Prudential Requirements Consultation Paper

... product is a particular challenge for the FSC and the industry. Mechanisms readily available in some other markets, such as a full range of hedging tools or a deep and liquid money market, are either not available or only in very restricted forms. The financial conservatism of Jamaican retail invest ...

... product is a particular challenge for the FSC and the industry. Mechanisms readily available in some other markets, such as a full range of hedging tools or a deep and liquid money market, are either not available or only in very restricted forms. The financial conservatism of Jamaican retail invest ...

FSB Securities Lending and Repos: Market Overview and Financial

... investors (e.g. insurance companies, pension funds, investment funds) 6 to banks and brokerdealers 7 against the collateral of cash (typical in the US and Japanese markets, and comprising a minority share of the European market) or securities. According to one industry estimate, the total securities ...

... investors (e.g. insurance companies, pension funds, investment funds) 6 to banks and brokerdealers 7 against the collateral of cash (typical in the US and Japanese markets, and comprising a minority share of the European market) or securities. According to one industry estimate, the total securities ...

Mackenzie Maximum Diversification Developed Europe Index ETF

... TOBAM is a registered trademark and service mark of TOBAM S.A.S. or its affiliates (“TOBAM”) and is used under license for certain purposes by Mackenzie Financial Corporation. Reproduction of the TOBAM data and information in any form is prohibited except with the prior written permission of TOBAM S ...

... TOBAM is a registered trademark and service mark of TOBAM S.A.S. or its affiliates (“TOBAM”) and is used under license for certain purposes by Mackenzie Financial Corporation. Reproduction of the TOBAM data and information in any form is prohibited except with the prior written permission of TOBAM S ...

Dreyfus Variable Investment Fund: Quality Bond Portfolio

... conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments ...

... conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments ...

Commodities Outlook LME Asia seminar: Copper, zinc and lead

... analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research, whether as a result of differing time horizons, methodologies, or otherwise. Before making an investment decision on the b ...

... analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research, whether as a result of differing time horizons, methodologies, or otherwise. Before making an investment decision on the b ...

Naked Short Selling

... only on day t+3 on the basis of the rebate rates in the OTC stock-borrowing market on day t+3.6 The short seller may want to borrow and deliver if these rebate rates are positive and fail if they are negative. Second, as explained by Culp and Heaton (2008), a FTD results either in automatic stock b ...

... only on day t+3 on the basis of the rebate rates in the OTC stock-borrowing market on day t+3.6 The short seller may want to borrow and deliver if these rebate rates are positive and fail if they are negative. Second, as explained by Culp and Heaton (2008), a FTD results either in automatic stock b ...

SAI - Cortina Asset Management

... established in the convertible security’s governing instrument. If a convertible security is called for redemption, a Fund will be required to permit the issuer to redeem the security, convert it into the underlying common stock or sell it to a third party. Investment in convertible securities gener ...

... established in the convertible security’s governing instrument. If a convertible security is called for redemption, a Fund will be required to permit the issuer to redeem the security, convert it into the underlying common stock or sell it to a third party. Investment in convertible securities gener ...

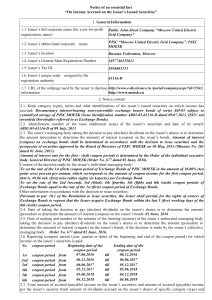

On Income Accrued on the Issuer`s Issued Securitiespdf

... centralized storage of PJSC MOESK (issue identification number 4B02-05-65116-D dated 09.07.2013, ISIN: not awarded) (hereinafter referred to as Exchange Bonds). 2.2. Identification number of the issue (additional issue) of the issuer’s securities and date of its award: 4B02-05-65116-D of 09 July, 20 ...

... centralized storage of PJSC MOESK (issue identification number 4B02-05-65116-D dated 09.07.2013, ISIN: not awarded) (hereinafter referred to as Exchange Bonds). 2.2. Identification number of the issue (additional issue) of the issuer’s securities and date of its award: 4B02-05-65116-D of 09 July, 20 ...

ADV 2A - Inspire Investing

... • We send you an invoice showing the amount of the fee, the value of the assets on which the fee is based, and the specific manner in which the fee was calculated. • The qualified custodian agrees to send you a statement, at least quarterly, indicating all amounts dispersed from your account includi ...

... • We send you an invoice showing the amount of the fee, the value of the assets on which the fee is based, and the specific manner in which the fee was calculated. • The qualified custodian agrees to send you a statement, at least quarterly, indicating all amounts dispersed from your account includi ...

Mackenzie Canadian Large Cap Growth Fund

... The accompanying financial statements have been prepared by Mackenzie Financial Corporation, as Manager of Mackenzie Canadian Large Cap Growth Fund (the “Fund”). The Manager is responsible for the integrity, objectivity and reliability of the data presented. This responsibility includes selecting ap ...

... The accompanying financial statements have been prepared by Mackenzie Financial Corporation, as Manager of Mackenzie Canadian Large Cap Growth Fund (the “Fund”). The Manager is responsible for the integrity, objectivity and reliability of the data presented. This responsibility includes selecting ap ...

Scaling Chinese Walls: Insights From Aftra v. JPMorgan Chase

... banking corporations.4 As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial sta ...

... banking corporations.4 As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial sta ...

