* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Hw4s-11 - uc-davis economics

Business cycle wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Economic growth wikipedia , lookup

Great Recession in Europe wikipedia , lookup

Real bills doctrine wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Monetary policy wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Inflation targeting wikipedia , lookup

Interest rate wikipedia , lookup

Phillips curve wikipedia , lookup

Helicopter money wikipedia , lookup

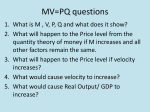

Solution Key: Homework 4, Economics 101 Chapters 6 1. s/(s+f) = 0.02/(0.02+0.10) = 16.67 percent 2. a. 39 million b. (36/39)100 = 92.3 percent c. 3x12+36 = 72 million(3/6)100 = 50 percent Chapters 4 1. a) %M + %V = %P + %Y so 9% + 0 = %P + 6% so %P = 3%, r = i - = 7% - 3% = 4% b) now 8% + 0 = %P + 6% so %P = 2% Since the real interest rate is determined by the real side of the economy, r is still 4%. (But the nominal interest rate will become i = r + = 4% + 2% = 6%.) 2. The cut in money growth lowered the government’s revenue from seigniorage and created a government deficit. People may have expected the government would need to use seigniorage in the future to pay off the debt the government was accumulating. So they expected the government to raise money growth in the future again, and this would lead to an expectation of inflation and a rise in the CURRENT nominal interest rate. Because money demand is a function of the nominal interest rate, these expectations would lower current money demand, and require a rise in the price level today to equate money demand with money supply. Hence, the government’s attempt to lower money growth will not lower inflation. 3. The money demand function is given as a. To find the average inflation rate the money demand function can be expressed in terms of growth rates: % growth Md – % growth P = % growth Y The parameter k is a constant, so it can be ignored. The percentage change in nominal money demand Md is the same as the growth in the money supply because nominal money demand has to equal nominal money supply. If nominal money demand grows 12 percent and real income (Y) grows 4 percent then the growth of the price level is 8 percent. b. From the answer to part (a), it follows that an increase in real income growth will result in a lower average inflation rate. For example, if real income grows at 6 percent and money supply growth remains at 12 percent, then inflation falls to 6 percent. In this case, a larger money supply is required to support a higher level of GDP, resulting in lower inflation. c. If velocity growth is positive, then all else the same inflation will be higher. From the quantity equation we know that: % growth M + % growth V = % growth P + % growth Y Suppose that the money supply grows by 12 percent and real income grows by 4 percent. When velocity growth is zero, inflation is 8 percent. Suppose now that velocity grows 2 percent: this will cause prices to grow by 10 percent. Inflation increases because the same quantity of money is being used more often to chase the same amount of goods. In this case, the money supply should grow more slowly to compensate for the positive growth in velocity. Chapters 9 1) a) The fall in velocity lowers demand in the economy (a leftward shift in the AD curve in the short run). This would lower output and generate a recession. Since price is fixed, inflation is not a problem in the short run. (Remember the AD curve here is determined by the equation M V = P Y. A fall in velocity would lower output for a given price level and money supply.) Since the shock to velocity is only temporary, demand will return to normal on its own in the long run. (AD shifts right in the long run back to its initial position. So there is no effect on output and no inflation in the long run.) b) To counteract the short-run effects of the shock, the Federal Reserve can increase the money supply in the short run. This would shift the AD to the right, returning it to its initial position. But it should reverse this policy in the long run. Otherwise when the velocity returns to normal in the long run, the extra money supply would generate inflation. The AD curve would be to the right of its initial position before the velocity shock.(One might argue that the gains from policy intervention in this case is not worth its side but that is a different issue) .