Philip Lowe: Internal balance, structural change and monetary policy

... boom without generating substantial imbalances in the economy. At the same time, these factors have prompted significant structural change which, while difficult, is critical to achieving higher overall productivity and higher living standards. There is clearly a lot of change going on in the Austra ...

... boom without generating substantial imbalances in the economy. At the same time, these factors have prompted significant structural change which, while difficult, is critical to achieving higher overall productivity and higher living standards. There is clearly a lot of change going on in the Austra ...

Factors affecting Currency Exchange Rate, Economical Formulas

... will get a higher return from saving in the Indian banks. Therefore demand for Indian Rupee will rise. Higher interest rate is an appreciation for money inflow which will have negative impact on local businesses of the country. Higher interest rate reduces purchase power of the consumer while the lo ...

... will get a higher return from saving in the Indian banks. Therefore demand for Indian Rupee will rise. Higher interest rate is an appreciation for money inflow which will have negative impact on local businesses of the country. Higher interest rate reduces purchase power of the consumer while the lo ...

Slide 1

... Stable exchange rate, heavy use of regulations (RR) Monetary policy works through banking sector Financial eurisation ...

... Stable exchange rate, heavy use of regulations (RR) Monetary policy works through banking sector Financial eurisation ...

Guyana_en.pdf

... public services, and wages). Revenue rose by 3.6% over the same period due to increases in both direct and indirect tax receipts. However, this deficit is expected to widen to 4.9% of projected GDP by the end of 2014, compared with the 4.4% deficit posted in 2013. The money supply as measured by M1 ...

... public services, and wages). Revenue rose by 3.6% over the same period due to increases in both direct and indirect tax receipts. However, this deficit is expected to widen to 4.9% of projected GDP by the end of 2014, compared with the 4.4% deficit posted in 2013. The money supply as measured by M1 ...

Purchasing Power Parity (PPP)

... The Implied PPP of the $ The Implied PPP of the $ is the exchange rate that would leave a good, such as the McDonald’s Big Mac, costing the same in the United States as in any other country where the Big Mac is being sold. The Implied PPP of the $ is the ratio of the price of a Big Mac in local cur ...

... The Implied PPP of the $ The Implied PPP of the $ is the exchange rate that would leave a good, such as the McDonald’s Big Mac, costing the same in the United States as in any other country where the Big Mac is being sold. The Implied PPP of the $ is the ratio of the price of a Big Mac in local cur ...

Dominican_Republic_en.pdf

... by the unfolding international financial crisis. The government’s crisis response plan, announced at the start of the year, included, as pertains to fiscal policy, tax exemptions for the agricultural sector, incentives for the construction of low-cost housing, support for small- and medium-sized ent ...

... by the unfolding international financial crisis. The government’s crisis response plan, announced at the start of the year, included, as pertains to fiscal policy, tax exemptions for the agricultural sector, incentives for the construction of low-cost housing, support for small- and medium-sized ent ...

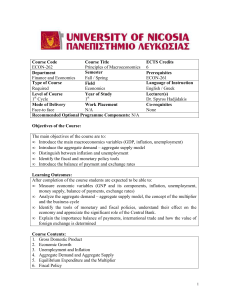

ECON-262 Principles of Macroeconomics

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

Evolution by Region - Pennsylvania State University

... • Net exports = -$706 billion – By comparison total US investment in residential construction = $704 billion in 2006 before the housing bust ...

... • Net exports = -$706 billion – By comparison total US investment in residential construction = $704 billion in 2006 before the housing bust ...

Inflation criterion: Slovenia 2004

... Beat the Mastricht Inflation Criterion by Exchange Rate Manipulation Entusiasm for Inflation Targeting ...

... Beat the Mastricht Inflation Criterion by Exchange Rate Manipulation Entusiasm for Inflation Targeting ...

Chapter 14:

... Chapter 14 uses the IS-LM-BP and AS-AD models that were developed in chapters 10 through 13 to study the potential incentives and potential drawbacks of international policy coordination. Specifically, the chapter uses “beggar-thy-neighbor” negative policy externalities to motivate an incentive for ...

... Chapter 14 uses the IS-LM-BP and AS-AD models that were developed in chapters 10 through 13 to study the potential incentives and potential drawbacks of international policy coordination. Specifically, the chapter uses “beggar-thy-neighbor” negative policy externalities to motivate an incentive for ...

INDICATIVE SOLUTION INSTITUTE OF ACTUARIES OF INDIA CT7 – Business Economics

... speculation can lead to high levels of exchange rate volatility exchange rate uncertainty can discourage international trade and investment without the need to maintain a stable exchange rate, governments may allow the economy to fall into a cycle of expansion and contraction. Exchange rate vo ...

... speculation can lead to high levels of exchange rate volatility exchange rate uncertainty can discourage international trade and investment without the need to maintain a stable exchange rate, governments may allow the economy to fall into a cycle of expansion and contraction. Exchange rate vo ...

