International Financial Market

... Eurodollar deposits are not demand deposit and can’t be transferred by a check drawn on the bank having the deposit. It can be transferred by a wire or cable from a balance-hold in a corresponding bank located in the U.S. Banks in which Eurodollar or Eurocurrencies are deposited are ...

... Eurodollar deposits are not demand deposit and can’t be transferred by a check drawn on the bank having the deposit. It can be transferred by a wire or cable from a balance-hold in a corresponding bank located in the U.S. Banks in which Eurodollar or Eurocurrencies are deposited are ...

Paraguay_en.pdf

... with the positive pattern of trade flows observed in 2013. In addition, imports from Asia were up by 4.6% in value terms. In 2013, the robust expansion in exports pushed the current account balance back into surplus to stand at the equivalent to 2.1% of GDP, compared with a deficit of 0.9% of GDP in ...

... with the positive pattern of trade flows observed in 2013. In addition, imports from Asia were up by 4.6% in value terms. In 2013, the robust expansion in exports pushed the current account balance back into surplus to stand at the equivalent to 2.1% of GDP, compared with a deficit of 0.9% of GDP in ...

Chapter 3

... relation between exchange rate volatility, trade and investment • Using cross-section evidence Andy Rose recently found strong effect of monetary union on trade: – A monetary union doubles trade among members of union, on average – More recent econometric evidence has reduced these effects to 10%-20 ...

... relation between exchange rate volatility, trade and investment • Using cross-section evidence Andy Rose recently found strong effect of monetary union on trade: – A monetary union doubles trade among members of union, on average – More recent econometric evidence has reduced these effects to 10%-20 ...

EconomicHistory(ASRIMarch2016)

... • To facilitate international trade (capital flows remained highly regulated): – The US would again peg its currency to gold (USD35 per ounce) and and all countries would peg their exchange rates to the US dollar, but it allowed for adjustments to be made to these pegs (to avoid the inflexibility th ...

... • To facilitate international trade (capital flows remained highly regulated): – The US would again peg its currency to gold (USD35 per ounce) and and all countries would peg their exchange rates to the US dollar, but it allowed for adjustments to be made to these pegs (to avoid the inflexibility th ...

Final Exam

... In the post-WWII period, social democratic capitalism was implemented in many countries. However, by the 1970s, both Keynesianism and social democratic capitalism were in serious crisis. According to Pollin, what factors/problems had contributed to the downfall of social democratic capitalism? Since ...

... In the post-WWII period, social democratic capitalism was implemented in many countries. However, by the 1970s, both Keynesianism and social democratic capitalism were in serious crisis. According to Pollin, what factors/problems had contributed to the downfall of social democratic capitalism? Since ...

ECONOMICS CLUB CAPSULS FOR UNDER ACHIEVERS

... Sources of Demand for Foreign Exchange. The following factors cause demand for foreign exchange. (a) To purchase goods and services by domestic residents from foreign countries. ...

... Sources of Demand for Foreign Exchange. The following factors cause demand for foreign exchange. (a) To purchase goods and services by domestic residents from foreign countries. ...

GOAL 9 MONSTER REVIEW Measuring the Economy GDP – Gross

... 14. Setting a ________________ places a limit on the amount of goods that are imported into a country. 15. What terms means removing government regulations from business? 16. Today, what term is used to describe a country that is primarily agricultural? 17. Today, what term is used to describe count ...

... 14. Setting a ________________ places a limit on the amount of goods that are imported into a country. 15. What terms means removing government regulations from business? 16. Today, what term is used to describe a country that is primarily agricultural? 17. Today, what term is used to describe count ...

Contents of the course - Solvay Brussels School of

... Monetary approach Overshooting model - Hypotheses Money is neutral in the long-run : changes in the supply of money have no long-run effect on the real economy : an % increase (decrease) in money supply will lead to the same % increase (decrease) in p and s. Short-run adjustments : m supply decr ...

