* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Stable growth with a more balanced demand structure

Survey

Document related concepts

Transcript

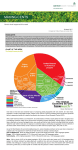

This CICC report is provided for the exclusive use of [email protected]. Macroeconomy Research October 31, 2016 China Macro Thematic Report Stable growth with a more balanced demand structure 2017 China Macro Outlook We maintain our 2016 real GDP growth forecast at 6.7% YoY, and adjust our 2017 real GDP growth forecast to 6.6% YoY from 6.7% Yo Y. Meanwhile, we expect nominal GDP growth to edge up to 8.3% Yo Y in 2017 from 8.0% YoY in 2016. Our forecasts are slightly higher than the current consensus real GDP growth forecasts of 6.6% YoY and 6.3% YoY for 2016 and 2017, respectively. Furthermore, we expect real GDP growth to edge down to 6.5% YoY in 2018. Consumption will likely contribute more to the headline GDP growth in 2017, fixed asset investment growth is expected to soften moderately, and external demand may improve. Hong LIANG A naly st S A C Reg. N o.: S 0080513050005 S F C CE Ref: A JD293 [email protected] Eva YI A naly st S A C Reg. N o.: S 0080515050001 S F C CE Ref: A M H263 ev a.y [email protected] CPI inflation is estimated to be at around 1.7% YoY in 2017, and average PPI may recover further to 1.9% YoY in 2017 from -1.6% Yo Y in 2016. As a result, GDP deflator will likely pick up to 1.6% YoY in 2017 from 1.1% YoY in 2016. In our view, monetary policy has little room to ease further in the near term given that real interest rates have fallen significantly on the back of rising inflation, particularly property price inflation. We expect no change to the benchmark interest rates in 2017. The PBoC may lower the 7-day reverse repurchase rate by 10bp in 2H2017. Meanwhile, there may be 1 RRR cut in 2H17. We expect USD/CNY to trade at around 6.78 by end-2016 and 6.98 by end-2017. Fiscal policy is likely to remain a key driver of growth support in 2017, but the policy mix may tilt towards promoting consumer demand vs. investment spending. We will likely see more efforts towards tax cuts and subsidies to promote personal income & consumption growth, as well as increased public spending on education, health care and poverty alleviation. We expect further progress to be made in the areas of fiscal, hukou, and land reforms to expedite China’s transition towards a more consumer-driven economy. Meanwhile, progress in SOE reforms may revolve around a more market -oriented framework for mixed ownership structure reform, SOE exits, and opening up more of the regulated industries. We see the risks to our 2017 growth and inflation forecasts as balanced. The main macro and market uncertainties lay in a sharper-than-expected property market correction, policy risks associated with stricter financial market regulation, and potential external demand volatility. On the other hand, the upside risks include stronger-than-expected personal consumption and investment demand, as well as faster external demand growth. The growth structure and policy mix next year will likely benefit personal consumption the most. We also expect a more stable macro backdrop and abundant liquidity to support investment in the secular growth sectors and new industries. Related reports • Mac roeconomy | A n update on "where is fis c al policy going?" (2 016.10.27) • Mac roeconomy | I f the MPA is s tric tly enforc ed... (2 0 1 6.10.2 7) • Mac roeconomy | Ups tream expanded, but midstream c ontracted (2 016.10.27) • Mac roeconomy | O c tober 17 ~21 : Some early signs of c yclical momentum peaking? (2 0 1 6.10.2 4) • Mac roeconomy | H ow to interpret "the boost to G DP from the property s ector"? (2 0 1 6.10.2 4) • Mac roeconomy | FX pos ition dec line widens , while liquidity injection inc reases (2 0 1 6.10.2 2) Please read carefully the im portant disclosures at the end of this report This CICC report is provided for the exclusive use of [email protected]. margin margin This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 Stable growth with a more balanced demand structure Part I: 2017 growth outlook We maintain our 2016 real GDP growth forecast at 