The Economic Bailout: An Analysis of the Economic

... investments, such as Treasury bills. The Dow Jones industrial average fell 449 points. • September 18: Fed Steps in The Treasury Department and Fed began discussions on a plan that would bail out the failing institutions. The Fed joined with five other central banks to add liquidity to the short-ter ...

... investments, such as Treasury bills. The Dow Jones industrial average fell 449 points. • September 18: Fed Steps in The Treasury Department and Fed began discussions on a plan that would bail out the failing institutions. The Fed joined with five other central banks to add liquidity to the short-ter ...

SEI Added 30 New Clients in First Half Of Year

... Group, stated in an email. “The appeal of our business model to these types of organizations is typically the additional layer Paul Klauder of governance and oversight we provide and our ability to act quickly on asset allocation or manager change decisions. In addition, we’re seeing increased openn ...

... Group, stated in an email. “The appeal of our business model to these types of organizations is typically the additional layer Paul Klauder of governance and oversight we provide and our ability to act quickly on asset allocation or manager change decisions. In addition, we’re seeing increased openn ...

Slide 1

... 1.6 THE PLAYERS • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

... 1.6 THE PLAYERS • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

Executive Compensation under the Emergency Economic

... In an effort to stabilize financial institutions and ensure liquidity during the current credit crisis, the Emergency Economic Stabilization Act of 2008 (EESA) creates a federal program to purchase “troubled assets” from the financial institutions that hold them. The Troubled Asset Relief Program (T ...

... In an effort to stabilize financial institutions and ensure liquidity during the current credit crisis, the Emergency Economic Stabilization Act of 2008 (EESA) creates a federal program to purchase “troubled assets” from the financial institutions that hold them. The Troubled Asset Relief Program (T ...

GNP - Finanstilsynet.no

... Financial conglomerates and alliances with high market shares Less concentrated banking market than in other Nordic countries Foreign ownership of importance in banking and non-life insurance Banks account for approximately 70% of domestic credit growth Securities markets of increasing importance. R ...

... Financial conglomerates and alliances with high market shares Less concentrated banking market than in other Nordic countries Foreign ownership of importance in banking and non-life insurance Banks account for approximately 70% of domestic credit growth Securities markets of increasing importance. R ...

Practice Exam 3

... C) Was worsened by the implementing of tighter regulations regarding asset holdings. D) Was worsened by the ceilings on interest rates which banks and S&L's could pay customers. 14) Financial intermediaries, particularly banks, A) are experts in the production of information about firms so that it c ...

... C) Was worsened by the implementing of tighter regulations regarding asset holdings. D) Was worsened by the ceilings on interest rates which banks and S&L's could pay customers. 14) Financial intermediaries, particularly banks, A) are experts in the production of information about firms so that it c ...

Lessons from the Financial Crisis

... Also argue that “did everything they could” with Lehman, but could not legally save it because it might have been insolvent But if the problem is liquidity, it can be solved for free by guaranteeing liabilities, as with money market funds, etc. The crisis came from insolvency of financial institutio ...

... Also argue that “did everything they could” with Lehman, but could not legally save it because it might have been insolvent But if the problem is liquidity, it can be solved for free by guaranteeing liabilities, as with money market funds, etc. The crisis came from insolvency of financial institutio ...

Daily Liquid Assets - Goldman Sachs Asset Management

... granted by the Congress of the United States, that are issued at a discount to the principal amount to be repaid at maturity and have a remaining maturity of 60 days or less; and (iv) securities that will mature or are subject to a demand feature that is exercisable and payable within five business ...

... granted by the Congress of the United States, that are issued at a discount to the principal amount to be repaid at maturity and have a remaining maturity of 60 days or less; and (iv) securities that will mature or are subject to a demand feature that is exercisable and payable within five business ...

Ch 11: 1.1

... b. Leverage is a double-edged sword. It can increase profits, but it can also magnify losses. These losses were so massive that they created systemic risk to the rest of the system. If Long-Term Capital Management had defaulted on its loans, many other financial firms would have taken large losses. ...

... b. Leverage is a double-edged sword. It can increase profits, but it can also magnify losses. These losses were so massive that they created systemic risk to the rest of the system. If Long-Term Capital Management had defaulted on its loans, many other financial firms would have taken large losses. ...

The New Capitalism

... prepared to finance the spendthrift ways of the US and UK: they don't want to lend more and they want to be confident that what they have lent won't disappear in a puff of bad debts and inflation. So the big question is how much debt will we have to repay until our economy is returned to some kind o ...

... prepared to finance the spendthrift ways of the US and UK: they don't want to lend more and they want to be confident that what they have lent won't disappear in a puff of bad debts and inflation. So the big question is how much debt will we have to repay until our economy is returned to some kind o ...

Partnerships and acquisitions pay off south of the border for

... out of the Mexican market until recently. But new rules established by the Mexican government over the past two years will allow the 13 Afores to make investments in active strategies overseas, allowing them to engage international money managers, said Javier Orvananos Marquez, chief investment offi ...

... out of the Mexican market until recently. But new rules established by the Mexican government over the past two years will allow the 13 Afores to make investments in active strategies overseas, allowing them to engage international money managers, said Javier Orvananos Marquez, chief investment offi ...

Economic 157b - Yale University

... - markets froze up (people could not make transactions) - stock market went down 30 % in a month and US dollar ROSE almost 20 %. - market fundamentalism lasted just 36 hours (!) - then bailout of AIG, Citibank, BofA, TARP, GM, etc. - Fed opened up several new facilities to steady markets ...

