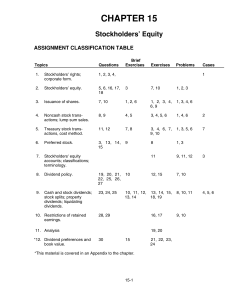

CHAPTER 15 Stockholders` Equity

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

Annex VI

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...

Speculation and Risk Sharing with New Financial Assets

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

US Treasury Market US Treasury Market

... provide tax advice or to be used by anyone to provide tax advice. Investors are urged to seek tax advice based on their particular circumstances from an independent tax professional. The bonds of the company are traded over-the-counter. Retail sales and/or distribution of this report may be made onl ...

... provide tax advice or to be used by anyone to provide tax advice. Investors are urged to seek tax advice based on their particular circumstances from an independent tax professional. The bonds of the company are traded over-the-counter. Retail sales and/or distribution of this report may be made onl ...

payments and securities clearance and settlement systems in

... National Bank (SNB), and the U.S. Securities and Exchange Commission (SEC). Other central banks, securities commissions and international organizations are expected to join the IAC over the course of the program. To assure quality and effectiveness, the CISPI includes two important elements. First, ...

... National Bank (SNB), and the U.S. Securities and Exchange Commission (SEC). Other central banks, securities commissions and international organizations are expected to join the IAC over the course of the program. To assure quality and effectiveness, the CISPI includes two important elements. First, ...

Answers to Questions

... Jones may be a closely held corporation so that no market value is available for its shares; The number of newly issued shares (especially if the amount is large in comparison to the quantity of previously outstanding shares) may cause the price of the stock to fluctuate widely so that no accura ...

... Jones may be a closely held corporation so that no market value is available for its shares; The number of newly issued shares (especially if the amount is large in comparison to the quantity of previously outstanding shares) may cause the price of the stock to fluctuate widely so that no accura ...

KDE Capital Asset Guide

... estimated life of greater than one year and an original cost equal to or greater than $1,000. Technology is an exception to this rule: all workstations were to be recorded as a fixed asset during the implementation. After initial GASB 34 asset valuation: Fixed Assets are all real or personal, stand- ...

... estimated life of greater than one year and an original cost equal to or greater than $1,000. Technology is an exception to this rule: all workstations were to be recorded as a fixed asset during the implementation. After initial GASB 34 asset valuation: Fixed Assets are all real or personal, stand- ...

Old Globe Theatre dba The Old Globe

... The Old Globe is the beneficiary of an irrevocable charitable remainder trust administered by a third party. The trust terminates upon the death of the grantor, at which time The Old Globe will receive the remaining trust assets. The fair value of the future benefits to b ...

... The Old Globe is the beneficiary of an irrevocable charitable remainder trust administered by a third party. The trust terminates upon the death of the grantor, at which time The Old Globe will receive the remaining trust assets. The fair value of the future benefits to b ...

myRA (my Retirement Account): A new Way to Start Saving for

... Withdraw money put in (contributions) without tax and penalty1 ...

... Withdraw money put in (contributions) without tax and penalty1 ...

"Super Equivalent" Basel III Liquidity Coverage Ratio

... considering the assets' risk profile, market-based characteristics, and central bank eligibility. As a general matter, most HQLAs need to be "liquid and readily marketable," which the proposed LCR defines as traded in an active secondary market with (1) more than two committed market makers; (2) a l ...

... considering the assets' risk profile, market-based characteristics, and central bank eligibility. As a general matter, most HQLAs need to be "liquid and readily marketable," which the proposed LCR defines as traded in an active secondary market with (1) more than two committed market makers; (2) a l ...

BANK-BASED AND MARKET-BASED FINANCIAL SYSTEMS

... In bank-based financial systems such as Germany and Japan, banks play a leading role in mobilizing savings, allocating capital, overseeing the investment decisions of corporate managers, and in providing risk management vehicles. In market-based financial systems such as England and the United State ...

... In bank-based financial systems such as Germany and Japan, banks play a leading role in mobilizing savings, allocating capital, overseeing the investment decisions of corporate managers, and in providing risk management vehicles. In market-based financial systems such as England and the United State ...

Superannuation funds and alternative asset investment

... assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of payments from the fund, as a result of members either retiring or moving to o ...

... assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of payments from the fund, as a result of members either retiring or moving to o ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

Mutual Fund Assets and Flows in 1999

... communications stocks performed well. However, other sectors of the U.S. stock market posted losses, and more than half of all stocks experienced price decreases for the year. Furthermore, rising interest rates led to one of the largest annual declines in bond prices in 30 years. Outside the U.S, ma ...

... communications stocks performed well. However, other sectors of the U.S. stock market posted losses, and more than half of all stocks experienced price decreases for the year. Furthermore, rising interest rates led to one of the largest annual declines in bond prices in 30 years. Outside the U.S, ma ...

The Economic Impact of the Stock Market Boom and Crash of 1929

... Obviously households experienced very large "paper" gains and losses on corporate stocks in the market boom and bust of 1927-33. But how many of these paper gains and losses were actually "realized" through sales? We can get some indication from the gains and lo~ses recorded on income tax returns. T ...