6.7% YoY, and adjust our 2017 real GDP growth forecast to 6.6% YoY from 6.7% YoY prev iously. Our forecasts are slightly higher than the current consensus real GDP forecasts of 6.6% YoY and 6.3% YoY for 2016 and 2017, respectively. Further more, we expect real GDP growth to edge down to 6.5% YoY in 2018. Please refer to Figure 1 for a summary of our forecasts for main macro and policy indicators in 2017~2018. Meanwhile, we expect nominal GDP gr owth to pick up moderately to 8.3% YoY in 2017 from 8.0% YoY in 2016. However, the incremental acceleration in nominal GDP growth may be milder in 2017 compared with 2016 (1.6ppt acceleration of nominal GDP growth from 2015), especially in the secondar y industr y and real estate service sector. Figure 1: Summary of our forecast for 2017~2018 % change, unless otherwise stated 2014 2015 Nominal GDP yoy qoq, ann. yoy 7.3 8.2 6.9 6.4 6.7 8.0 6.6 8.3 IP Nominal urban FAI Nominal Retail Sales yoy yoy yoy 8.3 15.0 11.9 6.3 9.9 10.7 5.9 8.2 10.5 Customs Exports Customs Imports yoy yoy 6.0 0.7 -2.6 -14.4 M2 Supply RMB New Loans yoy RMB trn 12.2 9.8 CPI PPI GDP Deflator yoy yoy yoy 1Yr Benchmark Lending 1Yr Benchmark Deposit 7 day reverse repo rate RRR (large banks) USD/CNY Real GDP 1Q2016 2Q2016 6.5 8.0 6.7 6.4 7.1 6.7 7.3 7.3 6.7 7.0 7.8 6.7 6.3 9.3 6.7 6.0 8.9 6.6 7.0 8.5 6.6 7.0 8.1 6.6 6.6 7.8 5.8 8.8 10.8 5.5 8.0 10.7 5.8 10.7 10.3 6.0 8.1 10.2 6.0 7.1 10.5 6.0 8.2 10.7 6.1 7.4 10.8 5.9 8.6 10.6 5.8 10.2 10.9 5.5 8.1 10.9 -6.7 -7.3 -0.5 1.6 0.9 1.0 -9.7 -13.3 -4.4 -6.7 -6.7 -4.7 -6.5 -5.2 -0.3 10.5 -2.4 -0.8 0.2 -0.4 0.5 -1.3 13.3 11.7 11.8 12.1 12.0 13.8 12.0 15.6 13.4 4.6 11.8 2.9 11.5 2.6 11.8 2.0 11.9 4.6 12.3 3.7 12.1 2.7 12.0 2.7 2.0 -1.9 0.9 1.4 -5.2 -0.4 1.9 -1.6 1.1 1.7 1.9 1.6 1.8 1.0 1.4 2.1 -4.8 0.4 2.1 -2.9 0.6 1.7 -0.8 1.0 1.9 2.1 2.4 1.6 3.0 2.1 1.5 2.3 1.8 1.7 1.8 1.4 1.8 0.6 1.1 %p.a. %p.a. %p.a. 5.60 2.75 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.15 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.25 4.35 1.50 2.15 4.35 1.50 2.15 % Market 20.0 6.21 17.5 6.46 17.0 6.78 16.5 6.98 17.0 6.46 17.0 6.63 17.0 6.68 17.0 6.78 17.0 17.0 16.5 16.5 6.98 2.1 2.3 3.0 3.0 Budget fiscal balance by NPC % of GDP 2016E 2017E 2018E 3Q2016 4Q2016E 1Q2017E 2Q2017E 3Q2017E 4Q2017E Source: CEIC, CICC Research From the aggregate demand perspective, we expect consumpt ion to contribute more to the headline GDP grow th compared with 2016, underlying FAI growth to soften modestly, and external demand to recover moderately. ► 1 We expect consumpt ion growth, especially that of discretionary consumpt ion, to pick up in 2017. Our more upbeat view on consumption is based on 1) continued increase in the share of household disposable income in GDP (Figure 2) and growing transfer payments to subsidize lower-income families; 1 See China Macro Weekly, Can consumption growth continue to decouple? February 15, 2016 Please read carefully the im portant disclosures at the end of this report 2 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 2) grow th of sales of large-ticket items and highly-discretionar y expenditure will likely recover after the property market peaks (Figure 3), as a net increase of down payments in the past 12 months alone has taken away the household “consumption power” equivalent to 4 ~5% of annual disposable income; 2 3) housing-related consumption may stay robust in the 2~3 quarters after the property boom; and 4) the positive wealth effect from property price inflation may boost consumption growth in the 4~5 quarters that follow. ► Real fixed asset investment growth may soften in 2017, but only at a moderate pace. Nominal FAI grow th may pick up in 2017 on higher annual average PPI. It is wor th reiterating that the nominal urban FAI reported monthly is plagued with data quality issues and fails to represent the underlying strength of FAI this year, especially with the abnormal >60% YoY drop in Liaoning FAI YTD. 3 We expect property invest ment growth to moderate in 2017 amidst policy tightening; however, the dampening effect on investment will likely be manageable as property investment grow th did not show significant improvement this year. In addition, the current level of property inventor y remains low in the leading cities. Infrastructure investment growth will likely hold up in 2017, as the considerable fiscal loosening in 2016 (growth of 40~50% YoY in value and an increase of 2. 