PPF - An Investment and Tax Saving Instrument

... PPF is a savings and tax-saving instrument. It also serves as a retirement planning tool for those who are not covered by any structured pension plan. The popularity of PPF as an investment avenue has been because of various reasons seldom found in other savings instruments - high rate of returns, c ...

... PPF is a savings and tax-saving instrument. It also serves as a retirement planning tool for those who are not covered by any structured pension plan. The popularity of PPF as an investment avenue has been because of various reasons seldom found in other savings instruments - high rate of returns, c ...

Fiscal and Monetary Policies The Nominal Anchor

... Note that to get determinacy (a unique solution) in the preceding example, we con…ned our analysis to solutions that keep the price level bounded Theoretical research – summarized and cited in Canzoneri, Cumby and Diba [CCD (2010)] – has demonstrated that the price level may not be uniquely determin ...

... Note that to get determinacy (a unique solution) in the preceding example, we con…ned our analysis to solutions that keep the price level bounded Theoretical research – summarized and cited in Canzoneri, Cumby and Diba [CCD (2010)] – has demonstrated that the price level may not be uniquely determin ...

Inflation Uncertainty, Investment Spending, and Fiscal Policy

... represents net investment. Net investment is directly related to past changes in the value of output, p Q, and inversely related to past changes in the cost of capital. Thus an increase in anticipated demand, estimated on the basis of past changes in output, Q, or in the anticipated price of output, ...

... represents net investment. Net investment is directly related to past changes in the value of output, p Q, and inversely related to past changes in the cost of capital. Thus an increase in anticipated demand, estimated on the basis of past changes in output, Q, or in the anticipated price of output, ...

Find the Payment and Amortization Table

... repaid in 6 quarterly payments. a. Find the payment necessary to amortize each loan. b. Find the total payments and the total amount of interest paid based on the calculated monthly payments. ...

... repaid in 6 quarterly payments. a. Find the payment necessary to amortize each loan. b. Find the total payments and the total amount of interest paid based on the calculated monthly payments. ...

Chapter 15

... If inflation is lower than expected: • Borrowers wish they had borrowed less • Lenders wish they had lent more ...

... If inflation is lower than expected: • Borrowers wish they had borrowed less • Lenders wish they had lent more ...

Stanley Fischer Robert C. Merton Working Paper No. 1291

... While the role of risk and uncertainty is central 1n each of these areas, it is perhaps not surprising that finance with its focus on security pricing and corporate investment decisions has placed greater emphasis on the explicit ...

... While the role of risk and uncertainty is central 1n each of these areas, it is perhaps not surprising that finance with its focus on security pricing and corporate investment decisions has placed greater emphasis on the explicit ...

The Close Connection Between Nominal

... any pT choice that depends only on currently available information. The speci…c implementation of nominal-GDP targeting analyzed in this paper is mathematically equivalent to setting nT = (p+Ey ) + T , where E(yT y )=T + . In words: To obtain future target nominal GDP, extrapolate current nominal po ...

... any pT choice that depends only on currently available information. The speci…c implementation of nominal-GDP targeting analyzed in this paper is mathematically equivalent to setting nT = (p+Ey ) + T , where E(yT y )=T + . In words: To obtain future target nominal GDP, extrapolate current nominal po ...

Stable growth with a more balanced demand structure

... FAI this year, especially with the abnormal >60% YoY drop in Liaoning FAI YTD. 3 We expect property invest ment growth to moderate in 2017 amidst policy tightening; however, the dampening effect on investment will likely be manageable as property investment grow th did not show significant improveme ...

... FAI this year, especially with the abnormal >60% YoY drop in Liaoning FAI YTD. 3 We expect property invest ment growth to moderate in 2017 amidst policy tightening; however, the dampening effect on investment will likely be manageable as property investment grow th did not show significant improveme ...

ec22 - Caritas University

... the state of economic growth and the rate at which money is supplied, it is clear that a great amount of empirical and theoretical work remain to be done. With monetary policies and association of monetary and fiscal policies in determining the exact influence of money supply, there is a sizeable li ...

... the state of economic growth and the rate at which money is supplied, it is clear that a great amount of empirical and theoretical work remain to be done. With monetary policies and association of monetary and fiscal policies in determining the exact influence of money supply, there is a sizeable li ...

Japan: Fragility of the consolidated government debt structure

... capacity) has declined, the job offers-to-applicants ratio, a critical indicator of labor supplydemand, has climbed to a level not seen since the heyday of the “bubble economy” in the early 1990s. Secondly, there has never been an administration so sensitive to possible changes in business condition ...

... capacity) has declined, the job offers-to-applicants ratio, a critical indicator of labor supplydemand, has climbed to a level not seen since the heyday of the “bubble economy” in the early 1990s. Secondly, there has never been an administration so sensitive to possible changes in business condition ...

