World Recession Set to Worsen* Prabhat Patnaik

... government with a degree of freedom to act with impunity in fiscal matters (since it is most unlikely to face any capital flight), monetary policy becomes the sole instrument for reviving the economy. And the U.S. Federal Reserve has done as much as it possibly could with this instrument. (It could ...

... government with a degree of freedom to act with impunity in fiscal matters (since it is most unlikely to face any capital flight), monetary policy becomes the sole instrument for reviving the economy. And the U.S. Federal Reserve has done as much as it possibly could with this instrument. (It could ...

Indonesian and S. Korean Financial Crisis

... Moody’s lowered South Korea’s credit rating from A1 to A3 then to B2 ...

... Moody’s lowered South Korea’s credit rating from A1 to A3 then to B2 ...

... strains in the third quarter), the slowdown of the Brazilian economy and the drop in the prices of the country’s main exports. The government’s expansionary fiscal policy mitigated these adverse factors to some extent, but did not manage to fully counteract them. Tensions eased somewhat in the fourt ...

MACRO 1-page graph summary 2011

... Demand = Investment Demand (business who borrow $) Use Real Interest Rate on this graph! Crowding Out: Supply shifts left as Gov’t savings falls (less national savings) Private investor are “crowded out” by ↑ real interest rates. (less (I) capital investment!) Real world example: Spain, Greece, Port ...

... Demand = Investment Demand (business who borrow $) Use Real Interest Rate on this graph! Crowding Out: Supply shifts left as Gov’t savings falls (less national savings) Private investor are “crowded out” by ↑ real interest rates. (less (I) capital investment!) Real world example: Spain, Greece, Port ...

12-3

... Currently the CA deficit is hovering around 3-4% because the recession has caused depreciation of the USD and Oil prices are substantially lower. ...

... Currently the CA deficit is hovering around 3-4% because the recession has caused depreciation of the USD and Oil prices are substantially lower. ...

International Economics PPT

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

Bolivia_en.pdf

... order to address the effects of the international financial crisis, the 2009 financial programme provided for a further expansion of liquidity and more financing for the NFPS than in previous years, by setting less ambitious goals for the accumulation of net international reserves and reducing net d ...

... order to address the effects of the international financial crisis, the 2009 financial programme provided for a further expansion of liquidity and more financing for the NFPS than in previous years, by setting less ambitious goals for the accumulation of net international reserves and reducing net d ...

International Economics II: International Monetary & Finance Economics

... Required Supplemental Readings: Additional readings will be handed out in class, placed on reserve or posted at Blackboard throughout the semester to supplement sections of the required textbook. * The required text has been ordered by UVM's bookstore and should be available by the start of classes. ...

... Required Supplemental Readings: Additional readings will be handed out in class, placed on reserve or posted at Blackboard throughout the semester to supplement sections of the required textbook. * The required text has been ordered by UVM's bookstore and should be available by the start of classes. ...

THE COLLAPSE OF THE CURRENCY BOARD Guillermo Rozenwurcel

... 3. The aftermath of the Currency Board collapse: Is there a way back to normality? The crisis reached its peak in 2002. The GDP fell almost 11%, the largest reduction since World War I, led by a dramatic plunge in aggregate investment which went down 36%, with its productive equipment component drop ...

... 3. The aftermath of the Currency Board collapse: Is there a way back to normality? The crisis reached its peak in 2002. The GDP fell almost 11%, the largest reduction since World War I, led by a dramatic plunge in aggregate investment which went down 36%, with its productive equipment component drop ...

midterm prep

... What do we mean by a fixed exchange rate regime and a flexible floating exchange rate regime? ...

... What do we mean by a fixed exchange rate regime and a flexible floating exchange rate regime? ...

Dr. SK Mitchell - people.vcu.edu

... Why do liberals tend to favor increased government spending while conservatives tend to favor decreased taxes as the preferred tool of expansionary fiscal policy? What are the reasons for and against counter-cyclical policies? In the case of a contractionary gap, which will result in the largest pri ...

... Why do liberals tend to favor increased government spending while conservatives tend to favor decreased taxes as the preferred tool of expansionary fiscal policy? What are the reasons for and against counter-cyclical policies? In the case of a contractionary gap, which will result in the largest pri ...

- International Growth Centre

... Additionally, whether positive demand shocks such as an increase in deficit spending will depreciate the real exchange rate depend crucially on the size of the deficit created by the fiscal policy, the future trend of the debt to the gross national product (GNP) of the country and the type and natur ...

... Additionally, whether positive demand shocks such as an increase in deficit spending will depreciate the real exchange rate depend crucially on the size of the deficit created by the fiscal policy, the future trend of the debt to the gross national product (GNP) of the country and the type and natur ...

