federal housing finance agency`s single security initiative

... When the Enterprises implement changes that affect the cash flows to investors, but do so in a different manner and over different time periods, it can lead to disruption in the market. For example, when Freddie Mac and Fannie Mae announced that they would be repurchasing all loans that were over 12 ...

... When the Enterprises implement changes that affect the cash flows to investors, but do so in a different manner and over different time periods, it can lead to disruption in the market. For example, when Freddie Mac and Fannie Mae announced that they would be repurchasing all loans that were over 12 ...

1 Complaint for Violation of the Federal Securities Laws 05/19/2015

... VIPS' revenue recognition policy highlights those elements of its business which it believes are more indicative of principal activity and which would suggest reporting revenues on a gross basis. However, Management freely admits that it operates as a consignee and has no intentions of becoming a pr ...

... VIPS' revenue recognition policy highlights those elements of its business which it believes are more indicative of principal activity and which would suggest reporting revenues on a gross basis. However, Management freely admits that it operates as a consignee and has no intentions of becoming a pr ...

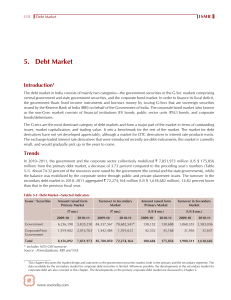

5. Debt Market

... (call option) at par value (equal to the face value), while the investor has the right to sell the bond (put option) to the government at par value at the time of any of the half-yearly coupon dates starting from July 18, 2007. Special Securities: In addition to T-Bills and dated securities issued b ...

... (call option) at par value (equal to the face value), while the investor has the right to sell the bond (put option) to the government at par value at the time of any of the half-yearly coupon dates starting from July 18, 2007. Special Securities: In addition to T-Bills and dated securities issued b ...

Securities Trading Policy

... a disposal of securities of Rift Valley that is the result of a secured lender exercising their rights, for example, under a margin lending arrangement. [Policy terms on providing shares as security required] the exercise (but not the sale of securities following exercise) of an option or a right un ...

... a disposal of securities of Rift Valley that is the result of a secured lender exercising their rights, for example, under a margin lending arrangement. [Policy terms on providing shares as security required] the exercise (but not the sale of securities following exercise) of an option or a right un ...

9780273713654_pp19

... Privileged Subscription – The sale of new securities in which existing shareholders are given a preference in purchasing these securities up to the proportion of common shares that they already own; also known as a rights offering. Preemptive Right – The privilege of shareholders to maintain their p ...

... Privileged Subscription – The sale of new securities in which existing shareholders are given a preference in purchasing these securities up to the proportion of common shares that they already own; also known as a rights offering. Preemptive Right – The privilege of shareholders to maintain their p ...

Financing Growth in the WAEMU Through the Regional

... Securities’ issuance procedures depend on the type of security. Although regional regulations require that government bills and bonds be auctioned on the primary market, some T-bonds are still issued by syndication. T-bill and T-bond auctions are carried out for each member country at the national b ...

... Securities’ issuance procedures depend on the type of security. Although regional regulations require that government bills and bonds be auctioned on the primary market, some T-bonds are still issued by syndication. T-bill and T-bond auctions are carried out for each member country at the national b ...

NEUTRAL - Maybank Kim Eng

... latter 2015, but the El Nino damage has been done with the market expecting FFB yield to be sharply lower YoY in 2016, especially for areas badly affected by the Aug-Oct 2015 dry spell. This situational play should benefit CPO price in general as it typically more than compensates for the decline in ...

... latter 2015, but the El Nino damage has been done with the market expecting FFB yield to be sharply lower YoY in 2016, especially for areas badly affected by the Aug-Oct 2015 dry spell. This situational play should benefit CPO price in general as it typically more than compensates for the decline in ...

NHA Mortgage-Backed Securities

... sources which we believe to be reliable, but we do not represent that they are accurate or complete, and should not be relied upon as such. All opinions expressed and data provided herein are subject to change without notice. A CIBC World Markets company or its shareholders, directors, officers and/ ...

