Aalborg Universitet Mortgage Finance and Security of Collateral Haldrup, Karin

... institution. Through the balance principle of securitization are mitigated a number of risks pertaining to other mortgage finance models (currency risk, interest rate risks, liquidity risks of mortgage credit institutions, etc.). As a result the main remaining risk held by the mortgage credit instit ...

... institution. Through the balance principle of securitization are mitigated a number of risks pertaining to other mortgage finance models (currency risk, interest rate risks, liquidity risks of mortgage credit institutions, etc.). As a result the main remaining risk held by the mortgage credit instit ...

Chapter 9

... interest on MBS backed by federally insured or guaranteed loans. GNMA charges issuers of pass-throughs a fee ranging from 0.25 % to 0.75 % to offer its guarantee. Investors in Ginnie Mae securities will earn a lower yield reflecting a lower default risk because of the dual guarantee by GNMA on the M ...

... interest on MBS backed by federally insured or guaranteed loans. GNMA charges issuers of pass-throughs a fee ranging from 0.25 % to 0.75 % to offer its guarantee. Investors in Ginnie Mae securities will earn a lower yield reflecting a lower default risk because of the dual guarantee by GNMA on the M ...

2005 Survey - Freddie Mac Home

... When asked unaided, the majority of homeowners say they are not aware of services that mortgage lenders can offer to a person having trouble with their mortgage (61% of delinquent and 73% of good standing owners). While top of mind awareness is low, when prompted homeowners express awareness of spec ...

... When asked unaided, the majority of homeowners say they are not aware of services that mortgage lenders can offer to a person having trouble with their mortgage (61% of delinquent and 73% of good standing owners). While top of mind awareness is low, when prompted homeowners express awareness of spec ...

The Freedom Recovery Plan

... occupancy lease that will have certain unique features attributable to it that will benefit both the landlord (the former lender, or a subsequent assignee of title to the home and the Recovery Lease) and the tenant (the former homeowner, with no right of assignment or sublease). The Recovery Lease i ...

... occupancy lease that will have certain unique features attributable to it that will benefit both the landlord (the former lender, or a subsequent assignee of title to the home and the Recovery Lease) and the tenant (the former homeowner, with no right of assignment or sublease). The Recovery Lease i ...

Prepared by, and after recording

... payable without further demand, and may invoke the power of sale and any one or more other remedies permitted by applicable law or provided in this Instrument or in any other Loan Document. Borrower acknowledges that the power of sale granted in this Instrument may be exercised by Lender without pri ...

... payable without further demand, and may invoke the power of sale and any one or more other remedies permitted by applicable law or provided in this Instrument or in any other Loan Document. Borrower acknowledges that the power of sale granted in this Instrument may be exercised by Lender without pri ...

Adequate explanations

... (some transitional elements are later) • Significant overlaps with MMR; which leaves changes still to do ...

... (some transitional elements are later) • Significant overlaps with MMR; which leaves changes still to do ...

File - The Mortgage Collaborative

... Source: JCHS tabulations of 2010 Survey of Consumer Finances. ...

... Source: JCHS tabulations of 2010 Survey of Consumer Finances. ...

General Information - Bank of Ireland Mortgage

... not repay any of the money you originally borrowed. When the mortgage comes to the end of the agreed term you will need to pay back the outstanding capital. It is your responsibility to make sure you have an adequate repayment strategy in place to do this. If you choose an interest only mortgage, me ...

... not repay any of the money you originally borrowed. When the mortgage comes to the end of the agreed term you will need to pay back the outstanding capital. It is your responsibility to make sure you have an adequate repayment strategy in place to do this. If you choose an interest only mortgage, me ...

Personal Financial Literacy - Warren Hills Regional School District

... – Discussing these issues ahead of time allows you to reduce conflict later ...

... – Discussing these issues ahead of time allows you to reduce conflict later ...

ATTORNEY BIOGRAPHICAL profile of spencer P. scheer

... Mr. Scheer is a principal of SLG. He graduated from the University of Massachusetts (B.A., cum laude, 1980), and earned his Juris Doctor Degree from Empire College of Law (1983). After clerking for Alan Jaroslovsky ( Bankruptcy Judge, N Dist of CA), Mr. Scheer worked as Bankruptcy Administrator and ...

... Mr. Scheer is a principal of SLG. He graduated from the University of Massachusetts (B.A., cum laude, 1980), and earned his Juris Doctor Degree from Empire College of Law (1983). After clerking for Alan Jaroslovsky ( Bankruptcy Judge, N Dist of CA), Mr. Scheer worked as Bankruptcy Administrator and ...

An Introduction - The Mortgage and Insurance Bureau

... as arranging the finance itself. It is important that you are fully aware of the tax regime in your chosen overseas location and also take appropriate legal advice. Please note that changes in the exchange rate may increase the sterling equivalent of your debt. ...

... as arranging the finance itself. It is important that you are fully aware of the tax regime in your chosen overseas location and also take appropriate legal advice. Please note that changes in the exchange rate may increase the sterling equivalent of your debt. ...

What does it mean? Common terms for home ownership factsheet

... AAPR - The Average Annual Percentage Rate or AAPR is also known as the mortgage comparison rate. This is used to compare the actual interest rate of a loan, taking into account up-front and ongoing fees. However, it is based on certain assumptions, which may not all apply to your circumstances. Agen ...

... AAPR - The Average Annual Percentage Rate or AAPR is also known as the mortgage comparison rate. This is used to compare the actual interest rate of a loan, taking into account up-front and ongoing fees. However, it is based on certain assumptions, which may not all apply to your circumstances. Agen ...