3ppt in relative scale to GDP) will continue to support government-led investment in the near term, w hile PPP investment growth may also step up in 2017. 4 More important ly, manufactur ing investment and private invest ment growth may be on the mend in 2017, as real interest rates for manufacturers started to fall substantially and industrial profitability recovered notably in 2016 (Figure 4). Meanwhile, the opportunity cost for private FAI has also declined fur ther in 2016 with lower wealth management product yield / money mar ket rates (Figure 5), and more recently, less perceived upside in property investment. ► External demand may also improve in 2017, as indicated by the leading indicators of the global industr ial cycle (Figure 6). Overseas private investment may recover in 2017 as political uncer tainties in 2016 subside, especially in the US. Fur thermore, a potential pick-up in infrastructure investment in the US may add to the upside of external demand. Sector wise, we expect stable YoY grow th of the manufacturing sector, with faster growth of consumer related products and marginally softer grow th of investment products. In the meantime, the headline growth of financial sector may improve as the base effect becomes more favorable. Fur thermore, the growth of consumer services may edge up, while the growth of real estate services may weaken. 2 See China Macro Weekly, How to interpret the “boost to GDP from the property sector”? October 24, 2016 Please refer to the 3 reports we have written on the data quality issue of monthly FAI for more details on this topic: 1) China Macro Weekly, How much should we read into the monthly FAI data? August 15, 2016; 2) China Macro Thematic Report, Overstated statistics distort FAI growth rates, August 9, 2016; 3) China Macro Brief, What happened to Liaoning’s FAI? July 28, 2016. 4 See China Macro Brief, An update on “Where is fiscal policy going?” October 27, 2016; China Macro Thematic Report, Where may fiscal policy go from here? September 1, 2016 3 Please read carefully the im portant disclosures at the end of this report 3 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 Figure 2: Share of personal income and consumption are both on the rise Figure 3: A visible negative correlation between property transactions and large-ticket discretionary consumption since 2009 % % chg yoy 140 70 Disposable income*/GDP 65 % chg yoy 70 property trasnaction value, 5M mid-point moving avg. overseas air travel volume, 5M mid-point moving avg., right scale 120 Consumption/GDP 100 63% 60 55 50 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E 45 *Disposable income before 2014 is from Flow of Funds Accounts; data after 2014 is calculated by disposable income per capital * total population; 2016E disposable income is estimated by 2016 YTD growth (8.4%) of disposable income 40 60 30 40 20 20 10 0 0 -20 -10 -40 -20 -60 2007 -30 2008 2009 2010 2011 2012 2013 2014 2015 2016 Source: Figure 4: Lower real interest for manufacturers may boost manufacturing and private investment Figure 5: The "opportunity cost" for private FAI continues to decline % yoy 30 means lower real interest rate 20 Real private FAI growth* 10 Real manufacturing FAI growth*, 5M mid-point moving avg. 0 Real interest rate for producers**, 8-month lead, reversed, RHS -10 CEIC, CICC Research %, p.a. %, p.a. 40 -4 7.0 -2 6.5 0 6.0 2 5.5 4 5.0 6 4.5 8 4.0 10 3.5 12 3.0 14 2.5 16 2.0 WMP expected return Yu'e Bao annualized yield 3.88% 2.39% * Manufacturing FAI growth and private FAI growth are both deflated by PPI ** Real interest rate for producers = benchmark 1 year lending rate - PPI inflation Source: CEIC, CICC Research Source: Wind Info, CICC Research Figure 6: Global industrial cycle appears to be on the mend 61 % Manufacturing PMI Index 59 US Euro area 50 80 Source: Wind Info, CICC Research 50 60 UK 57 55 53 51 49 47 45 Source: Wind Info, CICC Research Please read