The Argentine Recovery: some features and challenges Dr. P. Ruben Mercado

... restore equilibrium, a significant depreciation in the real exchange rate. Since Argentina was a relatively closed economy, the required depreciation was very large. But a large real depreciation in the context of widespread dollarization of the economy creates serious financial problems. And moreov ...

... restore equilibrium, a significant depreciation in the real exchange rate. Since Argentina was a relatively closed economy, the required depreciation was very large. But a large real depreciation in the context of widespread dollarization of the economy creates serious financial problems. And moreov ...

Worksheet #4 - The Digital Economist

... Calculate the rate of inflation between 1999 & 2000, derive the real rate of interest (return) for the year 2000 if nominal interest rates are 7%: Is this real rate of interest above or below the rate of economic growth for the same period of time?____________ Is this to the benefit of lenders or bo ...

... Calculate the rate of inflation between 1999 & 2000, derive the real rate of interest (return) for the year 2000 if nominal interest rates are 7%: Is this real rate of interest above or below the rate of economic growth for the same period of time?____________ Is this to the benefit of lenders or bo ...

FM11 Ch 26 Instructors Manual

... effect, the forces of supply and demand are allowed to determine currency prices with little government intervention. c. A country has a deficit trade balance when it imports more goods from abroad than it exports. Devaluation is the lowering, by governmental action, of the price of its currency rel ...

... effect, the forces of supply and demand are allowed to determine currency prices with little government intervention. c. A country has a deficit trade balance when it imports more goods from abroad than it exports. Devaluation is the lowering, by governmental action, of the price of its currency rel ...

Macroeconomics: The Bird`s Eye View of the Global Economy

... 1. Economists measure economic growth as an increase in income per capita. Is this an adequate measure of an economies well-being? What might this imply about immigration policy that increases the labor supply? Read http://news.ft.com/cms/s/5810f1bc-f715-11da-a5660000779e2340.html 2. Economic growth ...

... 1. Economists measure economic growth as an increase in income per capita. Is this an adequate measure of an economies well-being? What might this imply about immigration policy that increases the labor supply? Read http://news.ft.com/cms/s/5810f1bc-f715-11da-a5660000779e2340.html 2. Economic growth ...

AP Economics Final Exam

... Cost-Push Inflation – usually during recessionary periods, the per unit cost of goods increases and results in firms having to raise prices in order to maintain previous profit levels ...

... Cost-Push Inflation – usually during recessionary periods, the per unit cost of goods increases and results in firms having to raise prices in order to maintain previous profit levels ...

Venezuela_en.pdf

... Denominated Securities (SITME) for transactions that were not eligible for the 4.3 bolívares fuertes per dollar rate authorized by the Foreign Exchange Administration Commission (CADIVI). Nevertheless, high inflation during the period caused the real effective exchange rate in October to be 35.8% lo ...

... Denominated Securities (SITME) for transactions that were not eligible for the 4.3 bolívares fuertes per dollar rate authorized by the Foreign Exchange Administration Commission (CADIVI). Nevertheless, high inflation during the period caused the real effective exchange rate in October to be 35.8% lo ...

Dominican_Republic_en.pdf

... 8%. Annual inflation for 2012 is likely to be about 5% following an expected drop in international commodity prices associated with a global economic slowdown. Almost 120,000 jobs were created (mainly in the commerce sector) during the first half of 2011, owing in part to the rise in the overall par ...

... 8%. Annual inflation for 2012 is likely to be about 5% following an expected drop in international commodity prices associated with a global economic slowdown. Almost 120,000 jobs were created (mainly in the commerce sector) during the first half of 2011, owing in part to the rise in the overall par ...

Indian economy

... • Indi’s Exchange Rate Policy: Reduced Volatility and checking REER appreciation. • Limits to the policy: sharp nominal exchange rate fluctuations, inflation, persistent and increasing CAD. • Responsiveness of Exports to Exchange Rate: (-) 0.66 (Aziz & Chenoy 2012, insignificant) (-) 0.2 (L), -0.1 ( ...

... • Indi’s Exchange Rate Policy: Reduced Volatility and checking REER appreciation. • Limits to the policy: sharp nominal exchange rate fluctuations, inflation, persistent and increasing CAD. • Responsiveness of Exports to Exchange Rate: (-) 0.66 (Aziz & Chenoy 2012, insignificant) (-) 0.2 (L), -0.1 ( ...

E 2

... At E1, both the goods market and money market are in equilibrium, but the foreign exchange market is not, for BP is of deficit. The demand for foreign exchange is greater than the supply. The domestic currency will depreciate. The BP curve tends to move downward The depreciation of domestic curren ...

... At E1, both the goods market and money market are in equilibrium, but the foreign exchange market is not, for BP is of deficit. The demand for foreign exchange is greater than the supply. The domestic currency will depreciate. The BP curve tends to move downward The depreciation of domestic curren ...

pierre_yared - Academic Commons

... • Headline inflation: aggregates all prices • Core inflation: Excludes food and energy and is less volatile • What determines long run inflation? Money growth • Also applies to hyperinflation at shorter frequencies • Why do governments allow hyperinflation?: Seignorage • Inflation is a form of indir ...

... • Headline inflation: aggregates all prices • Core inflation: Excludes food and energy and is less volatile • What determines long run inflation? Money growth • Also applies to hyperinflation at shorter frequencies • Why do governments allow hyperinflation?: Seignorage • Inflation is a form of indir ...

