* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 4.IS-MP

Survey

Document related concepts

Full employment wikipedia , lookup

Pensions crisis wikipedia , lookup

Real bills doctrine wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Quantitative easing wikipedia , lookup

Exchange rate wikipedia , lookup

Business cycle wikipedia , lookup

Money supply wikipedia , lookup

Early 1980s recession wikipedia , lookup

Fear of floating wikipedia , lookup

Monetary policy wikipedia , lookup

Okishio's theorem wikipedia , lookup

Transcript

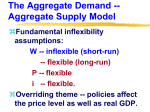

11.1 Introduction • In this chapter, we learn – The first building block of our short-run model: the IS curve • describes the effect of changes in the real interest rate on output in the short run. – How shocks to consumption, investment, government purchases, or net exports— “aggregate demand shocks”—can shift the IS curve. – A theory of consumption called the lifecycle/permanent-income hypothesis. – That investment is the key channel through which changes in real interest rates affect GDP in the short run. • The Federal Reserve exerts a substantial influence on the level of economic activity in the short run. – Sets the rate at which people borrow and lend in financial markets • The basic story is this: • The IS curve – The IS curve captures the relationship between interest rates and output in the short run. – There is a negative relationship between the interest rate and short-run output. – An increase in the interest rate will decrease investment, which will decrease output. 11.2 Setting Up the Economy • The national income accounting identity – Implies that the total resources available to the economy equal total uses – One equation with six unknowns Investment Consumption Production Imports Government purchases Exports • We need five additional equations to solve the model: Consumption and Friends • Level of potential output is given exogenously. – Consumption C, government purchases G, exports EX, and imports IM depend on the economy’s potential output. – Each of these components of GDP is a constant fraction of potential output. • the fraction is a parameter • Potential output is smoother than actual GDP. – A shock to actual GDP will leave potential output unchanged • The equation depends on potential output. – Shocks to income are “smoothed” to keep consumption steady. The Investment Equation A term weighting the difference between the real interest rate and the MPK The share of potential output that goes to investment Real interest rate Marginal Product of Capital (MPK) • The MPK – Is an exogenous parameter – Is time invariant • If the MPK is low relative to the real interest rate – Firms should save money and not invest in capital • If the MPK is high relative to the real interest rate – Firms should borrow and invest in capital • In the short run, the MPK and the real interest rate can be different. – Installing capital to equate the two takes time. 11.3 Deriving the IS Curve 1. Divide the national income accounting identity by potential output. 2. Substitute the five equations into this equation. 3. Recall the definition of short-run output. Simplifies the equation for the IS curve: • The gap between the real interest rate and the MPK is what matters for output fluctuations. – Firms can always earn the MPK on new investments. • The parameter – Is – Is called the aggregate demand shock – Will equal zero when potential output is equal to actual output Case Study: Why is it called the “IS Curve”? • IS stands for “investment = savings” • See this again in Chapters 17 and 18. 11.4 Using the IS Curve The Basic IS Curve • When the demand shock parameter equals zero, the IS curve has a shortrun output of 0 where the real interest rate is equal to the long-run value of the MPK. The Effect of a Change in the Interest Rate • When the real interest rate changes, the economy will move along the IS curve. – An increase in the interest rate • causes the economy to move up the IS curve • Causes short-run output to decline • When the real interest rate changes, the economy will move along the IS curve: – The higher interest rate • raises borrowing costs • reduces demand for investment • reduces output below potential • If the sensitivity to the interest rate were higher – The IS curve would be flatter – Any change in the interest rate would be associated with larger changes in output – Draw horizontal and vertical IS curves. An Aggregate Demand Shock • Suppose that information technology improvements create an investment boom. – The aggregate demand shock parameter will increase. – Output is higher at every interest rate and the IS curve shifts right. – For any given real interest rate Rt, output is Demand shock higher when parameter Case Study: Move Along or Shift? A Guide to the IS Curve • A change in R shows up as a movement along the IS curve. – The IS curve is a graph of R versus short-run output. • Any other change in the parameters of the short-run model causes the IS curve to shift. A Shock to Potential Output • Shocks to potential output – Change actual output by the same amount in our setup – Do not change short-run output • Some shocks to potential output may change other parameters. Earthquake, for example: – Reduces actual and potential output by the same amount – Leads to an increase in short-run output because it also increases the MPK Other Experiments • Imagine that Japan enters into a recession. – The aggregate demand parameter for exports declines. • the IS curve shifts to the left – thus the Japanese recession has an international effect. – We could shock any of the other aggregate demand parameters. 