EOCT Study Guide for Economics

... 8. Opportunity cost-value of the next best alternative (the thing you did not choose) 9. Marginal cost- the cost of getting or making one more item. 10. Marginal benefit-the benefit associated with one additional item 11. Marginal benefit=marginal cost; then no more will be made, its not worth it to ...

... 8. Opportunity cost-value of the next best alternative (the thing you did not choose) 9. Marginal cost- the cost of getting or making one more item. 10. Marginal benefit-the benefit associated with one additional item 11. Marginal benefit=marginal cost; then no more will be made, its not worth it to ...

What characteristics of an asset make it useful as a medium of

... people will not print their own money). That is why nearly all countries use paper money with fancy designs for larger denominations and coins for smaller denominations. For an asset to be useful as a store of value, it must be something that maintains its value over time and something that can be u ...

... people will not print their own money). That is why nearly all countries use paper money with fancy designs for larger denominations and coins for smaller denominations. For an asset to be useful as a store of value, it must be something that maintains its value over time and something that can be u ...

Quiz # 2 ECO403

... Is the income individual have available for spending during a given year Equals national income less indirect taxes Is the sum of wages plus interest received by individual during a given ...

... Is the income individual have available for spending during a given year Equals national income less indirect taxes Is the sum of wages plus interest received by individual during a given ...

Sense and Nonsense About Deflation

... ought almost exclusively be associated with “bad” economic outcomes and needs to be avoided at all costs. Two reasons explain this opinion. First, the decade-long economic stagnation in Japan, occurring simultaneously with deflation, suggests a negative link between falling prices and economic perfo ...

... ought almost exclusively be associated with “bad” economic outcomes and needs to be avoided at all costs. Two reasons explain this opinion. First, the decade-long economic stagnation in Japan, occurring simultaneously with deflation, suggests a negative link between falling prices and economic perfo ...

Review Sheet - Syracuse University

... 28. A store of value is: (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability to ...

... 28. A store of value is: (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability to ...

The Economic Theories all in one

... WWII and differed slightly from New Classical/Hayek/Austrian School • Majority of monetarists argue that inflation in the United States during the 1970’s could have been avoided if only the Fed had not expanded the money supply so rapidly. • Advocate for minimal govt. interventionderegulation. ...

... WWII and differed slightly from New Classical/Hayek/Austrian School • Majority of monetarists argue that inflation in the United States during the 1970’s could have been avoided if only the Fed had not expanded the money supply so rapidly. • Advocate for minimal govt. interventionderegulation. ...

Institute of Business Management Semester: Spring Course

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

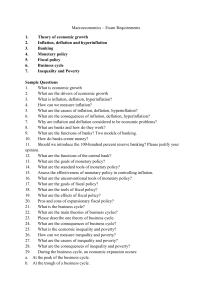

Macroeconomics – Exam Requirements 1. Theory of economic

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

deflation - Mises Institute

... On the other hand, deflations are bad whenever they are triggered by self-fulfilling expectations of decreasing prices or by “poor policy choices” (p. 10). The rationale for this kind of deflation being bad is that it leads to a decrease in aggregate demand, and hence in aggregate output according t ...

... On the other hand, deflations are bad whenever they are triggered by self-fulfilling expectations of decreasing prices or by “poor policy choices” (p. 10). The rationale for this kind of deflation being bad is that it leads to a decrease in aggregate demand, and hence in aggregate output according t ...

1. Cost-push inflation

... Description: In this case, the overall price level increases due to higher costs of production which reflects in terms of increased prices of goods and commodities which majorly use these inputs. This is inflation triggered from supply side i.e. because of less supply. (The opposite effect of this i ...

... Description: In this case, the overall price level increases due to higher costs of production which reflects in terms of increased prices of goods and commodities which majorly use these inputs. This is inflation triggered from supply side i.e. because of less supply. (The opposite effect of this i ...

Business Cycle

... People in certain cases (deflation, too much uncertainty, expected adverse events such as war etc.) will hold currency even as money supply increases, referred to as a liquidity trap. Currently a big challenge for CBs Loose monetary policy for periods longer than necessary can lead to bubbles. A ...

... People in certain cases (deflation, too much uncertainty, expected adverse events such as war etc.) will hold currency even as money supply increases, referred to as a liquidity trap. Currently a big challenge for CBs Loose monetary policy for periods longer than necessary can lead to bubbles. A ...

Accelerated Macro Spring 2015 Solutions to HW #4 1

... rule requires increasing the nominal Fed funds rate, which means the money supply is decreased. The decrease in the money supply shifts the aggregate demand curve down and to the left and helps stabilize the economy back toward full employment output. b. A negative technology shock. Solution: If the ...

... rule requires increasing the nominal Fed funds rate, which means the money supply is decreased. The decrease in the money supply shifts the aggregate demand curve down and to the left and helps stabilize the economy back toward full employment output. b. A negative technology shock. Solution: If the ...

Econ 2 UT2 F16 - Bakersfield College

... 15. Cash outside of bank vaults is part of: a. M1 only. b. M2 only. c. both M1 and M2. d. Neither M1 nor M2. 16. Which of the following is the equation showing what GDP will be? a. A + B + C. b. M1 + M2 + Bank Reserves. c. Saving accounts + Checking accounts + Cash outside banks. d. C + I + G. 17. ...

... 15. Cash outside of bank vaults is part of: a. M1 only. b. M2 only. c. both M1 and M2. d. Neither M1 nor M2. 16. Which of the following is the equation showing what GDP will be? a. A + B + C. b. M1 + M2 + Bank Reserves. c. Saving accounts + Checking accounts + Cash outside banks. d. C + I + G. 17. ...

Review Questions for Midterm #1

... 7) Leading into the Great Depression, there was a stock market crash reducing the wealth of many people and the Federal Reserve responded with a policy change that lowered the money supply. Show the change in equilibrium output on an IS-LM graph showing both changes. 8) Using an IS-LM graph show the ...

... 7) Leading into the Great Depression, there was a stock market crash reducing the wealth of many people and the Federal Reserve responded with a policy change that lowered the money supply. Show the change in equilibrium output on an IS-LM graph showing both changes. 8) Using an IS-LM graph show the ...

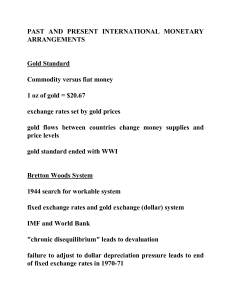

past and present international monetary

... Example: assume Malaysia produces rubber and Indonesia produces oil a change in tastes or technology shifts demand from rubber to oil Malaysia has an excess supply of labor and capital and a trade deficit and Indonesia has an excess demand for labor and capital and a trade surplus Adjustment possib ...

... Example: assume Malaysia produces rubber and Indonesia produces oil a change in tastes or technology shifts demand from rubber to oil Malaysia has an excess supply of labor and capital and a trade deficit and Indonesia has an excess demand for labor and capital and a trade surplus Adjustment possib ...

Self-Check (Units 1-3)

... 3. Complete the text by using the following words and answer the questions. assets consumer debts deflation excess employment hyperinflation interest producers restrictions spending supply unemployment weighted Inflation is a rise in the general level of prices. It is caused by an (1) .............. ...

... 3. Complete the text by using the following words and answer the questions. assets consumer debts deflation excess employment hyperinflation interest producers restrictions spending supply unemployment weighted Inflation is a rise in the general level of prices. It is caused by an (1) .............. ...