND VALUE CREATION

... acquire specific human capital, which will increase the employees’ productivity and create value for the firm as a whole. The result, however, may be higher pay for the employees, or a reduction of their opportunities and an increase in the cost of switching to a different employer. The same may occ ...

... acquire specific human capital, which will increase the employees’ productivity and create value for the firm as a whole. The result, however, may be higher pay for the employees, or a reduction of their opportunities and an increase in the cost of switching to a different employer. The same may occ ...

1 ANNEX A QUESTIONNAIRE FOREIGN EXCHANGE RISK: AN

... Adverse exchange rate movements may cause changes in future operating cash flows (decline in sales volume, increase in input costs, or decrease in competitive position) known as economic exposure 11. How often does your firm manage economic exposure? 1. All the times 2. Sometimes 3. Never 4. Not App ...

... Adverse exchange rate movements may cause changes in future operating cash flows (decline in sales volume, increase in input costs, or decrease in competitive position) known as economic exposure 11. How often does your firm manage economic exposure? 1. All the times 2. Sometimes 3. Never 4. Not App ...

for Financing by Seconds of Radio–TV Advertisements

... 4- If the seconds of advertisement are considered as Manfa’ah and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation6, the ownership of the benefits of which are completely transferred to investors and there would be no need to sign a new contract with originator (IR ...

... 4- If the seconds of advertisement are considered as Manfa’ah and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation6, the ownership of the benefits of which are completely transferred to investors and there would be no need to sign a new contract with originator (IR ...

EQUITY INVESTING FOR REGULAR, HIGH INCOME WITH LOW

... In recognition of the Western world’s rapidly ageing population there has been a spawn of income generating investments to match the lifestyle goals of retirees. But as the ‘2008/2009 global financial crisis’ has shown, either risk was forgotten or not appropriately accounted for in the design of ma ...

... In recognition of the Western world’s rapidly ageing population there has been a spawn of income generating investments to match the lifestyle goals of retirees. But as the ‘2008/2009 global financial crisis’ has shown, either risk was forgotten or not appropriately accounted for in the design of ma ...

The Fundamental Principles of Financial Regulation

... Each author has contributed on a personal basis, and no responsibility should be attached to any institution to which that author either is or has been attached. ...

... Each author has contributed on a personal basis, and no responsibility should be attached to any institution to which that author either is or has been attached. ...

Have big banks gotten safer?

... for the pricing of their securities. With less leverage, bank equity should be less volatile, and there should be less market expectation of future volatility. Bank stocks should also be less responsive to movements in overall economic conditions. As a consequence of reduced risk, the expected retur ...

... for the pricing of their securities. With less leverage, bank equity should be less volatile, and there should be less market expectation of future volatility. Bank stocks should also be less responsive to movements in overall economic conditions. As a consequence of reduced risk, the expected retur ...

Characteristics of the 2009/2010 financial crisis in Greece

... crisis is completely different from what has been experienced ever before”, some studies are indicating that the economic climate at the time before, during, and after, many crises are indeed following similar distinct patterns (Kamin, 1999), (Reinhart and Rogoff, 2008). As Kindelberger (1978 p. 14), ...

... crisis is completely different from what has been experienced ever before”, some studies are indicating that the economic climate at the time before, during, and after, many crises are indeed following similar distinct patterns (Kamin, 1999), (Reinhart and Rogoff, 2008). As Kindelberger (1978 p. 14), ...

Recapitalization and Banks` Performance: A Case Study of Nigerian

... 1990. Before then, capital adequacy was measured by the ratio of adjusted capital to total loans and advances outstanding. The CBN in 1990 introduced a set of prudential guidelines for licensed banks, which were complementary to both the capital adequacy requirement and Statement of Standard Account ...

... 1990. Before then, capital adequacy was measured by the ratio of adjusted capital to total loans and advances outstanding. The CBN in 1990 introduced a set of prudential guidelines for licensed banks, which were complementary to both the capital adequacy requirement and Statement of Standard Account ...

9535 Testimony [Dave] - Maryland Public Service Commission

... 1994 increases to be sustained, indicates that long-term interest rates are relatively low and ...

... 1994 increases to be sustained, indicates that long-term interest rates are relatively low and ...

More of the same? In Focus: Markets as we see them

... Nominal yields offered by large chunks of the government bond universe are still negligible. Investors will likely have to work hard to make real returns from these levels over the next several years. Our view remains that such valuations underestimate the underlying inflationary pressures within th ...

... Nominal yields offered by large chunks of the government bond universe are still negligible. Investors will likely have to work hard to make real returns from these levels over the next several years. Our view remains that such valuations underestimate the underlying inflationary pressures within th ...

cash - Initial Set Up

... CCRA (Canada Customs & Revenue Agency) allows some reporting policies for tax purposes that aren't allowed by GAAP ...

... CCRA (Canada Customs & Revenue Agency) allows some reporting policies for tax purposes that aren't allowed by GAAP ...

Macroeconomic imbalances and institutional reforms in EMU

... good position inside the global value chains already before the establishment of EMU. Nevertheless, they also improved their position in the global value chain to meet extra-EMU demand. The Southern European countries did not benefit from rising foreign demand, both from EMU and the rest of the worl ...

... good position inside the global value chains already before the establishment of EMU. Nevertheless, they also improved their position in the global value chain to meet extra-EMU demand. The Southern European countries did not benefit from rising foreign demand, both from EMU and the rest of the worl ...

Analytical report on economic and social dimensions in the united

... fiscal and monetary policies to stimulate aggregate demand and offset the large declines in global consumer demand. Moreover, large countries, notably in Asia, have relied on their large domestic markets to maintain their previous high rates of growth and consequently were not affected as severely a ...

... fiscal and monetary policies to stimulate aggregate demand and offset the large declines in global consumer demand. Moreover, large countries, notably in Asia, have relied on their large domestic markets to maintain their previous high rates of growth and consequently were not affected as severely a ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.

![9535 Testimony [Dave] - Maryland Public Service Commission](http://s1.studyres.com/store/data/009524184_1-6690ffe236a26be1dddea21ad3b9b7b9-300x300.png)