... Obviously households experienced very large "paper" gains and losses on corporate stocks in the market boom and bust of 1927-33. But how many of these paper gains and losses were actually "realized" through sales? We can get some indication from the gains and lo~ses recorded on income tax returns. T ...

Financial Instability Revisited: The Economics of Disaster

... depression cycles were associated with a financial crisis and all clearly mild depression cycles were not* Friedman and Schwartz choose to ignore this phenomena, preferring a monolithic explanation for both 1929-33 and 1960-61 • It seems better to posit that mild and deep depressions are quite diffe ...

... depression cycles were associated with a financial crisis and all clearly mild depression cycles were not* Friedman and Schwartz choose to ignore this phenomena, preferring a monolithic explanation for both 1929-33 and 1960-61 • It seems better to posit that mild and deep depressions are quite diffe ...

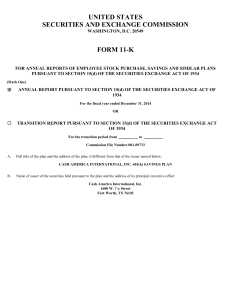

CASH AMERICA INTERNATIONAL INC

... the two-year period ended December 31, 2014 . The Plan’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting ...

... the two-year period ended December 31, 2014 . The Plan’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting ...

Motley Fool`s Ratio Procedure

... way for a non-U.S. company to trade their shares on the American exchanges. Some extremely high dividend yields, some South American companies … this group did not seem to carry the security of American GAAP and other regulatory controls. “Over The Counter” stocks are traded the same as issues on th ...

... way for a non-U.S. company to trade their shares on the American exchanges. Some extremely high dividend yields, some South American companies … this group did not seem to carry the security of American GAAP and other regulatory controls. “Over The Counter” stocks are traded the same as issues on th ...

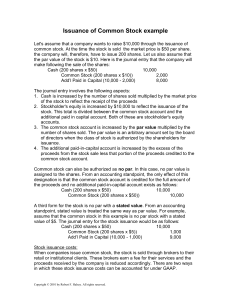

Issuance of Common Stock example

... When companies issue common stock, the stock is sold through brokers to their retail or institutional clients. These brokers earn a fee for their services and the proceeds received by the company is reduced accordingly. There are two ways in which these stock issuance costs can be accounted for unde ...

... When companies issue common stock, the stock is sold through brokers to their retail or institutional clients. These brokers earn a fee for their services and the proceeds received by the company is reduced accordingly. There are two ways in which these stock issuance costs can be accounted for unde ...

Download attachment

... • Represents the holder's proportionate ownership in the leased asset. • The holder will assume the rights and obligations of the owner/lessor to that extent. • The holder will have the right to enjoy a part of the rent according to his proportion of ownership in the asset. ...

... • Represents the holder's proportionate ownership in the leased asset. • The holder will assume the rights and obligations of the owner/lessor to that extent. • The holder will have the right to enjoy a part of the rent according to his proportion of ownership in the asset. ...

Financial Management: Principles and Applications

... B) They may guarantee to reimburse lenders should lenders' loans go into default. C) They participate in equipment leasing. D) They may only invest their reserves in interest paying bank accounts under Federal law. Answer: D Diff: 1 Topic: 2.2 The Financial Marketplace: Financial Institutions Keywor ...

... B) They may guarantee to reimburse lenders should lenders' loans go into default. C) They participate in equipment leasing. D) They may only invest their reserves in interest paying bank accounts under Federal law. Answer: D Diff: 1 Topic: 2.2 The Financial Marketplace: Financial Institutions Keywor ...

An Introduction to GAAP Basis Financial Report

... – Invoices received but not yet entered or approved by OSC – Billings collected but not yet processed ...

... – Invoices received but not yet entered or approved by OSC – Billings collected but not yet processed ...

Bank Finance Challenges Faced by UAE SME Sector

... SME lending in UAE is largely unsecured lending. Even if it is secured, there is hardly any collateral security apart from the primary security (stocks and receivables). This is because since most firms are in the trading or services sector (89% of total SMEs), they generally don’t have any major fi ...

... SME lending in UAE is largely unsecured lending. Even if it is secured, there is hardly any collateral security apart from the primary security (stocks and receivables). This is because since most firms are in the trading or services sector (89% of total SMEs), they generally don’t have any major fi ...

The Demand for Short-Term, Safe Assets and Financial Stability

... Nevertheless, overall, our empirical evidence appears to be broadly consistent with the substitution hypothesis, as well as with the results from the earlier literature that studies the relationship between the supply of government debt and interest rate spreads. Greenwood, Hanson, and Stein (2014) ...

... Nevertheless, overall, our empirical evidence appears to be broadly consistent with the substitution hypothesis, as well as with the results from the earlier literature that studies the relationship between the supply of government debt and interest rate spreads. Greenwood, Hanson, and Stein (2014) ...

THE IMPACT OF STATE OWNED BANKS ON INTEREST RATES SPREAD

... as a market player that could improve social welfare. Nevertheless, more recent studies have pointed that perhaps such market failures are not adequately tackled by state ownership and proper regulation could have a more efficient role to improve welfare.3 There are four sources of justification for ...

... as a market player that could improve social welfare. Nevertheless, more recent studies have pointed that perhaps such market failures are not adequately tackled by state ownership and proper regulation could have a more efficient role to improve welfare.3 There are four sources of justification for ...