The Stock Market

... Dividends-Pay out by corporations. Paid in quarters. • The higher the profit, the larger the dividend per share of stock. • Capital Gains-Sell the stock for more than he or she paid for it. – Capital Loss- Selling a stock at a lower price than it was purchased for. ...

... Dividends-Pay out by corporations. Paid in quarters. • The higher the profit, the larger the dividend per share of stock. • Capital Gains-Sell the stock for more than he or she paid for it. – Capital Loss- Selling a stock at a lower price than it was purchased for. ...

Dividend Policy Ziggo 2012

... “may”, “plan”, “potential”, “predict”, “project”, “should”, and “will” and similar words identify these forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties. Many of these assumptions, risks and uncertainties are beyond ...

... “may”, “plan”, “potential”, “predict”, “project”, “should”, and “will” and similar words identify these forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties. Many of these assumptions, risks and uncertainties are beyond ...

Ch 8 - Finance

... Very simple: Just assume the company will pay out a fixed percent, say 20%, of net income. If net income is less than zero, then the company will pay zero dividend. Many companies do target a payout ratio— at least over a several-year period. Produces dividends that are more volatile than a fixe ...

... Very simple: Just assume the company will pay out a fixed percent, say 20%, of net income. If net income is less than zero, then the company will pay zero dividend. Many companies do target a payout ratio— at least over a several-year period. Produces dividends that are more volatile than a fixe ...

CHAPTER 21 - MONEY AND BANKING

... dollar is compared to the currency of the countries in which Sun-2-Shade is interested. If our dollar is weak, or falling, in comparison to the euro, the British pound, the Japanese yen, or others, Sun-2-Shade could be very affordable for their target market. If the American dollar is strong, or ris ...

... dollar is compared to the currency of the countries in which Sun-2-Shade is interested. If our dollar is weak, or falling, in comparison to the euro, the British pound, the Japanese yen, or others, Sun-2-Shade could be very affordable for their target market. If the American dollar is strong, or ris ...

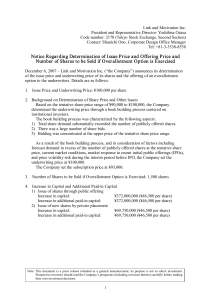

Application for an additional listing

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

File

... products or services, and its management • Free newsletters mailed to clients • Examples: Moody’s Investment Service or Value ...

... products or services, and its management • Free newsletters mailed to clients • Examples: Moody’s Investment Service or Value ...

Corporate Class: Tax-efficient Investing

... where both mutual funds are part of the same mutual fund corporation (corporate class structure), has been eliminated. However, switches between series of the same mutual fund are still allowed on a tax-deferred basis. Note: this change will have no impact when corporate class funds are held in a re ...

... where both mutual funds are part of the same mutual fund corporation (corporate class structure), has been eliminated. However, switches between series of the same mutual fund are still allowed on a tax-deferred basis. Note: this change will have no impact when corporate class funds are held in a re ...

Long-Term Financial Planning and Growth

... Balance Sheet Initially assume that all assets, including fixed, vary directly with sales Accounts payable will also normally vary directly with sales Notes payable, long-term debt and equity generally do not vary with sales because they depend on management decisions about capital ...

... Balance Sheet Initially assume that all assets, including fixed, vary directly with sales Accounts payable will also normally vary directly with sales Notes payable, long-term debt and equity generally do not vary with sales because they depend on management decisions about capital ...