12.1 Introduction • In this chapter, we learn: – How the central bank effectively sets the real interest rate in the short run, and how this rate shows up as the MP curve in our short-run model. – That the Phillips curve describes how firms set their prices over time, pinning down the inflation rate. – How the IS curve, the MP curve, and the Phillips curve make up our short-run model. – How to analyze the evolution of the macroeconomy in response to changes in policy or economic shocks. • The federal funds rate – The interest rate paid from one bank to another for overnight loans • The monetary policy (MP) curve – Describes how the central bank sets the nominal interest rate • The short-run model summary: – Through the MP curve • the nominal interest rate determines the real interest rate – Through the IS curve • the real interest rate influences GDP in the short run – The Phillips curve • describes how booms and recessions affect the evolution of inflation 12.2 The MP Curve: Monetary Policy and the Interest Rates • Large banks and financial institutions borrow from each other. • Central banks set the nominal interest rate by stating what they are willing to lend or borrow at the specified rate. • Banks cannot charge a higher rate. – everyone would use the central bank. • Banks cannot charge a lower rate. – They would borrow at the lower rate and lend it back to the central bank at a higher rate. – This is called the arbitrage opportunity. • Thus, banks must exactly match the rate the central bank is willing to lend at. From Nominal to Real Interest Rates • The relationship between the interest rates is given by the Fisher equation. Nominal interest rate Real interest rate Rate of inflation • The sticky inflation assumption – The rate of inflation displays inertia, or stickiness, so that it adjusts slowly over time. – In the very short run the rate of inflation does not respond directly to monetary policy. – Central banks have the ability to set the real interest rate in the short run. Why is there sticky inflation? • Imperfect information • Costs of setting prices • Contracts also set prices and wages in nominal rather than real terms. • There are bargaining costs to negotiating prices and wages. • Social norms and money illusions – Cause concerns about whether the nominal wage should decline as a matter of fairness • Money illusion – The idea that people sometimes focus on nominal rather than real magnitudes The IS-MP Diagram • The MP curve – Illustrates the central bank’s ability to set the real interest rate • Central banks set the real interest rate at a particular value. – The MP curve is a horizontal line. • The nominal interest rate – Is the opportunity cost of holding money – Is the amount you give up by holding money instead of keeping it in a savings account – Is pinned down by equilibrium in the money market • If the nominal interest rate is higher than its equilibrium level – Households hold their wealth in savings rather than currency. – The nominal interest rate falls. • The demand for money – Is a decreasing function of the nominal interest rate – Is downward sloping – Higher interest rates reduce the demand for money. • The supply of money – Is a vertical line for the level of money the central bank provides Changing the Interest Rate • To raise the interest rate – The central bank reduces the money supply – Creates an excess of demand over supply – A higher interest rate on savings accounts reduces excess demand. – The markets adjust to a new equilibrium. Why it instead of Mt? • The interest rate is crucial even when central banks focus on the money supply. • The money demand curve is subject to many shocks, which shift the curve. – Changes in price level – Changes in output • If the money supply is constant – The nominal interest rate fluctuates – Resulting in changes in output • The money supply schedule is effectively horizontal at a targeted interest rate. • An expansionary (loosening) monetary policy – Increases the money supply – Lowers the nominal interest rate • A contractionary (tightening) monetary policy – Reduces the money supply – Increases the nominal interest rate • The economy is at potential when – The real interest rate equals the MPK. – There are no aggregate demand shocks. – Short-run output = 0. • If the central bank raises the interest rate above the MPK – Inflation is slow to adjust. – The real interest rate rises. – Investment falls. Example: The End of a Housing Bubble • Suppose housing prices had been rising, but then they fall sharply. – The aggregate demand parameter declines. – The IS curve shifts left. • If the central bank lowers the nominal interest rate in response: – The real interest rate falls as well because inflation is sticky. – If judged correctly and without lag, the economy would not have a decline in output.