* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Chinese Economy: Current Issues and Future Scenarios

Survey

Document related concepts

Transcript

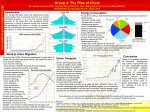

Chinese Economy: Current Issues and Future Scenarios FAN Gang National Economic Research Institute China Reform Foundation November, 2004 Trends or Scenarios: • Short-run: possible soft-landing: Government took actions much quicker; • Long-run: Possibility of high growth for another decade—fundamentals are still favorable. Short-run Growth Cycles There has been a Over-heating again GDP Growth, China 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 1997 1998 1999 2000 2001 2002 03.Q1 03.Q2 03.Q3 03.Q4 04.Q1 04.Q2 04.Q3 The main contributor: Investment Boom 40 35 30 25 20 15 10 5 0 1997 1998 GDP Growth rates % 1999 2000 2001 2002 03.Q1 03.Q2 Real growth of Gross domestic investment % 03.Q3 03.Q4 04.Q1 04.Q2 04.Q3 Real growth of retail sale of consumer goods % Price Indece 12 % CPI Input PI 6 0 -6 1997 1998 1999 2000 2001 2002 03.Q1 03.Q2 03.Q3 03.Q4 04.Q1 04.Q2 04.Q3 China's Trade balance US$ bn 60 30 0 -30 1997 1998 1999 2000 2001 2002 Year 2003 04.Q1 04.Q2 04.Q3 Why should (Chinese) economists worry about? • Potential growth rate: 8-9%; • Early find-tuning to stop the acceleration! • The economy is vulnerable to the fluctuations; A nice Soft-landing is highly likely • Government was quite quick to respond, so the over-heating was not fully developed; • Realistic policies, including administrative ones; • No hard-landing, if policy-making with normal wisdom. What will be the next? • With the growth rate back to the zone of 89%, China may continue the current boom for next 2-3 years; • While macroeconomic stability stays, more reforms will take place: banking, capital market, taxation….. Long-Run Development China is full of Problems and difficulties: Two Sets Set I. As a developing country -- Per capita GDP US$1,000 by 2002; 65% of population are rural. * Industrialization * Modern corporate system * Financial market development * Rule of law * Rural-urban difference and urbanization * Regional disparity and migration * Opening and competition * Unemployment: various categories * Democratization ………… Set II. As the economy in transition -- Legacy of Soviet-type system, currently 80 millions working as state employees. * The state owned enterprise (SOEs) * The state banking system * Social security system * Planning to Market * Government reform and political changes …… Achievements or Reasons for Achievements • No longer as a State company dominated economy (up to 70% of GDP comes from Nonstate sectors, most of small SOEs privatized); • Opening up (trade and FDI, WTO); • Decentralization of decision-making and diversification of society. Major concerns There are many concerns about if China’s growth would be interrupted by any kind of crises or upside downs. 2 biggest selected: – Financial crisis: NPL, etc, – Social crisis: Unemployment and social instability; Financial Risks • Financial Reform is seriously lagged behind as a bottleneck; • Foreign participation may cause financial difficulties for the state banks, but may improve the overall quality of financial assets, and therefore reduce the risk; • For the state banks, the NPL risk is still manageable. Indicators of Financial Risks of Chinese Economy (%) NPL over GDP – official statement Liability of AMCs over GDP Government domestic debt over GDP Total foreign debt over GDP ratio Short-term commercial debt over GDP ratio “Overall National Contingent Liability” “Short-term NCL” GDP Growth rate Budget deficit as % of GDP Interest rate on government bonds (1 year) Growth rate of budget revenue (3 year average) Current account balance US$ billion Capital account balance US$ billion Foreign exchange reserve, US$ billion Inflation rate * Most of figures 2000 25.0 16.0 14.5 15 4.3 70.5 59.8 8 2.8 2.4 19 20.5 19.2 16.5.1 0 2001 27.3 13.4 16.3 14.8 4.5 71.8 61.5 7.4 3.0 1.75 20 17.4 34.7 210.0 0 for the end of 2003 are estimated based on the data of previous quarters. 2003* 23.6 10.0 17.2 13.9 4.9 64.7 55.7 9.1 2.2 1.75 20 35.0 79.0 403.3 1.7 Unemployment and Social Stability Basic facts: • 25 millions of state workers were laid off in past 5-6 years; 6 millions still unemployed; at least 20 mil. More to come. • 45% of labor force, or 350—400 millions, are still dependent on farming, mostly underemployed; • 15 millions new non-farming jobs created by 78% growth per year; Why is still there the social stability • Special programs for the laid-off state workers; • New job creation by the growth; • Improvement of labor mobility; • Rural land system serving as China’s special social security for the rural unemployment; The realistic policies: • Prepared to go through a painful historical process of modernization; • Do not raise the expectations for the government subsidies; • Do more for education within the budgetary affordability; • Increase gradually the medical protection of the rural poor. Foreign Exchange Issues • Most South-East Asian currencies have been floating after 1997; • But China was forced to return to fixed regime since then. Market speculation still strong Foreign Exchange Reserve (US$bn) 600 100 90 80 70 60 50 40 30 20 10 0 500 400 300 200 100 20 02 03 .Q 1 03 .Q 2 03 .Q 3 03 .Q 4 04 .Q 1 04 .Q 2 04 .Q 3 20 01 20 00 19 99 19 98 19 97 0 Foreign Reserve (US$bn) Growth of FX reserve quarterly Revaluation seems less urgent in past months: -- Overall trade balance; -- Inflation is increasing; -- Uncertainty about the oil price and its impacts; -- US$ was not fast weakening until recently The real Issues: • How to de-peg from US$, and change to a basket-pegging system with higher flexibility? – That is China’s self-interest, not others’. • How to minimize the speculation; • How to catch up the good opportunity in the market to do so?