Share capital increase to service stock option plan

... 666,500 shares with a par value of Euro 1 each, carrying normal dividend rights; the increase is to exclude preemption rights, as provided by paragraphs 5 and 6 of Art. 2441 of the Italian Civil Code, and will depend on payment of a subscription price, inclusive of a premium, of at least Euro 13.80 ...

... 666,500 shares with a par value of Euro 1 each, carrying normal dividend rights; the increase is to exclude preemption rights, as provided by paragraphs 5 and 6 of Art. 2441 of the Italian Civil Code, and will depend on payment of a subscription price, inclusive of a premium, of at least Euro 13.80 ...

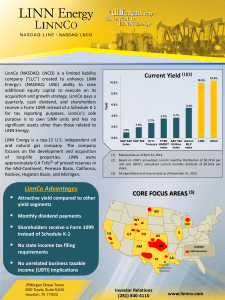

Measuring Dividend Quality

... distribution as a red flag that the dividend may be pared back further in the future ...

... distribution as a red flag that the dividend may be pared back further in the future ...

chapter 1

... The corporation should make its decision about how to pay out cash by answering two questions. First, it must decide how much cash to pay out, and second, whether to pay dividends or repurchase shares. In answer to the first question the firm must determine the amount of surplus cash. Cash is surplu ...

... The corporation should make its decision about how to pay out cash by answering two questions. First, it must decide how much cash to pay out, and second, whether to pay dividends or repurchase shares. In answer to the first question the firm must determine the amount of surplus cash. Cash is surplu ...

chapter 14

... paid on dividends immediately and dividends have historically been taxed as ordinary income. If the firm reinvests the capital back into positive NPV investments, then this should lead to an increase in the stock price. The investor can then sell the stock when she chooses and pay capital gains taxe ...

... paid on dividends immediately and dividends have historically been taxed as ordinary income. If the firm reinvests the capital back into positive NPV investments, then this should lead to an increase in the stock price. The investor can then sell the stock when she chooses and pay capital gains taxe ...

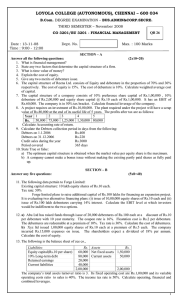

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... a) The optimum capital structure is obtained when the market value per equity share is the maximum. b) A company cannot make a bonus issue without making the existing partly paid shares as fully paid up. SECTION – B Answer any five questions: ...

... a) The optimum capital structure is obtained when the market value per equity share is the maximum. b) A company cannot make a bonus issue without making the existing partly paid shares as fully paid up. SECTION – B Answer any five questions: ...

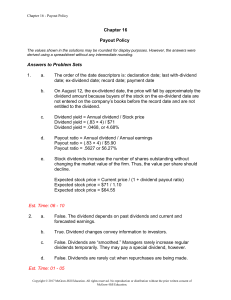

Final Exam, Fall 09 - Department of Finance, Insurance and

... following information to be accurate. The firm's shares are currently selling for $40.00, the estimated growth rate of earnings is 7%, and the expected dividend is $2.40. Talks with the investment banking company with which the firm does business indicate that selling new shares of common will cost ...

... following information to be accurate. The firm's shares are currently selling for $40.00, the estimated growth rate of earnings is 7%, and the expected dividend is $2.40. Talks with the investment banking company with which the firm does business indicate that selling new shares of common will cost ...

Dividend and Payout Policy (for you to read) Dividend Policy (aka

... Aside: The Bird-in-the-Hand Fallacy This popular fallacy goes something like this: • A dividend today is safer than the promise of future payments. • Investors will pay a premium for dividend-paying firms. • Hence, dividends increase firm value. What is wrong with this argument? •Everything! A chang ...

... Aside: The Bird-in-the-Hand Fallacy This popular fallacy goes something like this: • A dividend today is safer than the promise of future payments. • Investors will pay a premium for dividend-paying firms. • Hence, dividends increase firm value. What is wrong with this argument? •Everything! A chang ...

Block 3 - Webcourses

... 4 rights of shareholders - Right to vote; Right to receive dividends; Right to share in distribution of assets; and Preemptive right Preferred Stock - Has advantages over common: Receive dividends first, Receive assets first in liquidation, and Shareholders earn a fixed dividend Par value of stock - ...

... 4 rights of shareholders - Right to vote; Right to receive dividends; Right to share in distribution of assets; and Preemptive right Preferred Stock - Has advantages over common: Receive dividends first, Receive assets first in liquidation, and Shareholders earn a fixed dividend Par value of stock - ...

Sole Proprietorship - hrsbstaff.ednet.ns.ca

... Financial co-ops are formed to arrange savings and loans for members at better rates than those available a local banks (example: credit unions) Members have limited personal liability while maintaining all other privileges of membership. Advantages: one vote per member offers members an equal say i ...

... Financial co-ops are formed to arrange savings and loans for members at better rates than those available a local banks (example: credit unions) Members have limited personal liability while maintaining all other privileges of membership. Advantages: one vote per member offers members an equal say i ...

Syngene International Limited Dividend Distribution Policy Version. No

... Company. Through this, the Company would endeavour to maintain a consistent approach to dividend pay-out plans. GUIDELINES The Board, pursuant to provisions of section 123 of the Companies Act, 2013 and rules made thereunder, may declare interim dividend or recommend final dividend, payable to the e ...

... Company. Through this, the Company would endeavour to maintain a consistent approach to dividend pay-out plans. GUIDELINES The Board, pursuant to provisions of section 123 of the Companies Act, 2013 and rules made thereunder, may declare interim dividend or recommend final dividend, payable to the e ...