Chapter 12 Investing in Stocks

... The dollar-cost averaging technique involves the systematic purchase of an equal dollar amount of the same stock at regular intervals. The result is usually a lower average cost per share. ...

... The dollar-cost averaging technique involves the systematic purchase of an equal dollar amount of the same stock at regular intervals. The result is usually a lower average cost per share. ...

stop order

... eventually reaches $50 a share. He cancels his stop-loss order at $41 and puts in a stop limit order at $47 with a limit of $45. If the stock price falls below $47, then the order becomes a live sell-limit order. If the stock price falls below $45 before Frank’s order is filled, then the order will ...

... eventually reaches $50 a share. He cancels his stop-loss order at $41 and puts in a stop limit order at $47 with a limit of $45. If the stock price falls below $47, then the order becomes a live sell-limit order. If the stock price falls below $45 before Frank’s order is filled, then the order will ...

What is a Depository Receipt…?

... GDRs as well as GDRs itself must be freely transferable, fully paid and free from any liens & restrictions on transfer. ...

... GDRs as well as GDRs itself must be freely transferable, fully paid and free from any liens & restrictions on transfer. ...

Notice regarding Issuance of Preferred Stock

... Stock, not to solicit anyone into making any investment. This press release shall not be construed as an offering of securities in or outside of Japan. ...

... Stock, not to solicit anyone into making any investment. This press release shall not be construed as an offering of securities in or outside of Japan. ...

comparison of employee share incentive structures for SMEs

... If a loan is made to fund the purchase price it may result in tax on any ‘cheap loan’ under the benefit in kind rules Employer will need to report the acquisition on Form 42 at the end of the relevant tax year ...

... If a loan is made to fund the purchase price it may result in tax on any ‘cheap loan’ under the benefit in kind rules Employer will need to report the acquisition on Form 42 at the end of the relevant tax year ...

full paper · 1MB PDF

... the ex-dividend day studies have declined in recent years, as arbitrage costs have declined.8 In addition to the expressed concerns about ex-dividend-day studies, some of the inferences drawn from this research program are difficult to support. Although finding that share prices decline by less than ...

... the ex-dividend day studies have declined in recent years, as arbitrage costs have declined.8 In addition to the expressed concerns about ex-dividend-day studies, some of the inferences drawn from this research program are difficult to support. Although finding that share prices decline by less than ...

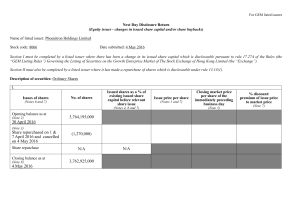

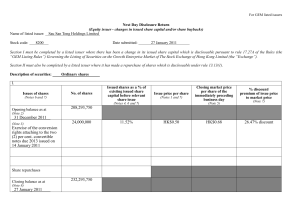

appendix 8a - Sau San Tong

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

Merchandising Operations and the Multiple

... Assets that are expected to be converted to cash or used up within one year. Current assets are listed in order of liquidity. Examples: Cash Short-term investments Receivables Inventories Supplies Prepaid expenses ...

... Assets that are expected to be converted to cash or used up within one year. Current assets are listed in order of liquidity. Examples: Cash Short-term investments Receivables Inventories Supplies Prepaid expenses ...

Lecture 17

... assumed to have been outstanding since the beginning of the year). If a stock dividend or stock split occurs after the end of the year, but before the financial statements are issued, the weighted average number of shares outstanding for the year (and any other years presented in comparative form) m ...

... assumed to have been outstanding since the beginning of the year). If a stock dividend or stock split occurs after the end of the year, but before the financial statements are issued, the weighted average number of shares outstanding for the year (and any other years presented in comparative form) m ...

To propose the issuance plan of private placement for

... To propose the issuance plan of private placement for common shares, ADR/GDR or CB/ECB, including Secured or Unsecured Corporate Bonds. The amount of shares issued or convertible is proposed to be no more than 10% of registered capital. 1) To provide the flexibility to engage in a semiconductor tech ...

... To propose the issuance plan of private placement for common shares, ADR/GDR or CB/ECB, including Secured or Unsecured Corporate Bonds. The amount of shares issued or convertible is proposed to be no more than 10% of registered capital. 1) To provide the flexibility to engage in a semiconductor tech ...