Uruguay_en.pdf

... certain negative indicators, the overall data on the labour market continued to point to signs of vigour and improvements in job quality, with higher rates of formality and social security coverage. In the period between January and September, average wages climbed by 3.0% in real terms over the sam ...

... certain negative indicators, the overall data on the labour market continued to point to signs of vigour and improvements in job quality, with higher rates of formality and social security coverage. In the period between January and September, average wages climbed by 3.0% in real terms over the sam ...

Document

... • The peso had a fixed exchange rate to the USD since 1991 which stopped the inflation • The peso was let to float in 2002 due to the crisis; this led to a quick depreciation • Inflation again became a problem after 2002 ...

... • The peso had a fixed exchange rate to the USD since 1991 which stopped the inflation • The peso was let to float in 2002 due to the crisis; this led to a quick depreciation • Inflation again became a problem after 2002 ...

ECON 401 November 19, 2012 Fragile Economy in the 1990s

... accumulation away from manufacturing constituted one of the main structural problems of the growth pattern of the period ...

... accumulation away from manufacturing constituted one of the main structural problems of the growth pattern of the period ...

Chile_en.pdf

... currency appreciation resumed —a pattern that had been interrupted, in late 2008, by the sharp exchange rate rises that accompanied the onset of the crisis. In response, the monetary authority has limited itself thus far to issuing statements, but has not ruled out the possibility of taking measures ...

... currency appreciation resumed —a pattern that had been interrupted, in late 2008, by the sharp exchange rate rises that accompanied the onset of the crisis. In response, the monetary authority has limited itself thus far to issuing statements, but has not ruled out the possibility of taking measures ...

Historical Monetary Overview

... domestic monetary policy To conduct monetary policy, means restricted international financial flows Then, the parity R = R* need not hold 4. Free international capital flows and monetary policy require a floating exchange rate Macroeconomic Policy under the Gold Standard 1870–1914 5. A gold stan ...

... domestic monetary policy To conduct monetary policy, means restricted international financial flows Then, the parity R = R* need not hold 4. Free international capital flows and monetary policy require a floating exchange rate Macroeconomic Policy under the Gold Standard 1870–1914 5. A gold stan ...

Source

... What factors affect the pace at which the interest rate is increased? Inflation environment (actual and expected inflation) Rate of growth in Israel and abroad, including their uncertainty. Pace of increase of the interest rate by the leading central banks Developments in the shekel exchange ...

... What factors affect the pace at which the interest rate is increased? Inflation environment (actual and expected inflation) Rate of growth in Israel and abroad, including their uncertainty. Pace of increase of the interest rate by the leading central banks Developments in the shekel exchange ...

Long Run Exchange Rate Determination

... This is an extension of the LOOP. At least on average (maybe?) goods should cost the same in all countries (aside from tariffs, transportation costs, etc.). If this is true, then exchange rates must adjust to make prices equal across countries, at least over the long run. This is LONG RUN because it ...

... This is an extension of the LOOP. At least on average (maybe?) goods should cost the same in all countries (aside from tariffs, transportation costs, etc.). If this is true, then exchange rates must adjust to make prices equal across countries, at least over the long run. This is LONG RUN because it ...

Chinese Money

... China's unemployment situation remained stable in the first half of this year with the urban unemployment rate reported at 4.2 percent. ...

... China's unemployment situation remained stable in the first half of this year with the urban unemployment rate reported at 4.2 percent. ...

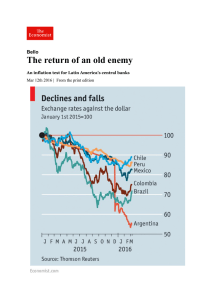

The return of an old enemy | The Economist

... Latin American countries floated their previously fixed currencies and adopted inflation targeting, large depreciations were associated with very high rates of inflation. Now the average pass-through in these countries is below 10% (ie, if the currency depreciates by 10%, domestic prices will rise ...

... Latin American countries floated their previously fixed currencies and adopted inflation targeting, large depreciations were associated with very high rates of inflation. Now the average pass-through in these countries is below 10% (ie, if the currency depreciates by 10%, domestic prices will rise ...

Macroeconomics Assignment

... more active lead in trying to lift poor African countries out of poverty. What does he suggest the world’s largest economies do to help these poor countries? What benefits would the largest economies accrue from his proposed actions? What criticism has confronted his cause? Section III- Central Bank ...

... more active lead in trying to lift poor African countries out of poverty. What does he suggest the world’s largest economies do to help these poor countries? What benefits would the largest economies accrue from his proposed actions? What criticism has confronted his cause? Section III- Central Bank ...

Pegged exchange rate

... the 12 countries of the European Monetary Union, all of which use the euro, which is managed by the European Central Bank ...

... the 12 countries of the European Monetary Union, all of which use the euro, which is managed by the European Central Bank ...