Location Efficient Mortgages: Is the Rationale

... In a reply to this article, Easterbrook (1999) argues that LEMs are not likely to generate significant new demand for houses in location efficient areas, but does not take up the issue of whether LEMs will affect mortgage default. In this paper, we present the results of an empirical test designed t ...

... In a reply to this article, Easterbrook (1999) argues that LEMs are not likely to generate significant new demand for houses in location efficient areas, but does not take up the issue of whether LEMs will affect mortgage default. In this paper, we present the results of an empirical test designed t ...

Redline2011-00370 - Colorado Secretary of State

... 6. If the ad shows the finance charge as a rate, that rate must be stated as an "annual percentage rate," using that term or the abbreviation "APR." The ad must state the annual percentage rate, even if it is the same as the simple interest rate. Disclosure of the annual percentage rate shall be dis ...

... 6. If the ad shows the finance charge as a rate, that rate must be stated as an "annual percentage rate," using that term or the abbreviation "APR." The ad must state the annual percentage rate, even if it is the same as the simple interest rate. Disclosure of the annual percentage rate shall be dis ...

The Company Charge Register after the Companies Bill 2012

... company and that, having done so, they have formed the opinion that the company, having entered into the transaction or arrangement will be able to pay or discharge its debts and other liabilities in full as they fall due during the period of 12 months after the date on which they enter into the tra ...

... company and that, having done so, they have formed the opinion that the company, having entered into the transaction or arrangement will be able to pay or discharge its debts and other liabilities in full as they fall due during the period of 12 months after the date on which they enter into the tra ...

Chapter 22 - SanyigoHistory

... A loan to purchase real estate is called a mortgage. A trust deed is similar to a mortgage; it is a debt security instrument that shows as a lien against property. Payments on a mortgage or trust deed are made over an extended period, such as 15 or 30 years. Monthly loan payments include principal a ...

... A loan to purchase real estate is called a mortgage. A trust deed is similar to a mortgage; it is a debt security instrument that shows as a lien against property. Payments on a mortgage or trust deed are made over an extended period, such as 15 or 30 years. Monthly loan payments include principal a ...

department of regulatory agencies

... closed-end credit transaction, credit is advanced for a specific time period, and the "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primar ...

... closed-end credit transaction, credit is advanced for a specific time period, and the "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primar ...

Lesson I

... Margie listed her real estate for sale at $100,000. If her cost was 80 percent of the listing price, what will her percentage of profit be when her real estate is sold for the listing price? a. 10 percent b. 15 percent c. 20 percent d. 25 percent ...

... Margie listed her real estate for sale at $100,000. If her cost was 80 percent of the listing price, what will her percentage of profit be when her real estate is sold for the listing price? a. 10 percent b. 15 percent c. 20 percent d. 25 percent ...

How the Affluent Manage Home Equity to Safely and Conservatively

... ability to pay off their mortgage but refuse to do so, understand how to make their mortgage work for them. They go against many of the beliefs of traditional thinking. They put very little money down, they keep their mortgage balance as high as possible, they choose adjustable rate interest-only mo ...

... ability to pay off their mortgage but refuse to do so, understand how to make their mortgage work for them. They go against many of the beliefs of traditional thinking. They put very little money down, they keep their mortgage balance as high as possible, they choose adjustable rate interest-only mo ...

Fannie Mae/Freddie Mac Home Mortgage Documents Interpreted as

... display excess assets. The Assistant General Counsel for the Single Family Mortgage Division of FHA observed that if someone walked away from an FHA insured house after winning the lottery, deficiency would likely be pursued. In a case such as that posed in the survey of my class, there would likely ...

... display excess assets. The Assistant General Counsel for the Single Family Mortgage Division of FHA observed that if someone walked away from an FHA insured house after winning the lottery, deficiency would likely be pursued. In a case such as that posed in the survey of my class, there would likely ...

REO Resources - Florida Realtors

... ensure a clean and marketable title. Further, with some negotiated issues, the asset manager handling the transaction may need to resubmit documents for approval, even if the changes are minor. Patience is a requirement for any REO closing. The purchase contract sent back to my buyer has a requireme ...