Calculate - LessonPaths

... 2. Which letter or symbol does Excel use to multiply numbers? 3. What is the correct order of operations for entering formulas into Excel? 4. Which of the following sequences will give you the square root of 25 in ...

... 2. Which letter or symbol does Excel use to multiply numbers? 3. What is the correct order of operations for entering formulas into Excel? 4. Which of the following sequences will give you the square root of 25 in ...

Impairment Measurement of the impairment loss: Debt

... cash flows discounted at asset’s original effective interest rate. (Use current rate if variable.) – Equity instruments: Difference between carrying amount and best estimate (approximation) of the amount (might be zero) that entity would receive if asset were sold at reporting date. © 2011 IFRS Foun ...

... cash flows discounted at asset’s original effective interest rate. (Use current rate if variable.) – Equity instruments: Difference between carrying amount and best estimate (approximation) of the amount (might be zero) that entity would receive if asset were sold at reporting date. © 2011 IFRS Foun ...

BALANCE OF PAYMENTS ADJUSTMENT

... WAMZ countries, are about to form a monetary union, and maintain an equilibrium in their external balance is highly relevant. Maintaining a healthy and stable balance-ofpayments, would promote trade and hence propel rapid economic growth in the WAMZ region. The literature suggests that current accou ...

... WAMZ countries, are about to form a monetary union, and maintain an equilibrium in their external balance is highly relevant. Maintaining a healthy and stable balance-ofpayments, would promote trade and hence propel rapid economic growth in the WAMZ region. The literature suggests that current accou ...

Annual Report 2015 Deutsche Bahn Finance B.V. Amsterdam

... At each balance sheet date, the Company tests whether there are any indications of assets being subject to impairment. If any such indications exist, the recoverable amount of the asset is determined. The amount of an impairment incurred on financial assets stated at amortised cost is measured as th ...

... At each balance sheet date, the Company tests whether there are any indications of assets being subject to impairment. If any such indications exist, the recoverable amount of the asset is determined. The amount of an impairment incurred on financial assets stated at amortised cost is measured as th ...

6The Short-run Model for the Closed Economy

... convergence of output to its natural rate. The need to keep the monetary policy parameter h positive has been termed the ‘Taylor Principle’ because it was stressed by John Taylor himself. While adherence to this principle is crucial for the stability of the macro economy, our specific assumption of ...

... convergence of output to its natural rate. The need to keep the monetary policy parameter h positive has been termed the ‘Taylor Principle’ because it was stressed by John Taylor himself. While adherence to this principle is crucial for the stability of the macro economy, our specific assumption of ...

PDF Download

... that social transfers for non-employed individuals of a working age are close to the full public pension (base pension plus supplements). Most people with an income in the 1st decile are out of work and receive a social ...

... that social transfers for non-employed individuals of a working age are close to the full public pension (base pension plus supplements). Most people with an income in the 1st decile are out of work and receive a social ...

An Aggregative Theory for a Closed Economy

... of claims to streams of real income between the government and the private sector. Interest rates rise in response to open market sales and reductions in tax rates and fall in response to open market purchases and tax increases. Open market operations induce larger changes in the price level than ta ...

... of claims to streams of real income between the government and the private sector. Interest rates rise in response to open market sales and reductions in tax rates and fall in response to open market purchases and tax increases. Open market operations induce larger changes in the price level than ta ...

Investment - Stanford University

... macroeconomics: investment in the national income accounting sense. In this context, investment refers to the accumulation of physical capital — roads, houses, computers, and machine tools. Nevertheless, each of these uses of the word “invest” captures something essential: it is by investing that ou ...

... macroeconomics: investment in the national income accounting sense. In this context, investment refers to the accumulation of physical capital — roads, houses, computers, and machine tools. Nevertheless, each of these uses of the word “invest” captures something essential: it is by investing that ou ...

Inflation and the business cycle

... Long run data strongly supportive of quantity theory – both time series and cross-country. However, short run data offers less support, low correlation between inflation and money supply growth. ...

... Long run data strongly supportive of quantity theory – both time series and cross-country. However, short run data offers less support, low correlation between inflation and money supply growth. ...

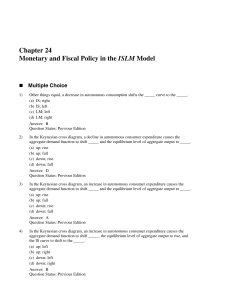

Chapter 24 Monetary and Fiscal Policy in the ISLM Model

... Changes in the interest rate affect planned investment spending and hence the equilibrium level of output, (a) but this change in investment spending merely causes a movement along the IS curve and not a shift. (b) but this change in investment spending is crowded out by higher taxes. (c) but this c ...

... Changes in the interest rate affect planned investment spending and hence the equilibrium level of output, (a) but this change in investment spending merely causes a movement along the IS curve and not a shift. (b) but this change in investment spending is crowded out by higher taxes. (c) but this c ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.