Instructor: Prof Robert Hill Friedman and Monetarism Lewis and

... (ii) Demand is positively related to expected return relative to other assets (iii)Demand is negatively related to the risk of return relative to other assets (iv)Demand is positively related to liquidity relative to other assets ...

... (ii) Demand is positively related to expected return relative to other assets (iii)Demand is negatively related to the risk of return relative to other assets (iv)Demand is positively related to liquidity relative to other assets ...

November - Public Sector Consultants

... The remaining funds are available to the private sector. With consumers and businesses engaged in a bidding war against the government for credit, interest rates will remain more than two to three percentage points above the inflation rate. If the Federal Reserve Board attempts to satisfy all credit ...

... The remaining funds are available to the private sector. With consumers and businesses engaged in a bidding war against the government for credit, interest rates will remain more than two to three percentage points above the inflation rate. If the Federal Reserve Board attempts to satisfy all credit ...

Question 1

... a) The real money stock falls with increasing Y, and it is the fall in the real money stock that increases i. b) Investment spending will increase when the interest rate increases. c) The demand for money increases with the level of real GDP but decreases with nominal interest rates. d) The quantity ...

... a) The real money stock falls with increasing Y, and it is the fall in the real money stock that increases i. b) Investment spending will increase when the interest rate increases. c) The demand for money increases with the level of real GDP but decreases with nominal interest rates. d) The quantity ...

Last day to sign up for AP Exam

... • But now consumers spend less on books (AD decreases) Another Example: • The government increases spending but must borrow the money (AD increases) • This increases the price for money (the interest rate). • Interest rates rise so Investment to fall. (AD decrease) ...

... • But now consumers spend less on books (AD decreases) Another Example: • The government increases spending but must borrow the money (AD increases) • This increases the price for money (the interest rate). • Interest rates rise so Investment to fall. (AD decrease) ...

File

... total deposits in cash reserves in their vaults or with the Federal Reserve bank. • This enables the bank to provide funds for customers who might suddenly want to withdraw large amounts of cash from their accounts. • Currently most financial institutions are required to reserve 10 percent of their ...

... total deposits in cash reserves in their vaults or with the Federal Reserve bank. • This enables the bank to provide funds for customers who might suddenly want to withdraw large amounts of cash from their accounts. • Currently most financial institutions are required to reserve 10 percent of their ...

Macro2 Problem #3key

... The changes observed over time with the same (real) policy values are the result of changes in inflationary expectations. This economy was already above full employment output in year 1 and the actual inflation rate was 8.12%, while the expected rate of inflation (measured as the gap between the nom ...

... The changes observed over time with the same (real) policy values are the result of changes in inflationary expectations. This economy was already above full employment output in year 1 and the actual inflation rate was 8.12%, while the expected rate of inflation (measured as the gap between the nom ...

Macro_online_chapter_09_14e

... Q9.2 In the context of aggregate supply, the short run is defined as the period during which 1. some prices are set by contracts and cannot be adjusted. 2. prices can change, but neither aggregate supply nor aggregate demand can shift. 3. individuals have sufficient time to modify their behavior in ...

... Q9.2 In the context of aggregate supply, the short run is defined as the period during which 1. some prices are set by contracts and cannot be adjusted. 2. prices can change, but neither aggregate supply nor aggregate demand can shift. 3. individuals have sufficient time to modify their behavior in ...

Last day to sign up for AP Exam

... • Now but consumer spend less on books (AD decreases) Another Example: • The government increases spending but must borrow the money (AD increases) • This increases the price for money (the interest rate). • Interest rates rise so Investment to fall. (AD decrease) ...

... • Now but consumer spend less on books (AD decreases) Another Example: • The government increases spending but must borrow the money (AD increases) • This increases the price for money (the interest rate). • Interest rates rise so Investment to fall. (AD decrease) ...

Remarks by Chairman Ben S. Bernanke Before the Economic Club

... gradualism was possible only because inflation expectations remained contained-testimony to the importance of a central bank's retaining credibility in financial markets and among businesses and households. A fourth interesting aspect of the latest tightening cycle, which is my principal focus this ...

... gradualism was possible only because inflation expectations remained contained-testimony to the importance of a central bank's retaining credibility in financial markets and among businesses and households. A fourth interesting aspect of the latest tightening cycle, which is my principal focus this ...

module 12 review

... 5. The unemployment problem in an economy may be understated by the unemployment rate due to a. people lying about seeking a job. b. discouraged workers. c. job candidates with one offer but waiting for more. d. overemployed workers. e. none of the above. Tackle the Test: Free-Response Questions (an ...

... 5. The unemployment problem in an economy may be understated by the unemployment rate due to a. people lying about seeking a job. b. discouraged workers. c. job candidates with one offer but waiting for more. d. overemployed workers. e. none of the above. Tackle the Test: Free-Response Questions (an ...

krugman ir macro module 36(72).indd

... operations. Students are sure to have an idea that the Federal Reserve sets interest rates. Explain that it actually has direct control only over the monetary base, although this control does allow it to influence interest rates. If you have played the money creation game suggested in the previous s ...