... sources which we believe to be reliable, but we do not represent that they are accurate or complete, and should not be relied upon as such. All opinions expressed and data provided herein are subject to change without notice. A CIBC World Markets company or its shareholders, directors, officers and/ ...

Technical Handbook

... a giro account with it a facility for the automatic investment of overnight funds with the Bank (tier one). A separate application for tier one investments is not required. The funds in the customer’s giro account at the end of the day – up to a maximum investment amount – are placed in the tier one ...

... a giro account with it a facility for the automatic investment of overnight funds with the Bank (tier one). A separate application for tier one investments is not required. The funds in the customer’s giro account at the end of the day – up to a maximum investment amount – are placed in the tier one ...

Asian Holdings of US Treasury Securities: Trade Integration as a

... The international version of the capital asset pricing model (ICAPM), based on traditional portfolio theory developed by Sharpe (1964) and Lintner (1965), predicts that to maximize risk-adjusted returns investors should hold a world market portfolio of risky assets. In other words, portfolio weights ...

... The international version of the capital asset pricing model (ICAPM), based on traditional portfolio theory developed by Sharpe (1964) and Lintner (1965), predicts that to maximize risk-adjusted returns investors should hold a world market portfolio of risky assets. In other words, portfolio weights ...

Varun Beverages

... Varun Beverage (Varun) is the one of the largest franchisees for PepsiCo in the world (ex-US) for production and distribution of the carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs) sold under trademarks owned by PepsiCo. The company has been associated with PepsiCo since 1990 and h ...

... Varun Beverage (Varun) is the one of the largest franchisees for PepsiCo in the world (ex-US) for production and distribution of the carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs) sold under trademarks owned by PepsiCo. The company has been associated with PepsiCo since 1990 and h ...

annual debt financing strategy

... Indonesia’s economy in 2015 is expected to recover from its slowing down in 2014. One of the growth factors will be the government spending as stipulated on Law Number 27 Year 2014 on State Budget for 2015. The Budget sets revenue targets and allocation of expenditures, as well as financing targets. ...

... Indonesia’s economy in 2015 is expected to recover from its slowing down in 2014. One of the growth factors will be the government spending as stipulated on Law Number 27 Year 2014 on State Budget for 2015. The Budget sets revenue targets and allocation of expenditures, as well as financing targets. ...

Knowledge Discovering in Corporate Securities Fraud by Using

... the large and latest China Corporate Securities Fraud (CCSF) dataset. We also highlight the advantages of using SMOTE as the technique for the imbalanced data manipulation. The main objective of this study is to contribute to identifying the factors of the company in assessing the likelihood of frau ...

... the large and latest China Corporate Securities Fraud (CCSF) dataset. We also highlight the advantages of using SMOTE as the technique for the imbalanced data manipulation. The main objective of this study is to contribute to identifying the factors of the company in assessing the likelihood of frau ...

Format pdf

... This press release does not contain or constitute an invitation or solicitation to invest. This press release is directed only at persons who (1) are outside the United Kingdom, (2) have professional experience in matters related to investments or (3) are persons falling within Article 49(2)(a) to ( ...

... This press release does not contain or constitute an invitation or solicitation to invest. This press release is directed only at persons who (1) are outside the United Kingdom, (2) have professional experience in matters related to investments or (3) are persons falling within Article 49(2)(a) to ( ...

HSI 12.31.16 - Stmt of Fin Condition

... As such, we have entered into a tax allocation agreement with HNAH and its subsidiary entities (the "HNAH Group") included in the consolidated return which governs the current amount of taxes to be paid or received by the various entities included in the consolidated return filings. Generally, such ...

... As such, we have entered into a tax allocation agreement with HNAH and its subsidiary entities (the "HNAH Group") included in the consolidated return which governs the current amount of taxes to be paid or received by the various entities included in the consolidated return filings. Generally, such ...