carefully the im portant disclosures at the end of this report 4 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 Part II: 2017 inflation outlook CPI inflat ion is estimated to be around 1.7% YoY in 2017. We expect moderate consumer price inflation next year, as both M2 and bank asset growth peaked in 1Q16, and the economic growth is not r unning above trend. Within CPI, we expect food price inflation to be relatively muted in 2017, while consumer price inflation of services and residences may continue to be lifted by the delayed effect of property price inflation in the near term. Although annual average PPI may recover further to 1.9% YoY in 2017 from -1.6% YoY in 2016, the incremental impr ovement of PPI in 2017 is unlikely to match the pace in 2016. We expect PPI inflation to continue rising rapidly before the 2017 Chinese New Year as the base will keep descending rapidly till then, while the short supply of coal and some other commodities may persist, especially in the face of the winter peak season. Assuming some moderation of supply side constraints after Chinese New Year and a lower oil price from here (our average oil price forecast for 2017 stands at US$42/bbl) , we expect PPI to peak in February 2017 and start moderating in the rest of 2017. As a result, GDP deflator may pick up to an average of 1.6% YoY in 2017 from 1.1% YoY in 2016, mainly boosted by higher annual average PPI, while property price inflation will likely moderate over the course of 2017. Part III: 2017 macro policy outlook In our view, monetary policy has little room to ease further in the near term given that real interest rates have fallen significant ly on the back of rising inflation, part icular ly property price inflat ion (Figure 7). We see enough fuel in the tank to maintain a relatively stable growth trajector y in the near term from the accumulated monetar y and fiscal loosening since 2015. On the other hand, the recent trend in inflation is not supportive of monetar y easing, with CPI standing at around 2% in the rest of 2016, PPI rising rapidly, and property price inflation staying elevated at the moment. We expect no change to the benchmar k interest rates in 2017. In our view, the room for monetar y easing remains limited in 2017, especially in 1H, as the weighted-average real interest may stays low and the economic growth is likely to remain stable. Furthermore, the Fed may continue on the “slow -but-steady rate hike path”. However, if PPI moderates and property prices begin to soften in 2H17, the PBoC may consider lower ing the 7-day reverse repurchase rate marginally (by 10bp); meanwhile, we expect one 50bp RRR cut in 2H17. It is worth noting that apar t from the RRR cut, money supply growth can be lifted via expansion of the base money through more PBoC OMO net injection, and/or lifting the money multiplier with faster expansion of the policy bank assets. We expect USD/ CNY to trade around 6.78 by end-2016 and 6.98 by end-2017, indicating around 3% depreciation in the course of 2017. The CNY depreciation pressure will likely remain manageable in 2017; given 1) our baseline scenario of one 25bp hike in the Federal Funds Rate in 2017, indicating moderate appreciation pressure of the USD, and 2) our continued expectation for a sizable trade surplus in 2017 at around US$530bn, or 4.2% of GDP. Please read carefully the im portant disclosures at the end of this report 5 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 Figure 7: Real interest rates have fallen significantly on the back of rising inflation 14 % p.a. real interest rate for consumers 12 real interest rate for producers real interest rate for home buyers 10 8 6 4 2 0 -2 -4 -6 3/2012 9/2012 3/2013 9/2013 3/2014 9/2014 3/2015 9/2015 3/2016 9/2016 real interest rate for consumers = benchmark 1 year saving rate - CPI inflation real interest rate for producers = benchmark 1 year lending rate - PPI inflation real interest rate for home buyers = benchmark mortgage rate - 70 city average housing price inflation Source: CEIC, CICC Research Fiscal policy is likely to remain a key dr iver of growth support in 2017, but the policy mix may tilt towar ds promoting consumer