Key Points WHY THE FOREIGN CURRENCY CRISIS IN PNG IS

... not be blamed entirely on the falling oil prices because PNG is not receiving the LNG gas export revenue in full. PNG’s foreign exchange reserves at the end of 2015 were US$1.9 billion (K5.2 billion), which was sufficient to cover a year’s worth of imports. This is higher than the 3 months reserve t ...

... not be blamed entirely on the falling oil prices because PNG is not receiving the LNG gas export revenue in full. PNG’s foreign exchange reserves at the end of 2015 were US$1.9 billion (K5.2 billion), which was sufficient to cover a year’s worth of imports. This is higher than the 3 months reserve t ...

Targeted review 4 Growth and Decay

... a= r= n= t= A hunter brings 20 rabbits to an island where they have no predators. The rabbits reproduce at a rate of 350% a year. How long will it take for there to be 10,000 rabbits on the island? ...

... a= r= n= t= A hunter brings 20 rabbits to an island where they have no predators. The rabbits reproduce at a rate of 350% a year. How long will it take for there to be 10,000 rabbits on the island? ...

Exchange Rates and Foreign Direct Investment

... The argument that producers engage in international investment diversification in order to achieve ex post production flexibility and higher profits in response to shocks is relevant to the extent that ex post production flexibility is possible within the window of time before the realization of the ...

... The argument that producers engage in international investment diversification in order to achieve ex post production flexibility and higher profits in response to shocks is relevant to the extent that ex post production flexibility is possible within the window of time before the realization of the ...

EXAM II

... c) A reduction of the interest rates in the Euro zone and other major economies This should make the US investments appear more attractive as the overseas investments reduce the return. Thus should increase the demand for the USD and hence cause an appreciation of the US currency. ...

... c) A reduction of the interest rates in the Euro zone and other major economies This should make the US investments appear more attractive as the overseas investments reduce the return. Thus should increase the demand for the USD and hence cause an appreciation of the US currency. ...

Thursday, June, 26, 2014 Economic News `700 million Euro fund for

... ‘Gov’t broke BoG’s forex rules – Financial analyst’ Some financial analysts are accusing government of breaching the forex rules by the Bank of Ghana by sanctioning the airlifting of 3 million dollars to Brazil as payment for the Black stars. Government is pre-financing the payment of the Black Star ...

... ‘Gov’t broke BoG’s forex rules – Financial analyst’ Some financial analysts are accusing government of breaching the forex rules by the Bank of Ghana by sanctioning the airlifting of 3 million dollars to Brazil as payment for the Black stars. Government is pre-financing the payment of the Black Star ...

PDF Download

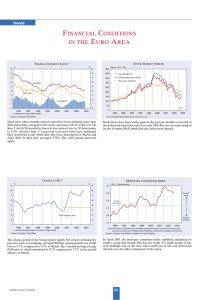

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

Document

... The primary advantage of a floating-rate system is that it allows a country to focus monetary policy on domestic objectives, rather than using monetary policy to maintain the currency peg. Moreover, allowing the exchange rate to float may theoretically at least protect the economy from forced change ...

... The primary advantage of a floating-rate system is that it allows a country to focus monetary policy on domestic objectives, rather than using monetary policy to maintain the currency peg. Moreover, allowing the exchange rate to float may theoretically at least protect the economy from forced change ...

Fixed versus floating exchange rates and the role of central bank

... the currency was requiring higher interest rates. But at a time when Mexico was in recession suffering high unemployment. (3) There was a lot of political pressure for a devaluation. Mexico had a history of devaluing in election years. Civil unrest at the hard economic conditions culminated in the a ...

... the currency was requiring higher interest rates. But at a time when Mexico was in recession suffering high unemployment. (3) There was a lot of political pressure for a devaluation. Mexico had a history of devaluing in election years. Civil unrest at the hard economic conditions culminated in the a ...

Assessment Terms

... When the exchange rate of a currency is not allowed to fluctuate against another (the exchange rate remains constant) Typically under fixed exchange rate regimes currencies are allowed to fluctuate within a small margin. They require central bank intervention to maintain the fixed rate NOTE: NZ has ...

... When the exchange rate of a currency is not allowed to fluctuate against another (the exchange rate remains constant) Typically under fixed exchange rate regimes currencies are allowed to fluctuate within a small margin. They require central bank intervention to maintain the fixed rate NOTE: NZ has ...

7.4 Asset Market Approach

... the long run, since the purchasing power parity is tenable, the result should be the same to that of the flexible-price monetary approach. In the short run: – First, since the price is sticky, it is not able to change at the time when the money supply is increased. – Second, excess money supply ca ...

... the long run, since the purchasing power parity is tenable, the result should be the same to that of the flexible-price monetary approach. In the short run: – First, since the price is sticky, it is not able to change at the time when the money supply is increased. – Second, excess money supply ca ...

The Demise of the Dollar

... in 2000 encouraged Americans to borrow ever greater amounts to both speculate in the housing market and purchase foreign imports. Lastly, financial deregulation undertaken in the 1980s led banks to transform themselves from careful stewards of their depositors’ savings into highly leveraged (which i ...

... in 2000 encouraged Americans to borrow ever greater amounts to both speculate in the housing market and purchase foreign imports. Lastly, financial deregulation undertaken in the 1980s led banks to transform themselves from careful stewards of their depositors’ savings into highly leveraged (which i ...