Company Report

... Securities (Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Vickers Securities (Thailand) ...

... Securities (Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Vickers Securities (Thailand) ...

7. Which of the following statements regarding money

... Options give investors a way to manage portfolio risk while futures do not. Options can be used by speculators to profit from price fluctuations while futures ...

... Options give investors a way to manage portfolio risk while futures do not. Options can be used by speculators to profit from price fluctuations while futures ...

Squeeze-out – Sell-out a significant reform to come.

... details on the mode of holding) at the latest by two months as from the entry into force of the Law, should he wish to exercise his squeeze-out rights. ...

... details on the mode of holding) at the latest by two months as from the entry into force of the Law, should he wish to exercise his squeeze-out rights. ...

Can the CFTC and SEC Work Together to Prevent Another Madoff?

... 27832_lpr_15-1 Sheet No. 19 Side A ...

... 27832_lpr_15-1 Sheet No. 19 Side A ...

FINRA Rule 5270 FAQs: Front Running of Block Transactions FAQs

... Under applicable FINRA guidance, a “block trade” would generally be described as a transaction of a large quantity of stock or in a large dollar amount. In general, 10,000 shares are considered to be a “block.” The term “block transaction” is currently found at IM-2110-3, and its general scope has b ...

... Under applicable FINRA guidance, a “block trade” would generally be described as a transaction of a large quantity of stock or in a large dollar amount. In general, 10,000 shares are considered to be a “block.” The term “block transaction” is currently found at IM-2110-3, and its general scope has b ...

PVH CORP. /DE/ (Form: 8-K, Received: 01/07/2015

... Forward-looking statements made in this press release, including, without limitation, statements relating to PVH Corp. ’ s future plans, strategies, objectives, expectations and intentions, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Inves ...

... Forward-looking statements made in this press release, including, without limitation, statements relating to PVH Corp. ’ s future plans, strategies, objectives, expectations and intentions, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Inves ...

The Second Circuit`s Role in Expanding the SEC`s Jurisdiction Abroad

... The Second Circuit has had such a profound impact on securities law that it has been referred to in this context as the "Mother Court."1 The breadth and significance of Second Circuit securities law decisions is not surprising. New York City is the financial center of the United States and the secur ...

... The Second Circuit has had such a profound impact on securities law that it has been referred to in this context as the "Mother Court."1 The breadth and significance of Second Circuit securities law decisions is not surprising. New York City is the financial center of the United States and the secur ...

Asset-Backed Securities and Companies in Mortgage

... The SEC is asking for comment on whether any of these existing or proposed provisions could serve as substitutes for references to ratings in Rule 3a-7 and the potential impact of incorporating them on issuers of asset-backed commercial paper and other issuers that may currently rely on Rule 3a-7 bu ...

... The SEC is asking for comment on whether any of these existing or proposed provisions could serve as substitutes for references to ratings in Rule 3a-7 and the potential impact of incorporating them on issuers of asset-backed commercial paper and other issuers that may currently rely on Rule 3a-7 bu ...

financial markets group

... OTC derivatives – have doubled in size several times in ten years or so. Whereas these instruments originally developed in the market risk area, they have been progressively extended to the field of credit risk as well. This tendency is also clearly visible in Europe. Among the instruments created t ...

... OTC derivatives – have doubled in size several times in ten years or so. Whereas these instruments originally developed in the market risk area, they have been progressively extended to the field of credit risk as well. This tendency is also clearly visible in Europe. Among the instruments created t ...

Repos - LexisNexis UK

... Liquidity Scheme (technically a securities lending or asset-swap arrangement, rather than a repo) has also been designed specifically to accept asset-backed securities as collateral. These moves by the central banks further increase market activity in respect of repos of asset-backed securities. ...

... Liquidity Scheme (technically a securities lending or asset-swap arrangement, rather than a repo) has also been designed specifically to accept asset-backed securities as collateral. These moves by the central banks further increase market activity in respect of repos of asset-backed securities. ...