Interim Report of the Commission of Enquiry_0

... excessive volatility in the forex market. Since high volatility is normally associated with uncertain and sharp price movements, authorised dealers will tend to increase the gap or spread between the buying and selling rates. The banks are reluctant to trade during such times by virtue of the fact t ...

... excessive volatility in the forex market. Since high volatility is normally associated with uncertain and sharp price movements, authorised dealers will tend to increase the gap or spread between the buying and selling rates. The banks are reluctant to trade during such times by virtue of the fact t ...

chapter 26 valuing real estate

... large that investors in it may not be able to diversify sufficiently. In addition, they note that real estate investments require localized knowledge and that those who develop this knowledge choose to invest primarily or only in real estate. Consequently, they note that the use of the Capital Asset ...

... large that investors in it may not be able to diversify sufficiently. In addition, they note that real estate investments require localized knowledge and that those who develop this knowledge choose to invest primarily or only in real estate. Consequently, they note that the use of the Capital Asset ...

ESSAYS ON MONETARY AND FISCAL POLICY By Andrea Pescatori

... are highly indebted I show that optimal monetary policy reaction (through interest rate) to inflationary pressure should be ‘milder’ than it is usually prescribed. The second chapter is based on the KM framework. This is a stronger type of credit market imperfection where households are not allowed ...

... are highly indebted I show that optimal monetary policy reaction (through interest rate) to inflationary pressure should be ‘milder’ than it is usually prescribed. The second chapter is based on the KM framework. This is a stronger type of credit market imperfection where households are not allowed ...

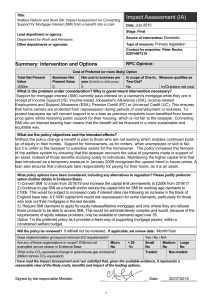

Impact Assessment (IA)

... paid to any claimant (plus interest on that loan and an administration charge) would be recouped from the equity in the property when it is sold, or repaid when the claimant returns to work. If there is insufficient equity in a claimant’s property to repay the whole SMI loan, the balance would be wr ...

... paid to any claimant (plus interest on that loan and an administration charge) would be recouped from the equity in the property when it is sold, or repaid when the claimant returns to work. If there is insufficient equity in a claimant’s property to repay the whole SMI loan, the balance would be wr ...

The Influence of Macroeconomic Factors on Stock Markets

... industry and particular listed firm’s return and sometime comparison between these certain return of two firms and/or industry with assistance of common independent variables exist in any economy. Emin et al. examined the market based ratio(s) of four independent variables namely quarterly earnings ...

... industry and particular listed firm’s return and sometime comparison between these certain return of two firms and/or industry with assistance of common independent variables exist in any economy. Emin et al. examined the market based ratio(s) of four independent variables namely quarterly earnings ...

MS Word - of Planning Commission

... on foreign savings has been extremely modest, more so in the 1970s. Inflows of foreign savings were as high as 2.5 Per cent of GDP or about 15 per cent of total investment in the early 1960s, but by 1970-1971 this had declined to 1 per cent. of GDP or 6 per cent of total investment. The contribution ...

... on foreign savings has been extremely modest, more so in the 1970s. Inflows of foreign savings were as high as 2.5 Per cent of GDP or about 15 per cent of total investment in the early 1960s, but by 1970-1971 this had declined to 1 per cent. of GDP or 6 per cent of total investment. The contribution ...

Monetary Policy Transparency - Faculty of Economics

... mation processing. So central banks use carefully crafted communications (such as policy announcements and monetary policy reports) to transmit relevant information and achieve greater transparency. But these communications may not be received or correctly understood by everyone due to frictions in ...

... mation processing. So central banks use carefully crafted communications (such as policy announcements and monetary policy reports) to transmit relevant information and achieve greater transparency. But these communications may not be received or correctly understood by everyone due to frictions in ...

Exchange Rates and the Foreign Exchange Market: An Asset

... Households and firms use exchange rates to translate foreign prices into domestic currency terms. Once the money prices of domestic goods and imports have been expressed in terms of the same currency, households and firms can compute the relative prices that affect international trade flows. ...

... Households and firms use exchange rates to translate foreign prices into domestic currency terms. Once the money prices of domestic goods and imports have been expressed in terms of the same currency, households and firms can compute the relative prices that affect international trade flows. ...