demand vs. invest ment spending. We will likely see more efforts towards tax cuts and subsidies to promote personal income & consumption growth, as well as increased public spending in education, health care and poverty alleviat ion. As we have discussed in recent reports, 5 the “broadly defined fiscal deficit” may approach 10% of GDP in 2016, setting up a high base for 2017. T herefore, it has become more pressing to boost the “efficiency” (i.e. investment return) of fiscal expansion next year. We expect the corporate tax-reduction effect of VAT reform to remain in force in 1H17, while more policy efforts may be directed towards tax and subsidy policies to boost consumption growth. Tax cuts and personal consumption subsidies have proven to be more effective than infrastructure investment in raising corporate sector profitability and overall demand. Further more, we expect the realm of fiscal policy to expand to more sizable investment in PPP projects, implying more financing from commercial bank lending to support the fiscal policy initiatives. In this regard, our guideline for filtering out the potential “noise” or “exaggeration” of the stunning reported headline “planned PPP investments” is to focus on actual financial activity as a leading indicator for actual investment demand in the pipeline. In this regard, the most comprehensive leading indicators of aggregate demand are still the adjusted TSF growth 6 and the speed of bank asset expansion. 5 See China Macro Brief, An update on “Where is fiscal policy going?” October 27, 2016; China Macro Thematic Report, Where may fiscal policy go from here? September 1, 2016 6 Adjusted TSF growth = reported TSF + local government and sovereign bond outstanding. For the merit of using the “adjusted TSF”, please refer to China Macro Brief, Impact of local government bond swap on loan and TSF data, August 13, 2015 Please read carefully the im portant disclosures at the end of this report 6 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 Part IV: What can be expected on the reform front? We expect further progress to be made in the areas of fiscal, hukou , and land refor ms to expedite China’s transit ion towards a more consumer-dr iven economy . In this regard, we expect fur ther income tax reforms efforts towards improving income distribution, including a higher minimum threshold for tax submission and a more comprehensive income tax regime. Furthermore, we expect continued initiatives to build out a more inclusive and equitable social security system, facilitated by government subsidies and higher efficiency of social security fund management. On the other hand, the burden of making social security contributions will likely be reduced further for both the household and corporate sectors, while the potential increase in subsidy for healthcare and education may continue to benefit lower income households. Meanwhile, progress may be achieved in SOE refor ms in promot ing the mixed ownership structure aiming at boosting t he efficiency of SOE operation, building a mar ket-oriented framewor k for SOE exit, and reducing state ownership in the sectors that are better served by a compet it ive mar ket structure. We expect progress to be made in mixed ow nership structure experiments in some key sectors, including telecom, transpor tation, energy, utilities, healthcare and education. Policy initiatives over SOE exits and disposal of SOE NPLs will continue to be carried out at a measured pace under market-oriented guidelines. In addition, we will continue to watch for any progress made on the front of reducing SOE dominance in the sectors that are classified as “competitive industries”. Part V: Market implications and risks to our forecast We see the risks to our 2017 growth and inflation forecasts as balanced. The main macro and mar ket uncertainties lay in a sharper-than-expected correction in the property mar ket; the potential risks associated with financial mar ket deleveraging and stricter implementation of the MPA; and potential external demand volatilities given the potential tail-risks associated with the upcoming political events. Our baseline forecast is a