... - markets froze up (people could not make transactions) - stock market went down 30 % in a month and US dollar ROSE almost 20 %. - market fundamentalism lasted just 36 hours (!) - then bailout of AIG, Citibank, BofA, TARP, GM, etc. - Fed opened up several new facilities to steady markets ...

London Borough of Camden

... This supplementary information for the Treasury Accountant is for guidance and must be used in conjunction with the Job Capsule for the Finance Family at Level 4 Zone 2. It is for use during recruitment, setting objectives as part of the performance management process and other people management pur ...

... This supplementary information for the Treasury Accountant is for guidance and must be used in conjunction with the Job Capsule for the Finance Family at Level 4 Zone 2. It is for use during recruitment, setting objectives as part of the performance management process and other people management pur ...

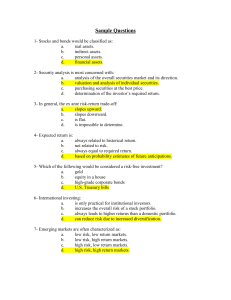

Sample Questions - U of L Class Index

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

11:00 Issues in Depository Institutions and Hedging

... including fraud and insider transactions were rampant. • Thrift institutions were generally not as impacted by the financial crisis of 2008 as were commercial banks. There were some important exceptions, as Washington Mutual Savings Bank, the largest thrift institution in the U.S. and Indy Mac both ...

... including fraud and insider transactions were rampant. • Thrift institutions were generally not as impacted by the financial crisis of 2008 as were commercial banks. There were some important exceptions, as Washington Mutual Savings Bank, the largest thrift institution in the U.S. and Indy Mac both ...

Guidelines on Investment of Idle Funds in Nigeria Treasury bill NTB

... With effect from the date of this circular, all idle balances in the capital accounts and the balances in all special accounts except recurrent accounts shall only be invested by the Ministries/Extra- Ministerial Departments and Agencies in 91 days Primary Market Nigeria Treasury Bills (NTB). Howeve ...

... With effect from the date of this circular, all idle balances in the capital accounts and the balances in all special accounts except recurrent accounts shall only be invested by the Ministries/Extra- Ministerial Departments and Agencies in 91 days Primary Market Nigeria Treasury Bills (NTB). Howeve ...

Firms and Financial Markets

... – If you only have limited amount of money and want to spread them in may different stocks. • If the idea of mutual funds is for the benefit of diversification, then the idea of an ETF comes from standardization and securitization – through securitization, one gains access to a much wider investor ...

... – If you only have limited amount of money and want to spread them in may different stocks. • If the idea of mutual funds is for the benefit of diversification, then the idea of an ETF comes from standardization and securitization – through securitization, one gains access to a much wider investor ...

FINANCIAL MARKETS

... Loose Monetary Policy – makes credit inexpensive & abundant, to increase money in circulation. (recession) Goal of the FED – balance the need to create long-term growth in the economy – more jobs, consumer goods, continuing higher standard of living – with the need to avoid inflation (higher prices) ...

... Loose Monetary Policy – makes credit inexpensive & abundant, to increase money in circulation. (recession) Goal of the FED – balance the need to create long-term growth in the economy – more jobs, consumer goods, continuing higher standard of living – with the need to avoid inflation (higher prices) ...

Chapter 1 - Practice Questions 1. Financial assets

... A) directly contribute to the country's productive capacity B) indirectly contribute to the country's productive capacity C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of ...

... A) directly contribute to the country's productive capacity B) indirectly contribute to the country's productive capacity C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of ...

Issues in Islamic Liquidity Management

... and/or bank guarantee. Sukuk holdings to be held as part of investment portfolio of the Treasury to earn higher returns. ...

... and/or bank guarantee. Sukuk holdings to be held as part of investment portfolio of the Treasury to earn higher returns. ...

Senate Passes Amended Version of Emergency Economic

... applicable in respect of direct purchases of troubled assets [Section 111(b)(2)A)] and the persons (senior executive officers) to whom restrictions on executive compensation set out in the House bill are applicable in respect of auction purchases of troubled assets [Section 111(c)(2)] has been corre ...

... applicable in respect of direct purchases of troubled assets [Section 111(b)(2)A)] and the persons (senior executive officers) to whom restrictions on executive compensation set out in the House bill are applicable in respect of auction purchases of troubled assets [Section 111(c)(2)] has been corre ...

Debt position of the Government of India

... reckoned at historical rates of exchange on which the liability was initially accounted for in the books of accounts after netting the repayments made at current exchange rates. In addition, Government is liable to repay the outstanding against the various Small Savings schemes, Provident Funds, sec ...

... reckoned at historical rates of exchange on which the liability was initially accounted for in the books of accounts after netting the repayments made at current exchange rates. In addition, Government is liable to repay the outstanding against the various Small Savings schemes, Provident Funds, sec ...

Treasury

... multiple bailout programs & liquidity maintenance efforts already begun by the Bush administration. These include: ...

... multiple bailout programs & liquidity maintenance efforts already begun by the Bush administration. These include: ...

The Big Three: Not dead yet!

... NEW YORK (CNNMoney.com) -- There wasn't much holiday good cheer on Wall Street Friday morning after the collapse of the Big Three bailout in the Senate late Thursday night. But investors started to feel merrier later in the day as hopes grew for a loan from the Treasury Department instead. Stocks tu ...

... NEW YORK (CNNMoney.com) -- There wasn't much holiday good cheer on Wall Street Friday morning after the collapse of the Big Three bailout in the Senate late Thursday night. But investors started to feel merrier later in the day as hopes grew for a loan from the Treasury Department instead. Stocks tu ...