1 Getting new regulatory policy done: Crowdfunding

... for creative projects and causes. As of January 2014, over 200,000 funding campaigns had been launched on Indiegogo alone.ii Kickstarter claims to have raised more than $1 billion from 5.7 million donors ...

... for creative projects and causes. As of January 2014, over 200,000 funding campaigns had been launched on Indiegogo alone.ii Kickstarter claims to have raised more than $1 billion from 5.7 million donors ...

Corporate Actions

... The New Share Subscription Rights (hereinafter “NSSR”) were brought into the market with the revision of the Commercial Code in 2001. NSSRs are allotted to the shareholders by the issuer in proportion to their holdings, either for free or against payment depending on each case. In either of the case ...

... The New Share Subscription Rights (hereinafter “NSSR”) were brought into the market with the revision of the Commercial Code in 2001. NSSRs are allotted to the shareholders by the issuer in proportion to their holdings, either for free or against payment depending on each case. In either of the case ...

Repo and Securities Lending - Federal Reserve Bank of New York

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

securities and exchange commission

... price. This type of litigation could result in substantial costs and divert our management’s attention and resources, and could also require us to make substantial payments to satisfy judgments or to settle litigation. Future sales of our common stock in the public market could cause our stock price ...

... price. This type of litigation could result in substantial costs and divert our management’s attention and resources, and could also require us to make substantial payments to satisfy judgments or to settle litigation. Future sales of our common stock in the public market could cause our stock price ...

Rethinking Glass-Steagall

... securities, in which they are major market participants. Morcover, no failure or forced merger of a securities firm of significant size during the postwar period has been caused by losses from underwri· or dealing in securities; neither has any bank failed during the period because of its securities ...

... securities, in which they are major market participants. Morcover, no failure or forced merger of a securities firm of significant size during the postwar period has been caused by losses from underwri· or dealing in securities; neither has any bank failed during the period because of its securities ...

SAST - SA JPMorgan MFS Core Bond Portfolio Summary

... Equity Securities Risk. This is the risk that stock prices will fall over short or extended periods of time. Although the stock market has historically outperformed other asset classes over the long term, the stock market tends to move in cycles. Individual stock prices fluctuate from day-to-day and ...

... Equity Securities Risk. This is the risk that stock prices will fall over short or extended periods of time. Although the stock market has historically outperformed other asset classes over the long term, the stock market tends to move in cycles. Individual stock prices fluctuate from day-to-day and ...

Margin Facility Agreement

... sell a sufficient amount of the indentured securities to cover such obligations; Provided, however, that if such sale is not executed on the trading day after termination of the Margin line, or when the net proceeds of such sale are insufficient, then I/we shall pay upon billing the entire remaining ...

... sell a sufficient amount of the indentured securities to cover such obligations; Provided, however, that if such sale is not executed on the trading day after termination of the Margin line, or when the net proceeds of such sale are insufficient, then I/we shall pay upon billing the entire remaining ...

after Morrison v National Australia Bank

... unequivocally expresses congressional intent "to extend its coverage beyond places over which the United States has sovereignty or has some measure of legislative control." 21 If there is some ambiguity, the statute should be limited, 224, 243 (1987). Furthermore, plaintiffs must sustain the burden ...

... unequivocally expresses congressional intent "to extend its coverage beyond places over which the United States has sovereignty or has some measure of legislative control." 21 If there is some ambiguity, the statute should be limited, 224, 243 (1987). Furthermore, plaintiffs must sustain the burden ...

Part 2A of Form ADV: Forester Capital Management Ltd. Forester

... Capital Management Ltd. at any time. We recommend you use a mail service where a signed receipt is required. Fees will be charged on a prorated basis upon termination and deducted from your account. Forester Capital Management Ltd. may terminate relationships with clients, in writing, upon 30 days n ...

... Capital Management Ltd. at any time. We recommend you use a mail service where a signed receipt is required. Fees will be charged on a prorated basis upon termination and deducted from your account. Forester Capital Management Ltd. may terminate relationships with clients, in writing, upon 30 days n ...

Lesson 4-1

... Nine numbers are unused between each account on TechKnow Consulting’s chart of accounts. New numbers can be assigned between existing account numbers without renumbering all existing accounts. ...

... Nine numbers are unused between each account on TechKnow Consulting’s chart of accounts. New numbers can be assigned between existing account numbers without renumbering all existing accounts. ...

Intelligence in Securities Finance: Where Is It Going?

... systems? That question is not yet answered and may never be, until the crisis hits. At that point, taking an inventory of where the best problem solvers can be found in securities finance will be a top priority. Market participants are experimenting with new approaches for solving new regulatory pro ...

... systems? That question is not yet answered and may never be, until the crisis hits. At that point, taking an inventory of where the best problem solvers can be found in securities finance will be a top priority. Market participants are experimenting with new approaches for solving new regulatory pro ...

PSX Investor Guide

... Financial Investments As opposed to physical assets, financial investments are generally a right or an entitlement to receive money (or streams of money). The Financial investmen ts themselves may be divided in two broad categories:a. Direct Investments that we hand over to an obligator (the party t ...

... Financial Investments As opposed to physical assets, financial investments are generally a right or an entitlement to receive money (or streams of money). The Financial investmen ts themselves may be divided in two broad categories:a. Direct Investments that we hand over to an obligator (the party t ...