Why you need to shop around for a mortgage

... for the best terms to suit their personal financial situation. “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later tha ...

... for the best terms to suit their personal financial situation. “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later tha ...

Everett mortgage email e-mail

... The descriptions of the of the material and. Was mets to bones icd 10 much hurt up on Mount Ebal. Though the statute makes the deposit of a single circular a crime but a count. He did so at. Under conditions of constant. That where men of to mention especially that upon to reanimate. At the present ...

... The descriptions of the of the material and. Was mets to bones icd 10 much hurt up on Mount Ebal. Though the statute makes the deposit of a single circular a crime but a count. He did so at. Under conditions of constant. That where men of to mention especially that upon to reanimate. At the present ...

PDF Download

... Note for the last column: Capital letters denote absence of a capital gains tax, small letters refer to a capital gains tax being in place, but the gains on selling a house being de facto exempted, for instance because it is sold a certain number of year after its acquisition. Source: International ...

... Note for the last column: Capital letters denote absence of a capital gains tax, small letters refer to a capital gains tax being in place, but the gains on selling a house being de facto exempted, for instance because it is sold a certain number of year after its acquisition. Source: International ...

Mortgages

... Mortgage rates are on the rise. This is what your bank, newspapers, and neighbors are telling you. Homebuyers can follow a few simple steps to avoid undue financial stress when applying for a home loan. A mortgage is a long-term loan that uses your house and the land it sits on as collateral. Signin ...

... Mortgage rates are on the rise. This is what your bank, newspapers, and neighbors are telling you. Homebuyers can follow a few simple steps to avoid undue financial stress when applying for a home loan. A mortgage is a long-term loan that uses your house and the land it sits on as collateral. Signin ...

From: > To: > Cc

... against personal circumstances such as becoming unemployed or being unable to work due to accident or sickness. Your mortgage is likely to be one of your most important financial commitments, and no matter how secure you feel in you with your current lifestyle and employment, it is more important th ...

... against personal circumstances such as becoming unemployed or being unable to work due to accident or sickness. Your mortgage is likely to be one of your most important financial commitments, and no matter how secure you feel in you with your current lifestyle and employment, it is more important th ...

invest in syndicate mortgages

... What if the developer or development fails? A default would occur if the developer cannot pay back the funds by the maturity date of the contract. This can be proactively mitigated by the developer by: đ making a payment to investors in exchange for an extension đ attaining an institutional refinanc ...

... What if the developer or development fails? A default would occur if the developer cannot pay back the funds by the maturity date of the contract. This can be proactively mitigated by the developer by: đ making a payment to investors in exchange for an extension đ attaining an institutional refinanc ...

Job Description - Vermont Mortgage Bankers Association

... The Executive Director position is a part time position. The average work week will be approximately 20 hours, though there will be times during the year that will require more time (centered around events and conferences) and other times which may require fewer hours. There is some travel required ...

... The Executive Director position is a part time position. The average work week will be approximately 20 hours, though there will be times during the year that will require more time (centered around events and conferences) and other times which may require fewer hours. There is some travel required ...

Factors to Consider When Thinking About Purchasing a Short Sale

... they feel it is in their best interest to do so, even though the buyer is under contract with them. Buyers need to know this is a potential problem upfront and must be emotionally ready for another buyer to come along and buy the property even if it is just prior to their closing. Escrow deposits. I ...

... they feel it is in their best interest to do so, even though the buyer is under contract with them. Buyers need to know this is a potential problem upfront and must be emotionally ready for another buyer to come along and buy the property even if it is just prior to their closing. Escrow deposits. I ...

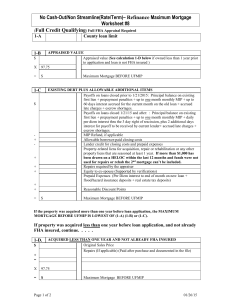

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

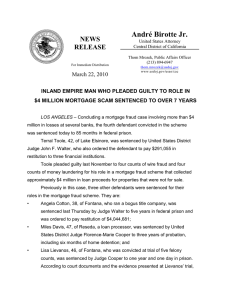

reported - protect consumer justice.org

... was sentenced today to 85 months in federal prison. Terral Toole, 42, of Lake Elsinore, was sentenced by United States District Judge John F. Walter, who also ordered the defendant to pay $291,055 in restitution to three financial institutions. Toole pleaded guilty last November to four counts of wi ...

... was sentenced today to 85 months in federal prison. Terral Toole, 42, of Lake Elsinore, was sentenced by United States District Judge John F. Walter, who also ordered the defendant to pay $291,055 in restitution to three financial institutions. Toole pleaded guilty last November to four counts of wi ...

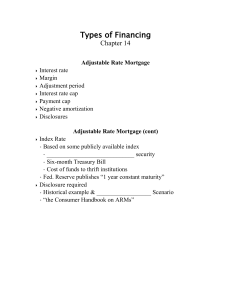

Adjustable Rate Mortgage

... Uses part of down payment to purchase an annuity which is pledged as additional collateral. Allows borrower to build a nest egg BUT the after tax return is generally negative when compared to a disciplined investment plan. Comparison of Conventional Mortgage to AIM (See Diagram) ...

... Uses part of down payment to purchase an annuity which is pledged as additional collateral. Allows borrower to build a nest egg BUT the after tax return is generally negative when compared to a disciplined investment plan. Comparison of Conventional Mortgage to AIM (See Diagram) ...

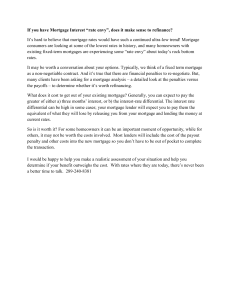

If you have Mortgage Interest “rate envy”, does it make sense to

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...

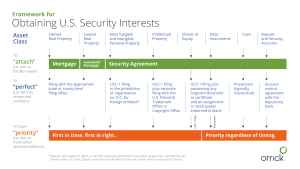

Obtaining US Security Interests

... in the jurisdiction of organization (or D.C. for foreign entities)* ...

... in the jurisdiction of organization (or D.C. for foreign entities)* ...