Module: 2103Y Economic Regulation Groups: 1001 and 1002

... government decides to cut income taxes. How will this decision affect the level of interest rates, exchange rates, investment and output? 67. Suppose that a small open economy operates under the fixed exchange rate regime and has pegged its currency to dollars. Describe the effect of following chang ...

... government decides to cut income taxes. How will this decision affect the level of interest rates, exchange rates, investment and output? 67. Suppose that a small open economy operates under the fixed exchange rate regime and has pegged its currency to dollars. Describe the effect of following chang ...

Inflation

... OMOs are the means of implementing monetary policy by which a central bank controls the nation’s money supply by buying and selling government securities, or other financial instruments ...

... OMOs are the means of implementing monetary policy by which a central bank controls the nation’s money supply by buying and selling government securities, or other financial instruments ...

Inflation Targeting

... • Band targets (Australia – from 2 to 3%; New Zeland – from 1 to 3%; RPA – from 3 to 6%) • Asymetric targets (Switzerland – always below 2%; EBC in €uro Area – below 2%, but close to this level) ...

... • Band targets (Australia – from 2 to 3%; New Zeland – from 1 to 3%; RPA – from 3 to 6%) • Asymetric targets (Switzerland – always below 2%; EBC in €uro Area – below 2%, but close to this level) ...

Baldwin & Wyplosz The Economics of Euroepan Integration

... The old debate: fixed vs. float • The case for flexible rates – With sticky prices, need exchange rate flexibility to deal with shocks – Remove the exchange rate from politicization – Monetary policy is too useful to be jettisoned ...

... The old debate: fixed vs. float • The case for flexible rates – With sticky prices, need exchange rate flexibility to deal with shocks – Remove the exchange rate from politicization – Monetary policy is too useful to be jettisoned ...

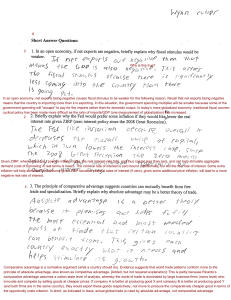

Why is this true? In an open economy, net exports being negative

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

20081220101748113

... If constantly run Current Account deficits and are not receiving foreign currency then this will be a problem. If market decides a devaluation is coming, foreign reserves drop sharply due to private capital flows abroad (capital flight). Self fulfilling currency crisis can occur when an economy is v ...

... If constantly run Current Account deficits and are not receiving foreign currency then this will be a problem. If market decides a devaluation is coming, foreign reserves drop sharply due to private capital flows abroad (capital flight). Self fulfilling currency crisis can occur when an economy is v ...

APS7

... price of imports from other countries to the US will be relatively more expensive. Therefore, the demand for US exports will increase, while the US demand for imports will decrease, and therefore the trade surplus will increase as we export more and import less. This will then cause AEd to increase, ...

... price of imports from other countries to the US will be relatively more expensive. Therefore, the demand for US exports will increase, while the US demand for imports will decrease, and therefore the trade surplus will increase as we export more and import less. This will then cause AEd to increase, ...

welcome-1 - WordPress.com

... Economic growth has been defined generally as an increase in real GDP or real GDP per capita for a given time period. While both of the measures are important in giving an idea of an economy’s economic soundness they serve different purposes. The level of real GDP of an economy represents the econo ...

... Economic growth has been defined generally as an increase in real GDP or real GDP per capita for a given time period. While both of the measures are important in giving an idea of an economy’s economic soundness they serve different purposes. The level of real GDP of an economy represents the econo ...

International Economics II: International Monetary & Finance Economics

... understanding of the fundamentals of international monetary economics, an increasingly important area of study given growing integration of the world's national economies into a global economic system. Students will acquire fluency with key global financial concepts and relationships, as well as con ...

... understanding of the fundamentals of international monetary economics, an increasingly important area of study given growing integration of the world's national economies into a global economic system. Students will acquire fluency with key global financial concepts and relationships, as well as con ...

Barbados_en.pdf

... declined by 15%. Companies operating in the offshore financial services sector also performed poorly, as new licences issued to companies remained flat. Inflation for the 12 months to September averaged 5%, up from 4% in June. It is projected to ease back down to 4% at the end of 2011. The unemploym ...

... declined by 15%. Companies operating in the offshore financial services sector also performed poorly, as new licences issued to companies remained flat. Inflation for the 12 months to September averaged 5%, up from 4% in June. It is projected to ease back down to 4% at the end of 2011. The unemploym ...

U.S. Economy Presentation

... The Fed can raise the money supply, so… Fed funds rate/discount rate will fall Other interest rates will fall Investment/consumption spending will rise Production (GDP) will rise ...

... The Fed can raise the money supply, so… Fed funds rate/discount rate will fall Other interest rates will fall Investment/consumption spending will rise Production (GDP) will rise ...

On Global Currencies Jeffrey Frankel, Harpel Professor, Harvard

... • How? By allowing the RMB to appreciate, • but also by increasing domestic demand. ...

... • How? By allowing the RMB to appreciate, • but also by increasing domestic demand. ...