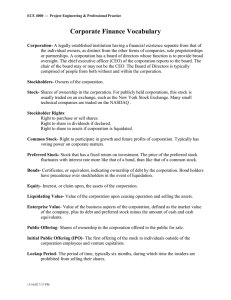

Corporate Finance Vocabulary

... the individual owners, as distinct from the other forms of companies, sole proprietorships or partnerships. A corporation has a board of directors whose function is to provide broad oversight. The chief executive officer (CEO) of the corporation reports to the board. The chair of the board may or ma ...

... the individual owners, as distinct from the other forms of companies, sole proprietorships or partnerships. A corporation has a board of directors whose function is to provide broad oversight. The chief executive officer (CEO) of the corporation reports to the board. The chair of the board may or ma ...

Chapter 10

... What is retained earnings? Why is retained earnings considered an indirect investment in an entity? Retained earnings are the accumulated earnings of a company that haven’t been distributed to the owners. Retained earnings are considered an indirect investment because the company is making the dec ...

... What is retained earnings? Why is retained earnings considered an indirect investment in an entity? Retained earnings are the accumulated earnings of a company that haven’t been distributed to the owners. Retained earnings are considered an indirect investment because the company is making the dec ...

dividend policy - SIF Banat

... If the opportunities for reinvesting the profit are more attractive for shareholders or in cases of buyback programs, the return on equity for SIF Banat-Crișana shareholder is likely to be higher than a mere distribution of taxable dividend. Remuneration of shareholders by dividend distribution or r ...

... If the opportunities for reinvesting the profit are more attractive for shareholders or in cases of buyback programs, the return on equity for SIF Banat-Crișana shareholder is likely to be higher than a mere distribution of taxable dividend. Remuneration of shareholders by dividend distribution or r ...