Miami Dade College ECO 2013 Section 2 Principles of

... A) now set below the federal funds rate. B) the interest rate banks charge one another when they lend or borrow reserves. C) the Fed's most effective monetary policy tool. D) the rate regional Federal Reserve banks charge depository institutions to borrow reserves. ...

... A) now set below the federal funds rate. B) the interest rate banks charge one another when they lend or borrow reserves. C) the Fed's most effective monetary policy tool. D) the rate regional Federal Reserve banks charge depository institutions to borrow reserves. ...

click - U of T : Economics

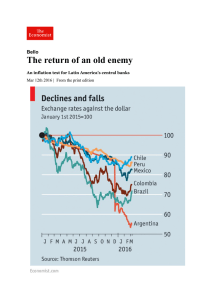

... Most of us were taught that price inflation is driven by a fundamental imbalance: too much money chasing too few goods. In Canada, the data seem to support this theory. Real economic growth wallowed below 2 per cent for most of last year, and average weekly earnings rose a paltry 1.4 per cent in the ...

... Most of us were taught that price inflation is driven by a fundamental imbalance: too much money chasing too few goods. In Canada, the data seem to support this theory. Real economic growth wallowed below 2 per cent for most of last year, and average weekly earnings rose a paltry 1.4 per cent in the ...

Business Cycle Theories

... in real money supply resulting from the deflation (fall in P). Keynes’ objection to the second channel is the possibility that planned autonomous expenditures are very or totally unresponsive to changes in the interest rate. This implies a very steep or vertical IS curve and AD curve, so that output ...

... in real money supply resulting from the deflation (fall in P). Keynes’ objection to the second channel is the possibility that planned autonomous expenditures are very or totally unresponsive to changes in the interest rate. This implies a very steep or vertical IS curve and AD curve, so that output ...

AP Macro The Quantity Theory of Money

... quantity theory of money states that the value of money is based on the amount of money in the economy. Thus, according to the quantity theory of money, when the Fed increases the money supply, the value of money falls and the price level increases. This dynamic relationship is represented by the fo ...

... quantity theory of money states that the value of money is based on the amount of money in the economy. Thus, according to the quantity theory of money, when the Fed increases the money supply, the value of money falls and the price level increases. This dynamic relationship is represented by the fo ...

Suppose a generous relative gave you a gift of $1000 for your high

... 3. The cost of raw materials rises in most industries, increasing cost for producers, who then raise prices on their goods. ...

... 3. The cost of raw materials rises in most industries, increasing cost for producers, who then raise prices on their goods. ...

17.1 Inflation and Deflation

... This comes about from AD shifting A downwards shift of AD will result in lower price levels but also lower output (less growth) This could lead to an increase in unemployment Demand for goods and services will decrease Labour is a derived demand If people think prices will go down they w ...

... This comes about from AD shifting A downwards shift of AD will result in lower price levels but also lower output (less growth) This could lead to an increase in unemployment Demand for goods and services will decrease Labour is a derived demand If people think prices will go down they w ...

Practice Exam - University of Notre Dame

... a. Firms negotiate labor contracts infrequently based on their expectations of prices, and may adjust their labor usage when realized prices are other than expected. b. Firms incorrectly believe that the relative price of their output has risen when in fact the aggregate price level has risen. c. Fi ...

... a. Firms negotiate labor contracts infrequently based on their expectations of prices, and may adjust their labor usage when realized prices are other than expected. b. Firms incorrectly believe that the relative price of their output has risen when in fact the aggregate price level has risen. c. Fi ...

Institute of Actuaries of India Subject CT7 – Business Economics

... 2. Government expenditure (G ). This is expenditure on goods and services such as roads and schools. (This does not include spending on transfer payments.) 3. Exports ( X ). This is expenditure by foreign residents on goods and services produced domestically. ...

... 2. Government expenditure (G ). This is expenditure on goods and services such as roads and schools. (This does not include spending on transfer payments.) 3. Exports ( X ). This is expenditure by foreign residents on goods and services produced domestically. ...

what is management

... When a government gets into financial trouble, one of the ways to finance those problems is through inflation. If the government owes people money, that debt is lessened considerably if money is worth less and less. A government can also print money to pay its bills. The more money pumped into an ec ...

... When a government gets into financial trouble, one of the ways to finance those problems is through inflation. If the government owes people money, that debt is lessened considerably if money is worth less and less. A government can also print money to pay its bills. The more money pumped into an ec ...

Is Europe heading for Japanese-style deflation?

... Over many years of nominal (without taking inflation into account) GDP stagnation, this drove the government debt stock to unsustainable levels, and although some commentators claim that this was a necessary policy, the full consequences remain to be borne. This is a classic case of crowding out, wh ...

... Over many years of nominal (without taking inflation into account) GDP stagnation, this drove the government debt stock to unsustainable levels, and although some commentators claim that this was a necessary policy, the full consequences remain to be borne. This is a classic case of crowding out, wh ...

How the Federal Reserve uses Fiscal and Monetary Policy to

... the total supply of money in the economy increases. So the end result of lowering interest economic activity - a good side effect. On the other hand, lowering interest rates also tends to increase inflation. This is a negative side effect because the total supply of goods and services is essentially ...

... the total supply of money in the economy increases. So the end result of lowering interest economic activity - a good side effect. On the other hand, lowering interest rates also tends to increase inflation. This is a negative side effect because the total supply of goods and services is essentially ...

Demand Pull Inflation

... capable of producing. In effect, the demand side of the aggregate market is pulling the price level higher ...

... capable of producing. In effect, the demand side of the aggregate market is pulling the price level higher ...

A rise in the price of oil imports has resulted in a decrease of short

... c. the interest rate the fed pays banks who have funds on deposit at the fed. d. the reduced interest rate that banks charge their best customers. 24. What goes up when an economy goes into the inflationary gap in the short-run? a. output. b. unemployment. c. wages. d. both a and c. 25. What happens ...

... c. the interest rate the fed pays banks who have funds on deposit at the fed. d. the reduced interest rate that banks charge their best customers. 24. What goes up when an economy goes into the inflationary gap in the short-run? a. output. b. unemployment. c. wages. d. both a and c. 25. What happens ...

Hw4s-11 - uc-davis economics

... The parameter k is a constant, so it can be ignored. The percentage change in nominal money demand Md is the same as the growth in the money supply because nominal money demand has to equal nominal money supply. If nominal money demand grows 12 percent and real income (Y) grows 4 percent then the gr ...

... The parameter k is a constant, so it can be ignored. The percentage change in nominal money demand Md is the same as the growth in the money supply because nominal money demand has to equal nominal money supply. If nominal money demand grows 12 percent and real income (Y) grows 4 percent then the gr ...

document

... How do they affect demand? When rates rise major purchases become more expensive When rates rise investments become less ...

... How do they affect demand? When rates rise major purchases become more expensive When rates rise investments become less ...