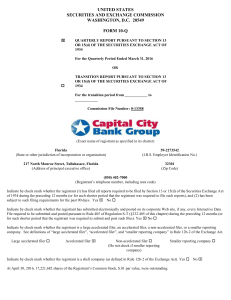

CAPITAL CITY BANK GROUP INC (Form: 10-Q

... the frequency and magnitude of foreclosure of our loans; the effects of our lack of a diversified loan portfolio, including the risks of geographic and industry concentrations; the strength of the United States economy in general and the strength of the local economies in which we conduct operations ...

... the frequency and magnitude of foreclosure of our loans; the effects of our lack of a diversified loan portfolio, including the risks of geographic and industry concentrations; the strength of the United States economy in general and the strength of the local economies in which we conduct operations ...

The costs of inflation – what have we learned?

... determinants of GDP growth, though, are more complex than the inflation rate alone. In this section, we outline the main complexities in the inflation-growth relationship before summarising the findings of empirical studies that have tested whether there is a negative relationship between inflation ...

... determinants of GDP growth, though, are more complex than the inflation rate alone. In this section, we outline the main complexities in the inflation-growth relationship before summarising the findings of empirical studies that have tested whether there is a negative relationship between inflation ...

The relevance of Keynes - Dr. Robert E. Looney Homepage

... investments can, in principle, be correctly priced and that expectations will, on average, be fulfilled. The argument seems to be between those who say risks are always correctly priced on average—the efficient market theorists—and those who concede that exogenous shocks, imperfect information and/o ...

... investments can, in principle, be correctly priced and that expectations will, on average, be fulfilled. The argument seems to be between those who say risks are always correctly priced on average—the efficient market theorists—and those who concede that exogenous shocks, imperfect information and/o ...

Sofia Bauducco Optimal Policy, Heterogeneity and Limited Commitment Prof. Albert Marcet

... A contract, signed by the two countries, regulates international capital flows. The terms of the contract depend on the commitment technology available to the two parts to honor their external obligations. When both countries can fully commit to stay in the contract in all states of nature, the only ...

... A contract, signed by the two countries, regulates international capital flows. The terms of the contract depend on the commitment technology available to the two parts to honor their external obligations. When both countries can fully commit to stay in the contract in all states of nature, the only ...

NBER WORKING PAPER SERIES INTERNATIONAL RESERVES MANAGEMENT AND THE CURRENT ACCOUNT

... triggered by adverse liquidity shocks. Section 1 evaluates empirically the impact of international reserves on real exchange rate volatility in the presence of terms of trade shocks. The evidence suggests that international reserves play a role in the mitigation of terms of trade (TOT) shocks in Dev ...

... triggered by adverse liquidity shocks. Section 1 evaluates empirically the impact of international reserves on real exchange rate volatility in the presence of terms of trade shocks. The evidence suggests that international reserves play a role in the mitigation of terms of trade (TOT) shocks in Dev ...

Chapter 1 - IDEAS/RePEc

... If the deficit is caused by a decrease in taxes, the government debt will ultimately be paid off with higher taxes that benefits current citizens and harms future ones. If the deficit is caused by higher government spending, however, the economy will be affected in a different way. ...

... If the deficit is caused by a decrease in taxes, the government debt will ultimately be paid off with higher taxes that benefits current citizens and harms future ones. If the deficit is caused by higher government spending, however, the economy will be affected in a different way. ...

Guide to Mortgage-Backed Securities

... Ginnie Mae’s most important activity has been its mortgage pass-through program, which was instituted in 1970. Under this program, Ginnie Mae guarantees the payments of principal and interest on pools of FHA-insured or VA-guaranteed mortgage loans. The enhanced availability of credit to homeowners w ...

... Ginnie Mae’s most important activity has been its mortgage pass-through program, which was instituted in 1970. Under this program, Ginnie Mae guarantees the payments of principal and interest on pools of FHA-insured or VA-guaranteed mortgage loans. The enhanced availability of credit to homeowners w ...

GOVERNMENT DEBT AND DEFICITS IN CANADA: A Macro

... RDXF as the main model used by Bank staff. See Poloz, Rose and Tetlow (1994) for an overview of the model and its use at the Bank. Some medium-term implications of fiscal experiments were investigated using a prototype of QPM in Laxton and Tetlow (1992). ...

... RDXF as the main model used by Bank staff. See Poloz, Rose and Tetlow (1994) for an overview of the model and its use at the Bank. Some medium-term implications of fiscal experiments were investigated using a prototype of QPM in Laxton and Tetlow (1992). ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.