... operations. Students are sure to have an idea that the Federal Reserve sets interest rates. Explain that it actually has direct control only over the monetary base, although this control does allow it to influence interest rates. If you have played the money creation game suggested in the previous s ...

ECO 212 Principles of Macroeconomics List of Formulas

... expenditure of the basket in base year BLS assumes the composition of the basket remains unchanged over time. 2. The inflation rate is the percentage change in price index from one year to the next. It is normally calculated using CPI. For example, the inflation in year t can be computed as: CPI Inf ...

... expenditure of the basket in base year BLS assumes the composition of the basket remains unchanged over time. 2. The inflation rate is the percentage change in price index from one year to the next. It is normally calculated using CPI. For example, the inflation in year t can be computed as: CPI Inf ...

INDICATIVE SOLUTION INSTITUTE OF ACTUARIES OF INDIA CT7 – Business Economics

... Expansionary fiscal policy involves increase in government expenditure and/or reduction in taxation. An increase in government expenditure constitutes additional injection in the economy which will have multiplier effect on national income. Initial injection might be sufficient to pump prime the eco ...

... Expansionary fiscal policy involves increase in government expenditure and/or reduction in taxation. An increase in government expenditure constitutes additional injection in the economy which will have multiplier effect on national income. Initial injection might be sufficient to pump prime the eco ...

Portland Community Leaders’ Luncheon

... unspecified currency basket. This is not a large revaluation, but some observers think that it is the beginning of a much bigger move over time. If this is the case, we may gain a better understanding of the impact, if any, that Chinese exchange rate policy has had on U.S. bond rates. An alternative ...

... unspecified currency basket. This is not a large revaluation, but some observers think that it is the beginning of a much bigger move over time. If this is the case, we may gain a better understanding of the impact, if any, that Chinese exchange rate policy has had on U.S. bond rates. An alternative ...

Steinar Holden, ECON 4325

... Interaction with fiscal policy o Expansionary fiscal policy leads to increased output and higher inflation, which is counteracted by a rise in the interest rate => dampens expansionary effect o Correspondingly, monetary response dampens the negative effect of fiscal contractions Zero lower boun ...

... Interaction with fiscal policy o Expansionary fiscal policy leads to increased output and higher inflation, which is counteracted by a rise in the interest rate => dampens expansionary effect o Correspondingly, monetary response dampens the negative effect of fiscal contractions Zero lower boun ...

ECON 3560/5040 Homework #6 (Answers)

... (b) [6 points] You are the chief economic adviser in a small open economy with a fixedexchange-rate system. Your boss, the president of the country, wishes to increase the level of output in the short run in order to win reelection. Do you recommend using monetary or fiscal policy? Use the Mundell-F ...

... (b) [6 points] You are the chief economic adviser in a small open economy with a fixedexchange-rate system. Your boss, the president of the country, wishes to increase the level of output in the short run in order to win reelection. Do you recommend using monetary or fiscal policy? Use the Mundell-F ...

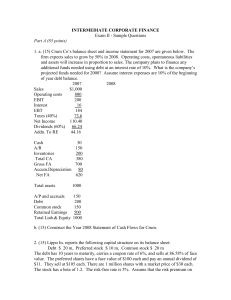

A corporate bond maturing in 5 years carries a 10% coupon rate and

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

Looking Back and Thinking Ahead Looking Back

... mix as well as broad interest rate risk exposures. From there we can move to tactical decision-making, relative value analysis, and the security selection process. This sort of top-down method provides a framework for active management of investments by rebalancing and restructuring the portfolio in ...

... mix as well as broad interest rate risk exposures. From there we can move to tactical decision-making, relative value analysis, and the security selection process. This sort of top-down method provides a framework for active management of investments by rebalancing and restructuring the portfolio in ...

mankiw9e_lecture_sli..

... The Fed knows better than to let M fall so much, especially during a contraction. Fiscal policymakers know better than to raise taxes or cut spending during a contraction. ...

... The Fed knows better than to let M fall so much, especially during a contraction. Fiscal policymakers know better than to raise taxes or cut spending during a contraction. ...

Correction

... a. Makes banks in Singapore vulnerable to default as they are making capital losses. b. Makes banks safer as they are making capital gains on their assets in the Singaporean economy. c. Makes banks safer as it reduces their wage bill in Singaporean dollar. d. Is irrelevant for the financial conditio ...

... a. Makes banks in Singapore vulnerable to default as they are making capital losses. b. Makes banks safer as they are making capital gains on their assets in the Singaporean economy. c. Makes banks safer as it reduces their wage bill in Singaporean dollar. d. Is irrelevant for the financial conditio ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.