JUSTIN`S COMMENTARY - Investors in Excellence

... country irrevocably, reasserting its political strength and overseeing the radical adjustment in domestic society. These changes would reverberate both domestically and internationally and have a direct effect on the country’s subsequent leaders. These policies were not accepted by ...

... country irrevocably, reasserting its political strength and overseeing the radical adjustment in domestic society. These changes would reverberate both domestically and internationally and have a direct effect on the country’s subsequent leaders. These policies were not accepted by ...

Should Ireland stay in the Euro

... structures of intermediate technology while, as in Ireland, real wages are above those of competitors in Asia and elsewhere. There is a risk, therefore, that conservative exit coupled with liberalisation would lead to protracted stagnation accompanied by bouts of inflation, successive devaluations, ...

... structures of intermediate technology while, as in Ireland, real wages are above those of competitors in Asia and elsewhere. There is a risk, therefore, that conservative exit coupled with liberalisation would lead to protracted stagnation accompanied by bouts of inflation, successive devaluations, ...

real interest rate

... in productivity (no resort to devaluation) • The removal of the BOP-constraint can only have beneficial effects ...

... in productivity (no resort to devaluation) • The removal of the BOP-constraint can only have beneficial effects ...

Aplia Test #1 Which of the following best describes the key

... Factors that cause the CPI to exaggerate the inflation rate do NOT include Political pressure from unions and retirees on the providers of a country's official statistics to overstate the inflation rate. ...

... Factors that cause the CPI to exaggerate the inflation rate do NOT include Political pressure from unions and retirees on the providers of a country's official statistics to overstate the inflation rate. ...

Bolivia_en.pdf

... foreign currency, this time to 13.5%, while the reserve requirement for securities was lowered from 12% to 8%. These policies were part of the government’s effort to bolivianize the financial system. At the end of 2010, for the first time more than half of deposits and loans were in local currency. ...

... foreign currency, this time to 13.5%, while the reserve requirement for securities was lowered from 12% to 8%. These policies were part of the government’s effort to bolivianize the financial system. At the end of 2010, for the first time more than half of deposits and loans were in local currency. ...

The G-20 Calls a Truce in the Currency War

... First, the agreement recognizes that both excessive surpluses and deficits should be fixed, subject to country-specific factors such as natural resource endowment and the asymmetry between reservecurrency and non-reserve-currency countries. In fact, it calls on advanced economies, including those wi ...

... First, the agreement recognizes that both excessive surpluses and deficits should be fixed, subject to country-specific factors such as natural resource endowment and the asymmetry between reservecurrency and non-reserve-currency countries. In fact, it calls on advanced economies, including those wi ...

EASY - Testbank44

... 2.34 The _______ for/of foreign currency in the U.S. is derived from the demand for ___________ by American consumers. a. Demand, foreign products b. Demand, tax loopholes c. Supply, lower tariffs d. Supply, local products Ans: a: Section: Setting the equilibrium spot exchange rate Level: Difficult ...

... 2.34 The _______ for/of foreign currency in the U.S. is derived from the demand for ___________ by American consumers. a. Demand, foreign products b. Demand, tax loopholes c. Supply, lower tariffs d. Supply, local products Ans: a: Section: Setting the equilibrium spot exchange rate Level: Difficult ...

7: INTERNATIONAL TRADE VOCABULARY (with some additional

... U.S. has economic boom. Because AD increases, people are wealthier. Wealthier people consume more foreign goods. Demand for foreign currency increases. Dollar price for foreign currency increases, causing foreign currency to appreciate in value as dollar value decreases In the long run, since value ...

... U.S. has economic boom. Because AD increases, people are wealthier. Wealthier people consume more foreign goods. Demand for foreign currency increases. Dollar price for foreign currency increases, causing foreign currency to appreciate in value as dollar value decreases In the long run, since value ...

Lecture Slides Chapter 16

... Copyright © 2009 South-Western, a division of Cengage Learning. All rights reserved. ...

... Copyright © 2009 South-Western, a division of Cengage Learning. All rights reserved. ...

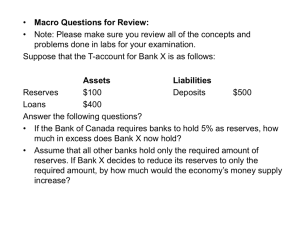

ECONOMICS DPM REVIEW

... member banks to borrow money Reserve Requirement: Percentage of deposits that member banks are forced to hold onto Open Market Operations: The Fed’s action of buying or selling US government securities ...

... member banks to borrow money Reserve Requirement: Percentage of deposits that member banks are forced to hold onto Open Market Operations: The Fed’s action of buying or selling US government securities ...

Chapter 9:

... 12. When the domestic price level is equal to the spot exchange rate times the foreign price level then A. B. C. D. ...

... 12. When the domestic price level is equal to the spot exchange rate times the foreign price level then A. B. C. D. ...

Venezuela_en.pdf

... In the fourth quarter of the year, the authorities reversed some of these measures in order to stimulate domestic demand, which had decelerated sharply. On 1 January 2008, a redenomination of the bolivar took place. Three zeros were cut from the currency unit, which was renamed the “bolivar fuerte” ...

... In the fourth quarter of the year, the authorities reversed some of these measures in order to stimulate domestic demand, which had decelerated sharply. On 1 January 2008, a redenomination of the bolivar took place. Three zeros were cut from the currency unit, which was renamed the “bolivar fuerte” ...

Ch 6 MCQs File

... B) a nation's exchange rate will differ from another nation's exchange rate by an amount depending upon the difference between the domestic and foreign rates of inflation. C) a nation's exchange rate is determined by the extent of speculation in the foreign-exchange market. D) a nation's exchange ra ...

... B) a nation's exchange rate will differ from another nation's exchange rate by an amount depending upon the difference between the domestic and foreign rates of inflation. C) a nation's exchange rate is determined by the extent of speculation in the foreign-exchange market. D) a nation's exchange ra ...

Document

... The quoted exchange rate is the nominal exchange rate and it accounts for only one of the two prices involved in purchasing foreign goods, services or financial assets. The real exchange rate is a bilateral exchange rate that has been adjusted for price changes that occurred in the two nations. Henc ...

... The quoted exchange rate is the nominal exchange rate and it accounts for only one of the two prices involved in purchasing foreign goods, services or financial assets. The real exchange rate is a bilateral exchange rate that has been adjusted for price changes that occurred in the two nations. Henc ...

Fiscal Policy:

... • The Federal Reserve (FED) is in control of monetary policy. • The FED will control the money supply by raising or decreasing interest rates for banks. – Interest rates: the payment on a loan ...

... • The Federal Reserve (FED) is in control of monetary policy. • The FED will control the money supply by raising or decreasing interest rates for banks. – Interest rates: the payment on a loan ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.