* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download mankiw9e_lecture_sli..

Fear of floating wikipedia , lookup

Full employment wikipedia , lookup

Real bills doctrine wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Nominal rigidity wikipedia , lookup

Quantitative easing wikipedia , lookup

Inflation targeting wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Helicopter money wikipedia , lookup

Early 1980s recession wikipedia , lookup

Monetary policy wikipedia , lookup

Money supply wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Business cycle wikipedia , lookup

Phillips curve wikipedia , lookup

Interest rate wikipedia , lookup

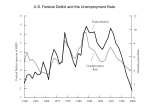

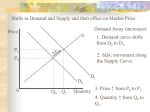

Chapter 12/11 Aggregate Demand II: Applying the IS-LM Model The Great Depression 30 Unemployment (right scale) 220 25 200 20 180 15 160 10 Real GNP (left scale) 140 120 1929 5 0 1931 1933 1935 1937 1939 percent of labor force billions of 1958 dollars 240 Great Depression: Observations Real side of economy: Output: falling Consumption: falling Investment: falling a lot Gov. purchases: fall (with a delay) Great Depression: Observations Nominal side: Nominal interest rate: falling Money supply (nominal): falling Price level: falling (deflation) THE SPENDING HYPOTHESIS: Shocks to the IS curve Asserts the Depression was largely due to an exogenous fall in the demand for goods & services—a leftward shift of the IS curve. Evidence: output and interest rates both fell, which is what a leftward IS shift would cause. THE SPENDING HYPOTHESIS: Reasons for the IS shift Stock market crash reduced consumption Oct 1929–Dec 1929: S&P 500 fell 17% Oct 1929–Dec 1933: S&P 500 fell 71% Drop in investment Correction after overbuilding in the 1920s. Widespread bank failures made it harder to obtain financing for investment. Contractionary fiscal policy Politicians raised tax rates and cut spending to combat increasing deficits. THE MONEY HYPOTHESIS: A shock to the LM curve Asserts that the Depression was largely due to huge fall in the money supply. Evidence: M1 fell 25% during 1929–33. But, two problems with this hypothesis: P fell even more, so M/P actually rose slightly during 1929–31. (M/P increased from 52.6 to 54.5) nominal interest rates fell, which is the opposite of what a leftward LM shift would cause. THE MONEY HYPOTHESIS AGAIN: The effects of falling prices Asserts that the severity of the Depression was due to a huge deflation: P fell 25% during 1929–33. This deflation was probably caused by the fall in M, so perhaps money played an important role after all. In what ways does a deflation affect the economy? THE MONEY HYPOTHESIS AGAIN: The effects of falling The stabilizing effects of deflation: iP g h(M/P) g LM shifts right g hY Pigou effect: iP g h(M/P ) g consumers’ wealth h g hC g IS shifts right g hY THE MONEY HYPOTHESIS AGAIN: The effects of falling prices The destabilizing effects of unexpected deflation: debt-deflation theory iP (if unexpected) g transfers purchasing power from borrowers to lenders g borrowers spend less and lenders spend more g if borrowers’ propensity to spend is larger than lenders’, then aggregate spending falls, the IS curve shifts left, and Y falls THE MONEY HYPOTHESIS AGAIN: The effects of falling prices There was a big deflation: P fell 25% 1929-33. A sudden fall in expected inflation means the ex-ante real interest rate rises for any given nominal rate (i ) ex ante real interest rate = i – e This could have discouraged the investment expenditure and helped cause the depression. g planned expenditure & agg. demand i g income & output i Since the deflation likely was caused by fall in M, monetary policy may have played a role here. New Stuff: IS-LM Model with e ≠0 Y = C(Y – T) + I(i - e) + G : IS-Curve M/P = L( i, Y) : LM-Curve Expect inflation enters the model in the IS-curve πe ≠ 0, i on the vertical axis Expected deflation shifts the IS-curve to the left IS (π < 0) IS (π = 0) i 2 e 1 e LM r2 A r1 = i 1 πe B i2 Y2 Y1 Y The IS-curve is drawn for a given expected inflation. At point A, πe = 0, on IS1 and r1 = i1 πe < 0 shifts IS to IS2, at B, r2 = i2 - πe => r2 = i2 - (-πe). πe ≠ 0, i on the vertical axis Expected inflation shifts the IS-curve to the right IS (π = 0) IS (π > 0) i 1 e 2 e LM B i2 A r = i1 πe r2 Y1 Y2 Y The IS-curve is drawn for a given expected inflation. At point A, πe = 0, on IS1 and r1 = i1 πe > 0 shifts IS to IS2, at B, r2 = i2 - πe Unconventional Monetary Policy in a Liquidity Trap πe ≠0 i IS1 (πe =2%) IS2 (πe =4%) Y0 LM YF Y The Fed increases inflation and inflationary expectations. Why another Depression is unlikely Policymakers (or their advisers) now know much more about macroeconomics: The Fed knows better than to let M fall so much, especially during a contraction. Fiscal policymakers know better than to raise taxes or cut spending during a contraction. Federal deposit insurance makes widespread bank failures very unlikely. Automatic stabilizers make fiscal policy expansionary during an economic downturn. CASE STUDY The 2008–09 financial crisis & recession 2009: Real GDP fell to about 6% below potential, unemployment rate approached 10% Important factors in the crisis: early 2000s Federal Reserve interest rate policy subprime mortgage crisis bursting of house price bubble, rising foreclosure rates falling stock prices failing financial institutions declining consumer confidence, drop in spending on consumer durables and investment goods CHAPTER SUMMARY 1. IS-LM model a theory of aggregate demand exogenous: M, G, T, P exogenous in short run, Y in long run endogenous: r, Y endogenous in short run, P in long run IS curve: goods market equilibrium LM curve: money market equilibrium 19 CHAPTER SUMMARY 2. AD curve shows relation between P and the IS-LM model’s equilibrium Y. negative slope because hP g i(M/P) g hr g iI g iY expansionary fiscal policy shifts IS curve right, raises income, and shifts AD curve right. expansionary monetary policy shifts LM curve right, raises income, and shifts AD curve right. IS or LM shocks shift the AD curve. 20