more moderate macro impact from a slower property mar ket, since 1) there has been limited impact on investment growth from the property boom this time round, and 2) property inventory remaining low in leading cities and proper ty developer cash flow remaining buoyant. However, a sharper correction in the proper ty market triggered by harsher policies and/or slower growth may dampen the growth and inflation outlook for 2017. Furthermore, there are still uncertainties associated with market liquidity and asset prices with the expected full implementation of the new MPA framework next year. We will continue to closely monitor the changes in short-term market interest rates to gauge the potential liquidity risks associated with a more prudent regulatory framework and the ongoing financial market deleveraging process. Meanwhile, the upside risks to aggregate demand include faster-than expected personal consumption and pr ivate invest ment growth on lower “opportunity costs”; as well as stronger-than-expected recovery in global demand. One key driving force of consumption and investment grow th next year is the low and declining real interest rates for consumption and investment measured by the alternative risk-free rates such as wealth management product yield. Furthermore, it is worthwhile to closely monitor the magnitude of US fiscal expansion after the new president takes command, as faster infrastr ucture investment grow th in the US is welcome news for global grow th and liquidity conditions (assuming no significant monetar y tightening in the US). In addition, it is also worthwhile to closely watch the magnitude of further fiscal easing to gauge future grow th and inflation tren ds, since in our view, the cumulative effect of sizable fiscal loosening in 2015 and 2016 may continue to support investment demand in the near term. Please read carefully the im portant disclosures at the end of this report 7 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research: October 31, 2016 The growth structure and policy mix next year will likely benefit personal consumpt ion the most, including consumer goods and services that cater towards upgrading lower income and middle-class consumption, as well as discretionary consumer sectors. In addition, secular growth sectors such as healthcare, education, and new consumer services may present attractive investment opportunities. We also expect a more stable macro backdrop and abundant liquidity to support invest ment in the secular growth sectors and “new industr ies”, including (but perhaps not limited to) those in the areas of technology and communication, new consumer services, and financial services. Please read carefully the im portant disclosures at the end of this report 8 This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. CICC Research Important legal disclosures General Disclosures This report has been produced by China International Capital Corporation Hong Kong Securities Limited (CICCHKS). This report is based on information available to the public that we consider reliable, but CICCHKS and its associated company(ies)(collectively, hereinafter “CICC”) do not represent that it is accurate or complete. The information and opinions contained herein are for investors’ reference only and do not take into account the particular investment objectives, financial situation, or needs of any client, and are not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. Under no circumstances shall the information contained herein or the opinions expressed herein constitute a personal recommendation to anyone. Investors should make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. Neither CICC nor its related persons shall be liable in any manner whatsoever for any c onsequences of any reliance thereon or usage thereof. The performance information (including any expression of opinion or forecast) herein reflect the most up-to-date opinions , speculations and forecasts at the time of the report’s production and publication. Such opinions , speculations and forecasts are subject to change and may be amended without any notification. Past performance is not a reliable