Haiti_en.pdf

... authorities do not appear to herald major changes, and certain initiatives still under negotiation are expected to materialize, in particular, the extension for three more years of the Poverty Reduction and Growth Facility with the International Monetary Fund (IMF). The primary and overall fiscal de ...

... authorities do not appear to herald major changes, and certain initiatives still under negotiation are expected to materialize, in particular, the extension for three more years of the Poverty Reduction and Growth Facility with the International Monetary Fund (IMF). The primary and overall fiscal de ...

MONETARY POLICY

... - It assigns overriding importance to price stability. - It makes clear that ensuring price stability is the most important contribution that monetary policy can make to achieve the objectives of the EC (favourable economic environment and high level of ...

... - It assigns overriding importance to price stability. - It makes clear that ensuring price stability is the most important contribution that monetary policy can make to achieve the objectives of the EC (favourable economic environment and high level of ...

Presentation

... upgrading dynamic industries with the combination of closed and open areas and took export-led international hedge finance position. • South European countries such as Greece have been unsuccessful in upgrading dynamic industries and took domestic demand-led Ponzi finance • A currency union is an ex ...

... upgrading dynamic industries with the combination of closed and open areas and took export-led international hedge finance position. • South European countries such as Greece have been unsuccessful in upgrading dynamic industries and took domestic demand-led Ponzi finance • A currency union is an ex ...

Real exchange rate - YSU

... – Disposable income: more disposable income means more expenditure on foreign products ...

... – Disposable income: more disposable income means more expenditure on foreign products ...

The Seductive Myth of Canada`s Overvalued Dollar

... of purchasing power parity (PPP). The theory predicts that international trade in products eventually leads exchange rates to adjust until a typical basket of consumer goods and services in Canada costs the same as similar baskets in other countries.2 The basic idea is that if goods are more expensi ...

... of purchasing power parity (PPP). The theory predicts that international trade in products eventually leads exchange rates to adjust until a typical basket of consumer goods and services in Canada costs the same as similar baskets in other countries.2 The basic idea is that if goods are more expensi ...

The Open Economy: International Trade and Finance

... • Measures international sales of financial assets • Stocks, securities, savings bonds • Capital inflows and outflows ...

... • Measures international sales of financial assets • Stocks, securities, savings bonds • Capital inflows and outflows ...

10_Floating

... • The Bretton Woods system collapsed in 1973 because central banks were unwilling to continue to buy over-valued dollar assets and to sell under-valued foreign currency assets. • Central banks thought they would stop trading in the foreign exchange for a while, and would let exchange rates adjust to ...

... • The Bretton Woods system collapsed in 1973 because central banks were unwilling to continue to buy over-valued dollar assets and to sell under-valued foreign currency assets. • Central banks thought they would stop trading in the foreign exchange for a while, and would let exchange rates adjust to ...

INTERNATIONAL MONETARY ECONOMICS Syllabus and study

... These questions, prepared by the same John Harvey, are to help guide your studying. Though these exact questions may not appear on your exams, the tests will be based also on this list. 1. List the balance of payments accounts. 2. What is a floating or flexible exchange rate system. 3. Why, logicall ...

... These questions, prepared by the same John Harvey, are to help guide your studying. Though these exact questions may not appear on your exams, the tests will be based also on this list. 1. List the balance of payments accounts. 2. What is a floating or flexible exchange rate system. 3. Why, logicall ...

Macroeconomic Theory M. Finkler Suggested Answers to Spring

... and services. Such a desire to purchase is based on income that people have. Since income is determined on the supply side and since aggregate demand only influences the price level, changes in the stock of money have no influence on real variables including GDP, real wages, employment, investment, ...

... and services. Such a desire to purchase is based on income that people have. Since income is determined on the supply side and since aggregate demand only influences the price level, changes in the stock of money have no influence on real variables including GDP, real wages, employment, investment, ...

apes review part 1

... THE IMPACT OF A PERSON OR COMMUNITY ON THE ENVIRONMENT, EXPRESSED AS THE AMOUNT OF LAND REQUIRED TO SUSTAIN THEIR USE OF NATURAL RESOURCES. ...

... THE IMPACT OF A PERSON OR COMMUNITY ON THE ENVIRONMENT, EXPRESSED AS THE AMOUNT OF LAND REQUIRED TO SUSTAIN THEIR USE OF NATURAL RESOURCES. ...

PDF Download

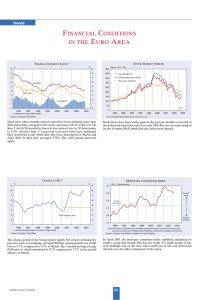

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

Macroeconomic and International Policy Terms

... one important currency, the U.S. dollar, is used as a standard to express and compare all rates. Floating (flexible) exchange rates are determined solely by the supply and demand conditions (i.e., no government intervention) in the foreign exchange market. This compares to a fixed exchange rate wher ...

... one important currency, the U.S. dollar, is used as a standard to express and compare all rates. Floating (flexible) exchange rates are determined solely by the supply and demand conditions (i.e., no government intervention) in the foreign exchange market. This compares to a fixed exchange rate wher ...

Title Goes Here - Binus Repository

... in the UK. British customers want to see pound-denominated prices. They are not interested in looking up an exchange rate to see how many pounds they will have to pay by dividing dollar prices by the dollar-pound exchange rate. Furthermore, saying “Prices are subject to fluctuations due to possible ...

... in the UK. British customers want to see pound-denominated prices. They are not interested in looking up an exchange rate to see how many pounds they will have to pay by dividing dollar prices by the dollar-pound exchange rate. Furthermore, saying “Prices are subject to fluctuations due to possible ...