... ensure a clean and marketable title. Further, with some negotiated issues, the asset manager handling the transaction may need to resubmit documents for approval, even if the changes are minor. Patience is a requirement for any REO closing. The purchase contract sent back to my buyer has a requireme ...

Loan Agreement - Act respecting financial assistance for education

... totime, the repay in advance all or partatofhis theorloan. borrower, her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rul ...

... totime, the repay in advance all or partatofhis theorloan. borrower, her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rul ...

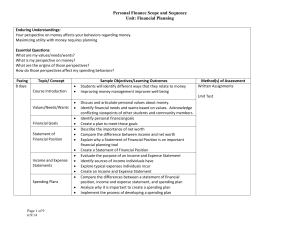

Personal Finance Scope and Sequence Unit: Financial Planning

... Use cost benefit analysis to assess apartment location Assess costs associated with renting/furnishing an apartment Estimate monthly expenditures for utilities Understand different mortgage types and function Calculate down payments on a given mortgage Calculate the monthly payment for a given mortg ...

... Use cost benefit analysis to assess apartment location Assess costs associated with renting/furnishing an apartment Estimate monthly expenditures for utilities Understand different mortgage types and function Calculate down payments on a given mortgage Calculate the monthly payment for a given mortg ...

New Trends in Mortgage Fraud - National Crime Prevention Council

... Alicia was proud to be a homeowner, diligently making her mortgage payments each month. When she lost her job in 2009 she fell behind in her payments. Shortly afterwards, Alicia received a brochure from a company offering loan modification services. The company claimed to be affiliated with the gove ...

... Alicia was proud to be a homeowner, diligently making her mortgage payments each month. When she lost her job in 2009 she fell behind in her payments. Shortly afterwards, Alicia received a brochure from a company offering loan modification services. The company claimed to be affiliated with the gove ...

Trust and equitable charges

... comply with s.53(1)(c); s.53(l)(c) presupposed there to be an existing equitable interest in place capable of being disposed of, which there was not in this case. • The court held that the document was sufficient to create an equitable charge and was enforceable because it complied with s.53 LPA. As ...

... comply with s.53(1)(c); s.53(l)(c) presupposed there to be an existing equitable interest in place capable of being disposed of, which there was not in this case. • The court held that the document was sufficient to create an equitable charge and was enforceable because it complied with s.53 LPA. As ...

FRAUD: When gross negligence is not enough

... There is a high bar for proving deceit. It is a difficult task which can have devastating reputational consequences and should not be embarked upon lightly. Overcoming the causation hurdle is often very difficult for a claimant to do. This is particularly so in the age of modern communication. E-mai ...

... There is a high bar for proving deceit. It is a difficult task which can have devastating reputational consequences and should not be embarked upon lightly. Overcoming the causation hurdle is often very difficult for a claimant to do. This is particularly so in the age of modern communication. E-mai ...

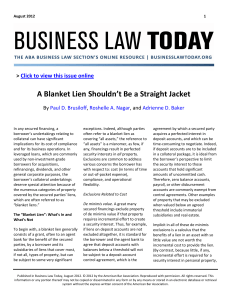

In any secured financing, a borrower`s undertakings relating to

... anti‐assignment provisions (which prohibit the granting of liens on rights in licenses or in other agreements) in order to avoid a breach of those anti‐ assignment clauses. Often there is a workaround to this exclusion: UCC § 9‐408(a) limits the effect of anti‐ assignment clauses in general in ...

... anti‐assignment provisions (which prohibit the granting of liens on rights in licenses or in other agreements) in order to avoid a breach of those anti‐ assignment clauses. Often there is a workaround to this exclusion: UCC § 9‐408(a) limits the effect of anti‐ assignment clauses in general in ...