indicator of future performance. At different periods, CICC may release reports which are inconsistent with the opinions, speculations and forecasts contained herein. CICC’s salespeople, traders, and other professionals may provide oral or written market commentary or trading ideas that may be inconsistent with, and reach different conclusions from, the recommendations and opinions presented in this report. Such ideas or recommendations reflect the different assumptions, views and analytical methods of the persons who prepared them, and CICC is under no obligation to ensure that such other trading ideas or recommendations are brought to the attention of any recipient of this report. CICC’s asset management area, proprietary trading desks and other investing businesses may make investment decisions that are inconsistent with the recommendations or opinions expressed in this report. This report is distributed in Hong Kong by CICCHKS, which is regulated by the Securities and Futures Commission. Q ueries concerning CICC Research from readers in Hong Kong should be directed to our Hong Kong sales representatives . The CE numbers of SFC licensed authors of this report are disclosed by the authors’ names on the cover page. This report is distributed in Singapore only to accredited investors and/or institutional investors, as defined in the Securities and Futures Act and Financial Adviser Act of Singapore, by China International Capital Corporation (Singapore) Pte. Limited (“CICCSG”), which is regulated by the Monetary Authority of Singapore. By virtue of distribution by CICCSG to these categories of investors in Singapore, disclosure under Section 36 of the Financial Adviser Act (which relates to disclosure of a financial adviser’s interest and/or its representative’s interest in securities) is not required. Recipients of this report in Singapore should contact CICCSG in respect of any matter arising from or in connection with this report. This report is not intended for and should not be distributed or passed on, directly or indirectly, to any other person in the jurisdiction of Singapore. This report is distributed in the United Kingdom by C hina I nternational Capital Corporation (UK) Limited (“CICCUK”), which is authorised and regulated by the Financial Conduct Authority. The investments and services to which this report relates are only available to persons of a kin d described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) O rder 2005 . This report is not intended for retail clients. In other EEA countries, the report is issued to persons regarded as professional investors (or equivalent) i n their home jurisdiction. T his report will be made available in other jurisdictions pursuant to the applicable laws and regulations in those particular jurisdictions. Special Disclosures CICC may have positions in, and may effect transactions in securities of companies mentioned herein and may also perform or seek to perform investment banking services for those companies. Investors should be aware that CICC and/or its associated persons may have a conflict of interest that could affect the objectivity of this report. Investors should not solely reply on the opinions contained in this research report when making any investment decision or other dec isions. Copyright of this report belongs to CICC. A ny form of unauthorized distribution, reproduction, publication, release or quotation is prohibited without CICC’s written permission. V150902 Editing: Jim SATKO This CICC report is provided for the exclusive use of [email protected]. This CICC report is provided for the exclusive use of [email protected]. Beijing Shanghai Hong Kong China International Capital Corporation Limited China International Capital Corporation Limited – Shanghai Branch China International Capital Corporation (Hong Kong) Limited 28th Floor, China World Office 2 1 Jianguomenwai Avenue Beijing 100004, P.R. China Tel: (86-10) 6505-1166 Fax: (86-10) 6505-1156 32nd Floor Azia Center 1233 Lujiazui Ring Road Shanghai 200120, P.R. China Tel: (86-21) 5879-6226 Fax: (86-21) 5888-8976 29th Floor, One International Finance Centre 1 Harbour View Street Central, Hong