Corporate Actions Events

... Similar to stock splits where the share nominal value is changed which normally results in a change in the number of shares held. Scheme of Arrangement – Occurs when a parent company takes over its subsidiaries and distributes proceeds to its shareholders. Scrip Dividend – No stock dividends / coupo ...

... Similar to stock splits where the share nominal value is changed which normally results in a change in the number of shares held. Scheme of Arrangement – Occurs when a parent company takes over its subsidiaries and distributes proceeds to its shareholders. Scrip Dividend – No stock dividends / coupo ...

Management Buy Outs

... implies, more debt than equity is used to finance the purchase, e.g. 90% debt to 10% equity. Normally, the assets of the company being acquired are put up as collateral to secure the debt. (Beatrice Foods by ...

... implies, more debt than equity is used to finance the purchase, e.g. 90% debt to 10% equity. Normally, the assets of the company being acquired are put up as collateral to secure the debt. (Beatrice Foods by ...

For the time being Hungary does not provide a participation

... change the “rough” offshore tax breaks. Tax on Dividend As of January 1, 2006 the dividend paid to foreign corporate owner, member or shareholder will be free of any withholding tax irrespective of the resident country of the beneficiary of the dividend. (The received dividend has been tax-free for ...

... change the “rough” offshore tax breaks. Tax on Dividend As of January 1, 2006 the dividend paid to foreign corporate owner, member or shareholder will be free of any withholding tax irrespective of the resident country of the beneficiary of the dividend. (The received dividend has been tax-free for ...

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED

... [([excluding] [including] conversion of the Notes,] and approved by the Company] (the “Investors”). The first than sixty (60) days from the date of this Term Sheet. ...

... [([excluding] [including] conversion of the Notes,] and approved by the Company] (the “Investors”). The first than sixty (60) days from the date of this Term Sheet. ...

Stockholders` Equity

... Stockholders' equity represents the owners' claim to the business. These claims arise for two reasons. First, the owners have a claim on amounts they invested in the business by making direct contributions ...

... Stockholders' equity represents the owners' claim to the business. These claims arise for two reasons. First, the owners have a claim on amounts they invested in the business by making direct contributions ...

Form 8-K, 12/14/15

... Board of Directors declared a quarterly cash dividend of nine cents ($0.09) per common share, payable February 5, 2016 to shareholders of record as of December 31, 2015. The press release announcing the dividend is attached hereto as Exhibit 99.1. The amount of dividends, if any, that the Company pa ...

... Board of Directors declared a quarterly cash dividend of nine cents ($0.09) per common share, payable February 5, 2016 to shareholders of record as of December 31, 2015. The press release announcing the dividend is attached hereto as Exhibit 99.1. The amount of dividends, if any, that the Company pa ...

Transcript

... stock dividend where shareholders get additional stock based upon their current level of ownership. For example, let us say a company declared a stock dividend of 1 share for every 4 shares someone owns. We call this a “pro rata” distribution. This dividend distribution results in a decrease in reta ...

... stock dividend where shareholders get additional stock based upon their current level of ownership. For example, let us say a company declared a stock dividend of 1 share for every 4 shares someone owns. We call this a “pro rata” distribution. This dividend distribution results in a decrease in reta ...

1 - Madeira City Schools

... •Capital Stock is the shareholders owner’s equity account. •Retained Earnings is the account for money that will be retained by the company for business expansion. •Dividends - A temporary account used to record the distribution of earnings (dividends) to stockholders. ...

... •Capital Stock is the shareholders owner’s equity account. •Retained Earnings is the account for money that will be retained by the company for business expansion. •Dividends - A temporary account used to record the distribution of earnings (dividends) to stockholders. ...

Brandywine Realty Trust Announces Common Quarterly Dividend

... Organized as a real estate investment trust (REIT), we own, develop, lease and manage an urban, town center and transit-oriented portfolio comprising 204 properties and 26.8 million square feet as of March 31, 2017, which excludes assets held for sale. Our purpose is to shape, connect and inspire th ...

... Organized as a real estate investment trust (REIT), we own, develop, lease and manage an urban, town center and transit-oriented portfolio comprising 204 properties and 26.8 million square feet as of March 31, 2017, which excludes assets held for sale. Our purpose is to shape, connect and inspire th ...

Checklist for shareholders` agreement

... If so, will existing shareholders have the right to buy such shares in any amount other than their proportion of the current shareholding which they hold? ...

... If so, will existing shareholders have the right to buy such shares in any amount other than their proportion of the current shareholding which they hold? ...

Dividend increase to EUR 1.05 approved by large majority of

... Shareholders with a majority equivalent to 99.93% of the company's share capital present at the AGM resolved, among other issues, to pay a dividend of EUR 1.05 per share. This reflects an increase of EUR 0.20 over the previous year’s level. As in past years, the dividend will be paid free of tax for ...

... Shareholders with a majority equivalent to 99.93% of the company's share capital present at the AGM resolved, among other issues, to pay a dividend of EUR 1.05 per share. This reflects an increase of EUR 0.20 over the previous year’s level. As in past years, the dividend will be paid free of tax for ...

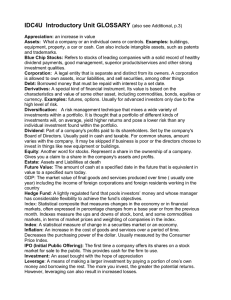

Penny Stocks: Low-priced stocks that typically sell

... Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own asse ...

... Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own asse ...

Chapter 11: Reporting and Analyzing Stockholders` Equity

... business for the protection of corporate creditors. 3. Capital stock that has contractual preferences over common stock in certain areas. 4. A corporation that may have thousands of stockholders and whose stock is regularly traded on a securities market. 5. Capital stock that has been issued and is ...

... business for the protection of corporate creditors. 3. Capital stock that has contractual preferences over common stock in certain areas. 4. A corporation that may have thousands of stockholders and whose stock is regularly traded on a securities market. 5. Capital stock that has been issued and is ...

Basic Principles Of Corporate Management Of State

... Joint-stock company (JSC) a company whose capital stock is divided into shares. The company (not the shareholders) shall be liable before its creditors with its assets. All shares can be possessed by a single person – in our case – the state. Limited liability company (LLC) may be formed by one or m ...

... Joint-stock company (JSC) a company whose capital stock is divided into shares. The company (not the shareholders) shall be liable before its creditors with its assets. All shares can be possessed by a single person – in our case – the state. Limited liability company (LLC) may be formed by one or m ...