Loans Classified by Special Provision

... 90 days. Two full years are required for those enlisting for the first time after September 7, 1980). GI loans assist veterans in financing the purchase of homes with no down payments, at comparatively low interest rates. Rules and regulations are issued from time to time by the VA, setting forth th ...

... 90 days. Two full years are required for those enlisting for the first time after September 7, 1980). GI loans assist veterans in financing the purchase of homes with no down payments, at comparatively low interest rates. Rules and regulations are issued from time to time by the VA, setting forth th ...

Eight Steps to Your New Front Door

... (principal) that is generally repaid with interest. Loan-to-Value (LTV) Percentage: The relationship between the principal balance of the mortgage and the appraised value (or sales price if it is lower) of the property. For example, a $100,000 home with an $80,000 mortgage has an LTV of 80 percent. ...

... (principal) that is generally repaid with interest. Loan-to-Value (LTV) Percentage: The relationship between the principal balance of the mortgage and the appraised value (or sales price if it is lower) of the property. For example, a $100,000 home with an $80,000 mortgage has an LTV of 80 percent. ...

More... - Kevin Kavakeb

... There are mixed messages out there about when and if interest rates are going to go up. But just as important is a thorough understanding of fixed-rate mortgages and what it could mean for you and your home investment in the long run. Keep in mind that the cost of interest rates rising by 1% is equi ...

... There are mixed messages out there about when and if interest rates are going to go up. But just as important is a thorough understanding of fixed-rate mortgages and what it could mean for you and your home investment in the long run. Keep in mind that the cost of interest rates rising by 1% is equi ...

25 KB - National Homelessness Advice Service

... numbers of households have already been in long term forbearance e.g. 12 months or more and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a numb ...

... numbers of households have already been in long term forbearance e.g. 12 months or more and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a numb ...

Real Estate Retention Agreement 2.5" Margin

... For purposes of this Agreement1, the following terms shall have the meanings set forth below: “FHLBI” shall refer to the Federal Home Loan Bank of Indianapolis. “Member” shall refer to “Borrower(s)” shall refer to ...

... For purposes of this Agreement1, the following terms shall have the meanings set forth below: “FHLBI” shall refer to the Federal Home Loan Bank of Indianapolis. “Member” shall refer to “Borrower(s)” shall refer to ...

General information about AA mortgages

... There are two different repayment options; capital repayment and interest only. Capital repayment means you gradually pay off the amount you borrowed together with interest. You make one payment each month, part of it goes towards repaying the capital and part pays the interest due that month. Inter ...

... There are two different repayment options; capital repayment and interest only. Capital repayment means you gradually pay off the amount you borrowed together with interest. You make one payment each month, part of it goes towards repaying the capital and part pays the interest due that month. Inter ...

a predator in america`s midst: a look at predatory lending

... debt retention. During this period, many Americans were becoming first-time home buyers, refinancing their own homes to take out a second mortgage so they could have some cash, and selling their homes because they were being appraised at an inflated value. What would lead to an overvaluation in home ...

... debt retention. During this period, many Americans were becoming first-time home buyers, refinancing their own homes to take out a second mortgage so they could have some cash, and selling their homes because they were being appraised at an inflated value. What would lead to an overvaluation in home ...

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... This document is provided for informational purposes only. The information contained in this document is subject to change without notice and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations ...

... This document is provided for informational purposes only. The information contained in this document is subject to change without notice and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations ...

6218 - Fannie Mae

... unsecured trade payables incurred in the ordinary course of the operation of the Mortgaged Property or the Disclosed Assets (exclusive of amounts for rehabilitation, restoration, repairs, or replacements of the Mortgaged Property or the Disclosed Assets) that (i) are not evidenced by a promissory no ...

... unsecured trade payables incurred in the ordinary course of the operation of the Mortgaged Property or the Disclosed Assets (exclusive of amounts for rehabilitation, restoration, repairs, or replacements of the Mortgaged Property or the Disclosed Assets) that (i) are not evidenced by a promissory no ...

Ohio Mortgage Bankers Association

... 79 S. State Street, Suite D1 Westerville, OH 43081 614.682.6555 [email protected] ...

... 79 S. State Street, Suite D1 Westerville, OH 43081 614.682.6555 [email protected] ...

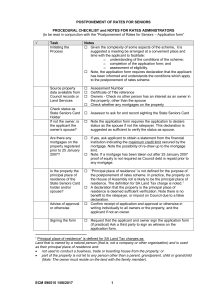

postponement of rates for seniors

... “Principal place of residence” is not defined for the purpose of the postponement of rates scheme. In practice, the property on the House of Assembly roll is likely to be the principal place of residence. The definition for SA Land Tax charge is noted. 1 A declaration that the property is the pr ...

... “Principal place of residence” is not defined for the purpose of the postponement of rates scheme. In practice, the property on the House of Assembly roll is likely to be the principal place of residence. The definition for SA Land Tax charge is noted. 1 A declaration that the property is the pr ...

Building a greener society

... • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

... • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

Solving the Long-Range Problems of Housing and Mortgage Finance

... is not to convert them into commercial banks. What we need are specialized housing finance institutions which are capable of functioning in an inflationary economy. To produce this capability, it will be necessary to move away from sole reliance on the long-term, fixed-rate mortgage, a nancial instr ...

... is not to convert them into commercial banks. What we need are specialized housing finance institutions which are capable of functioning in an inflationary economy. To produce this capability, it will be necessary to move away from sole reliance on the long-term, fixed-rate mortgage, a nancial instr ...