Kong Tel: (852) 2872-2000 Fax: (852) 2872-2100 Shenzhen Singapore United Kingdom China International Capital Corporation Limited – Shenzhen Branch China International Capital Corporation (Singapore) Pte. Limited China International Capital Corporation (UK) Limited #2503, 25th Floor, China Merchants Bank Tower 7088 Shennan Boulevard, Futian District Shenzhen 518040, P.R. China Tel: (86-755) 8319-5000 Fax: (86-755) 8319-9229 #39-04, 6 Battery Road Singapore 049909 Tel: (65) 6572-1999 Fax: (65) 6327-1278 Level 25, 125 Old Broad Street London EC2N 1AR, United Kingdom Tel: (44-20) 7367-5718 Fax: (44-20) 7367-5719 Beijing Jianguomenwai Avenue Branch 1st Floor, Capital Tower 6A Jianguomenwai Avenue Beijing 100022, P.R. China Tel: (86-10) 8567-9238 Fax: (86-10) 8567-9235 Beijing Kexueyuan South Road Branch 6th Floor, Block A, Raycom Infotech Park 2 Kexueyuan South Road, Haidian District Beijing 100022, P.R. China Tel: (86-10) 8286-1086 Fax: (86-10) 8286 1106 Shanghai Middle Huaihai Road Branch 398 Huaihai Road (M) Shanghai 200020, P.R. China Tel: (86-21) 6386-1195 Fax: (86-21) 6386-1180 Shanghai Defeng Road Branch Room 1105, Building A 299-1 Defeng Road, Fengxian District Shanghai 201400, P.R. China Tel: (86-21) 5879-6226 Fax: (86-21) 6887-5123 Shenzhen Fuhuayilu Branch Room 201, Annex Building Shenzhen Duty Free Commercial Tower 6 Fuhua 1st Road, Futian District Shenzhen 518048, P.R. China Tel: (86-755) 8832-2388 Fax: (86-755) 8254-8243 Hangzhou Jiaogong Road Branch 1st Floor, Euro American Center 18 Jiaogong Road Hangzhou 310012, P.R. China Tel: (86-571) 8849-8000 Fax: (86-571) 8735-7743 Nanjing Hanzhong Road Branch Section C, 30th Floor, Asia Pacific Tower 2 Hanzhong Road, Gulou District Nanjing 210005, P.R. China Tel: (86-25) 8316-8988 Fax: (86-25) 8316-8397 Guangzhou Tianhe Road Branch 40th Floor, Teemtower 208 Tianhe Road Guangzhou 510620, P.R. China Tel: (86-20) 8396-3968 Fax: (86-20) 8516-8198 Chengdu Binjiang Road (East) Branch 1st & 16th Floors, Shangri-La Center Block 9B, Binjiang Road (East) Chengdu 610021, P.R. China Tel: (86-28) 8612-8188 Fax: (86-28) 8444-7010 Xiamen Lianyue Road Branch 4th Floor, Office Building, Paragon Center 1 Lianyue Road, Siming District Xiamen 361012, P.R. China Tel: (86-592) 515-7000 Fax: (86-592) 511-5527 Wuhan Zhongnan Road Branch 4301-B, Poly Plaza 99 Zhongnan Road, Wuchang District Wuhan 430070, P.R. China Tel: (86-27) 8334-3099 Fax: (86-27) 8359-0535 Qingdao Middle Hongkong Road Branch 11th Floor, Shangri-La Center Block 9, Hongkong Road (M), South District Qingdao 266071, P.R. China Tel: (86-532) 6670-6789 Fax: (86-532) 6887-7018 Chongqing Honghu Road (West) Branch 1st & 10th Floors, Ourui Lanjue Center Block 9, Honghu Road (W), New North District Chongqing 401120, P.R. China Tel: (86-23) 6307-7088 Fax: (86-23) 6739-6636 Tianjin Nanjing Road Branch 10th Floor, Tianjin Global Trading Center 219 Nanjing Road, Heping District Tianjin 300051, P.R. China Tel: (86-22) 2317-6188 Fax: (86-22) 2321-5079 Dalian Gangxing Road Branch 16th Floor, Wanda Center 6 Gangxing Road, Zhongshan District Dalian 116001, P.R. China Tel: (86-411) 8237-2388 Fax: (86-411) 8814-2933 Foshan Jihua 5th Road Branch 12th Floor, Trend International Business Building 2 Jihua 5th Road, Chancheng District Foshan 528000, P.R. China Tel: (86-757) 8290-3588 Fax: (86-757) 8303-6299 Yunfu Xinxing Dongdi North Road Branch 2nd Floor, Service Building C1, Wens Science & Technology Garden, Dongdi North Road Xincheng Town, Xinxing County Yunfu 527499, P.R. China Tel: (86-766) 2985-088 Fax: (86-766) 2985-018 Changsha Chezhan Road (North) Branch 3rd Floor, Annex Building, Securities Tower 459 Chezhan Road (North), Furong District Changsha 410001, P.R. China Tel: (86-731) 8878-7088 Fax: (86-731) 8446-2455 Ningbo Yangfan Road Branch 11th Floor, Building Five, 999 Yangfan Road Hi-tech Industrial Development Zone Ningbo 315103, P.R. China Tel: (86-574) 8907-7288 Fax: (86-574) 8907-7328 Fuzhou Wusi Road Branch 38th Floor, Henglicheng Office Building No.128 Wusi Road, Gulou District Fuzhou 350001, P.R. China Tel: (86-591) 8625 3088 Fax: (86-591) 8625 3050 This CICC report is provided for the exclusive use of [email protected].