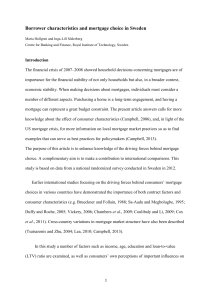

Borrower characteristics and mortgage choice in Sweden

... Literature on the impact of loan takers’ tolerance of sudden increases in mortgage costs is scarce. However, a Swedish study by Kulander and Lind (2009) found statistically significant differences between groups that experienced worry and those who felt more secure in their ability to manage their m ...

... Literature on the impact of loan takers’ tolerance of sudden increases in mortgage costs is scarce. However, a Swedish study by Kulander and Lind (2009) found statistically significant differences between groups that experienced worry and those who felt more secure in their ability to manage their m ...

drafting of documents of real estate transactions

... WHAT IS A DOCUMENT? A document is something that furnishes evidence and shall also include matter written, expressed or described upon any substance by means of letters, figures or marks or by more than one of those means which is intended to be used or which may be used for the purpose of recordin ...

... WHAT IS A DOCUMENT? A document is something that furnishes evidence and shall also include matter written, expressed or described upon any substance by means of letters, figures or marks or by more than one of those means which is intended to be used or which may be used for the purpose of recordin ...

III-2 - Fannie Mae

... Identify significant competition with the Property. Access or proximity to employment centers, recreational facilities, shopping centers, schools, public transportation, and major roads, etc. Note any economic obsolescence, incompatible uses, or negative influences (e.g., traffic problems, train tra ...

... Identify significant competition with the Property. Access or proximity to employment centers, recreational facilities, shopping centers, schools, public transportation, and major roads, etc. Note any economic obsolescence, incompatible uses, or negative influences (e.g., traffic problems, train tra ...

CLERGY PER$ONAL FINANCE

... with a very small minimal monthly payment. She also rents an apartment with a monthly rent of $800. Her salary is sufficient to cover the rent plus offer an affordable lifestyle. Recently her parents offered to give her sufficient funds for a down payment on a home and she finds the perfect place fo ...

... with a very small minimal monthly payment. She also rents an apartment with a monthly rent of $800. Her salary is sufficient to cover the rent plus offer an affordable lifestyle. Recently her parents offered to give her sufficient funds for a down payment on a home and she finds the perfect place fo ...

Towards the Upturn of Residential Mortgage Markets: Which

... As a second step, the study will investigate the key variables of the residential mortgage supply with the goal of highlighting analogies and differences at cross-border level and pointing out some trends. ...

... As a second step, the study will investigate the key variables of the residential mortgage supply with the goal of highlighting analogies and differences at cross-border level and pointing out some trends. ...

Georgia Real Estate, 8e - PowerPoint for Ch 09

... A lender will want to be in the most senior position possible. The first lender to record holds the first mortgage. If the same property is used to secure another note before the first is fully satisfied, the new mortgage is a second mortgage. © 2015 OnCourse Learning ...

... A lender will want to be in the most senior position possible. The first lender to record holds the first mortgage. If the same property is used to secure another note before the first is fully satisfied, the new mortgage is a second mortgage. © 2015 OnCourse Learning ...

whether it is movable or immovable

... Ruling: No, Padilla's rights were impaired because there was FAMEN. She is an innocent buyer for value 1973 consti disqualifies aliens from acquiring private lands By attempting to acquire interest, he violated the constitution rendering the sale as to him void. ...

... Ruling: No, Padilla's rights were impaired because there was FAMEN. She is an innocent buyer for value 1973 consti disqualifies aliens from acquiring private lands By attempting to acquire interest, he violated the constitution rendering the sale as to him void. ...

PPT

... Covenants in a mortgage • In Wanner v Caruana [1974] 2 NSWLR 301 the court was asked to consider whether a provision in a mortgage was void as a penalty. The provision said: • PROVIDED THAT in the event that any monthly instalment being in default for fourteen (14) days the whole of the balance of ...

... Covenants in a mortgage • In Wanner v Caruana [1974] 2 NSWLR 301 the court was asked to consider whether a provision in a mortgage was void as a penalty. The provision said: • PROVIDED THAT in the event that any monthly instalment being in default for fourteen (14) days the whole of the balance of ...