... Monetary approach Overshooting model - Hypotheses Money is neutral in the long-run : changes in the supply of money have no long-run effect on the real economy : an % increase (decrease) in money supply will lead to the same % increase (decrease) in p and s. Short-run adjustments : m supply decr ...

Final Exam

... 6. Albonia has a fixed exchange rate with the US dollar and Balbonia maintains a real interest rate which rises when domestic inflation rises. We could say that: a. GDP would decline more sharply in Balbonia than in Albonia if oil prices rose and GDP would decline more sharply in Balbonia than in Al ...

... 6. Albonia has a fixed exchange rate with the US dollar and Balbonia maintains a real interest rate which rises when domestic inflation rises. We could say that: a. GDP would decline more sharply in Balbonia than in Albonia if oil prices rose and GDP would decline more sharply in Balbonia than in Al ...

Improved inflation outlook but a tight stance is still needed

... is clearly dependent on the willingness of global investors and creditors to finance its deficit. Accordingly, the economy is more exposed to shifts in global financial markets and their responses to news, correct or otherwise, about its performance. Events in the first months of this year should st ...

... is clearly dependent on the willingness of global investors and creditors to finance its deficit. Accordingly, the economy is more exposed to shifts in global financial markets and their responses to news, correct or otherwise, about its performance. Events in the first months of this year should st ...

Economics

... 32% compared with only 13% for the US. Smaller Asian countries are even more dependent on exports; Singapore’s ratio of exports to GDP is 234%, Hong Kong’s is 169%. It will be difficult for economies such as these to increase domestic demand and reduce their dependence on export-led growth. (Source: ...

... 32% compared with only 13% for the US. Smaller Asian countries are even more dependent on exports; Singapore’s ratio of exports to GDP is 234%, Hong Kong’s is 169%. It will be difficult for economies such as these to increase domestic demand and reduce their dependence on export-led growth. (Source: ...

and the Exchange Rate

... domestic interest rate implies an expected appreciation to maintain uncovered interest parity. If the expected future exchange rate is fixed, an expected appreciation implies a depreciation of the current exchange rate, which is incompatible with a fixed exchange rate regime. To defend the exchange ...

... domestic interest rate implies an expected appreciation to maintain uncovered interest parity. If the expected future exchange rate is fixed, an expected appreciation implies a depreciation of the current exchange rate, which is incompatible with a fixed exchange rate regime. To defend the exchange ...

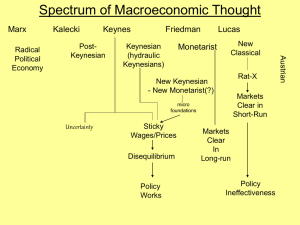

Macro Spectrum

... equilibrium macroeconometric models is that predicatable changes in the money supply do not affect real GNP or total employment. • The new classical models continue to assume that markets always clear and that agents optimize. • A New Classical Story: Because they do not have all the information tha ...

... equilibrium macroeconometric models is that predicatable changes in the money supply do not affect real GNP or total employment. • The new classical models continue to assume that markets always clear and that agents optimize. • A New Classical Story: Because they do not have all the information tha ...

A Macroeconomic Theory of the Open Economy

... Real Exchange Rate (RER) adjusts to balance the demand and supply of domestic currency (Can$). At the equilibrium RER, the demand for $ to buy net exports exactly balances the supply of $ to be exchanged into foreign currency to buy assets abroad. What if the NFI is negative? ...

... Real Exchange Rate (RER) adjusts to balance the demand and supply of domestic currency (Can$). At the equilibrium RER, the demand for $ to buy net exports exactly balances the supply of $ to be exchanged into foreign currency to buy assets abroad. What if the NFI is negative? ...

Comparisons between regions

... relative prices of internationally traded goods and services, financial flows, and interest rates • Exchange rates do not adequately reflect the relative overall purchasing power of currencies in their national markets ...

... relative prices of internationally traded goods and services, financial flows, and interest rates • Exchange rates do not adequately reflect the relative overall purchasing power of currencies in their national markets ...