Balance –of-Payments Adjustments with Exchange Rate Changes

... The Gold Standard The international monetary system operating from about 1880 to 1914 under which gold was the only international reserve, exchange rates fluctuated only within the gold points, and balance-of-payments adjustment was described by the pricespecie-flow mechanism Under the gold s ...

... The Gold Standard The international monetary system operating from about 1880 to 1914 under which gold was the only international reserve, exchange rates fluctuated only within the gold points, and balance-of-payments adjustment was described by the pricespecie-flow mechanism Under the gold s ...

Long term trends in nominal exchange rates

... See the equation… rise in Pd = appreciation And, rise in Pf generates import parity pricing & wage demands Higher inflation means need another larger depreciation to re-lower domestic price level relative to foreign. Higher interest rates have larger negative effect on the economy than depreciation ...

... See the equation… rise in Pd = appreciation And, rise in Pf generates import parity pricing & wage demands Higher inflation means need another larger depreciation to re-lower domestic price level relative to foreign. Higher interest rates have larger negative effect on the economy than depreciation ...

the exchange rate

... different from PPP. Some of these differences are systematic: in general, aggregate price levels are lower in poor than in rich countries because services tend to be cheaper in poor countries But even among countries at roughly same level of economic development, nominal exchange rates vary quite a ...

... different from PPP. Some of these differences are systematic: in general, aggregate price levels are lower in poor than in rich countries because services tend to be cheaper in poor countries But even among countries at roughly same level of economic development, nominal exchange rates vary quite a ...

Bolivia_en.pdf

... of the peso between September 2006 and September 2007. In addition, the rate of the transaction fee on remittances of funds from abroad was increased to 1% in a bid to avert speculative capital inflows that could inject more liquidity into the economy; this measure does not apply to transactions con ...

... of the peso between September 2006 and September 2007. In addition, the rate of the transaction fee on remittances of funds from abroad was increased to 1% in a bid to avert speculative capital inflows that could inject more liquidity into the economy; this measure does not apply to transactions con ...

Exhange Rate Project

... pound nosedived further down south due to the lax monetary policy in the UK. While the Dutch Central Bank was situated at a healthy distance from the government, the Old Lady from Threadneedle Street was a willing servant of the ministry of finance. Even the iron lady could not resist the temptation ...

... pound nosedived further down south due to the lax monetary policy in the UK. While the Dutch Central Bank was situated at a healthy distance from the government, the Old Lady from Threadneedle Street was a willing servant of the ministry of finance. Even the iron lady could not resist the temptation ...

Foreign exchange topic exploration pack

... often only have a single rate for buying and selling, rather than two slightly different rates, and they rarely include commission. Students are very likely to be familiar with United States dollars and with Euros, but questions can be asked on any foreign currency, and could include conversion from ...

... often only have a single rate for buying and selling, rather than two slightly different rates, and they rarely include commission. Students are very likely to be familiar with United States dollars and with Euros, but questions can be asked on any foreign currency, and could include conversion from ...

Real exchange rate - YSU

... – Disposable income: more disposable income means more expenditure on foreign products ...

... – Disposable income: more disposable income means more expenditure on foreign products ...

Macroeconomic Policies Under Globalization

... inflation; • Target a real exchange rate consistent with external competitiveness. This would require the pragmatic use of “intermediary” exchange rate regimes; • Additional policy space may also be gained through temporary capital controls. ...

... inflation; • Target a real exchange rate consistent with external competitiveness. This would require the pragmatic use of “intermediary” exchange rate regimes; • Additional policy space may also be gained through temporary capital controls. ...

Economics 303

... Suppose the British central bank intervenes in the currency markets to prevent the value of the pound from falling. If the central bank does not want this to affect the domestic money supply, it must make another transaction. The other transaction must involve: a. b. c. d. e. ...

... Suppose the British central bank intervenes in the currency markets to prevent the value of the pound from falling. If the central bank does not want this to affect the domestic money supply, it must make another transaction. The other transaction must involve: a. b. c. d. e. ...

No Slide Title

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

The Long Run

... Effects of changes in real exchange rates on nominal exchange rates E$/€ = qUS/EU x PUS/PEU • When only monetary factors change and PPP holds, we have the same predictions as before: no changes in the real exchange rate occurs • When factors influencing real output change, the real exchange rate ch ...

... Effects of changes in real exchange rates on nominal exchange rates E$/€ = qUS/EU x PUS/PEU • When only monetary factors change and PPP holds, we have the same predictions as before: no changes in the real exchange rate occurs • When factors influencing real output change, the real exchange rate ch ...

Postwar US economic resurgence after self destructiopn of Europe

... Even China’s government played a role in facilitating the US real-estate bubble, by investing a huge portion of China’s export earnings into Fannie Mae and Freddie Mac bonds, and by “sterilizing” the inflow of cash into China for speculation or for goods by using existing RMB (rather than printing n ...

... Even China’s government played a role in facilitating the US real-estate bubble, by investing a huge portion of China’s export earnings into Fannie Mae and Freddie Mac bonds, and by “sterilizing” the inflow of cash into China for speculation or for goods by using existing RMB (rather than printing n ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.