1. The Balance of Payments

... The Asian crisis has prompted most investors to move to USD denominated assets. As a result, there is a large positive net portfolio investment in the U.S., leading to a surplus of the KA and of the BOP. According to the theory, this excess demand for U.S. assets should lead to an appreciation of th ...

... The Asian crisis has prompted most investors to move to USD denominated assets. As a result, there is a large positive net portfolio investment in the U.S., leading to a surplus of the KA and of the BOP. According to the theory, this excess demand for U.S. assets should lead to an appreciation of th ...

Chinese Economy: Current Issues and Future Scenarios

... Foreign Exchange Issues • Most South-East Asian currencies have been floating after 1997; • But China was forced to return to fixed regime since then. ...

... Foreign Exchange Issues • Most South-East Asian currencies have been floating after 1997; • But China was forced to return to fixed regime since then. ...

International Political Economy

... TWO Governing the International Monetary System Central to the international economy. Framework for trade, investment, ...

... TWO Governing the International Monetary System Central to the international economy. Framework for trade, investment, ...

Lecture 7: Factors Affect Current Account

... Terms of trade (TOT): more volatile TOT tends to save more for precautionary reasons. On the other hand, multinationals tend to diversify their production base across countries with volatile TOT in order to have the flexibility to exploit TOT movements. (+, For developing countries, -, for industria ...

... Terms of trade (TOT): more volatile TOT tends to save more for precautionary reasons. On the other hand, multinationals tend to diversify their production base across countries with volatile TOT in order to have the flexibility to exploit TOT movements. (+, For developing countries, -, for industria ...

College of Business Administration

... Q11. If MPM is .15, at point E there is a: A. BOP surplus of 45 B BOP deficit of 45 C BOP deficit of 75 D BOP surplus of 75 C Q12. Under a flexible exchange rate system adjustment of real GDP can be achieved using A. Monetary policy only B. Fiscal policy only C. Exchange rate policy only D. combinat ...

... Q11. If MPM is .15, at point E there is a: A. BOP surplus of 45 B BOP deficit of 45 C BOP deficit of 75 D BOP surplus of 75 C Q12. Under a flexible exchange rate system adjustment of real GDP can be achieved using A. Monetary policy only B. Fiscal policy only C. Exchange rate policy only D. combinat ...

Chapter 9

... The Maastricht Treaty of 1993 set the stage for the eventual creation of the Euro created an integrated system of European central banks overseen by a single European Central Bank (ECB) The Euro (€), the currency of the European Union (EU), began trading on January 1, 1999 when eleven European cou ...

... The Maastricht Treaty of 1993 set the stage for the eventual creation of the Euro created an integrated system of European central banks overseen by a single European Central Bank (ECB) The Euro (€), the currency of the European Union (EU), began trading on January 1, 1999 when eleven European cou ...

Diapositiva 1 - Manufacturing Circle

... 2. Emerging market economies have become more vulnerable to currency volatility because: a) They are generally not well hedged against a currency risk; b) A strengthening of the exchange rate may result in the loss of competitiveness of the traded goods sector and the ensuing effect could become per ...

... 2. Emerging market economies have become more vulnerable to currency volatility because: a) They are generally not well hedged against a currency risk; b) A strengthening of the exchange rate may result in the loss of competitiveness of the traded goods sector and the ensuing effect could become per ...

AP Macroeconomics

... Using the above model, in the long-run nominal wages will rise so the AS curve will shift from _____________________. The equilibrium will be at point _____ with the price level at ________ and real output at ________. Using the previous model, now assume that the economy is initially in equilib ...

... Using the above model, in the long-run nominal wages will rise so the AS curve will shift from _____________________. The equilibrium will be at point _____ with the price level at ________ and real output at ________. Using the previous model, now assume that the economy is initially in equilib ...

International Lecture - Rockhurst University

... Stocks (measured at a point in time eg. Balance sheet items): ...

... Stocks (measured at a point in time eg. Balance sheet items): ...